A car factory in Wolfsburg, Germany. The economic shock of COVID-19 on Europe’s largest economy has been profound. (photo: POOL New REUTERS Newscom)

Germany’s Post-COVID-19 Recovery in Five Charts

January 19, 2021

According to the IMF’s latest economic assessment of Germany, priority should be placed on setting the economy on a sustained recovery path by minimizing labor market scarring, protecting vulnerable people, and ensuring that viable firms remain in business.

Related Links

Looking beyond the near term, emphasis should be on “building better for the future” by supporting the transformation toward a smarter, greener economy.

The following five charts illustrate the impact of the pandemic on Germany and the policies needed for a durable recovery.

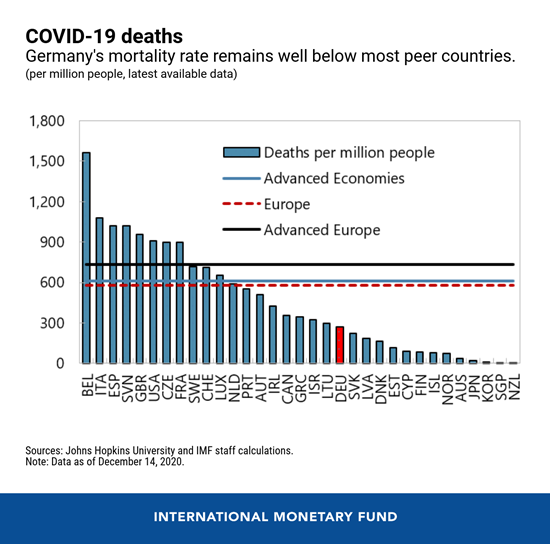

- Germany has to date been relatively successful at managing the pandemic, but the economic shock has still been profound. The country’s early and vigorous public health response has led to some of the lowest mortality rates in Europe. However, the containment measures caused a substantial drop in business activity, especially in contact-intensive sectors. Economic activity started recovering following the re-opening in late April, but a new wave of infections in the fall has triggered another round of lockdowns. Overall, the economy likely contracted by over 5 percent in 2020. Economic growth is expected to pick up in 2021 as vaccines become widely distributed, but output is not projected to return to its precrisis level before 2022.

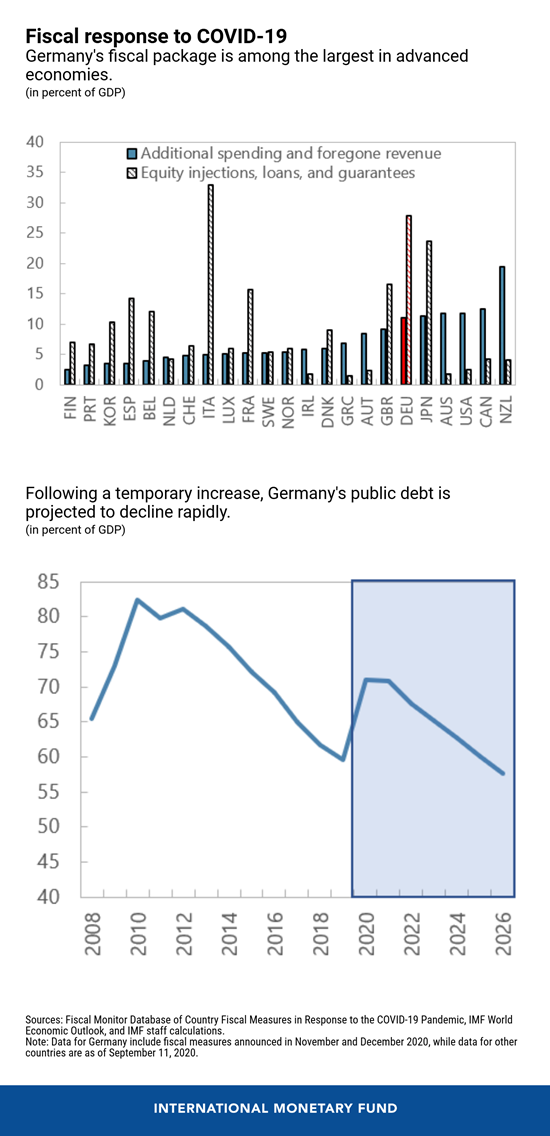

- Fiscal policy should remain supportive until there is firm evidence of a sustained recovery. Making good use of long-accumulated fiscal space, the government implemented sizable measures—among the largest in advanced economies—to combat the pandemic. Apart from scaling up medical spending, initial measures provided critical support to households and businesses by expanding the short-time work benefit (“Kurzarbeit”), extending the duration of unemployment benefits, providing liquidity to firms, and expanding loan guarantees. A stimulus package in June focused on boosting domestic demand through a temporary value-added tax cut, expanding support for small businesses, and increasing public spending on green investment, digital infrastructure, and healthcare. In November and December, further measures were introduced to support the most affected businesses during the renewed lockdowns. The pace of fiscal normalization should be carefully calibrated to the epidemic's path and evolving economic conditions. Public debt remains sustainable and should not hamper vigorous policy action.

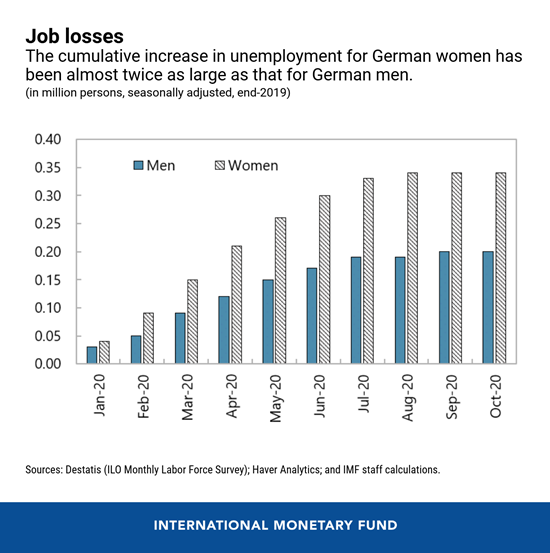

- Germany’s well established short-time work subsidy, “Kurzarbeit,” has played a critical role in retaining jobs, but cannot by itself fully address the labor market shock. Kurzarbeit contributed to Germany’s remarkable labor market resilience during the global financial crisis and is proving critical again during the pandemic by preserving jobs and stabilizing incomes. That said, most of the job losses to date have been borne by marginally-employed workers who are not eligible for Kurzarbeit. The majority of these workers are employed in hard-hit contact-intensive services, and around two-thirds of them are women. Moreoever, young workers will likely suffer scarring effects to their long-term earnings and career prospects, while older workers may permanently exit the labor market early. To protect these vulnerable groups and support their re-integration into the labor market, Kurzarbeit should be supplemented with targeted hiring incentives, an expanded social safety net, and stepped-up training.

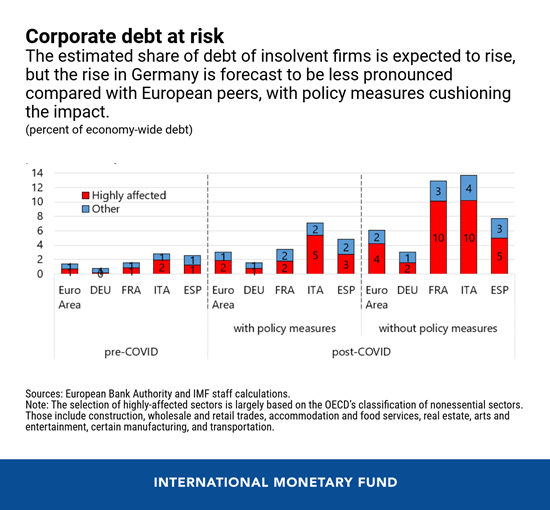

- Phasing out support for corporate borrowers during the recovery period will require a careful balancing act. So far, bankruptcies have not risen, due partly to the insolvency moratorium, but might rise as exceptional policy support is rolled back. Meanwhile, lending conditions could tighten as other measures to support borrowers expire. The government should ensure a smooth transition by continuing some direct support for viable firms, especially those that are key for the functioning of the economy, while facilitating the exit of unviable ones. As the recovery gathers momentum, support for businesses should be more targeted to prevent credit misallocation and the rise of “zombie” firms.

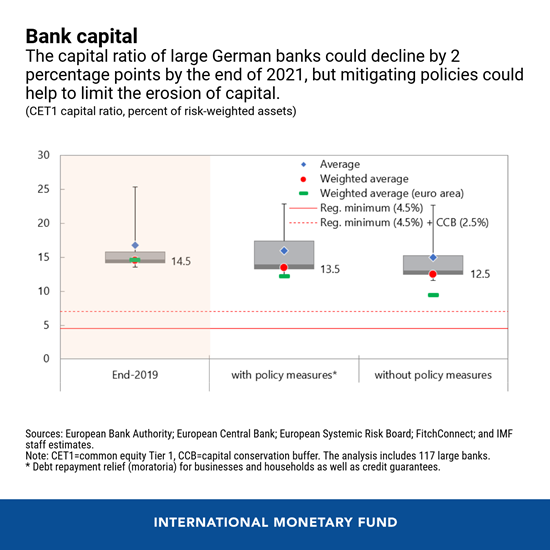

- The German banking sector is broadly resilient, but capital relief and restrictions on dividend payouts should remain in place until the recovery proves sustainable. Thanks to strong equity buffers and multi-pronged borrower support policies, most banks are expected to absorb the shock to their capital ratios without breaching regulatory capital requirements. But to maintain financial stability, supervisors should allow banks to continue to dip into their capital buffers and extend dividend restrictions until the recovery gains momentum. In the medium-term, long-standing profitability weaknesses, exacerbated by the pandemic, call for faster restructuring efforts by banks.