Luxembourg: Staff Concluding Statement of the 2019 Article IV Mission

March 8, 2019

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

Luxembourg has benefited from strong growth in recent years, supported by sound economic policies and favorable global conditions. This has translated into solid employment growth and a decline in unemployment to record post-crisis lows. The outlook remains favorable, though a number of risks could cloud prospects. These include a weaker-than-expected global growth, a disorderly Brexit, changes in international tax rules, and a sharp tightening of global financial conditions.

The new government has a broad program of reforms which aims to make the economy more inclusive and greener, and lift its growth potential. We encourage the authorities to: (i) build on the strong fiscal record and preserve buffers ; (ii) continue to implement the new international tax standards, while exploring options to mitigate revenue risks from changes in international taxation; (iii) further enhance regulation and supervision of the financial sector in line with the recommendations of the 2017 Financial Stability Assessment Program (FSAP); (iv) address structural challenges in the pension system and housing supply; and (v) improve public investment efficiency.

Context

Luxembourg’s business model has served the country well . Sound economic and fiscal policies, openness, firm prudential oversight, and business-friendly environment have led to strong economic performance. The large and vibrant financial sector has been a key pillar of the economy and an important driver of growth. Following a strong print in 2018—with unemployment at record post-crisis lows and confidence indicators well above long-term averages—output is close to its potential. Given the evolving complexity of the economy, highlighted by frequent and large revisions to GDP, more resources should be devoted to this end at the national statistical agency, STATEC.

The outlook remains favorable, but risks are tilted to the downside . Real GDP growth is projected to remain robust, notwithstanding some deceleration in 2019 and over the medium term reflecting weaker global economic prospects. However, Luxembourg faces external downside risks from a synchronized slowdown across major world economies, a changing international taxation environment, a disorderly Brexit, and a sharp tightening of global financial conditions.

Preserving fiscal buffers

The draft 2019 budget envisages some fiscal expansion this year . Thanks to sound and prudent fiscal policy, Luxembourg maintained low public debt and consistently kept its structural fiscal balance well above the Medium-Term Objective (MTO). Key measures in the 2019 budget include a reduction of the corporate income tax (CIT) rate by 1 percentage point, an increase of net minimum wages, higher excise duties on fuel, higher investment in housing, education, and the digitalization of the economy. The net cost of the envisaged measures to the budget is expected to be 0.5 percent of GDP.

Beyond 2019, planned fiscal measures to lift the economy’s potential and make growth more inclusive and greener are appropriate, but their cost and timing are yet to be determined . Main intended measures over the medium term include: (i) stepping up public investment to close infrastructure gaps and increase the supply of social housing; (ii) generalizing the individual income taxation to enhance female labor market participation; (iii) reforming the real estate taxation to counter speculation, boost housing supply, and enhance housing affordability; and (iv) introducing free public transport in 2020 to support more inclusive and greener mobility.

These plans should be funded while preserving sizable fiscal buffers given fiscal risks from the changing international tax environment. Luxembourg has taken welcome steps to implement the international tax reform agenda, such as the transposition of the EU’s Anti-Tax Avoidance Directive (ATAD) I into national law in December 2018 and the planned transposition of ATAD II by end-2019. In light of a more level playing field in international taxation, some firms may decide to expand their local presence given Luxembourg’s competitive advantages. However, changes in international taxation could reduce multinationals’ incentives to locate assets in Luxembourg, eroding the country’s corporate tax base and potentially leading to non-negligible tax revenue losses. The authorities should try to quantify these risks to revenues under alternative scenarios, and explore growth-friendly options to mitigate them—such as adjusting the low property taxes, further enhancing environmental taxation, and reducing tax exemptions.

Enhancing financial sector resilience against shocks

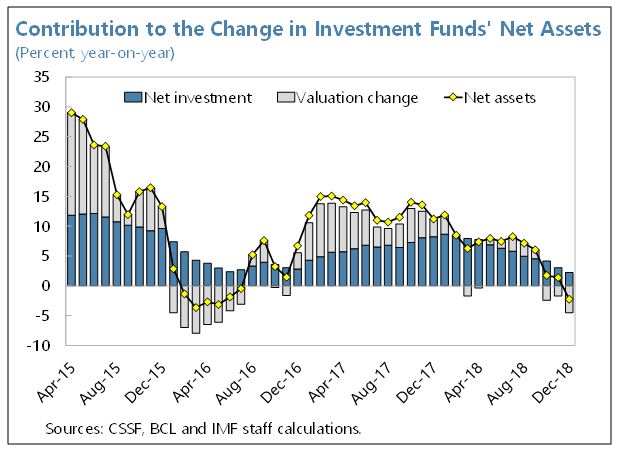

Luxembourg’s large and interconnected financial sector remains resilient, but new challenges are emerging. Luxembourg’s banks maintained larger capital and liquidity buffers and better asset quality than the average EU banks. They have also preserved robust interest margins, notwithstanding the continued low interest rates. Investment funds, which benefited from surge in capital inflows in previous years, experienced slower asset growth and negative valuation effects due to increased volatility in global equity markets at the end of 2018. Common-risk taking behaviors in the sector—partly reflecting similar investment strategies—has led to greater interconnectedness, which might exacerbate financial stress as a result of a sharp tightening of global financial conditions. Increased uncertainty related to Brexit adds to the challenges, although measures at the national and EU level have been taken to mitigate them.

Building on their ambitious regulatory and supervisory reform agenda, the authorities should continue to implement the 2017 FSAP recommendations:

- In the banking sector, efforts to strengthen the supervision of banks’ large cross-border exposures should continue. The authorities should reinforce the oversight of non-bank holding companies of banks while continuing to advocate for a European approach. It is essential to: (i) finalize some operational modalities in the existing framework of emergency liquidity assistance (ELA) provision, as specified in the 2017 FSAP; (ii) complete the resolution plans for the less systemic banks building on recent progress; and (iii) implement the country’s component for the euro area credit bureau.

- In the investment fund sector, recent efforts to strengthen supervision, such as the issuance of specific guidance on substance requirements in the context of delegated activities, are welcome. The authorities should continue to engage with regulators in jurisdictions where delegated portfolio and risk management are prominent. Furthermore, they should continue to: (i) increase macroprudential-based surveillance; (ii) pursue efforts to close existing data gaps, including system-wide indicators for leverage, asset quality, and average maturity; (iii) and strengthen internal capacity and methodologies for system-wide stress testing.

- Macroprudential oversight appears to be working well but should be strengthened. The authorities appropriately announced the introduction of a 0.25 percent countercyclical capital buffer to be implemented by January 2020, took steps to standardize the reporting of borrower-related indicators, and are planning to publish the substance of the risk dashboard this year. Risks in the real estate market should continue to be closely monitored and the authorities should stand ready to put measures to contain excessive household indebtedness. The institutional framework for macroprudential policy could be further reinforced by: (i) swiftly approving the draft bill from December 2017 to implement borrower-based mortgage lending limits; and (ii) enshrining into law the de-facto lead role of the Banque Centrale du Luxembourg (BCL) in financial stability analysis.

- Governance arrangements should be upgraded by enshrining in legislation the operational independence of the Commission de Surveillance du Secteur Financier and the Commissariat aux Assurances, and introducing codes of conduct for the members of the non-executive boards. The relationship between the government and banks with state participation should be formalized on an arms-length basis.

- Risks related to money laundering and terrorism financing (ML/TF) should continue to be addressed. Luxembourg transposed the 4 th EU Anti-Money Laundering Directive into national law in 2018 and finalized the first National Risk Assessment (NRA) Report. The authorities should move forward with implementing the national strategy developed based on the NRA. They should focus on mitigating risks identified in the NRA, particularly those related to private banking and foreign trusts.

Addressing structural challenges

- Pension system. Thanks to dynamic population growth, Luxembourg’s pension system remains in surplus and has accumulated appreciable reserves in recent years. However, less favorable migration flows and population ageing in the future would put the pension system under pressure in a generation. The 2012 pension reform was a key step in the right direction, but further action is needed to assure the long-term sustainability of the pension system. Given the long lags of pension reforms, it would be appropriate to engage with key stakeholders in a timely manner, taking into account intergenerational equity and the tradeoffs of various reform options.

- Housing market. House prices have continued to rise rapidly, driven by limited supply as well as demand factors reflecting high demographic growth. The government should follow through on its medium-term agenda to alleviate supply constraints by boosting the construction of social housing, changing urban planning laws, and reforming real estate taxation.

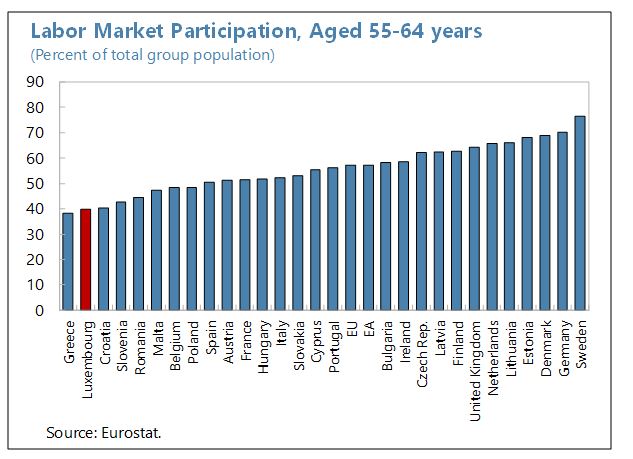

- Labor market. The historically low job-seekers-to-vacancies ratio points to labor shortages and skills mismatches. The young and low-skilled benefited the most from the recent strong job creation, although structural unemployment remains relatively high. Furthermore, elderly labor market participation—at 40 percent—continues to be significantly lower than the EU average of 57 percent. The introduction of the Revenu d’Inclusion Sociale (REVIS) can increase incentives to actively search for a job and encourage job acceptance, and the Digital Skills Bridge program can help better adapt to digital transformation and reduce skill mismatches. Further action is needed to raise labor market participation of seniors, including by phasing out benefits for early retirement.

- Public investment efficiency. Luxembourg has maintained relatively high public investment spending, resulting in one of the highest public capital stock-to-GDP ratios in the EU. The government should continue to invest in upgrading the infrastructure of the country to remove potential bottlenecks, such as in transportation, while improving public investment spending efficiency. Strengthening the multiyear budget sectoral planning would ensure a better coordination, improving the prioritization and efficiency of investment projects.

The mission thanks the authorities and other interlocutors for constructive discussions.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Gediminas Vilkas

Phone: +1 202 623-7100Email: MEDIA@IMF.org