Albania: Staff Concluding Statement of the First Post-Program Monitoring Mission

September 28, 2020

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff virtual visit (or ‘mission’). Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

Washington, DC: An International Monetary Fund (IMF) mission, led by Ms. Yan Sun, conducted a virtual visit during September 17-28, 2020 for the first Post-Program Monitoring (PPM) discussions. PPM is a regular surveillance tool for countries with IMF credit outstanding above 200 percent of quota. PPM missions focus on vulnerabilities and risks to the repayment capacity to the IMF. At the end of the visit, the mission issued the following statement:

Main highlights

The November 2019 earthquake and the COVID-19 pandemic have taken a big toll on the lives of Albanian people and the economy. Thanks to adept policy management and globally accommodative financial conditions, macroeconomic and financial stability have been maintained . Albania’s capacity to repay the Fund is broadly adequate, but risks have risen in light of the shocks. Aside from a more severe global pandemic, key risks stem from elevated public deficits and debt, weaknesses in public finances, and a relatively high level of non-performing loans (NPLs). Managing these risks amid large uncertainty will require continued support for the economy, gradually rebuilding room for policy maneuver as the recovery becomes entrenched, and close supervision of the financial sector.

- Support for people and firms hurt by the shocks is warranted, but should be temporary and well-targeted, subject to transparency and accountability. There is a need to make room for supporting essential activities and protecting the most vulnerable, including by containing non-priority spending and improving spending efficiency.

- As the effects of the shocks subside and to recreate room for fiscal policy maneuver, it will be critical to resume some modest fiscal consolidation from 2021 and build on it substantially over time, underpinned by a sound Medium-Term Revenue Strategy.

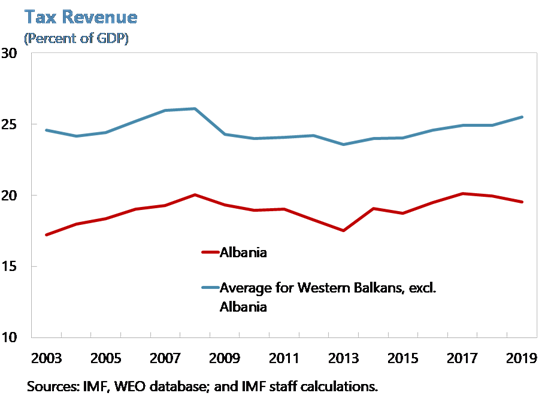

- The authorities should redouble their efforts to raise tax revenue by building a fairer, simpler, more efficient, and more transparent tax system that is growth conducive. Higher revenue is critical to sustain the higher spending needs of the people and the economy. At the same time, there is a need to contain and manage increasing fiscal risks and strengthen the management of public resources, notably of public investment, so as to obtain more value for money.

- Strong efforts are warranted to safeguard financial stability while supporting borrowers hit by the shocks.

- There is a need to prepare contingency measures in case of a more severe pandemic.

Public finances—balance supporting the economy and addressing development gaps with the need to rebuild room for fiscal policy maneuver and reduce debt

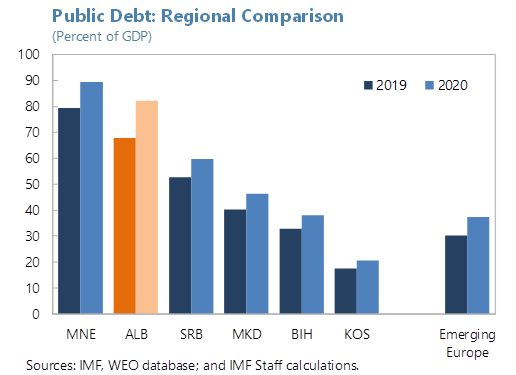

A sizeable increase of the 2020 fiscal deficit to cushion the impact of the shocks is warranted. Reflecting its dependence on tourism and remittances, the economy is projected to contract by about 7½ in 2020. The fiscal deficit is projected to rise to about 7 percent of GDP and the public debt to slightly above 80 percent of GDP at end-2020. International financial support, including from the IMF, and the June Eurobond issuance will help cover the financing needs. We expect the economy to recover from the second half of 2020 and strengthen gradually over 2021 as the impact from the shocks subsides and earthquake reconstruction continues. Inflation is projected to remain low and we support the Bank of Albania’s accommodative policy stance and flexible exchange rate policy.

Support for the economy needs to continue in 2021 but with growth recovering, the budget should also strive to achieve a modest decline in the debt ratio. Further progress in rebuilding room for fiscal policy maneuver by reducing the fiscal deficit needs to be embedded in a credible medium-term budget framework. During 2021, the authorities should contain non-priority spending to make room for adequate health care provision for the pandemic and social protection for the most vulnerable, and maintain sizable liquidity for contingency, as the risks to activity are mainly to the downside. Continued earthquake reconstruction must be based on a robust institutional framework with transparency and accountability. We welcome the recent amendment to the fiscal rule stipulating a primary balance of at least zero from 2023 onward and note that this requirement should be seen as a floor rather than a target.

Fiscal support should be temporary and well-targeted, subject to transparency, accountability, and adequate public financial management (PFM) controls. PFM short-cuts necessary during the emergency should be regularized as soon as possible and earthquake reconstruction funds be subject to adequate PFM controls, including planning through the budget process. It is important to ensure proper procurement, adequate monitoring and timely reporting, adequate oversight, and independent ex-post audits. The ongoing efforts to strengthen the Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) framework need to continue. We reiterate our advice against a possible tax amnesty, given concerns about its impact on tax compliance as well as money laundering and governance risks.

We stress the importance to complete, adopt, and start implementing a sound Medium-Term Revenue Strategy (MTRS) in 2021, following proper public consultation. Higher tax revenue is essential to support much needed investment in physical and human capital while reducing fiscal deficits and the high public debt ratio. Albania’s tax system is complex and fragmented, and frequent ad hoc changes have undermined its stability and transparency. A fairer, simpler, more efficient, and more transparent tax system can boost revenue mobilization while also improving the investment climate and reducing informality. The ongoing preparation of a MTRS offers a welcome opportunity to comprehensively review and redesign the tax system and should proceed without further delays.

There is an urgent need to strengthen public investment management and the quality of spending. Projects should be taken from a pipeline that has gone through a rigorous preparation, assessment, and prioritization process and will contribute sufficiently to an inclusive recovery. We reiterate our call to establish a unified process for preparing, prioritizing, and evaluating all public investment projects, including Public-Private Partnerships (PPPs). The use of unsolicited PPPs should continue to be prevented.

Fiscal risks are increasing and need to be carefully monitored and managed. Strong efforts are needed to rigorously assess and manage not only the direct budgetary impact but also contingent liabilities stemming from PPPs. The PPP law rightly strengthened the gatekeeping role of the Ministry of Finance and Economy (MOFE), which needs to build the capacity to perform this important task. The MOFE also needs to closely monitor and explicitly report and budget for the two recent government guarantee schemes. Furthermore, efforts must continue to improve the performance of the state-owned electricity sector and other SOEs. We remain concerned that the Albania Investment Corporation (AIC), once operational, will bring new fiscal risks.

The authorities should avoid creating new spending and VAT refunds arrears and stick to the plan to clear the existing stock. These arrears not only undermine the business climate and trust in the government, but also hurt businesses’ cash flows at a time when they are already stressed by the shocks. We welcome progress made so far to clear VAT refunds arrears. A permanent solution to the VAT arrears problem calls for realistic revenue forecasts, disentangling VAT repayments from collection, and strengthening budgetary controls. Given the elevated debt level and high gross financing needs, efforts should be stepped up to strengthen cash and debt management.

Financial sector—safeguard financial stability while supporting borrowers hit by the shocks

The banking system has so far remained stable and liquid, but it has pockets of vulnerabilities and its resilience will be tested by the shocks . In particular, relatively high levels of NPLs are likely to rise due to the impact of the pandemic on borrowers. Given that the shocks are exceptionally large and their full impact may only be visible on banks’ balance sheets after some time, the buildup of vulnerabilities in banks may not be detected soon enough unless they are monitored and managed very carefully by the Bank of Albania.

A near-term priority for the Bank of Albania is to closely monitor and guide banks’ restructuring of credit portfolios. We support prudent bank loan restructuring where necessary to support borrowers hit by the shocks. There is a need to ensure consistency and prudence of restructuring practices across the banks. The Bank of Albania’s decision to temporarily relax loan classification and provisioning rules may delay the timing when the impact of the shocks on banks’ asset quality and capital position can be accurately assessed. We stress the importance of maintaining loan classification and provisioning rules to appraise banks’ potential losses as accurately as possible.

We support the decision to restrict dividend distributions until end-2020 and recommend that it be retained until the full impact of the pandemic is known and banks’ capital position is assessed, under both the local regulations and IFRS-9 standards, to be sufficient to absorb the losses from the shocks. In line with risk-based supervision, the Bank of Albania should closely monitor the capital position of vulnerable banks. Where shortfalls arise, a credible capital restoration plan should be adopted, while capital could be allowed to temporarily fall below prudential limits.

The authorities should prepare for a likely surge in NPLs and continue to improve the resolution framework. Efforts should be stepped up to (i) swiftly and credibly operationalize and enforce the insolvency and resolution framework; (ii) implement the regulatory framework for out-of-court restructuring of loans; and (iii) make progress in bailiff reform. Improvements in the judicial process would also be important.

Continued efforts are needed to align Albania’s regulatory framework with international standards. The implementation process should continue, though a sufficiently long phase-in period may be provided to banks so as to avoid procyclicality and disruptions during the pandemic. We recommend close monitoring of risks from related-party lending, cross-border lending, and large exposures.

Risk of a more severe global pandemic—stand ready to adjust and preserve stability

The unprecedented uncertainty of the pandemic highlights the importance of contingency planning. In case of a more severe pandemic, the authorities will need to target new measures to ensure adequate health care provision and protect those most in need, identify options for budget reallocations and additional financing, and keep the domestic financial market liquid. They should stand ready to take these and any further measures that may be warranted, while preserving macroeconomic and financial stability.

Finally, we would like to thank the authorities and all our other counterparts for the excellent collaboration and productive discussions.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Gediminas Vilkas

Phone: +1 202 623-7100Email: MEDIA@IMF.org