Pedestrians walk past the Bank of England in London: the potency of monetary policy can be stronger in countries with financial sectors dominated by nonbanks (photo: Peter Macdiarmid/Getty Images)

Monetary Policy Not Hurt by Rise of Nonbank Finance

September 29, 2016

- Impact of monetary policy actions on economic activity has generally strengthened since 2000

- Nonbank credit increases the effectiveness of monetary policy

- Risk taking by banks, nonbanks responds to monetary policy

The growth in credit by financial institutions that are not banks has, if anything, strengthened the impact of monetary policy on the economy over the past 15 years, according to new research from the International Monetary Fund.

Related Links

These so-called nonbanks include insurance companies, pension funds, and other financial institutions such as money market mutual funds, hedge funds, and finance companies. This latest analysis continues the IMF’s research on the growth in the nonbank sector.

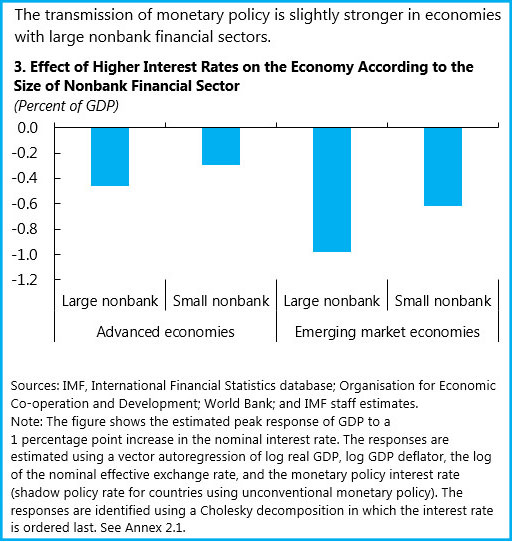

The new Global Financial Stability Report shows that the potency of monetary policy appears to be, on average, stronger in countries with financial sectors dominated by nonbanks. However, the chapter does not attempt to ascertain the strength of monetary policy in specific countries at the current juncture.

Like banks, nonbanks cut credit when central banks increase policy interest rates, and, in general, they cut credit even more than traditional banks. Nonbanks also amplify the effect of monetary policy on the economy by adjusting the degree to which they take risks. For example, investment funds tend to sell riskier bonds quickly when monetary policy rates rise. This makes yields on bonds rise further, which means a greater increase in the cost of borrowing, and therefore a bigger restraint on economic activity.

The financial sector and the impact of monetary policy on the economy continue to change

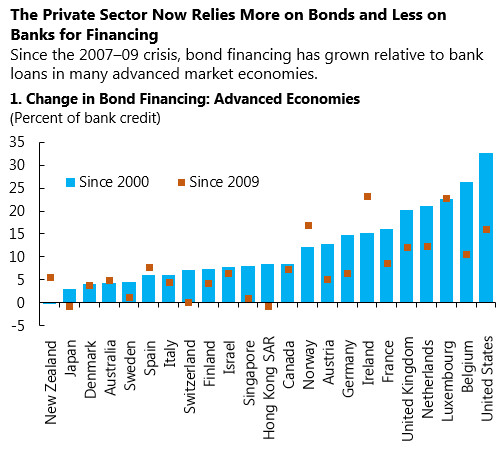

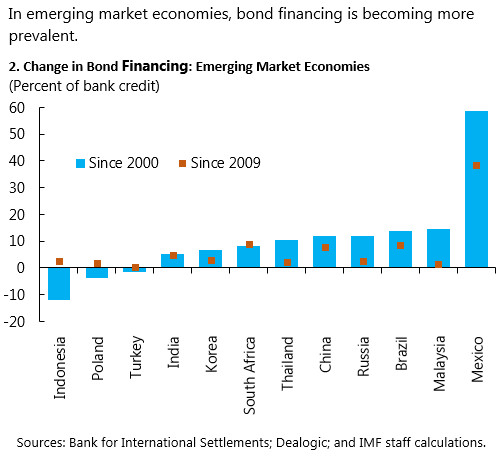

The structure of financial markets has changed considerably since 2000, according to the IMF. Ongoing financial innovation, weak bank balance sheets following the financial crisis, changes in business models, and strengthened bank regulation have all supported a shift from bank lending to bond issuance by nonbanks as a source of financing in advanced and emerging market economies. This has enabled a larger role for nonbanks to fill the gap and provide credit to the economy (see Chart 1 and 2).

Some have argued that the way in which monetary policy affects economic activity may have lessened because one of the traditional avenues for monetary policy to affect the economy—bank lending—has become less important. However, the IMF report finds that, if anything, nonbanks have increased the transmission of monetary policy to the real economy (see Chart 3).

“As a consequence, the conduct of monetary policy will need to continue to adapt to changes in the composition of the financial system,” said Luis Brandao Marques, the lead author of the report.

Nonbanks’ impact on monetary policy

The growing role of nonbanks implies that central bankers will need to continue to adapt monetary policy to changes in how the interest rate and other policies impact a country’s economy. As the importance of banks’ and nonbanks’ risk taking grows, the effects of monetary policy changes on countries’ economies may become more rapid and pronounced. Although not a focus of this Global Financial Stability Report, changes in regulations are likely to influence how monetary policy affects the economy because some of the differences in banks’ and nonbanks’ responses to monetary policy actions reflect differences in their regulatory regimes.

What this means for policy:

·Central banks should take into account the size and composition of banks and nonbanks’ balance sheets to better gauge changes in their risk appetite

·Regulators and supervisors should monitor the effects of monetary policy on financial stability

·Countries should continue to improve data collection on nonbanks

“The effects of monetary policy on financial stability are becoming more important,” according to Gaston Gelos, Division Chief of the Global Financial Stability Analysis Division at the IMF. "The reason is that risk taking by nonbanks can change sharply in response to monetary policy. This suggests that prudential and regulatory authorities need to be vigilant.”

The IMF will release more details from its Global Financial Stability Report on October 5.