IMF Releases the 2018 Financial Access Survey

September 28, 2018

On September 28, 2018, the International Monetary Fund (IMF) released the results of the ninth annual Financial Access Survey (FAS). [1] The FAS collects annual data on indicators tracking access to and use of financial products, such as deposit accounts, loans, and insurance policies. The FAS is collected through national central banks or financial regulators. Currently, the dataset covers 189 countries spanning more than 10 years and contains 180 time-series on financial access and use (e.g., the number of ATMs, commercial bank branches, and mobile money accounts). This unique supply-side database allows policymakers to formulate and monitor financial inclusion targets and benchmark against peers.

The 2018 FAS expands to include data on non-branch retail agent outlets

This year’s FAS pioneers a new dataset on non-branch retail agent outlets - a form of branchless banking which entails offering basic financial services through retail stores, post offices or small businesses. Retail agent outlets allow banks to penetrate areas and reach “last-mile” customers not reached by traditional “brick-and-mortar” bank branch networks. The data suggests that retail agent outlets are widespread in South Asia and Latin America, with countries like Mexico, Colombia and Maldives showing fast growth.

Mobile money growth continues across regions

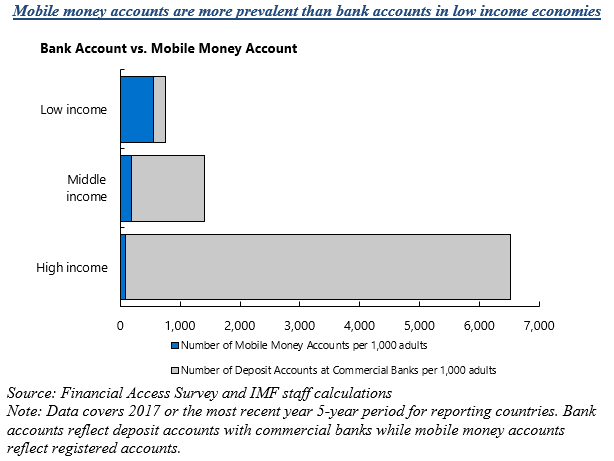

The 2018 FAS suggests that low-income countries are leading the way in mobile money adoption. On average, the number of mobile money accounts in a low-income economy is more than twice the number of bank accounts per 1,000 adults. While Africa continues to lead the mobile money revolution, other regions are not far behind. In countries like Bangladesh, Myanmar and Guyana, mobile money services are growing fast in terms of both the number of accounts and transactions.

The 2018 FAS mainstreamed gender-disaggregated data suggests varied progress on closing the financial inclusion gender gap

FAS data shows that although financial inclusion gender gaps remain, some countries have made significant progress towards greater financial inclusion of women, suggesting the need to study the factors contributing to the closing of this gap. These factors may include targeted schemes offered by microfinance institutions (e.g., Malaysia) and simplified deposit accounts regulations (e.g., Chile).

FAS continues to provide data for SDG Target 8.10

Two FAS indicators have been adopted as part of the 2030 Sustainable Development Goals (SDGs) indicator framework: (1) the number of commercial bank branches per 100,000 adults; and (2) the number of automated teller machines (ATMs) per 100,000 adults. These indicators are used to monitor Target 8.10, which aims to measure the strengthening of the capacity of domestic financial institutions to expand access to banking, financial services and insurance for all.

[1] The 2018 FAS was made possible with the generous support of the Netherlands’ Ministry of Foreign Affairs. The latest FAS data with country-specific metadata are available at http://0-data-imf-org.library.svsu.edu/FAS and the 2018 FAS Trends and Development can be downloaded here.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Pemba Sherpa

Phone: +1 202 623-7100Email: MEDIA@IMF.org