Namdaemun Market in Seoul. Growth is expected to decline to around 2.6 percent in 2019, but pick up in the medium term, led by recovering investment and stronger domestic consumption (photo: istock/mariusz_prusaczyk)

Korea's Economic Outlook in Six Charts

May 21, 2019

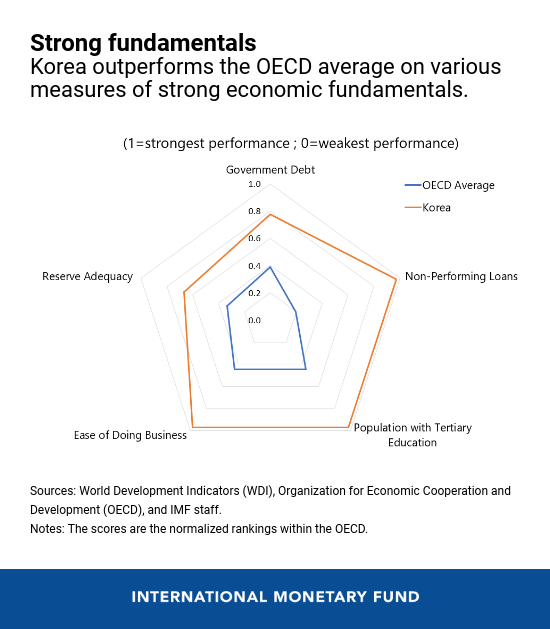

With strong fundamentals, Korea’s economy has performed well in recent years, but short-term growth is now moderating, and long-term growth is facing headwinds. Fiscal and monetary policies should boost growth, and structural policies should foster inclusion and enhance productivity, according to the IMF’s latest assessment of the Korean economy.

Related Links

Korea is the 11th largest economy in the world and its per capita income has recently passed the $30,000 mark. It has a very strong export base and a skilled labor force. Importantly, to guard the economy against significant adverse developments, Korea has built large buffers in the financial and public sectors.

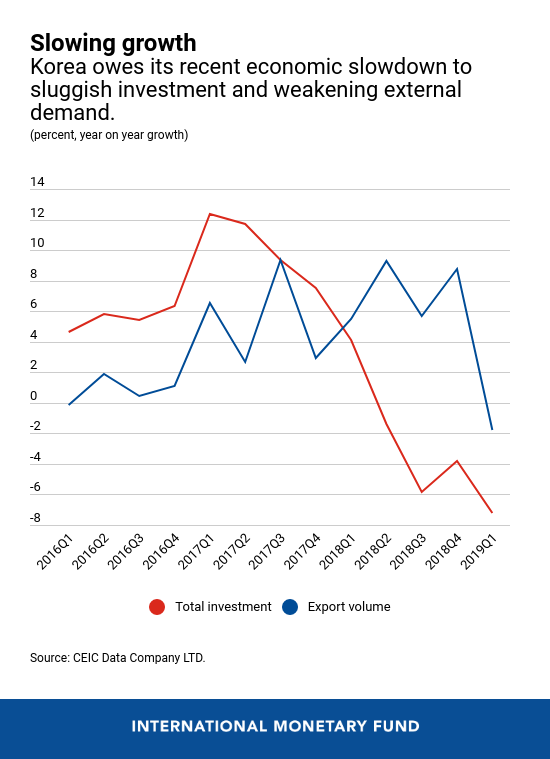

Despite these strong fundamentals, GDP growth dropped to 2.7 percent in 2018 from 3.1 percent in 2017. The global trade slowdown, particularly for semi-conductors, is taking a toll on equipment investment. Export growth is deteriorating on the back of trade tensions and China’s slowdown. Inflation pressures are weak and job creation tepid. Household leverage keeps increasing, albeit at a slower pace, raising concerns about financial risk.

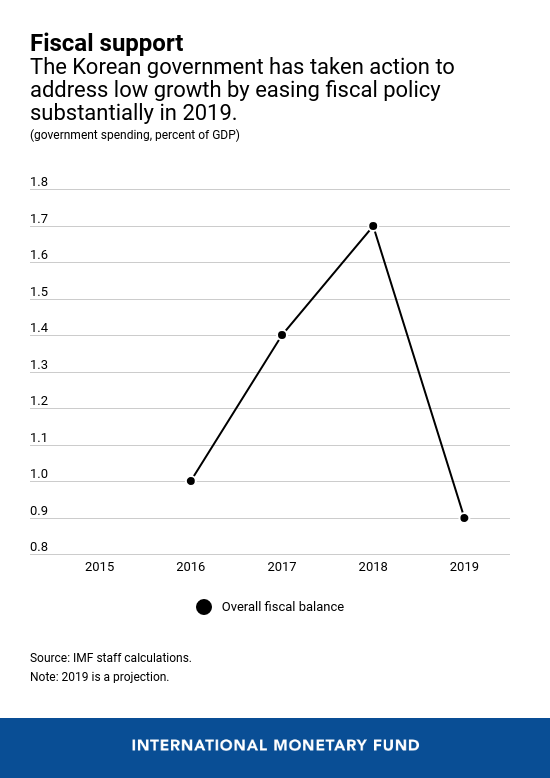

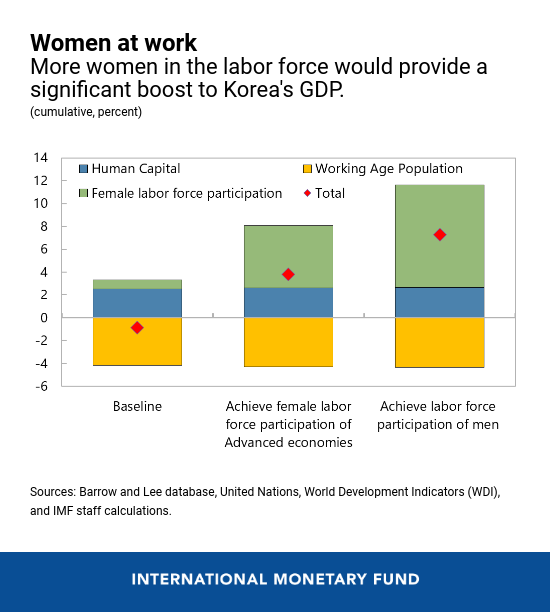

In the short term, an easing of fiscal and monetary policy would help support economic growth and contain risks. To promote long-term, inclusive growth and job creation, fiscal policy should remain expansionary in the medium term, focusing on increasing social protection, boosting female labor force participation, and supporting growth-enhancing reforms in product and labor markets. In addition, public sector job creation should be linked to developing services that cannot be provided by the private sector.

Here are six charts that tell the story.

- Korea’s economy has strong fundamentals. The banking sector appears to be well capitalized with sizable liquidity buffers. Korea has substantial fiscal space to aim for a zero structural balance in the medium term without risking debt sustainability.

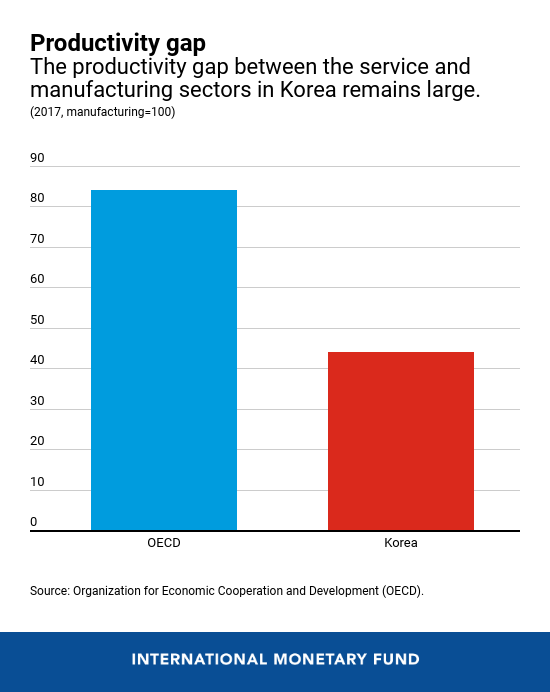

- Korea is now facing cyclical and structural headwinds. Recently, both exports and investment weakened, even though consumption is supported by fiscal policy. Employment creation has been tepid, with inflation lower than the Bank of Korea’s target. Moreover, potential growth is declining on the back of unfavorable demographics and slowing productivity.

- The good news is that the government is taking appropriate action to support growth. The 2019 budget rightly envisages an increase in government spending and the proposed supplementary budget is expected to further support economic activity.

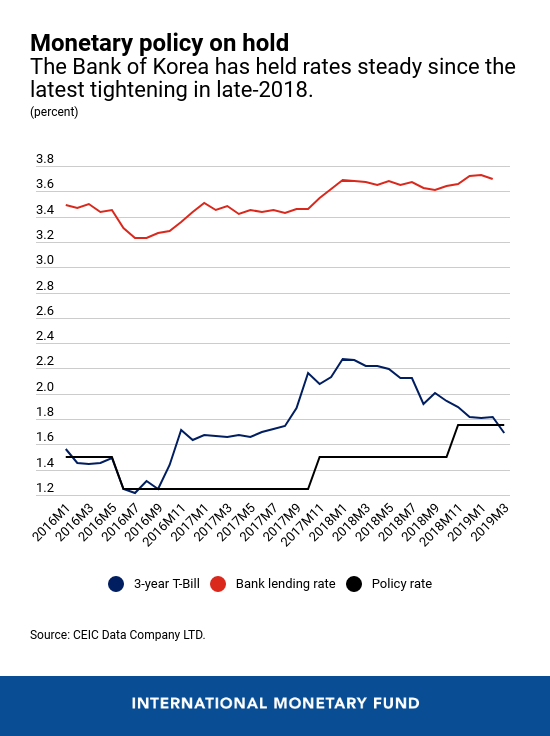

- Monetary policy should also be eased, as inflation is projected to remain below the target for this year and next, inflationary pressures are weak, signs are emerging that inflation expectations have started to decline, and the output gap is negative.

- “Flexicurity” should be adopted as a basis for labor market policies. The main principle is to protect the worker not the job, and involves three pillars: more flexibility for regular workers; a strong and inclusive safety net; and active labor market policies. In particular, efforts to encourage the participation and leadership of women in the labor market should continue.

- Deregulating the non-manufacturing sector could help boost long-term growth. For example, the government initiative to create regulatory sandboxes is a useful move. In addition, the barriers to entry could be brought down, the regulatory protection of incumbents could be lowered, and price controls could be reduced.