A woman in a market in Bamako, Mali. The IMF-supported program will help the country boost inclusive growth through more jobs for all its citizens, economic diversification, and greater resiliency. (photo: Michael Kappeler/dpa/picture-alliance/Newscom)

Mali: Supporting Growth in the Face of Security Challenges

September 4, 2019

Mali faces an intense security crisis dating back to 2012 that has long-lasting economic and humanitarian impacts. To help strengthen the resiliency of the economy, the IMF has just approved financial assistance to the country under the Extended Credit Facility (ECF).

Related Links

The financial assistance approved for Mali amounts to about $200 million to be disbursed over three years in support of the government’s efforts to achieve higher and more inclusive growth, economic diversification, and greater resiliency.

In an interview with Boriana Yontcheva, the IMF’s mission chief for Mali discusses some details of the program.

Mali is a fragile, low-income country facing a difficult security situation. How can the IMF-supported program help?

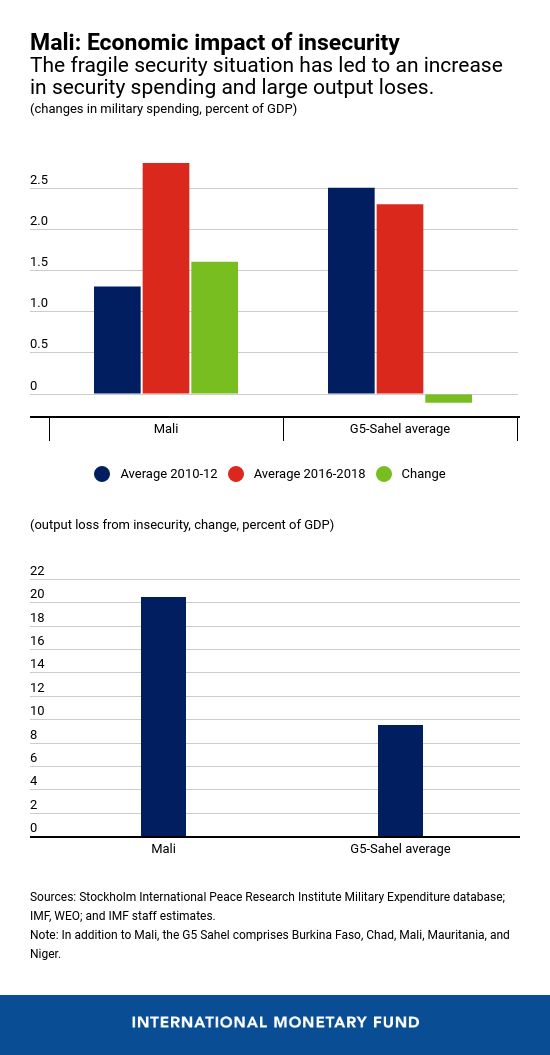

The difficult security situation impacts millions of Malians, weighing on economic activity and development prospects. Security spending is consuming an increasing share of overall public spending, making the preservation of much needed spending on social services and development investment a key challenge for the government.

Broadly speaking, the program will support the government’s new, medium-term development strategy (CREDD) for strong and inclusive growth through inclusive job creation, economic diversification, and greater resiliency.

What are the main objectives of the just-approved economic program?

The program focuses on three key areas to address immediate challenges:

• creating fiscal space to safeguard priority social and infrastructure spending, while accommodating necessary security expenditures and preserving macroeconomic stability;

• reforming the energy sector; and

• supporting reforms to improve governance and transparency.

Creating fiscal space is critical to allow investment, security, and social spending. The immediate priority is to improve domestic revenue mobilization. The government’s program supported by the ECF includes corrective measures to address the sharp decline in tax revenue collection experienced in 2018, modernize the tax administration, enforce taxpayer compliance, improve the effectiveness of mining sector taxation, and further streamline tax exemptions. Performance during the first half of the year indicates that the government’s efforts are already beginning to bear fruit and that collections are broadly as targeted, but the reforms need to be continued.

Reinforcing public financial management will also help by ensuring that the public purse gets the biggest bang for each buck spent.

Another urgent matter is putting the country’s electricity company (EDM) on a sound financial footing so that it can provide electricity, a crucial ingredient of economic development, to Malian businesses and households in an efficient and cost-effective manner.

How can the Malian government lessen the security threat and ease social tensions?

These are difficult questions for which there are no easy answers. A comprehensive peace plan, involving fiscal transfers to regions, was reached in 2015 but its implementation has been challenging. The implementation of the ECF-supported policies will allow Mali to create fiscal space for restoring the state presence over the entire country. The government has already allocated resources to improve the delivery of social services, notably in health care and education, to the center and the north.

What about corruption?

Governance, including corruption, is a critical issue that many countries are grappling with. The government recognizes the importance of reforms in this area to help anchor macroeconomic stability and support inclusive growth. In this regard, strengthening tax and customs administration is a key measure toward improved governance.

In addition, further improvement in public financial management and a better follow-up of governance issues flagged by the Office of the Auditor General, as well as pursuing the revision of the law against unlawful enrichment to widen the scope of officials that are subject to the asset declaration obligation are important future steps.