International Monetary Fund Releases Gender Disaggregated Financial Access Survey

March 19, 2018

As part of its commitment to support financial inclusion, the International Monetary Fund (IMF) conducts an annual Financial Access Survey (FAS). [1] The FAS is a high-quality supply-side financial inclusion database with a global reach to support policy analysis and formulation in the financial inclusion area. The 2016 FAS round included a pilot to capture the financial access gender data gap and support the IMF’s analysis of women’s economic empowerment in boosting growth and reducing income inequality. [2] The pilot, which included the participation of 28 countries, revealed that in almost half of the participating economies, financial service providers had access to their customers’ gender information.

Casting the wider net …

Drawing from the 2016 pilot, an expanded pilot in 2017 invited all the IMF country members to report the gender breakdown of their commercial banks’ depositors and borrowers. This time, 27 countries provided information on this breakdown from 2004–16, almost doubling the number of reporting countries. The results of the 2017 expanded pilot are available at FAS website.

The 2017 expanded pilot results are promising…

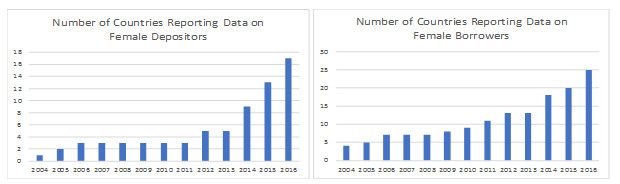

Two-thirds of the countries reporting gender-disaggregated data provided historical series, which bodes well for trend analysis. The results reveal the increasing availability of data on gender‑related financial access over the past four years (Figure 1). This trend may reflect awareness, in several countries, of gender inequality and the need to gather better data to inform policies that boost women's economic participation.

Figure 1. Number of Countries Reporting Gender-Disaggregated Financial Access Data (2004–16)

Source: 2017 FAS pilot on gender-disaggregated financial access.

The expanded pilot also identified regional variations in the financial access gender gap…

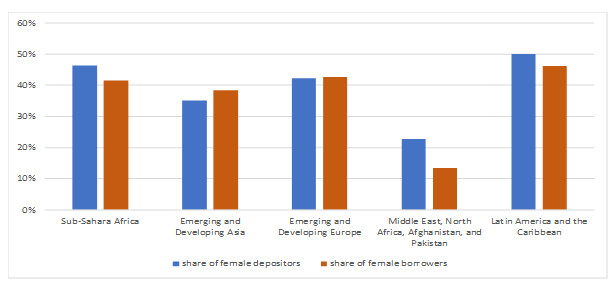

While the average share of female depositors and borrowers for gender-disaggregated reporting countries in 2016 was around 40 percent, the data also revealed noticeable cross‑regional differences (Figure 2). The variations could be linked to the well‑documented cross‑country differences in women participation in the labor market.

Figure 2. Shares of Female Depositors & Female Borrowers by Region (2016)

Source: 2017 FAS pilot on gender-disaggregated financial access.

Cross-country comparisons may contribute to closing the financial access gender gap…

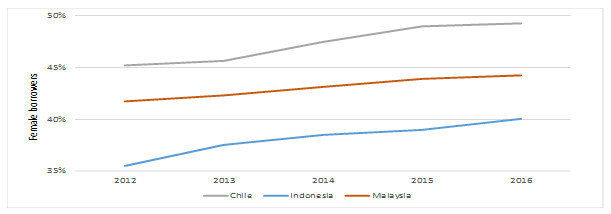

Availability of consistent, reliable and internationally comparable information is vital to focus attention on policies that could help close this gender gap. For example, analysts will want to explore the reasons for the apparent steady closing of this gap in Chile, Indonesia and Malaysia from 2012–16 (Figure 3).

Figure 3. Share of Female Borrowers (2012–16)

Source: 2017 FAS pilot on gender-disaggregated financial access.

Initiatives such as Malaysia’sWomen Entrepreneur Financing Program and Chile’s Simplified Deposit Accounts (requiring only a national identification to open an account) could be the reason for closing this gender gap. Improvements on data collection and granularity could foster deeper analysis in this area.

IMF will continue to work with countries to improve data availability …

FAS will continue to work with country authorities to address data collection challenges and to improve the availability of cross-country comparability of financial access information. Indeed, the FAS is a key element of the IMF’s “Data for Decisions (D4D) Fund”—a multi-partner trust fund that will be launched in mid-2018 and aim to fund statistics capacity development to broaden the availability of data to policy-makers and support the monitoring of the SDGs. Furthermore, the IMF sees the importance of gender-disaggregated financial access information and will make future FAS rounds, an integral standard part of the survey.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Pemba Sherpa

Phone: +1 202 623-7100Email: MEDIA@IMF.org