Dutch houses set against the background of a wind farm in Urk, the Netherlands, where household debt remains high (photo: Remko de Waal/ANO/Newscom)

Netherland's Economic Outlook in Five Charts

February 14, 2019

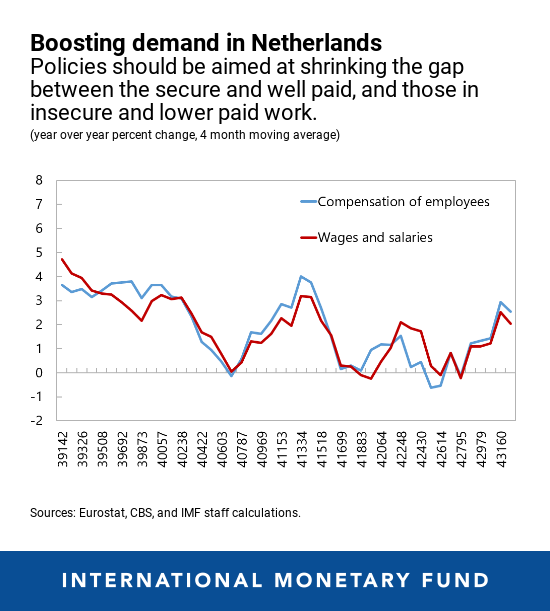

Growth in the Netherlands has picked up and unemployment has fallen sharply in recent years. But real wage and productivity growth have been slow, possibly exacerbated by the increasing share of short-term labor contracts. Finally, the high savings rate and low level of domestic investment by large multinationals, as well as the high debt and illiquid assets of households, are hindering a pickup in the country's growth potential.

Related Links

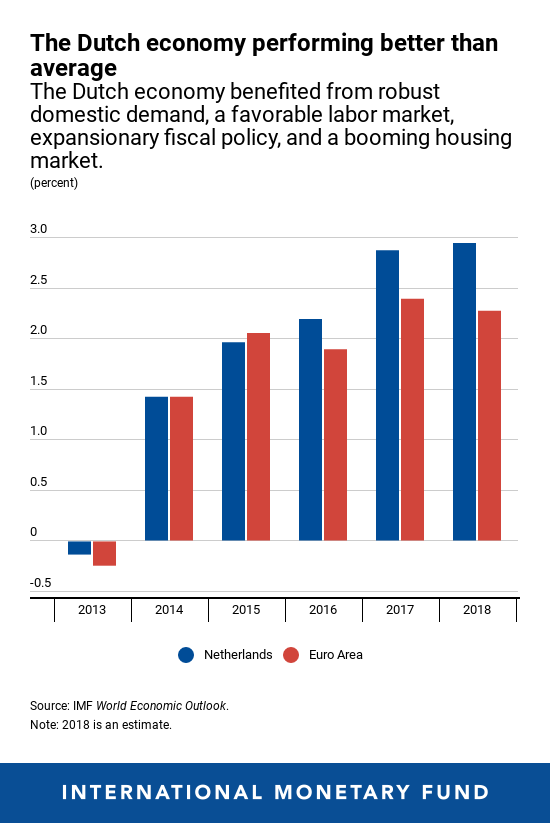

- The Dutch economy has grown faster than the euro area average over the past few years, reflecting recovering consumption and investment, and strong net exports. Labor market developments were favorable, with unemployment reaching a historic low of 3.8 percent. However, wages grew moderately, and inflation remained subdued.

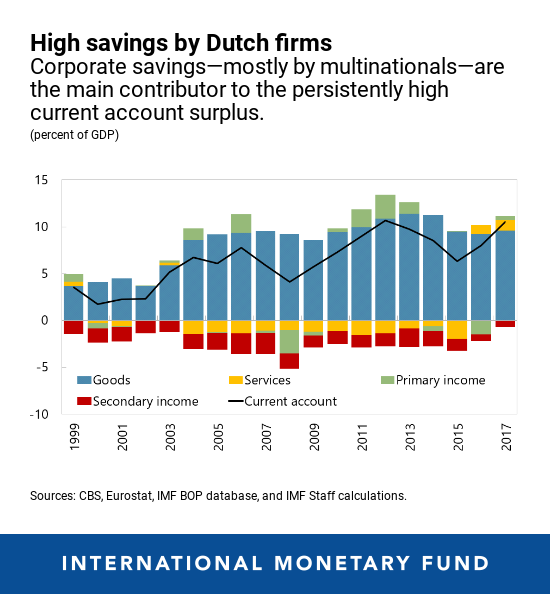

- The current account surplus remains high at almost 10 percent of GDP, reflecting high corporate savings by mostly multinational corporations residing in the Netherlands. Slower global trade and expedited phasing-out of gas production should lead to lower exports and a modest rebalancing in the short term. However, returns on a rising net foreign assets position will preserve the large current account surplus over the medium term.

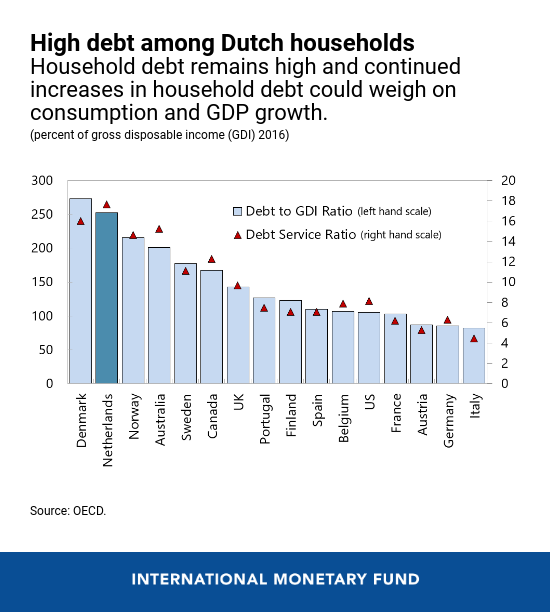

- The external imbalance also likely reflects imbalances in the household sector, where low wage growth and sizeable labor income taxation are compressing disposable income and limiting domestic demand. Household debt remains high, even though households have positive net worth. Households are left too cash-constrained to effectively weather downturns and support rebalancing. Scaling down mortgage interest deductibility beyond current plans would help address the debt bias but this needs to go hand-in-hand with more affordable rental opportunities.

- The Netherlands' fiscal position is strong, resulting in declining public debt and sizeable fiscal space. However, fiscal policy is limited in its potential for rebalancing demand by national rules and capacity constraints. Attempts to fully use the available fiscal space in 2018 were unsuccessful due to difficulties with hiring against a background of low unemployment. While near-term budget plans imply greater spending, over the medium-term substantial fiscal space will re-open with public debt projected to decline below 40 percent of GDP by 2024.

- Policies to support rebalancing and strengthen growth potential over the medium term could include boosting disposable income by bringing it closer in line the different types of labor contracts, further lowering the weight of tax on labor, and fostering productivity and wage growth. Promoting the growth of small and medium-sized enterprises should focus on expanding direct support to research and development, investing in digitalization and lifelong learning, and establishing a business credit bureau.