Russian Federation: Staff Concluding Statement of the 2018 Article IV Mission

May 23, 2018

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

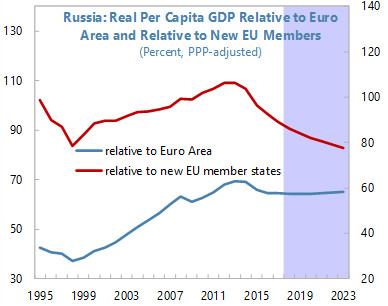

The Russian economy is recovering from a two-year recession. Over the past few years, the authorities have implemented a strong macroeconomic policy framework, which has reduced uncertainty and helped weather external shocks. However, Russia’s convergence to advanced economy income levels has stalled and its weight in the global economy is shrinking. A wide range of structural issues remains unaddressed and that is where the authorities need to focus in order to accelerate growth. Last year’s high-profile failure of several large private banks underscores the importance of completing the cleanup of the banking system. Those failures have expanded the state’s footprint in the sector, raising questions about the adequacy of financial statements and underscoring the need to strengthen supervision further. The fiscal rule has helped to anchor the fiscal path and shield the economy from disruptive swings in oil prices. The recovery in oil prices should not delay the much-needed fiscal adjustment and a growth-friendly shift in the budget. With inflation below the 4 percent target and a closing output gap, a continued transition to a neutral monetary policy stance is appropriate.

The Russian economy medium-term outlook remains weak, despite the ongoing recovery. With the projected growth rates, the country would lag behind peers in Eastern Europe and convergence with advanced economies would not take place. A combination of factors is at work, including insufficient infrastructure, an aging population, a large footprint of the state, as well as governance and institutional weaknesses which have increased economic concentration and stifled dynamism. In addition, Russia’s integration in the global economy is progressing slowly, thus weakening incentives to improve performance and reducing positive spillovers from foreign technological change. Uncertainty due to geopolitical tensions is affecting negatively private investment.

The authorities have established a strong macroeconomic policy framework , including a prudent fiscal rule, inflation targeting, and a flexible exchange rate. This will continue to help address uncertainty, which has increased recently due to renewed geopolitical tensions and turbulence in emerging markets. However, to accelerate potential growth, the focus has to shift to structural reforms to boost productivity and the supply of labor and capital. We welcome the authorities’ plans to boost spending on health, education, and infrastructure. However, this should be done without compromising the credibility of the new fiscal rule. Long-delayed parametric pension reform could help to offset negative demographic trends at least temporarily. Also, a well-designed and deficit-neutral shift from social security to consumption taxes could incentivize labor supply, reduce labor informality, and attract new investment. To accelerate productivity growth, the authorities would have to persist with their efforts to strengthen competitiveness, promote trade integration, and diversify exports.

Boosting growth requires stronger competition in domestic markets, a leaner state, and a more vibrant private sector. The footprint of the state, estimated at around a third of the economy, needs to be reduced, particularly in banking and other sectors with limited rationale for public ownership. However, sequencing is critical here. The first step would be to strengthen institutional architecture to avoid further concentration of economic power after privatization. In particular, the authorities should enhance competition, including by facilitating entry/exit. Despite formal procedures to support competition in public procurement, more can be done to use state purchases to promote market contestability and the development of SMEs. The authorities should also strengthen transparency, accountability, and governance standards in the corporate sector, particularly for SOEs, in order to raise efficiency in the use of state resources.

The financial sector plays a key role in channeling savings to the most productive companies. However, last year’s failure of several large banks has placed a non-negligible burden on public finances and pointed to significant shortcomings, such as excessive risk concentration and lending to connected parties rather than to the most competitive firms. This needs to be addressed by a renewed effort to close the gaps in bank supervision and regulation, as well as in the provision of accurate financial statements. The bank failures also underscored the importance of completing the cleanup of the banking sector. The supervision of risks should be intensified, with a focus on related-party lending. Elements of asset quality reviews have been introduced, but more efforts are needed to swiftly complete them and to also ensure their transparency, credibility, and alignment with best international practices. Moreover, the Central Bank of Russia (CBR) could strengthen the ex post communication of the rationale behind its bank resolution decisions. It is also important to have a credible strategy for returning rehabilitated banks to private hands in a way that is consistent with increasing competition and improving the allocation of capital.

The fiscal rule shields the economy from fluctuations in oil prices, which should help to facilitate export diversification. In addition, it has anchored fiscal policy by providing a credible fiscal path. Thus, the authorities should resist the temptation to revise the rule as this could undermine the credibility of the macroeconomic framework. Fiscal consolidation should continue in line with the rule, in order to rebuild fiscal buffers which are essential for reducing Russia’s vulnerability to external shocks. The pace of adjustment over 2018-20 is appropriate, but its quality could be improved, as it relies excessively on across-the-board spending freezes which are suboptimal and unsustainable. Further consolidation of 1-2 percent of GDP is needed over the medium term to reach a fiscal balance consistent with sharing Russia’s natural resources with future generations.

There is scope to engineer a growth-friendly shift in spending and taxes within the confines of the fiscal rule. To finance increased spending on health, education, and infrastructure, the authorities could consider re-prioritizing other spending, strengthening tax compliance, and broadening the tax base by reducing tax expenditures under VAT and PIT. Also, although expenditure on social assistance is high, it is too broadly and thinly spread. To have a meaningful impact on reducing poverty, it needs to be better targeted. Parametric pension reform could provide some fiscal space as well.

With inflation below the 4 percent target and a closing output gap , a continued transition to a neutral monetary policy stance is appropriate. The current monetary stance is moderately tight, especially in the context of the ongoing fiscal consolidation. However, t he CBR should maintain its gradual and data-driven approach, as inflation expectations are not yet firmly anchored and external and fiscal risks have increased. The central bank should continue refining its communication strategy in order to strengthen its credibility further and reduce inertia in the formation of inflation expectations.

***

The IMF team thanks the authorities and other interlocutors in the public and private sectors for their cooperation, open and constructive discussions, and warm hospitality.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Wiktor Krzyzanowski

Phone: +1 202 623-7100Email: MEDIA@IMF.org