Japanese couple walking in autumn foliage. Japan’s population is the world’s oldest, with ramifications for the country’s public finances. (photo: iStock/Satoshi-K)

Japan: Demographic Shift Opens Door to Reforms

February 10, 2020

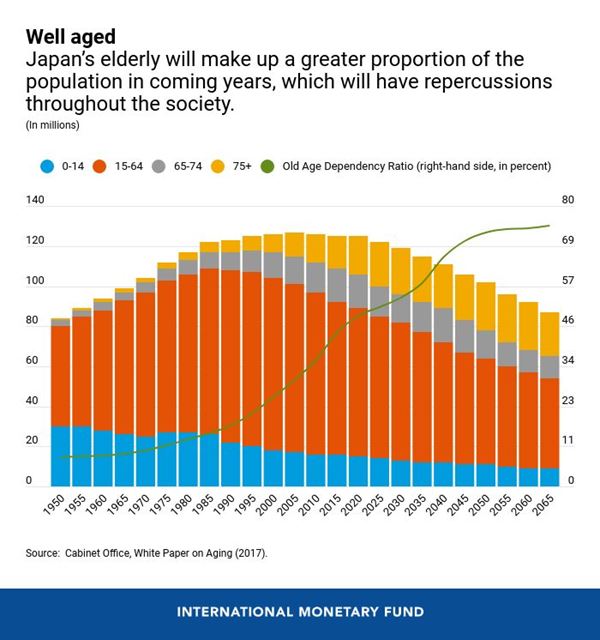

Japan’s population is aging and shrinking fast. With a median age of 48.4 years, Japan’s population is the world’s oldest. The government of Japan projects that there will be almost one elderly person for each person of working age by 2060.

Over the same 40-year span, Japan’s current population of 127 million will shrink by over a quarter—a population loss equivalent to the entire population of Malaysia or Peru. This accelerated speed of aging and shrinking of its population places Japan at the leading edge of global demographic change, posing economic and other challenges for the country.

In its most recent assessment of Japan’s economy, the IMF projects 2020 economic growth to remain resilient at 0.7 percent. Women’s labor force participation has increased significantly in recent years, but in coming years the shrinking and aging of the population will mean fewer and older workers—depressing both growth and productivity. A recent IMF staff paper estimates that Japan’s economic growth will decline by 0.8 percentage points on average each year over the next 40 years due to demographics alone.

Wide-ranging repercussions

The aging and shrinking population will strain Japan’s public finances, as age-related spending—such as on healthcare and pensions—rises while the tax base shrinks. Demographic trends are closely tied to low interest rates. In an aging society like Japan’s, during the pre-retirement phase, individuals increase savings for retirement while investment remains restrained due to a weak outlook, leading to pressure for lower rates. Low interest rates depress the profitability of financial institutions, and incentivizes them to invest in riskier assets in a continuing search for higher returns.

Japan’s rapidly declining population has also led to empty homes due to oversupply, and an accompanying weakening of house prices, particularly in rural areas. Such an effect on the housing market raises risks for the financial health of Japanese households and banks. As a result, Japan’s financial sector vulnerabilities will grow as its demographic transition continues.

The right policy mix

As a result of these growing challenges, Japan needs to strengthen the mutually-reinforcing policies of “Abenomics”—including monetary easing, flexible fiscal policy, and structural reforms (particularly labor market reforms). This comprehensive set of policies is needed to boost potential economic growth, lift inflation to meet the Bank of Japan's inflation target, and stabilize public debt. Priorities include:

- For monetary policy: Maintain the accommodative monetary policy stance, including by keeping Bank of Japan’s short- and long-term interest rate targets, to support growth and inflation.

- For financial sector policies: Safeguard financial stability.

- For fiscal policy: Maintain supportive near-term stimulus while ensuring fiscal sustainability.

Importantly, policy reforms that are “structural” in nature are essential to navigate Japan’s demographic headwinds. Labor-market reforms are the top priority as they can deliver the most gains in terms of growth and supporting higher inflation. Increasing training and career opportunities for workers without lifetime employment, who are mostly women, will help raise labor productivity and wages.

In addition, reforms to boost the labor force by adding more women, older workers and foreign workers are needed. For example, increasing child-care availability will support women’s participation in the labor force, while abolishing firms’ right to set a mandatory retirement age will support older workers.

Product and service sector deregulation, reforms to small- and medium-sized enterprises, and corporate governance reforms are important to lift productivity and investment. Reforms to further liberalize trade and promote foreign direct investment will further support investment and growth. A credible implementation of the reforms outlined above could offset as much as 60 percent of the predicted demographic-driven growth slowdown. Moreover, automation can also help mitigate the challenges brought on by an aging and shrinking population, particularly automation in healthcare, transportation, infrastructure, and fintech.

Interested in learning more about the economic impact of changing demographics? Our March 2020 issue of IMF F&D magazine will focus on this topic. Click here to sign up to our newsletter and be alerted of the launch.