Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Africa Set for Faster Growth amid Changes in Global Trends

April 24, 2014

- Robust regional growth seen in 2013 expected to accelerate in 2014

- Global trends supporting past growth could weaken over medium term

- Home-grown risks may cloud outlook further for some countries

Robust growth in sub-Saharan Africa is set to accelerate in 2014, reflecting improved prospects in most oil exporters, and in several low-income countries and fragile states.

Farmer plows in Saulawa, Nigeria: rebound in farm output should help underpin faster sub-Saharan African growth (photo: Joe Brock/Reuters/Newscom)

REGIONAL ECONOMIC OUTLOOK

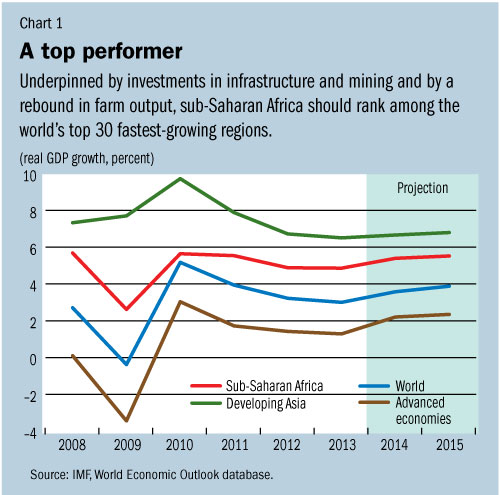

The IMF’s latest Regional Economic Outlook for Sub-Saharan Africa projects GDP growth to accelerate to 5½ percent in 2014 from about 5 percent in 2013 (see Chart 1).

The faster growth is expected to be underpinned by large investments in infrastructure and mining, maturing investments in transport and telecommunications, and a rebound in agricultural output.

The strong economic performance of 2013 was mainly driven by domestic demand, while external demand provided a modest contribution to growth in the region, as world economic activity and commodity prices remained relatively subdued during most of the year.

Global trends

The solid near-term outlook is nonetheless subject to downside risks. Three global trends that have supported growth in sub-Saharan Africa in the past are expected to become less favorable in the near term.

For a start, growth in some of sub-Saharan Africa’s key partners is likely to remain relatively subdued. Should growth in emerging markets—and particularly in China—slow much more than currently envisaged, many countries in the region would be certain to face lower export demand.

In those conditions, the outlook for some commodity prices—particularly copper and iron ore—would likely also be grim, with adverse implications on related investments in the region. In addition, tighter financial conditions, especially in China, could also reduce the appetite of companies for investing in sub-Saharan Africa.

The phasing out of unconventional monetary policies in advanced economies could result in effectively higher borrowing costs, especially among emerging markets and frontier economies. This would pose considerable financial strains for the region, including renewed pressures on exchange rates and domestic prices.

The change in these global trends could become increasingly challenging for most of the region over the medium term, and pose the more potent threats to the region as a whole. However, for some countries domestic risks are more significant.

Home-grown risks

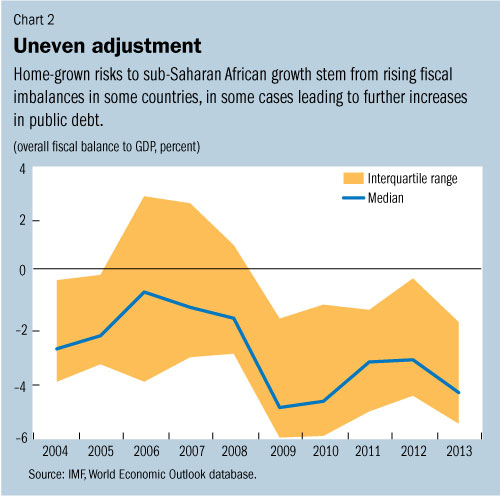

Home-grown risks stem from rising fiscal imbalances in a number of countries, in some cases leading to further increases in public debt. Region-wide deficits have remained broadly unchanged after 2009 when many countries in the region avoided procyclical fiscal policy for the first time (see Chart 2). For the most part, persistent deficits reflect policies favoring the much-needed expansion of capital expenditure while maintaining sustainable debt levels, and do not represent a major source of concern at the regional level.

However, government finances have deteriorated markedly in several countries that have undertaken excessive fiscal expansions partly financed by foreign borrowing, resulting in rapid increases in public debt. Some of these countries favored current spending and reduced public investment. In a few cases, borrowing costs have increased and exchange rates have been under pressure after the May 2013 announcement by the US Federal Reserve of the tapering of its unconventional monetary policy operations.

There are also a few countries—such as the Central African Republic and South Sudan—where security conditions remain difficult and conflict is exacting a heavy toll, with spillover effects into some neighboring countries. Other countries in the Sahel also face terror threats, with adverse implications for stability and development.

Reduce deficits

Policies should put greater emphasis on sustaining the macroeconomic stability that has supported strong growth in the region.

Wherever growth is doing well, fiscal policy should gradually reduce deficits by containing expenditure. Policy should also be used to ensure that tax revenue collection at least keeps pace with spending growth.

In those countries where macroeconomic imbalances are evident, there is urgent need for corrective policies. Countries with heightened reliance on portfolio flows should be ready to adjust their fiscal plans in the event of a fall in external financing, while allowing the exchange rate to adjust as appropriate.

Background studies

The Regional Economic Outlook also discusses, in two background studies, how growth in sub-Saharan Africa can be made durable and more inclusive, and the recent evolution of monetary policy frameworks in a group of countries in the region.

The first study finds that despite some improving social indicators, growth has not been inclusive in most countries. It argues that, alongside ongoing initiatives to promote structural transformation, such as investment in physical and human capital, growth could be made more inclusive by facilitating job creation, promoting financial inclusion, and raising productivity in agriculture—where most of the population is employed.

These objectives can be pursued by improving the business climate, providing better technical training, reducing financial transaction costs, and exploiting new technologies such as mobile banking.

The second study discusses the way forward in improving the conduct of monetary policy in a selected group of countries, given that the traditional approach of focusing on monetary aggregates to combat inflation seems to be increasingly inefficient.

The study recommends that to enhance the effectiveness of monetary policy, reforms should include better instruments to manage excess liquidity, high-frequency data to guide timely intervention, sound analytical models to forecast inflation, and a clear communication strategy that contributes to anchor expectations. Several sub-Saharan African countries have already taken steps in this direction.