Street scene of Paris, France. Growth slowed last year but remained relatively resilient (photo: ImageBROKER/Ralph Fisher/Newscom)

Five Charts on France’s Economic Outlook

July 23, 2019

France’s economic performance has been solid, and the authorities have made notable progress in recent years to introduce reforms supporting growth. But external risks have increased and some domestic structural challenges remain. France needs to stay the course on reforms, deepening and complementing them with additional measures to bolster economic resilience, public finance sustainability, and inclusive long-term potential growth.

Related Links

The following five charts illustrate the IMF’s latest annual economic assessment for France and the key policy recommendations.

-

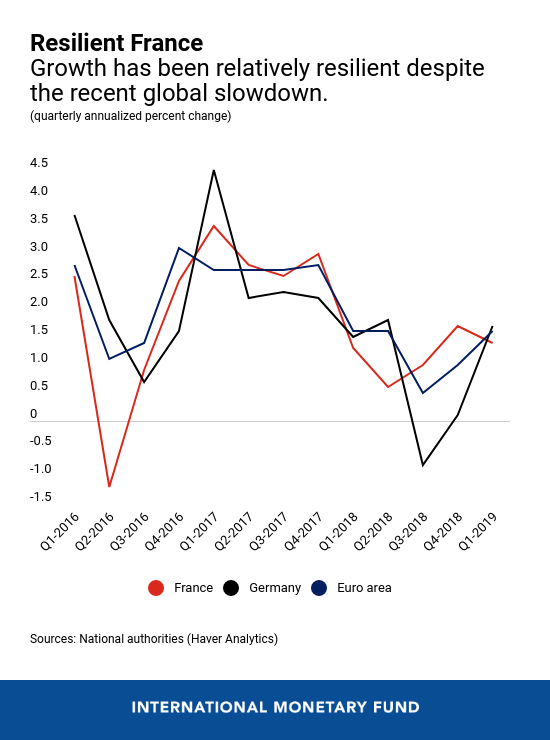

Outlook: After the French economy expanded by 2.3 percent in 2017, growth declined to 1.7 percent last year, due to slowing global growth and some one-off domestic factors. Still, economic activity remained relatively more resilient compared to France’s peers, and the labor market continued to improve gradually.

Growth is expected to reach 1.3 and 1.4 percent this year and next, and gradually converge to its long-term potential level of 1.5 percent by 2021, supported by ongoing tax relief and structural reforms. However, risks have risen, related to a disorderly Brexit, trade tensions, and a softening of activity in the euro area.

-

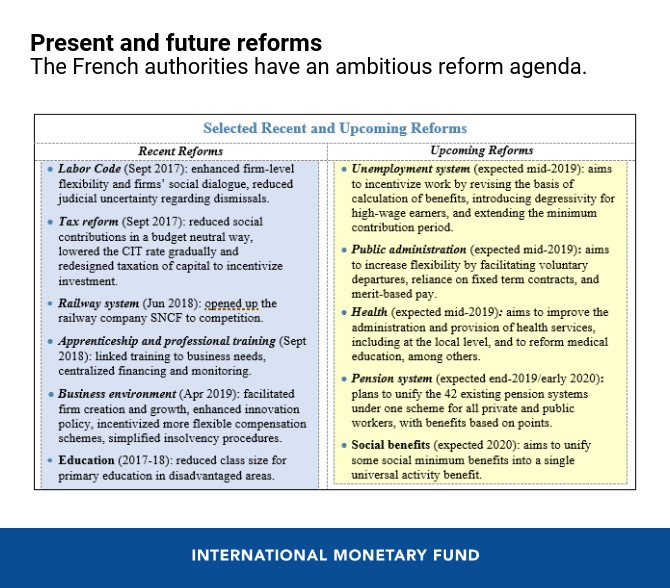

Economic policies: The government has been working on a broad and ambitious policy agenda. A number of key labor market, product market, tax, and education reforms have been enacted over the last 18 months. Further reforms of unemployment benefits, civil service, pensions, and healthcare, are expected this year. Building on the ongoing agenda, future policies should continue to address France’s remaining structural challenges: high public debt and spending, rising private sector indebtedness, high structural unemployment, and sluggish productivity.

-

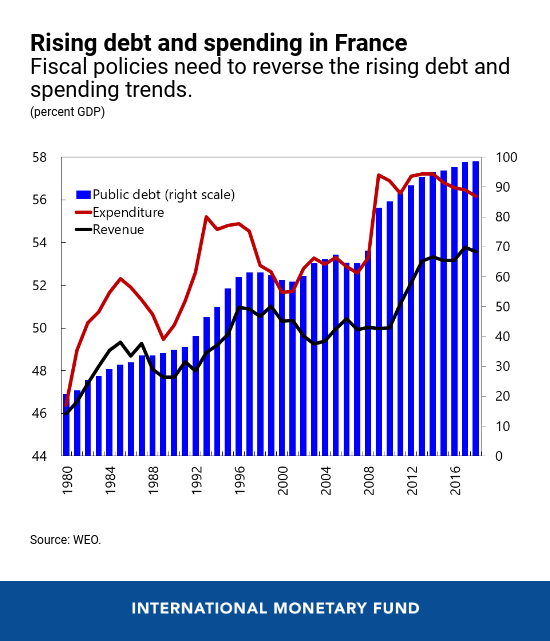

Fiscal policy: France’s public debt has been consistently rising over the last four decades, increasing by 80 percent of GDP since the 1980s to reach close to 100 percent of GDP at end-2018. This reflects the inability of successive governments to take full advantage of good times to reverse the spending increases undertaken during downturns.

Having legislated significant tax relief in the coming years to support investment and purchasing power, the government must prioritize spending reforms to reduce its debt level and rebuild fiscal space to prepare for the next downturn. The upcoming reforms of unemployment benefits, civil service, and pensions should help, but need to be complemented with additional measures to reduce France’s spending ratio, which has increased rapidly over the last decades to the highest level among OECD countries.

Such measures could include streamlining corporate tax expenditures and subsidies; rationalizing spending on medical products and hospital services; improving the allocation of resources in education; better targeting social to those most in need and streamlining administrative costs, and merging small municipalities and eliminating overlaps between the local and central government.

-

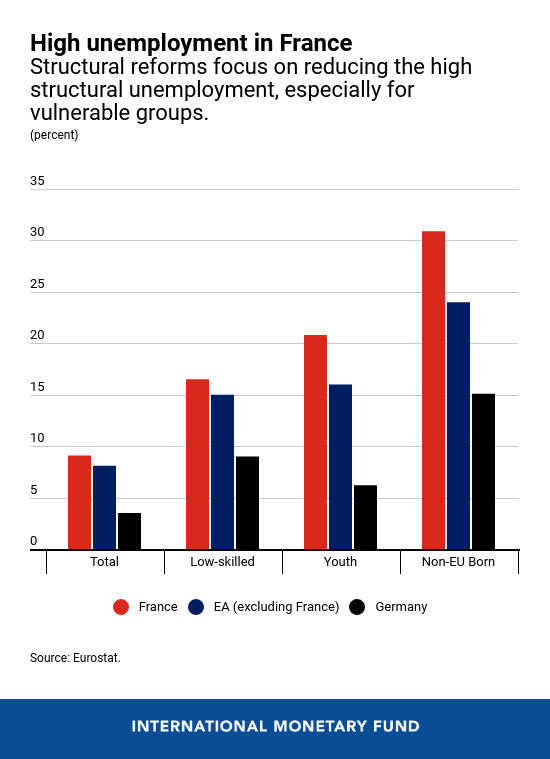

Structural reforms: With structural unemployment still very high, especially for youth, low skilled, and non-EU migrants, and productivity growth sluggish, structural reforms are essential to bolster employment and growth. Recent and upcoming labor code, apprenticeship and training, and unemployment benefit reforms should support labor force participation and increase opportunities for vulnerable groups. Resolute implementation, careful monitoring of effects and their deepending if outcomes fall short of expectations will be essential. Complementing these reforms with measures to ease the administrative burden on start-ups and foster competition in regulated professions, retail trade and sales could generate synergies, increase resilience, and support living standards.

-

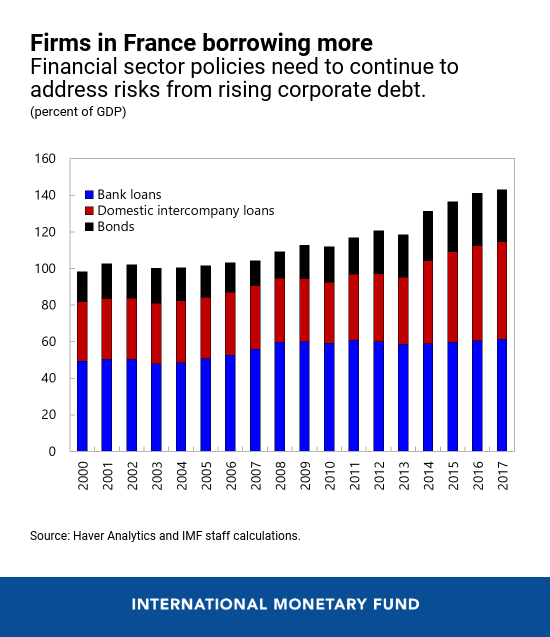

Financial sector : This year’s Financial Sector Assessment Program (FSAP) for France concludes that the authorities made notable progress in supporting financial stability, especially through proactive macroprudential policies to address risks, especially arising from increased corporate debt. Looking forward, safeguarding financial stability will require continued close monitoring and preparedness to make further use of macro and microprudential policies if risks remain or intensify.

Given the global significance and complexity of France’s financial system, further integration of supervisory monitoring and oversight the group level, strengthening liquidity-risk management within financial groups, and ensuring adequate liquidity buffers in all currencies can also help build resilience against risk.