A worker producing malaria and other medications in Kampala, Uganda. Tomorrow’s jobs are based on a good education today. (photo: Steve Jaffe/IMF photo)

Uganda's Economic Outlook in Six Charts

May 9, 2019

Uganda’s economy continues its robust recovery with projected growth of 6.3 percent in FY2018/19. Timely implementation of public infrastructure and oil-related projects would support growth in the medium term, according to the IMF’s latest assessment of the Ugandan economy.

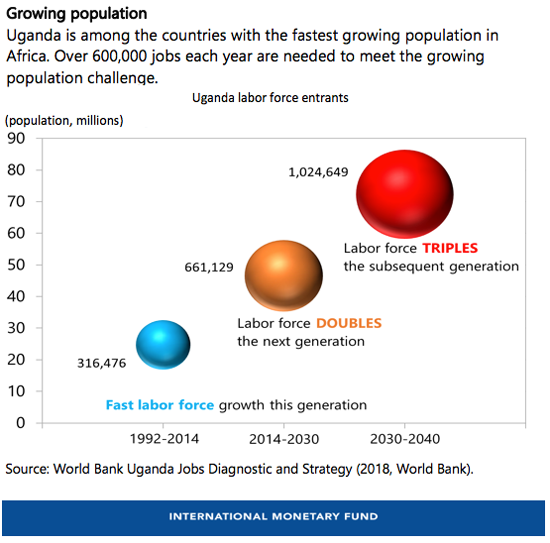

Uganda is among the countries with the fastest growing population in Africa and remains on course to exceed 60 million by 2030. This challenges the country to create more than 600,000 jobs a year for its expanding labor force and to ensure that the benefits of growth are shared fairly.

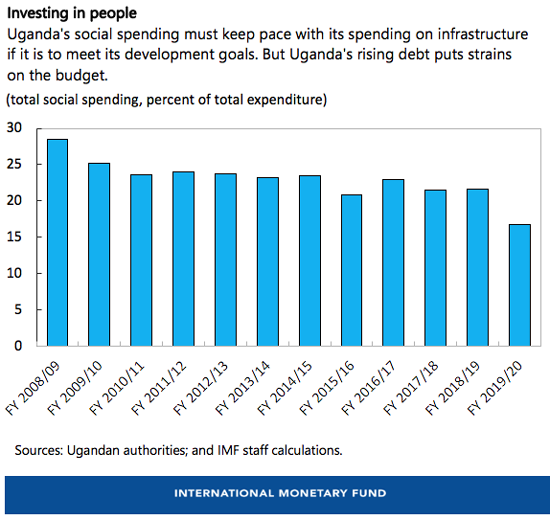

Uganda’s development strategy prioritizes scaling up public investment to address critical infrastructure bottlenecks. Long-term sustainability of the development strategy also depends on strong investment in people. Given limited budget resources, the government must find a balance between infrastructure needs and supporting social sectors, such as health and education.

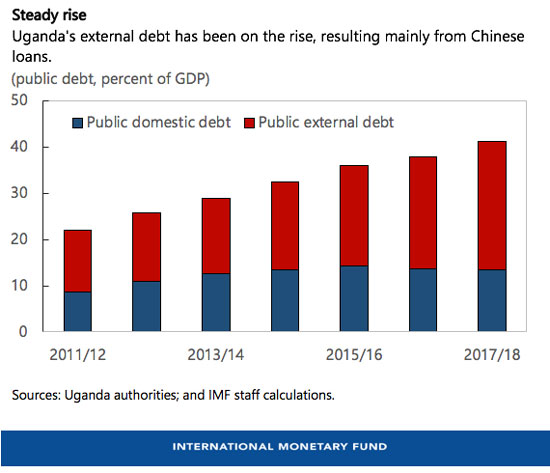

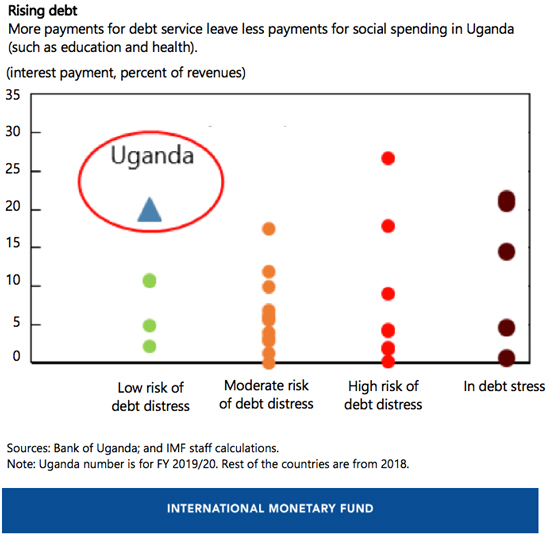

Uganda has relied on external borrowing to finance its large-scale infrastructure projects, which contributed to rising debt, putting more strain on the budget as more resources need to be allocated for interest payments. Nevertheless, the country remains at low risk of debt distress. To help keep debt at manageable levels, the government is finalizing a 5-year domestic revenue mobilization strategy.

Here are six charts that tell the story.

- In the face of a rapidly-growing population, Uganda needs to ensure a

sustainable growth that would create more than 600,000 new jobs every year

in the next decade and lift more Ugandans out of poverty.

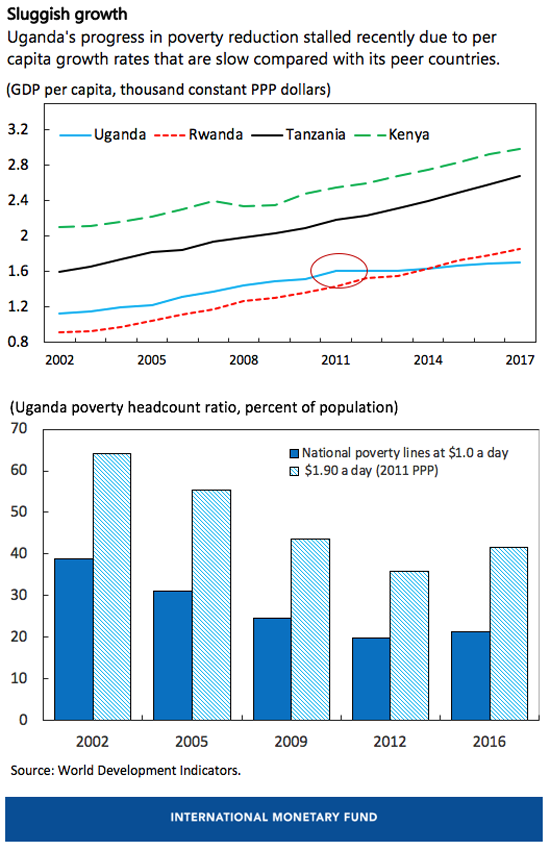

- From 1990 to 2010, Uganda achieved high growth in per capita income,

which allowed it to drastically reduce poverty. Since then, however, growth

rates have slowed compared to peer countries, which is likely to have

contributed to a stalling of poverty reduction.

- After receiving debt relief of close to $5.5 billion from multilateral

organizations and bilateral donors in the 2000s, Uganda’s debt has been

steadily growing. In addition to domestic debt, the country relied

initially on the World Bank and African Development Bank for financing. But

the share of non-concessional loans from China has been rising in recent

years.

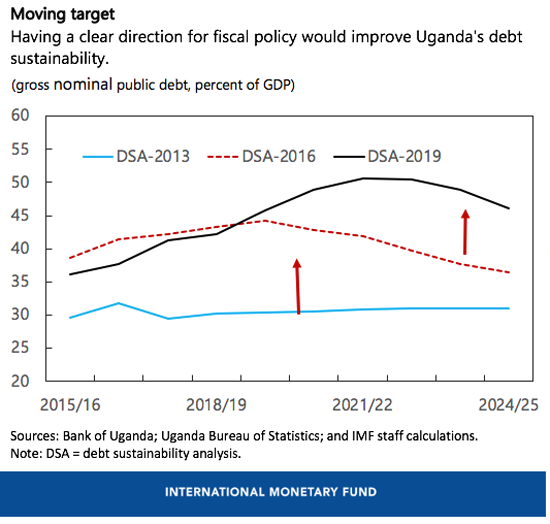

- Fiscal plans have been a “moving target.” In each of the last three

macroeconomic assessments of Uganda, the projected debt path was revised

upwards. Having a clear direction for fiscal policy would help budget

planning and execution.

- Rising debt puts more strain on the budget as more resources need to be

allocated for interest payments. One shilling paid for debt service is one

shilling less going to a school or a health clinic. The current ratio of

interest payments to revenue is comparable to what countries with high risk

or in debt distress typically face.

- To complement the growing physical capital and ensure its most

productive use, the Ugandan government needs to invest adequately in

people. But, in recent years, social spending has declined as a share of

total expenditure.