A worker assembles aluminum panels for passenger jets at an aerospace industry assembly plant in Querétaro, Mexico: improving gender gaps in the country is vital for economic growth (photo: Benedicte Desrus/Sipa USA/Newscom)

Mexico's Economic Outlook in Five Charts

November 8, 2018

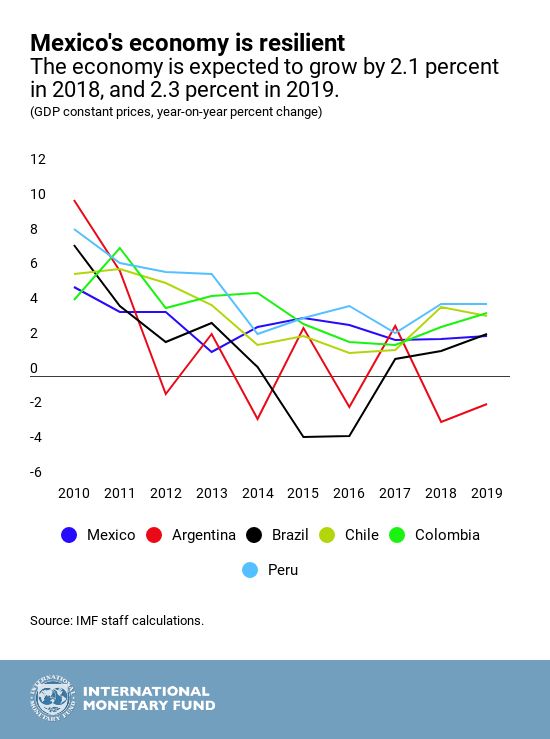

Mexico's economy grew moderately this year, supported mainly by domestic demand, with growth projected at 2.1 percent for 2018, the IMF said in its latest annual economic assessment.

Economic activity in Mexico has remained resilient despite political and economic uncertainty in the first half of 2018, caused by the lead up to the elections and the US-Mexico-Canada trade negotiations.That said, the country continues to face challenges that include raising living standards by reducing poverty and inequality, as well as addressing crime and corruption.

To tackle these challenges and boost growth in a way that will benefit a wider share of the population, reforms will need to focus on raising public investment and social spending, as well as re-invigorating the structural reform agenda with emphasis on strengthening the rule of law, fighting corruption, and reducing labor market informality, the IMF report said.

Here are five charts that tell the story.

- Mexico’s economy continued to grow despite uncertainty linked to the recent elections and the country’s future trade relationship with the United States. In the near term, growth is expected to moderately pick up to 2.1 percent this year and 2.3 percent in 2019. Growth will benefit from strong economic activity in the United States in both years. But continued tight monetary policy and uncertainty related to both the incoming administration’s policies and trade relations with the US will continue, thus dampening growth.

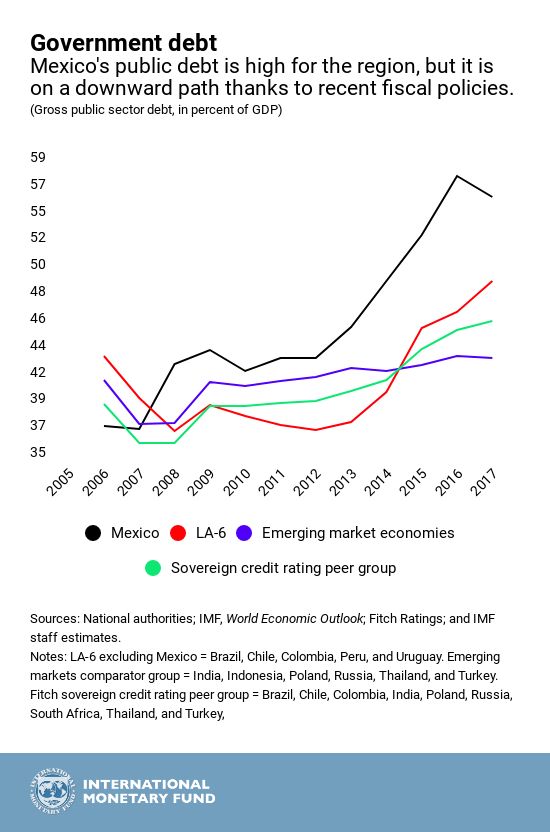

- While Mexico’s public debt is projected to stabilize, the current level—at 54 percent of GDP—limits space for social and infrastructure spending. Keeping the overall fiscal deficit at 2.5 percent of GDP over the medium term would stabilize debt at around the current level, assuming that medium-term growth increases to around 3 percent and the interest rate path remains steady. A slightly more ambitious target would improve budgetary spending room to deal with large infrastructure needs, high levels of poverty and inequality and the fiscal costs of an aging population.

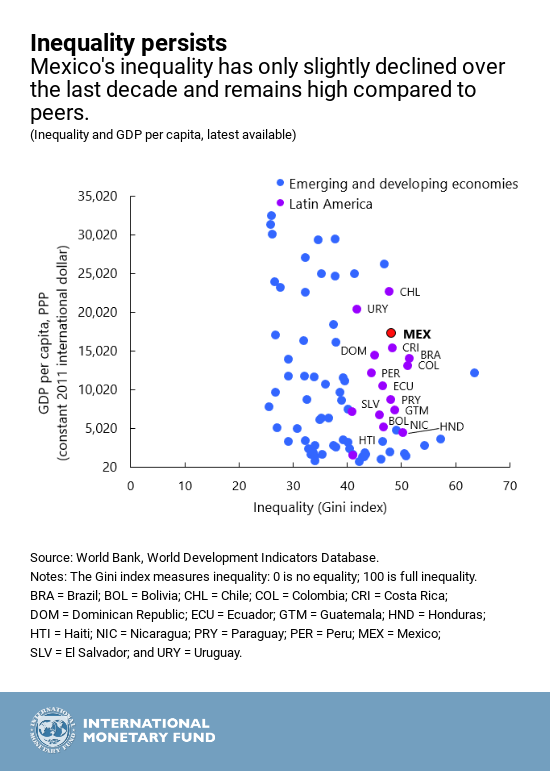

- Poverty, at over 43 percent of the population, and inequality at a Gini Index of almost 50, remain high in Mexico. One reason why poverty rates remain high is Mexico’s meager per capita growth in recent decades. Another is that social policies have not been targeted as well as they could have been. While conditional cash transfer programs have been very effective at reducing inequality, other social programs have disproportionately benefited individuals at the top rather than at the bottom of the income distribution. Further, the redistributive role of fiscal policy—targeted government expenditures to help lower income inequality—is generally weaker in Mexico than in other members of the Organisation for Economic Co-operation Development (OECD) and could be expanded.

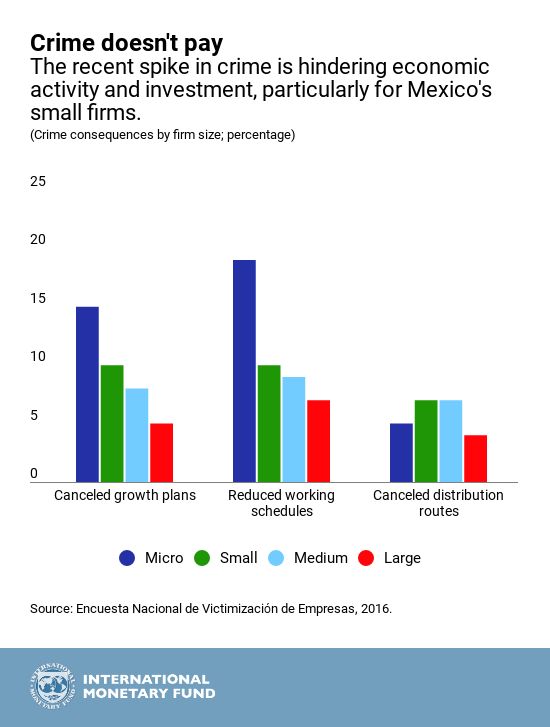

- Improving security and strengthening the rule of law is critical to reducing crime and promoting economic activity. Mexico experienced its most murderous year on record in 2017, and incidences of theft have also been on the rise. High levels of crime come with both direct and indirect economic costs due not only to damages but also the need for costly security measures. Even more importantly, firms may limit their activities and cancel their investment plans in response to a weak security situation. Small firms suffer these consequences disproportionately in Mexico, although Pemex—the Mexican state-owned petroleum company—is also dealing with a continuous rise in pipeline taps with sizable costs to the firm’s operations.

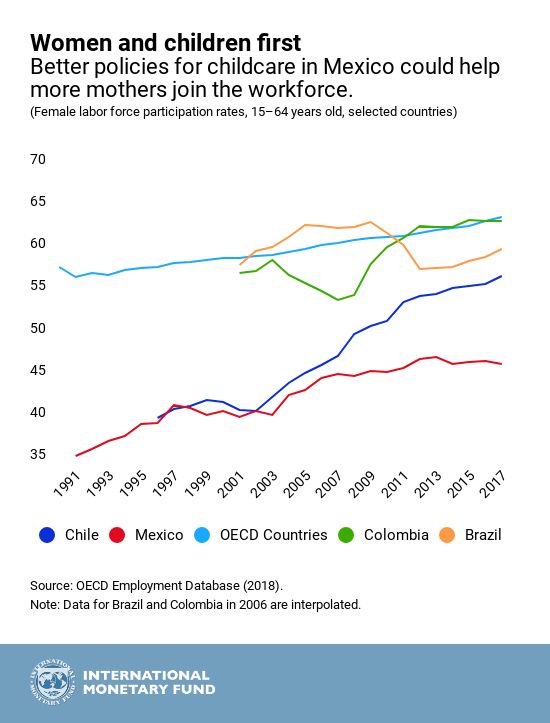

- Mexico should continue to support women joining the workforce. Despite significant improvements in female labor market participation and pay equality, women remain heavily underrepresented in the Mexican economy. Lowering participation gaps for mothers remains a priority. Childcare and maternity and paternity benefits remain well below OECD peers and could help close these gaps.