Tourists in Portugal where booming tourism has boosted services (photo: Rafael Marchante/Reuters/Newscom)

Portugal: Recovery and Risks

September 13, 2018

Portugal has turned the page on its 2010-13 crisis and is now enjoying a job-rich economic recovery, driven by investment and exports, says the IMF in its latest annual assessment of the country’s economy. The main challenge now is to take advantage of the current good times by maintaining prudent policies and paying down debt to strengthen the country’s position against any future downturns.

Here are five key charts that tell the story of Portugal’s recovery:

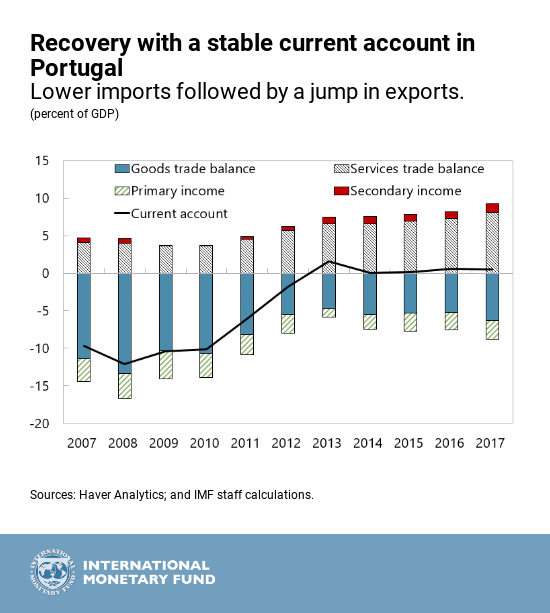

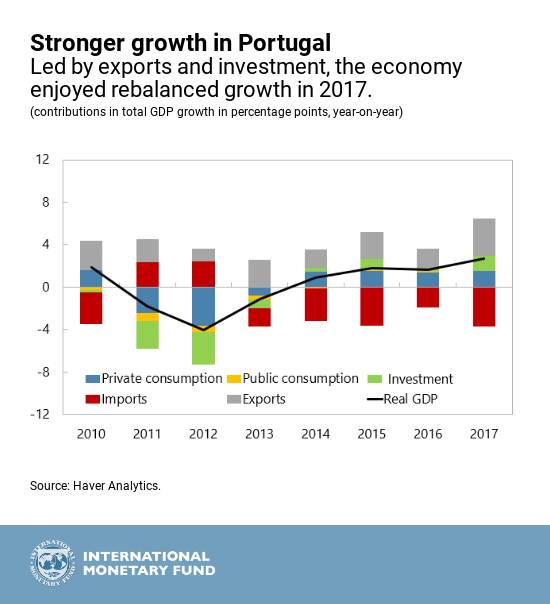

A strong recovery in investment and exports. Real GDP growth reached 2.7 percent in 2017, the highest rate since 2000. With re-energized investment, robust exports, and stable consumption, this recovery has supported a rebalancing of the economy. In 2018, real GDP should grow by 2.3 percent.

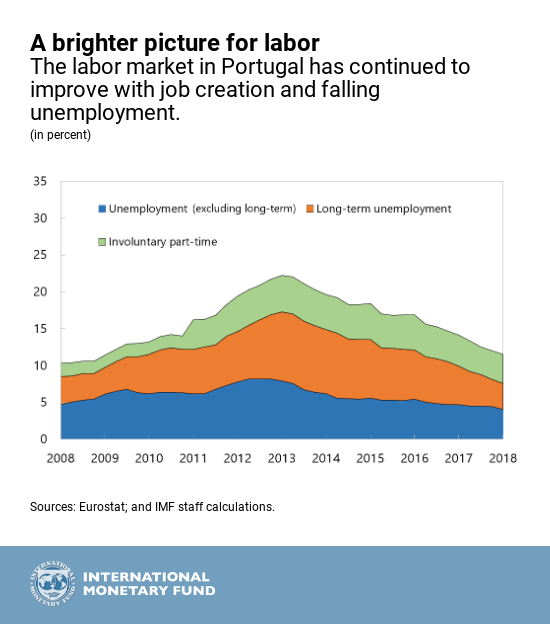

Job-rich growth. The unemployment rate fell to a record low of 7. 1 percent in April 2018. The long-term unemployed are also returning to work in large numbers. The low unemployment rate is based on a vigorous improvement in employment, which grew by 3.3 percent in 2017, even as labor force participation increased by 1.1 percent.

External balance. Trade has played an increasingly important role as a driver of economic growth. A booming tourism sector has meant that exports of services have offset an increase in goods imports.

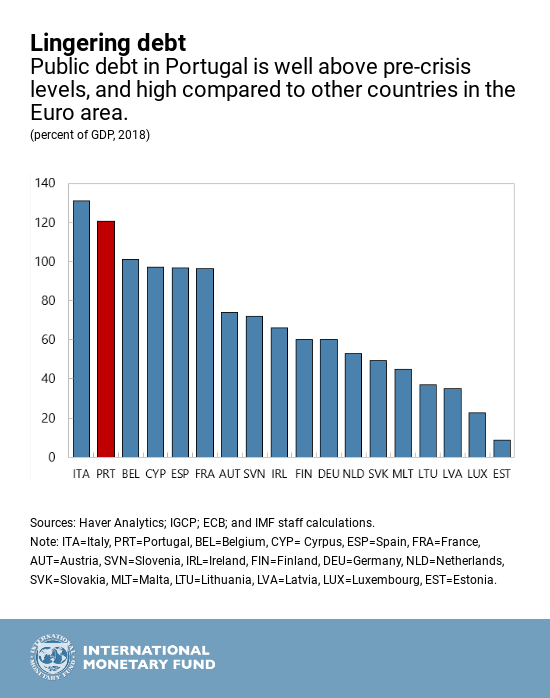

High public debt is a major vulnerability. Under current policies, Portugal's debt-to-GDP ratio is projected to decline by 23 percentage points from its 2017 level to 103 percent in 2023. Given its high starting point, Portugal needs to keep public debt on a firm downward trajectory to build buffers against future shocks and maintain investor confidence.

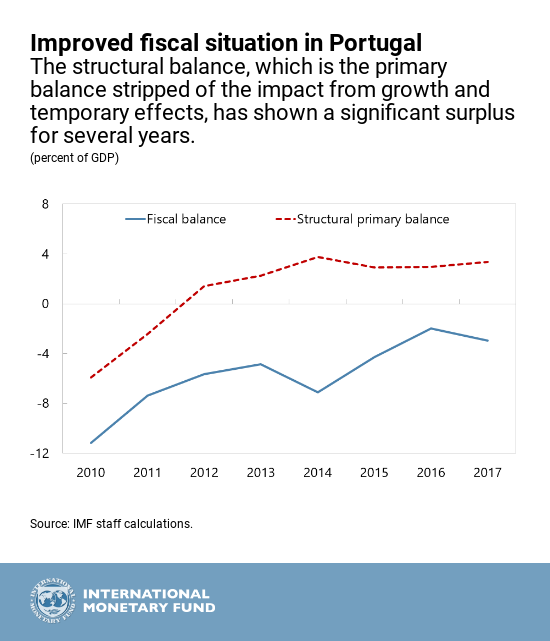

Continued fiscal discipline will be key. The fiscal performance in 2017 was robust, reflecting strong economic growth, controlled budget execution, and falling interest costs. Building on the strong track record established in the last several years, fiscal consolidation should focus on a sustainable plan to reduce current expenditure, with particular attention on wages and pensions. Fiscal discipline is a cornerstone of debt reduction.