People’s Republic of China—Hong Kong Special Administrative Region: Staff Concluding Statement of the 2019 Article IV Consultation Discussions

December 4, 2019

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

The Hong Kong SAR economy has been hit hard by both external and domestic shocks and fell into a technical recession in the third quarter. The recovery is expected to be gradual and both near- and medium-term risks have increased. With significant buffers in place, securing sustainable growth and maintaining the city’s long-term competitiveness require stabilizing the economy with short-term stimulus while addressing underlying structural challenges through a comprehensive policy package. Despite the slowing economy, financial markets remain resilient and the Linked Exchange Rate System remains the appropriate arrangement for Hong Kong SAR.

Slowing Growth Amid Rising Uncertainty

1. After robust growth of 3 percent in 2018, economic activity weakened significantly in 2019 and the economy fell into a technical recession in Q3. Rising trade tensions between the U.S. and China and heightened uncertainty have taken a toll on exports and investment. Private consumption and visitor arrivals have declined significantly due to the social unrest that started this summer. There are signs of moderation in the housing sector with property prices declining by about 4 percent between May and September, but housing affordability remains stretched and income inequality high. The unemployment rate remained low at 2.9 percent in Q3.

2. The economy is expected to start recovering next year, but the pace is expected to be gradual with a negative output gap over the medium term. As the cyclical downturn continues, GDP is expected to contract by 1.2 percent in 2019. Growth is projected to rise to 1 percent in 2020 led by a recovery of private consumption but remain well below potential growth of about 2½ percent. [1] With increased trade barriers and disruptions to global supply chains as a persistent drag on trade-related activities, growth would recover at a slower pace than in previous recoveries. The slowing economy is expected to shed jobs, thus raising unemployment, though the flexible labor market should allow for a significant share of affected workers to be absorbed by the public and other services sector s. With an estimated negative output gap of about 2¾ percent of GDP in 2020, inflation is projected to fall to around 2½ percent as food prices stabilize.

3. Risks to outlook are tilted to the downside.

- Downside. On the external side, further escalation of trade tensions between the U.S. and China could dampen global trade and lower the volume of trade passing through the city, with negative spillovers for business and employment in trade-related industries. Additional barriers, including potential restrictions by the U.S. against China in technology and the financial sectors, could reduce growth through adverse confidence effects and greater financial market volatility. A significant slowdown of Mainland China or a disorderly adjustment in its financial markets could exert significant impact on Hong Kong SAR given the close connectedness through both real and financial channels. On the domestic side, a deterioration of the sociopolitical situation and delays in addressing structural challenges of insufficient housing supply and high income inequality could further weaken economic activity and negatively affect the city’s competitiveness in the long term. As house prices are highly procyclical, a significant slowdown of the economy could trigger an adverse feedback loop between house prices, the real economy and the financial sector.

- Upside. An easing of trade tensions between the U.S. and China could lift global trade and spur confidence and investment, including in Hong Kong SAR. The development of the Greater Bay Area could further improve medium-term growth prospects.

4. A history of prudent macroeconomic policies has left Hong Kong SAR with significant buffers to address both cyclical and structural challenges. FX reserves at around 120 percent of GDP or twice the monetary base, together with a large net international investment position of about 390 percent of GDP, provide a strong buffer against external shocks. Enhanced regulatory and supervisory frameworks have built up banks’ strong capital and liquidity buffers, with both capitalization and liquidity levels well above international standards. Prudent fiscal management under the balanced budget principle and strong revenue growth during the real estate market boom have helped accumulate large fiscal reserves of about 40 percent of GDP.

Policy Recommendations

A. Fiscal Support for Macroeconomic Stability

5. Greater countercyclical fiscal support would help the economy navigate through negative shocks while maintaining long-term sustainability. With a comfortable level of fiscal reserves, expansionary fiscal policy is needed to support the slowing economy in the near term. The authorities should balance the near-term need of boosting aggregate demand against longer-term weakening of the structural fiscal position arising from rapid population aging and the corresponding increase in social expenditure. This can be achieved by aligning short-term measures with long-term goals and shifting spending forward (e.g., on identified infrastructure projects) in a manner that helps ensure long-term sustainability.

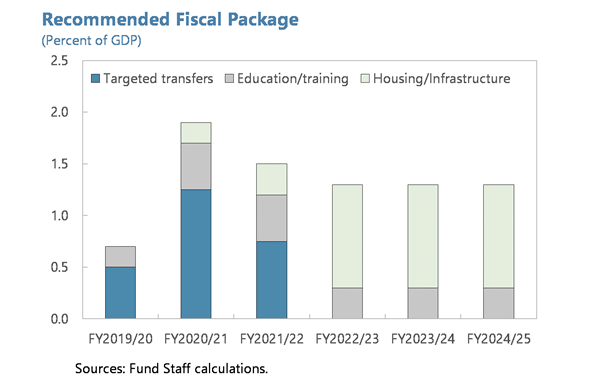

6. In the near term, government spending should be increased significantly to cope with the cyclical downturn and address structural challenges of insufficient housing supply and high income inequality. In addition to one-off relief measures included in the 2019/20 budget, the authorities have announced new fiscal stimuli to help the slowing economy, including support for the SMEs, further tax relief, extra social security payments, and subsidies for households, which the mission supports. Despite these announced measures, we project the fiscal surplus to remain at about 1 percent of GDP over the medium term and would recommend an additional comprehensive medium-term fiscal package, including another fiscal stimulus in the current fiscal year targeted to vulnerable households and SMEs . Spending increases of around 1½ percent of GDP per year (8 ppt of GDP in total over 2019–24), relative to the projected baseline , would help close the negative output gap over the medium term with a drawdown of fiscal reserves of about 5½ ppt of GDP. Such a package could include:

- Targeted transfers. Additional fiscal spending of about 2½ ppt of GDP over two years, that is significantly frontloaded to the current fiscal year, would help those severely affected by the cyclical downturn . As overall tax rates are already low, fiscal stimulus could be better delivered by targeted spending to vulnerable households and SMEs, including through extra allowances, rent relief, and subsidies for low-income students.

- Housing/infrastructure. Given the urgent need to increase housing supply, additional spending on housing and related infrastructure developments is warranted. Bringing forward planned spending on infrastructure projects and scaling it up after the above-mentioned targeted transfers are unwound would not only expedite the supply of land and housing but would avoid an early withdrawal of the fiscal impulse needed to close the negative output gap over the medium term. Cumulative increase in spending of 3½ ppt of GDP over the next five years would increase real GDP by about 2¼ ppt during this period.

- Education/training. Despite the very flexible labor market, unemployment is expected to increase given the significant slowdown of the economy and the persistence of external headwinds, highlighting the urgency of retraining the affected workers . As Hong Kong SAR faces increased competition from other financial centers, it is also important to upgrade “soft” infrastructure through education and R&D to further improve competitiveness. Increasing spending on education and job training, cumulatively by 2 ppt of GDP over the next five years, would increase real GDP by about 2½ ppt in the long run through higher productivity and increased labor supply.

7. If growth falters more than expected, the authorities should provide more near-term fiscal support. Additional targeted spending to vulnerable households and SMEs could help cushion the negative impact of a more severe economic downturn. Retraining programs as well as housing and infrastructure projects could be scaled up further to support the displaced workers and expedite the supply of land and housing.

8. In the medium term, the authorities should also consider structural measures to ensure fiscal sustainability and greater equity. The economy faces challenges of rapid population aging and the corresponding increase in social expenditures in the medium to long term. Thus, the authorities could consider the following measures to avoid scaling back the social safety net, which would incur undesirable social costs and hinder inclusive growth.

- Raising revenues. International benchmarking with other global financial centers suggests that there is room to introduce a VAT, raise excise taxes, and increase the top personal income tax (PIT) rate and the tax rate under personal assessment while maintaining competitiveness. The lowering of the effective PIT rates since 2018 should also be reversed once macroeconomic conditions improve. Introducing a carbon tax for some sectors (e.g., energy, building, and transportation) may help reach the 2030 carbon intensity target laid out in the government’s Climate Action Plan 2030+ and raise revenues in the long run.

- Optimizing spending. Regular fundamental expenditure reviews would help identify any wasteful spending and ensure that long-term goals of increasing productivity, raising labor force participation, and tackling income inequality are addressed. The authorities should also prepare a long-term healthcare spending strategy.

- Improving the effectiveness of budget planning and execution. Reducing reliance on property-related revenues and avoiding systematic under-execution of operating expenditures would help increase the countercyclicality of fiscal policy and ensure the effectiveness of the fiscal response to the economic downturn.

- Increasing labor force participation. Measures to increase the provision of childcare services, especially for children below two years of age and at subsidized rates for poor/single parent families, would help encourage female labor force participation.

B.Containing Housing Market Risks

9. The three-pronged approach to containing housing market risks and increasing housing affordability remains valid and should continue. The combination of macroprudential measures and stamp duties has helped limit household vulnerabilities and contain risks to the financial sector. However, housing prices remain overvalued and affordability stretched. A sustained supply increase remains the most needed course of action to alleviate price pressures and improve affordability.

- Increasing housing supply is critical to resolving the structural supply-demand imbalance and should be accelerated by increasing land allocation for residential housing. While housing production has increased in recent years, it has fallen short of housing demand as well as the government’s target in the Long-Term Housing Strategy. The recent announcement of various measures to increase land supply for residential housing is welcome and should be implemented as planned. Given the difficulties in meeting the housing supply target, it is urgent to expedite the process for identifying land and building sites, together with streamlining the environmental, transportation, and other relevant assessments.

- The macroprudential stance should stand ready to adjust to address financial stability risks. Despite weak economic activity and some signs of housing market stabilization, adjustments to macroprudential measures should be based on evolving financial stability risks. If housing prices and mortgage lending start to increase rapidly again, further tightening would be warranted, with due attention paid to the emerging risk of regulatory leakages to the non-banks (e.g., mortgage financing by property developers) . International experience suggests that regulators should apply the same macroprudential policies to all mortgage providers to prevent leakages and strengthen the effectiveness of the measures.

- Stamp duties have helped contain house price growth by curbing excess demand, especially from cash buyers and, consequently, helped contain household leverage and systemic risks . The New Residential Stamp Duty (NRSD) continues to be appropriate as systemic risk from the housing market remain elevated. However, under the IMF’s Institutional View on capital flows, as NRSD is levied at a higher rate on non-residents than on first-time resident home buyers, going forward, it should be phased out and replaced with alternative non-discriminatory macroprudential measures when systemic risks from the non-resident inflows dissipate.

10. The eligibility criteria of the mortgage insurance program (MIP) were adjusted for first-time home buyers. While the LTV limit without the MIP remains unchanged at 60 percent, the maximum property values eligible for higher LTV ratios with the MIP were raised from HKD 4 to 8 million (LTV ratio of 90 percent) for first-time home buyers and from HKD 6 to 10 million (LTV ratio of 80 percent) for all home buyers considering recent appreciation of property prices. While this could also help reduce mortgage financing by non-banks, given that a significant portion of new mortgages are financed with this insurance (about 9 percent for the first nine months of 2019), the authorities should carefully monitor and assess the overall impact of the policy changes on the housing market and household leverage, and stand ready to adjust the policy mix of macroprudential policies and the MIP.

C. Safeguarding Financial Stability

11. The authorities have strengthened the regulatory and supervisory framework. Key Basel III standards, including minimum capital and liquidity requirements, have been implemented. The countercyclical capital buffer was lowered from 2.5 to 2.0 percent in October to support bank lending as credit growth has declined sharply since the second half of 2018 and remains subdued. The Hong Kong Monetary Authority (HKMA) updated its liquidity facilities framework to reduce the stigma and provide more operational flexibility for banks accessing business-as-usual facilities and introduced a new resolution facility. The Securities and Futures Commission has capped total margin lending to clients by brokers for stock purchases at five times of the brokers’ capital since October 2019, which should help safeguard financial stability when facing adverse shocks. The Insurance Authority is on track to implement a risk-based capital regime for insurance companies with the third quantitative impact study launched in August 2019.

12. Continued efforts are necessary to maintain financial sector resilience and safeguard financial stability amid rising global financial volatility. Following the preliminary assessment of the ongoing FSAP mission:

- Private non-financial sector debt remains elevated, with pockets of vulnerability in certain corporate sectors. Sectoral macroprudential measures (e.g., sectoral risk weights or caps on total sectoral exposures) could be considered to limit concentration risk of financial institutions.

- With a resolution regime for financial institutions in place, the resolution authorities should maintain close coordination with home country authorities of Hong Kong SAR-based subsidiaries or branches of global banks, including in the areas of resolution planning and the roll-out of loss-absorbing capacity requirements.

- The recently-concluded assessment of the Financial Action Task Force found that Hong Kong SAR has a solid anti-money laundering/combating the financing of terrorism (AML/CFT) system that is delivering good results. Hong Kong SAR has a strong legal and institutional framework. The authorities generally have a good understanding of the money laundering and terrorist financing risks they are exposed and actively prosecute money laundering from domestic offences. They should enhance prosecution of money laundering involving crimes committed abroad and strengthen supervision of certain non-financial businesses. Implementation of the priority actions identified in the Mutual Evaluation Report on AML/CFT, including with respect to transparency of corporate and trusts, would be crucial in helping to sustain Hong Kong SAR’s reputation as a leading global financial center.

13. In light of the growing role of fintech in the banking sector, the HKMA stepped up the supervision of technology risk management and operational resilience. While granting eight banking licenses to virtual banking operators, which are expected to become operational from late 2019, the HKMA required virtual banks to meet the same supervisory rules as conventional banks, and to establish the appropriate risk management framework. The authorities aim to achieve a balance between innovation and regulation , including by implementing the Cybersecurity Fortification Initiative. Close collaboration across regulatory agencies should help the Council of Financial Regulators and the Financial Stability Committee identify and close potential regulatory loopholes in a timely manner.

14. The development of green finance and the Greater Bay Area offers opportunities to maintain Hong Kong SAR’ competitiveness as a global financial center . The three green finance initiatives launched in May 2019, including promoting Green and Sustainable Banking, aim to address the climate change-related risks facing the banking sector and achieve sustainable green financing. Following the announcement of the Outline Development Plan for the Greater Bay Area in February 2019, the authorities have announced new measures to improve cross-border cooperation, including allowing the city’s residents working in high-tech sectors and living in the Mainland to pay Hong Kong SAR’s taxes. To promote financial integration, the HKMA has worked with the Mainland authorities to allow the use of e-wallets in Hong Kong SAR for cross-border payment and to streamline the process of opening Mainland bank accounts by Hong Kong SAR residents on a pilot basis.

D. Preserving an Anchor of Stability

15. The LERS remains the appropriate arrangement for Hong Kong SAR. The Linked Exchange Rate System (LERS) anchors the stability of Hong Kong SAR’s highly-open economy with its large and globally integrated financial services industry. The currency board arrangement has anchored the city’s monetary and financial stability against external shocks, including the Asian Financial Crisis and Global Financial Crisis. The credibility of the currency board arrangement has been ensured by a transparent set of rules governing the arrangement, ample fiscal and FX reserves, strong financial regulation and supervision, the flexible economy, and a prudent fiscal framework.

16. The LERS continues to function well despite increased global financial market volatility. The interbank rates have remained stable, net capital outflows have been limited, and market expectations of HKD/USD exchange rate have remained well anchored. Hong Kong SAR’s external position remains broadly in line with medium-term fundamentals and desirable policy settings. The authorities should continue implementing policies aimed at supporting smooth functioning of the LERS. In particular, maintaining the strong track record of public communications on the functioning of the arrangement and the HKMA’s corresponding FX operations as well as enhanced communication on overall FX and money market developments will help ensure credibility of the arrangement.

In closing, the mission would like to thank the Hong Kong SAR authorities, Shenzhen Central Sub-Branch of the People’s Bank of China, and Shenzhen Municipal Financial Regulatory Bureau for their kind hospitality and open and productive discussions.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Daisy Wong

Phone: +1 202 623-7100Email: MEDIA@IMF.org