Kosovo: Staff Concluding Statement of the 2020 Article IV Mission

October 8, 2020

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

Washington, DC: An International Monetary Fund (IMF) mission, led by Mr. Gabriel Di Bella, conducted a virtual visit during September 23-October 7 in the context of the 2020 Article IV consultations. At the end of the visit, the mission issued the following statement:

“Kosovo’s people and its economy have been hit hard by the pandemic. Fiscal and financial policies have mitigated the impact of the shock on households and firms, though lack of political consensus has so far prevented a stronger policy response. The sharp increase in infections in July-August forced the government to slow the reopening and reinstate partial lockdown measures, setting back the incipient economic rebound. Near-term policies should focus on ensuring that the health system can effectively cope with unusually high demand for its services, while continuing to support incomes. Amid extraordinarily high uncertainty, key priorities are:

- Fiscal policy needs to continue to cushion income losses for households and firms, but strengthening the design, targeting, and transparency of measures will be key going forward. While the suspension of the fiscal rule over 2020–21 is warranted, it needs to be combined with a clearly communicated commitment for its gradual reinstatement as the economic recovery takes hold.

- In turn, financial policies should continue mitigating the shock to incomes without endangering banking sector stability.

- While preserving people’s health and combating the recession are the near-term priorities, the pandemic exacerbated many pre-existing structural challenges. Addressing them remains essential to increase productivity and ensure that gains are evenly shared.

Kosovo has been hit hard by the Pandemic

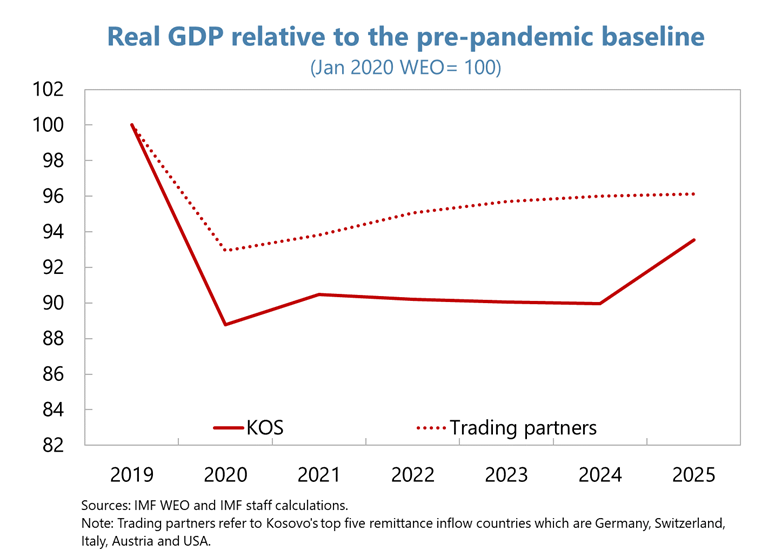

After surging strongly during July-August, new COVID-19 cases have recently subsided. While the health system has responded well, its capacity was stretched at the height of the spread last August. On the economic front, real GDP is projected to fall by 7.5 percent in 2020, and to rebound by 6 percent in 2021.[1] Plummeting growth in countries where the diaspora resides (-6 percent in 2020) and international travel restrictions will cost Kosovo 6 percentage points of GDP in diaspora flows in 2020. This will compound the negative effect on growth from mandatory and voluntary decreases in domestic mobility and heightened uncertainty.

There is large uncertainty about the outlook

The uncertainty surrounding the baseline projection is large and the risk of worse than projected outcomes remains sizable. This reflects a combination of public health and economic factors that are difficult to predict. Weaker external growth and longer international travel restrictions could magnify the shock. Domestically, longer lockdowns can hurt demand and confidence. Political division could complicate the implementation of mitigation and recovery measures. On the upside, progress with vaccines and treatments may allow mobility to return to normal levels more rapidly.

Fiscal policy needs to continue supporting the health response while cushioning income losses

The implementation of mitigation and recovery measures will require a temporary suspension of the fiscal rule over 2020 – 21. Overall deficits are expected at around 6 and 5.5 percent of GDP in 2020 and 2021 respectively. The extraordinary situation may warrant refocusing part of the Privatization Agency of Kosovo’s (PAK) deposits from financing investment to mitigation and recovery measures, which as a rule should be well-designed, transparent, and targeted to those most in need. As the mid-year revision of the 2020 budget does not fully define PAK-financed mitigation and recovery measures, they should be redeployed to the budget of 2021 once their full design, targeting, and costing have been completed.

Response and mitigation efforts were led by essential workers in the health and security sectors. Bonus payments for these sectors (0.6 percent of GDP planned for 2020) recognize such efforts. Given the very uncertain path for the pandemic, the budget for 2021 should include a general contingency allocation for mitigation efforts that could be deployed in the first half of 2021 if needed.

Transfers to private firms should be targeted and transparent. Planned transfers of Euro 60 million (1 percent of GDP) should ensure that jobs are protected in firms that are expected to remain viable after the pandemic subsides. Eligibility criteria should be clear, and the list of beneficiaries should be publicly available (in line with legislation). The design of large subsidies to agriculture (of about 1 percent of GDP in 2020, including planned recovery measures) needs to be strengthened with a view to increasing their transparency and effectiveness.

The extraordinary fiscal effort in 2020 – 21 needs to be anchored by a credible consolidation path as the economic recovery takes hold. To prepare for this, a clear communication strategy that highlights the temporary nature of current bonuses and transfers is needed. Moreover, reforms to refocus social spending to protect the most vulnerable should start in earnest. Creating additional pension benefits on top of existing schemes without an actuarial sustainability analysis of existing benefits should be avoided. Further, the proposed 10 percent withdrawal of pension savings from the Kosovo Pension Saving Trust (KPST) undermines Pillar 2, reduces future pensions, and limits the size of the domestic capital market, which has been an essential source for budgetary financing.

Financial policies should aim to mitigate the shock without endangering banking stability

The CBK decisions to postpone loan repayments and then to allow for up to 1-year loan reprogramming have mitigated the impact of the shock on borrowers and banks. The decision to postpone loan payments in March resulted in a 3-month loan payment moratorium that reached more than 50 percent of total bank loans. As this window closed, the CBK in June allowed applications for up to 1-year loan extensions and restructuring on a case by case basis. At the closing of this window in September, about 15 percent of the banks’ loan book have been reprogrammed.

The lifting of regulatory forbearance should be gradual, and the CBK needs to be prepared to adapt its plans if 2021 growth disappoints. The extent of loan reprograming, and the deep recession suggest that non-performing loans (NPLs) will increase in the coming months. To avoid limiting credit availability, regulatory forbearance should be lifted gradually, bringing any deficiency in provisions to zero over the next 12 months. The CBK should provide guidance along these lines as soon as possible and strengthen supervision efforts, focusing on large borrowers. Uncertainty about the economic outlook and the damage to credit quality suggests that the pace at which forbearance is scaled back should be kept under review. If growth in 2021 disappoints, further loan reprogramming could be considered for viable borrowers. Avoiding any weakening of capital or provisioning standards remains essential.

On the institutional front, vacancies at the CBK Board should be filled urgently. The CBK Board has not functioned since June due to lack of quorum. Filling the vacancies is essential to ensure that policies have adequate institutional backing. Once the CBK Board resumes operations, the current institutional arrangements should be strengthened to ensure that the financial stability and macroprudential policy functions are adequately represented at the CBK’s Executive Board.

Structural Reforms are needed to accelerate income convergence

Kosovo faces several structural constraints that have prevented faster income convergence, and the pandemic exacerbated many of these pre-existing challenges. The impact of public investment remains low, and the quality of health and education spending is below regional standards. While combating the near-term recession is the priority, strengthening budget effectiveness, reducing human capital and infrastructure gaps, improving governance, and further enhancing international integration would create a more enabling growth environment.

“The mission wishes to thank the authorities and other stakeholders for the frank, open and constructive dialogue.”

[1] Staff is revising these projections to account for 2020:Q2 GDP data released on September 30. In this regard, we expect the contraction in 2020 to be in the 6 – 7.5 percent range, while the rebound in 2021 will be in the 4.5 – 6 percent range.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Gediminas Vilkas

Phone: +1 202 623-7100Email: MEDIA@IMF.org