Mexico: Staff Concluding Statement of the 2021 Article IV Mission

October 8, 2021

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

Washington, DC:

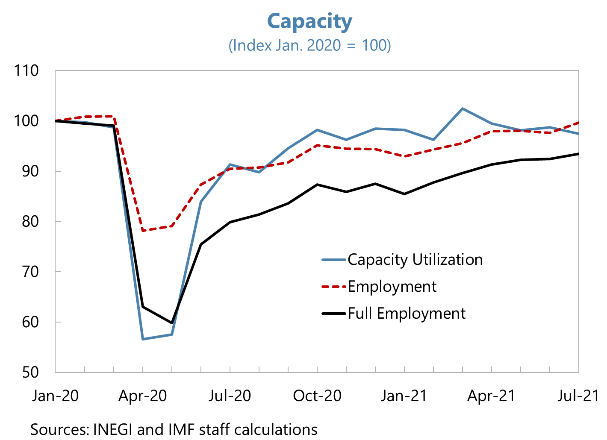

The Mexican economy is rebounding from its deepest downturn in decades. Spurred by U.S. growth and rising vaccination rates, it is set to grow by 6.2 percent in 2021 and 4 percent in 2022. Manufacturing and exports are above pre-pandemic levels, services are re-opening, and employment is recovering. The authorities have successfully maintained external, financial, and fiscal stability in a very challenging period.

Nevertheless, Mexico is bearing a very heavy humanitarian, social, and

economic cost.

There have been over half a million excess deaths likely linked to

COVID-19. Under-employment remains above the peak reached during the global

financial crisis; over 4½ million more people are unemployed,

under-employed, or available to work (the broad U6 unemployment category)

than before the pandemic. Already-high levels of poverty have increased

further. The young face sizable learning losses with potentially harmful

longer-term effects.

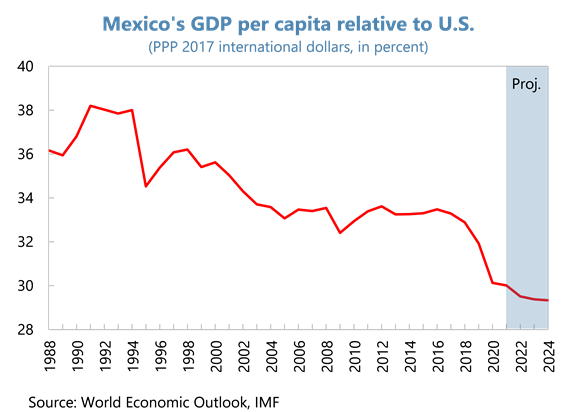

Real income per capita has continued its long-run divergence from the U.S., with projections signaling further divergence ahead. Low productivity growth and high poverty remain Mexico’s key problems. Looking forward, the economy will face new challenges from technological shifts and the effects of climate change.

Against this backdrop, the priorities are to safeguard the recovery, preserve economic stability, and promote inclusive and sustainable growth. First and foremost, this will require vaccinating the eligible population as swiftly as possible. Given the economic slack, a supportive near-term fiscal stance would help mitigate scarring and secure the recovery. Targeting this fiscal support toward well-designed social assistance, education, health, and public investment spending would alleviate the burdens on society’s most vulnerable and promote more inclusive growth. Such higher, upfront spending would need to be combined with a fiscal reform that is phased-in over the medium term as the economy strengthens. Supply-side reforms to raise productivity and tackle informality would raise investment and potential growth. The present conjuncture, with a tailwind from a strong U.S. rebound, provides a valuable opportunity to decisively address Mexico’s challenges.

Fiscal policy

The authorities have pursued a conservative fiscal policy through the pandemic, with a focus on containing public debt. The support in response to COVID-19 was notably less than that of emerging market (EM) and regional peers. The authorities have increased resources for health, social (non-contributory) pensions for the elderly, Pemex, and public investment projects, but have restrained spending in other areas. They have sought to tackle tax evasion, which is welcome. Despite the historic downturn last year, these efforts have boosted revenues and the authorities plan to deepen them going forward. They are simplifying the tax regime for small and medium-sized enterprises and the self-employed. While the government is not projecting additional revenues from this measure, multiplicity of tax regimes can incentivize tax planning, deter business growth (through scale or threshold effects), and be complicated to administer (owing to the co-existence of cash and accrual basis regimes); therefore, careful attention to design is warranted.

A more accommodative fiscal stance in 2022 could have significant social and economic payoffs. Mexico has some fiscal space and enjoys comfortable market access that could be deployed to limit the human costs ( IMF Fiscal Monitor, April 2021 and IMF WP 21/181 ). Specifically, a permanent increase in spending of about 1½ percent of GDP in 2022 could help alleviate the pressures on the vulnerable, mitigate scarring, and secure the recovery. Around ¾ percent of GDP would go toward increasing education and health spending (particularly since education losses from nearly 1½ years of school closures have been magnified in under-served areas), about ½ percent of GDP could go toward strengthening poverty reduction efforts (including for childcare benefits), and ¼ percent of GDP could be for incremental public investment in green infrastructure.

These measures could be followed by a further, permanent increase in spending of 1½ percent of GDP in 2023-24. Thus, in total, there would be a permanent increase in spending of about 3 percent of GDP, of roughly equal amounts for poverty alleviation, education and health, and quality public investment. Although even more resources are likely needed to make satisfactory progress toward the Sustainable Development Goals in education and health, such spending would constitute a meaningful and pragmatic down payment.

- Social assistance should be strengthened by improving targeting, reducing overlaps and coverage gaps across multiple programs, and enhancing administrative capacity.

- Education and health. Increased spending should be paired with efficiency-enhancing measures, such as investing in education equipment and facilities, improving early-childhood education and childcare facilities, curbing absenteeism, targeting health sector investments toward impoverished areas, and decreasing administrative and insurance costs.

- Public investment (besides Pemex) is low and investing in high quality projects would support growth. Conducting rigorous and transparent cost-benefit analyses, including through a process of external review, would help ensure sound project selection.

The above supportive policies would need to be coupled with measures that contain rising pension costs as well as reforms to Pemex’s business plan. The scope for further cuts to non-pension, non-Pemex spending is limited on account of previous sizable cuts.

- Pensions. Building on last year’s reform, consideration could be given to reforming the design of the minimum pension to mitigate risks of early retirement (strengthening the link between retirement age and pensions), aligning the special pension regimes with the broader system, swiftly completing the transition from the expensive pre-1997 pension scheme, and increasing the age at which workers in the public sector become eligible for a full pension. Consideration should also be given to maintaining the current level of social (noncontributory) pensions, adjusted for inflation, in the coming years.

- Pemex ’s losses are placing a burden on taxpayers and crowding out other more productive uses of fiscal resources. Past corruption scandals underline the critical importance of strengthening governance and procurement processes within the company. Further support for Pemex should be accompanied by a new strategy that prioritizes financial objectives (e.g., focus on profitable fields, sell non-core assets, postpone new refinery plans, and reform its costly pension scheme) and increases transparency. Partnering with private firms would leverage specialized expertise and help manage costs.

To ensure that the above-mentioned public spending can be accommodated while putting debt/GDP on a firm downward path, a progressive tax reform will be needed. There is important room to raise non-oil revenue collections which, pre-pandemic, were nearly 6 percent of GDP below Latin American peers and about half those of the OECD. Such a reform could be designed and legislated over the next year or so and phased in gradually over the medium term as the economy strengthens, with a goal of raising 3-4 percent of GDP. Efforts should also continue in parallel to further strengthen tax administration. Combining this reform with an increase in social assistance (as described above) will help bolster social stability and improve living standards for the poor. The authorities are well-placed to engineer a carefully calibrated and gradual reform drawing from a menu of options that include:

- personal income taxes : broaden the base by eliminating a range of exclusions and tax expenditures and broaden the top bracket;

- subnational property taxes : update the cadaster, improve coordination across levels of government, and simplify and better enforce the vehicle tax;

- mining taxation : reform the regime to collect more revenues when profits increase, while minimizing the impact on competitiveness;

- VAT : eliminate zero-rating except for a few key food items, rationalize exemptions, implement a comprehensive compliance risk management strategy, and eliminate reduced rates at the border; and

- gasoline excise : adopt a more market-based system for gasoline prices (as the current excise formula disproportionately benefits the rich).

Monetary policy

With inflation above the target range, the central bank has raised the policy rate by 75 basis points since June 2021. From mid-2019 until earlier this year, the central bank had cut the policy rate to 4 percent, although this still left the rate positive in ex ante real terms and one of the highest among large EMs. However, since March inflation has been above the inflation target range. This mostly reflects external factors (elevated food, energy, and merchandise inflation) but also local demand-supply imbalances as the economy re-opens. These price pressures are expected to be mostly transitory. The rise in inflation above the target range has prompted the central bank to raise rates to signal its firm commitment to its inflation objective and ensure a firm anchoring of inflation expectations. While the rate hikes create costs in the form of foregone output and employment, these costs are seen as relatively modest compared to those that would need to be incurred if inflation expectations started to drift upwards and the central bank needed to re-establish its nominal anchor. The central bank has also enhanced transparency by presenting an updated inflation forecast with each decision and publicizing the vote of each board member.

A gradual path of policy normalization would balance the need to support the economy as it recuperates from the pandemic with the need to ensure a firm anchoring of medium-term inflation expectations. The expectation that price pressures are largely transitory, the existence of considerable economic slack, and the fact that Mexico did not cut its policy rate abruptly in 2020 provide room for the central bank to move gradually to give itself time to more fully assess the extent and durability of recent price pressures. Such a patient approach is supported by the fact that Mexican policy rates, output, and inflation have historically co-moved very closely with the U.S., and price pressures in the U.S. are generally viewed to be transitory. That said, policy will need to remain highly attuned to the evolution of inflation expectations. A somewhat faster pace of policy tightening could be called for if medium-term inflation expectations start to rise. Exchange rate flexibility should be maintained to continue facilitating adjustment to shocks, with foreign exchange intervention limited to instances of disorderly market conditions.

Greater clarity on the central bank’s assessment of the outlook would help to better navigate the current challenges. Clear communication on the transitory nature of current inflationary pressures will remain essential. Building on recent innovations to enhance transparency, further steps to provide more details about the central bank’s macroeconomic forecasts—including eventually publishing an internally consistent macroeconomic forecast that includes the policy rate path that underpins the forecasts—would help guide market participants and facilitate orderly adjustments across the yield curve. In that context, it will be important to continue emphasizing that policy is not on a pre-set path but will respond to developments, including the evolution of inflation expectations and potential emergence of second-round effects. Over time, this would allow analysts to also infer how the central bank’s expected policy rate path evolves with changes in the macroeconomic outlook.

A strategic review of the monetary policy framework could suggest areas for enhancing effectiveness. The framework has served Mexico well. However, inflation and inflation expectations have historically been at the upper end of the central bank’s target range. The review could assess the performance of the framework and possible changes to the monetary policy toolkit or to the central bank’s communications strategy. The review could also consider the roles of financial stability, inclusion, employment, and the greening of the financial system within the bank’s existing legal framework.

Supply-side reforms

The government’s inclusive growth strategy comprises several elements. These include implementing the USMCA trade deal, increasing public investment including to improve regional integration, enhancing financial inclusion, and promoting governance, among others. However, efforts to privilege state-owned energy producers and reverse previous reforms and the canceling of certain investment projects have weighed on investment and risk offsetting the growth benefits of other measures.

Changing course on energy policy would improve competitiveness and investment. Electricity prices for corporations remain notably above those in the U.S. and many other EMs. Despite these high costs, reliability of electricity supply is a rising concern. Leveraging Mexico’s large and diverse renewable energy resource base, encouraging private sector participation in electricity generation and hydrocarbon distribution, and strengthening the electricity grid would foster a cheaper, more reliable, sustainable, and competitive energy sector. As noted above, Pemex’s business plan needs to be reformed.

Mexico has been an early adopter of climate change mitigation policies, but more is needed to reduce greenhouse gas emissions and promote sustainable growth. Mexico was the first EM to implement carbon taxation back in 2014 and, more recently, has put in place a pilot emissions trading scheme. However, the carbon price is below that in other countries and well below what is needed to achieve its Nationally Determined Contribution (NDC). Comprehensively pricing emissions, gradually increasing the role of carbon pricing, and implementing reinforcing sectoral measures (e.g., feebates) could enable Mexico to achieve its pledge for reducing emissions by 2030 and contribute significantly toward achieving the ambitious net zero emissions goal for mid-century. A balance could also be considered between such price-based measures and the use of alternative instruments to achieve the government’s mitigation goals. Revenues raised from higher carbon taxes could be used to protect the poor and enhance inclusive growth, including by funding the achievement of the Sustainable Development Goals. A border carbon adjustment may also need to be considered to help preserve competitiveness.

Measures to promote formalization of the labor market, narrow gender gaps, enhance financial depth, and improve the rule of law and governance would foster productivity and inclusion.

- Considering Mexico’s level of development, informality is high. Sharp increases in the minimum wage in recent years have put it above the median informal income and much of the formal income distribution. Calibrating minimum wage increases in line with labor productivity growth and taking a comprehensive approach (e.g., reducing regulatory costs of formalizing a business and lowering firing restrictions as the labor market strengthens) would raise incentives for formalization.

- Low female labor force participation, large gender pay gaps, and high levels of violence against women are long-standing issues that have become more acute in the pandemic. Improving access to, and the quality of, childcare would increase female labor force participation and could more than pay for itself over time.

- Strengthening the business climate remains crucial to raise productivity and investment as well as position Mexico to take advantage of rapid technological change. Investment in education and training (including digital connectivity) would enable the labor force to adapt to these changes. Enhancing independence and resources of regulatory institutions would underpin investment sentiment and further support these efforts.

- Boosting competition for financial services and tackling impediments such as timely legal enforcement of contracts would lower costs and enhance access to finance. Harnessing the benefits of rapid technological evolution in finance will require regulatory agility, alongside due care to balance considerations of operational, financial and market integrity, consumer and investor protection, and financial stability.

- Steps to combat corruption and strengthen AML/CFT include adequately resourcing the relevant anti-corruption agencies, enhancing the powers of the institutions in charge of investigations, prosecution, and oversight of public spending, enhancing the verification mechanism related to the public asset declarations by high-level public officials, enhancing money laundering enforcement commensurate with Mexico’s risk profile, and introducing comprehensive criminal liability for legal persons.

The IMF staff team is grateful to the Mexican authorities and other counterparts for their time and constructive discussions.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Maria Candia

Phone: +1 202 623-7100Email: MEDIA@IMF.org