Employees work at a call center in Davao City, Philippines: investing more in digital infrastructure can further support the country’s outsourcing industry (photo: Lean Daval Jr/Reuters/Newscom)

The Philippines' Economic Outlook in Six Charts

September 27, 2018

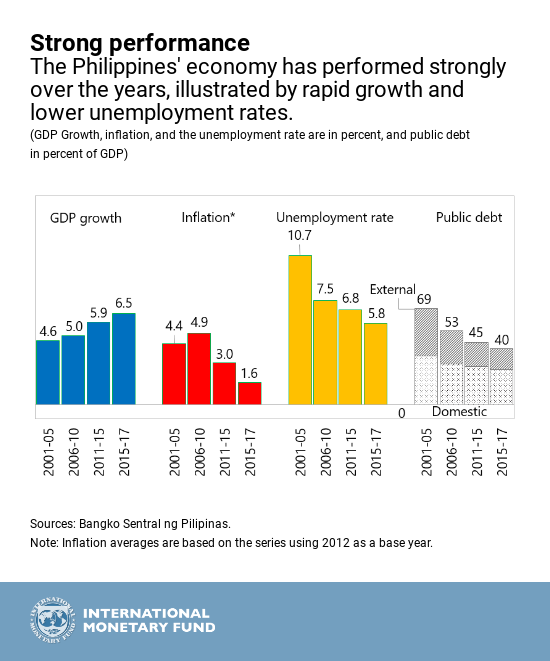

The Philippine economy continues to perform strongly, due in part to robust public investment, with growth projected at 6.5 percent for 2018, and 6.7 percent in 2019, the IMF said in its latest annual economic assessment.

Related Links

But the country faces challenges from rising inflation, tighter global financial conditions, as well as persistent poverty and inequality. To ensure that growth benefits everyone, the government will need to strike the right balance between maintaining a strong and stable economy in an uncertain global environment, while continuing to prioritize reforms that raise living standards, such as targeted social spending and investing in infrastructure, the IMF report said.

Here are six charts that tell the story.

- Strong economic growth continues in the Philippines. The Philippines has been one of Asia’s strong performers over the years. Sound policies and a favorable global economic environment have delivered robust growth, low inflation, and a sustainable debt path, placing the Philippines in a good position to tackle still elevated poverty and inequality. Improving people’s living standards in a sustainable manner requires deepening ongoing reforms—for instance, by increasing social spending—along with timely adjustments of macroeconomic policies to evolving domestic and external conditions.

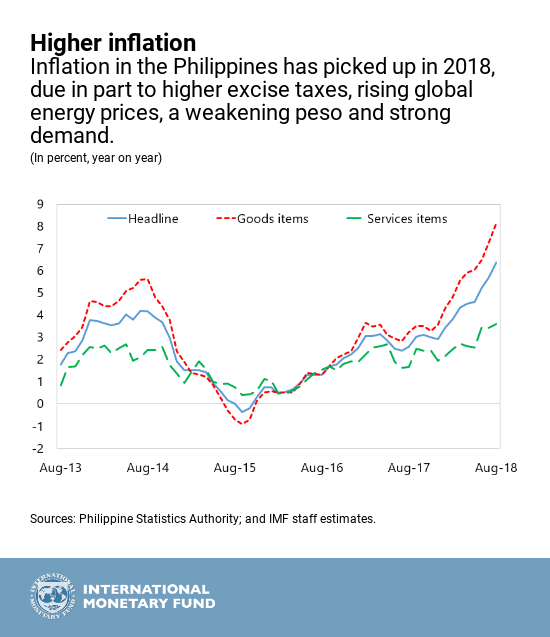

- Tackling rising inflation is a priority.

Headline inflation, which captures the prices of all goods and services including commodities, rose to 6.4 percent in August (year on year) from 3.4 percent in January 2018. Higher excise taxes, rising global energy prices, the weaker peso, and challenges in managing rice supply are driving inflation. To contain inflation and preserve market confidence, the Bangko Sentral ng Pilipinas, the country’s central bank, increased the policy rate three times this year and stands ready to further tighten monetary policy (by raising interest rates) to anchor inflation expectations and temper further second-round effects.

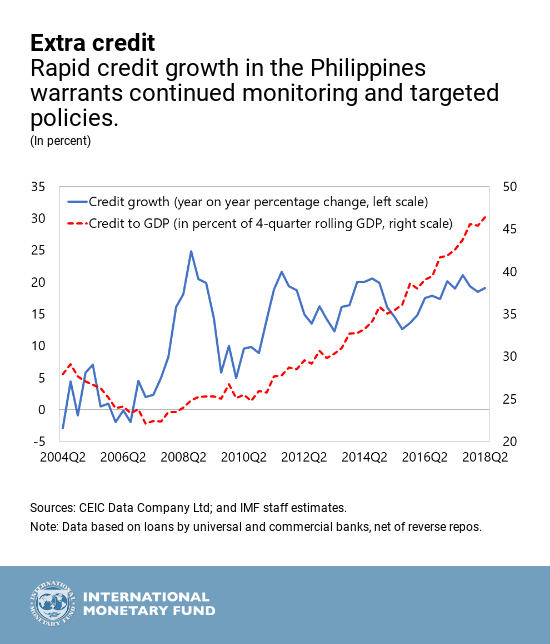

- Efforts to strengthen financial stability should continue. While fast credit growth may be good for the Philippine economy—as it supports more consumption and investment—bank credit is currently outpacing economic growth. As the credit-to-GDP gap—which is defined as the difference between the credit-to-GDP ratio and its long-run trend—widens and approaches early warning levels, the risks to the financial system increase. In this regard, the central bank has taken steps to enhance surveillance and enact macroprudential policies to stem excessive credit growth in specific sectors to address the buildup of risks to financial stability.

With well-capitalized banks, the financial system appears sound, but more timely data for nonfinancial corporates and non-bank financial institutions is needed to better monitor risks.

The approval of proposed amendments to the charter of the Bangko Sentral ng Pilipinas, is also a priority. Introducing the planned countercyclical buffer for banks would also help manage financial stability risks from sustained rapid credit growth.

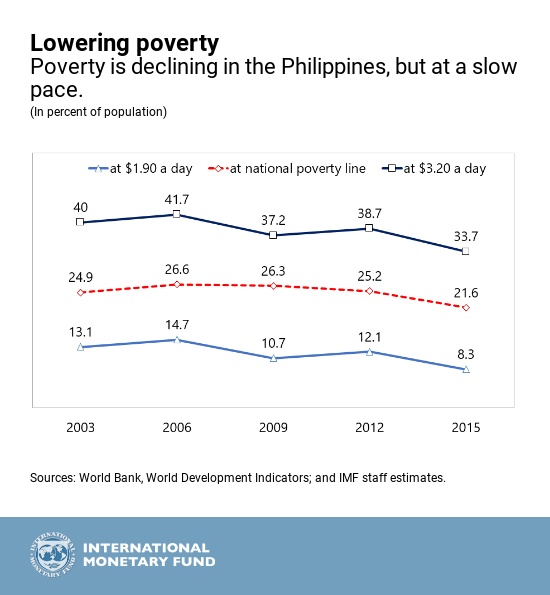

- The Philippines needs to maintain the reform momentum to tackle high levels of poverty and inequality. To create more jobs, policymakers should continue prioritizing reforms that open new sectors of the economy to foreign investment and further improve competition and the business environment. Replacing the rice import quota system with one based on tariffs would benefit consumers by reducing domestic rice prices but this action should be accompanied by protection of affected small farmers. There is also room to gradually expand social protection programs to reduce poverty, such as the conditional cash transfer program.

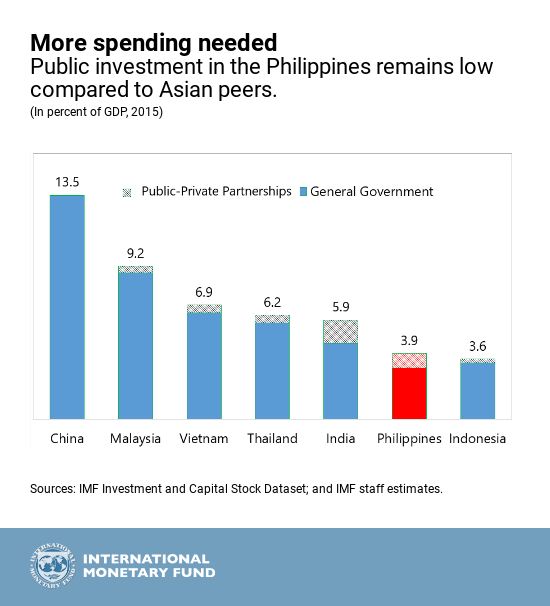

- Scaling up public investment in the Philippines is essential to sustain long-term growth and reduce poverty. To improve the state of infrastructure and close the infrastructure gap to the level of peer countries, the government plans to scale up investment. Raising revenues and reallocating spending from nonpriority programs can support the continued expansion of public investment and social spending and keeping a neutral fiscal stance for 2018-19 would avoid overburdening monetary policy.

Public investment, if well managed and targeted, can help boost overall productivity, stimulate private investment, and reduce poverty by creating jobs. At the same time, public investment management should aim to maximize the return from large infrastructure projects, including through a more rigorous appraisal of projects and by fostering effective competition in procurement.

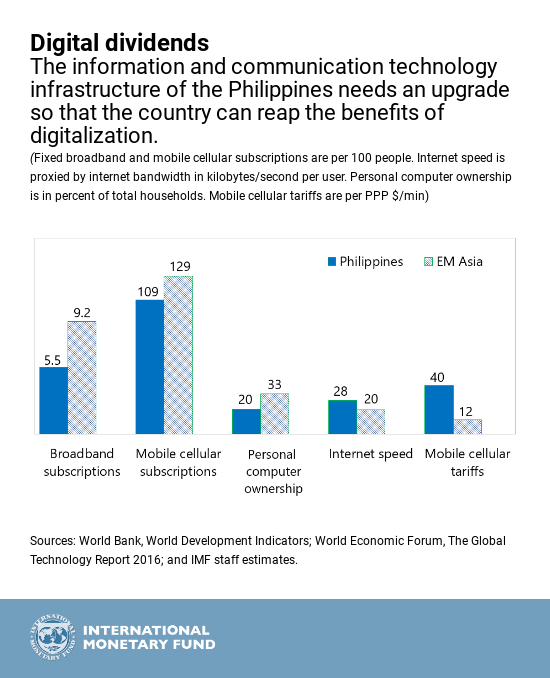

- More investment in human and physical capital will help reap the digital benefits. Given the growing young population and the prospering business process outsourcing industry in the Philippines, emerging digital technologies create both opportunities and challenges to the economy.

Improving education and training to better equip today’s job seekers, as well as investing more in digital infrastructure, like broadband technology, can help the Philippines fully reap the digital dividend and elevate the standing of the country’s outsourcing industry in the global economy.

Cyber security also needs to be strengthened to minimize the risk of cyber threats. The government’s digital strategy, including the National Broadband Plan and planned introduction of a third telecom player, is appropriately aligned with these priorities.