Tourists visiting the Selaron stairway in Rio de Janeiro, Brazil, where growth is expected to pick up in 2020 (photo: filipefrazao/iStock)

Six Charts on Boosting Growth in Brazil

July 25, 2019

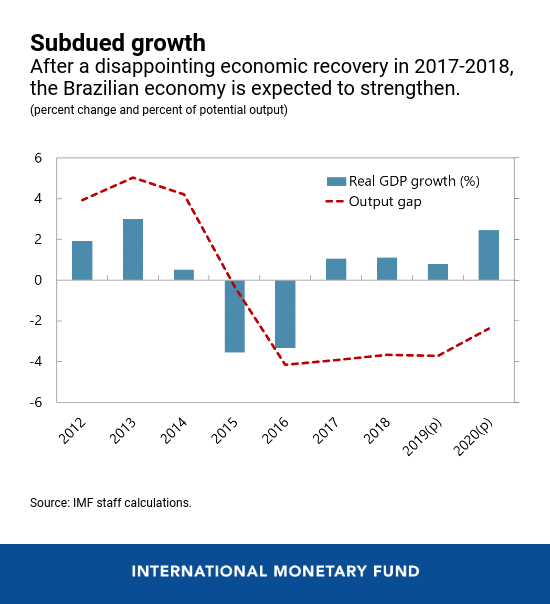

Brazil’s economic recovery after the 2015−2016 recession remains sluggish. Real per capita growth has fallen by 8 percent since the beginning of the recession in 2014, and poverty and inequality are on the rise. While the unemployment rate did fall this year, it is still high compared to pre-crisis levels.

Related Links

To boost growth and create more jobs, Brazil needs to vigorously pursue pension and tax reforms, trade openness, investment in infrastructure, and key financial reforms, the IMF stated in its latest annual economic assessment.

For instance, the pension reform currently being discussed by Brazil’s Congress is a landmark step in rejuvenating the country’s economy. Continuing to implement these policies—which are a major part of the government’s agenda—will be critical to improving Brazil’s future growth.

Here are six charts that tell the story:

- Brazil’s economic recovery remains sluggish but is expected to strengthen in 2020. After the 2015−2016 recession, real GDP grew by only 1.1 percent in 2017 and 2018. Growth is expected to stay subdued at 0.8 percent in 2019. Approval of the pension reform—currently in Brazil’s Congress—and progress in finalizing and implementing the government’s structural reform agenda would boost GDP growth to 2.4 percent in 2020.

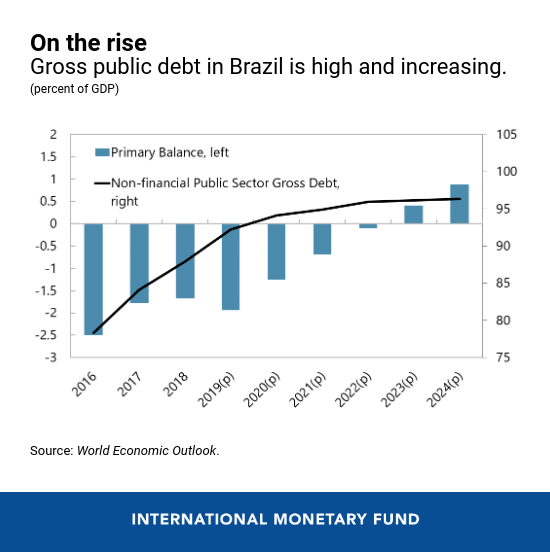

- Putting debt—currently at 88 percent of GDP—on a more sustainable path is critical for economic growth. Public debt is high by international standards and is increasing, exposing Brazil to debt sustainability risks.

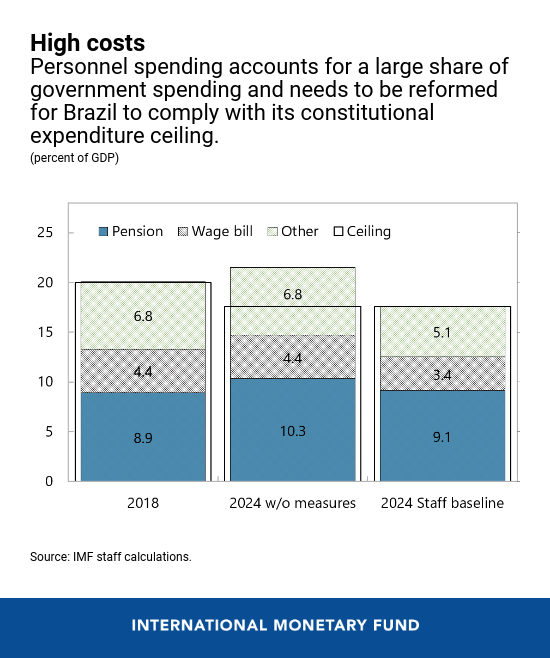

- Pension reform, which is underway, is a crucial first step to bringing down debt. Spending on pensions and public wages accounts for a large share of total government expenditure. Absent reforms, pension spending is projected to increase substantially, driven by Brazil’s population aging. In addition to being unsustainable, the current system is also bad for income distribution. The pension reform currently under Congress consideration is also key to putting debt on a sustainable path.

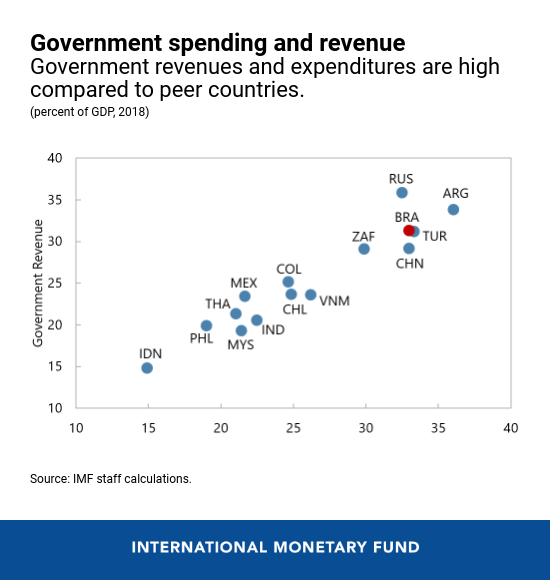

- Measures to improve the tax system will help attract investment. Brazil has a complex tax system. For instance, ICMS—which is the Tax on Commerce and Services—is important in terms of revenue. However, it is also fraught with substantial distortions and exemptions. Given the relatively high tax burden, tax reform should aim at harmonizing the system and reducing costly and distortive tax exemptions while raising the same amount of revenues. Simplifying the tax system would also boost private investment. Revenue-neutral tax reform is high in the government’s priorities and could follow the pension reform.

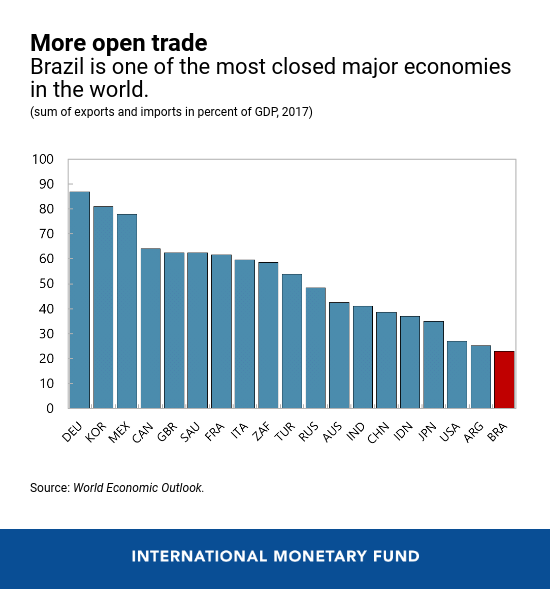

- Brazil’s economy would benefit from opening up. Brazil is one of the most closed economies in the world due to both tariff and non-tariff barriers. Opening up to more trade is essential to improve competitiveness and could give a much-needed fillip to investment. In this respect, the recent European Union-Mercosur trade agreement and efforts to comply with the Organisation for Economic Co-operation and Development liberalization codes provide important opportunities to foster trade integration.

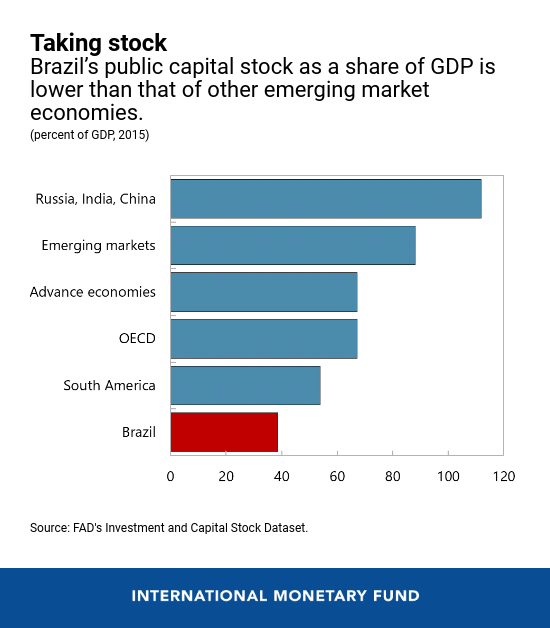

- Closing the large infrastructure gap would boost productivity. Brazil’s public capital stock and quality of infrastructure are lower than in peer countries because of low public investment—in particular on infrastructure—over the past two decades. Reducing the infrastructure gap will require public investment funds to be spent more effectively, supplemented by mobilization of private capital through concessions.