ISRAEL: Estimates of Expenditures of Israeli Households for On-Line Purchases from Abroad

ISRAEL: Estimates of Expenditures of Israeli Households for On-Line Purchases from Abroad

Introduction

Recent years have witnessed a change in purchasing patterns in the world in general and in Israel in particular. The main change is a substantial increase in on-line purchases made by Israeli consumers on commercial sites abroad.

Over the years, there have been Israelis who personally imported products. In addition, Israeli citizens returning from an extended stay abroad and new immigrants to Israel have brought personal imports to the country. These products were listed in the category of "household consumption" under the item "personal imports of goods" (i.e., goods purchased abroad by Israelis, without using importers or merchants as intermediaries).

Scope, Methodology, Compilation Practices, and Data Sources

The source of data for this item, as in all import items, is the administrative file that the CBS receives from the customs authorities, which contains data on all goods imported to Israel. However, it is quite apparent that the data on household consumption from abroad via the Internet have not reflected the scope of smaller on-line purchases.

The estimation of on-line purchases for On-Line Purchases from Abroad is based on credit card companies' reports, regarding on-line purchases from commercial sites abroad.

The same definitions were established for all three credit card companies. The credit card companies classify transactions according to the international classification of Merchant Category Codes (MCC) – a classification of businesses made by credit card companies.

The data related only to households and did not include business credit cards.

The companies were asked to provide all of the data according to the duty rates for imported goods set by the customs authorities:

- $0-75 –Products in this price range (except for alcohol and tobacco products) are exempt from customs import duty as well as from Value Added Tax and purchase tax.

- $75-$500 –Products in this price range are exempt from customs duty only, and are subject to VAT and purchase tax.

- $500-$1,000 –Products in this price range are subject to VAT, customs duty, and purchase tax.

- $1,000 and more–Products worth $1,000 and more or consignments of tobacco, cigarettes, alcohol and alcoholic beverages are subject to VAT, customs duty, and purchase tax as paid by commercial importers.

This table of tax rates on transactions was intended to distinguish goods that cleared customs, which are already included in household consumption expenditures, as to avoid double counting.

The credit card companies provide us with m$onthly or quarterly data approximately two weeks after the end of the quarter. It was decided to apply the following rules to income data:

- Regarding expenditures for on-line purchases abroad, the data will apply only to the first two levels, i.e., to purchases up to $500.

- Every industry in the MCC was classified in the following way:

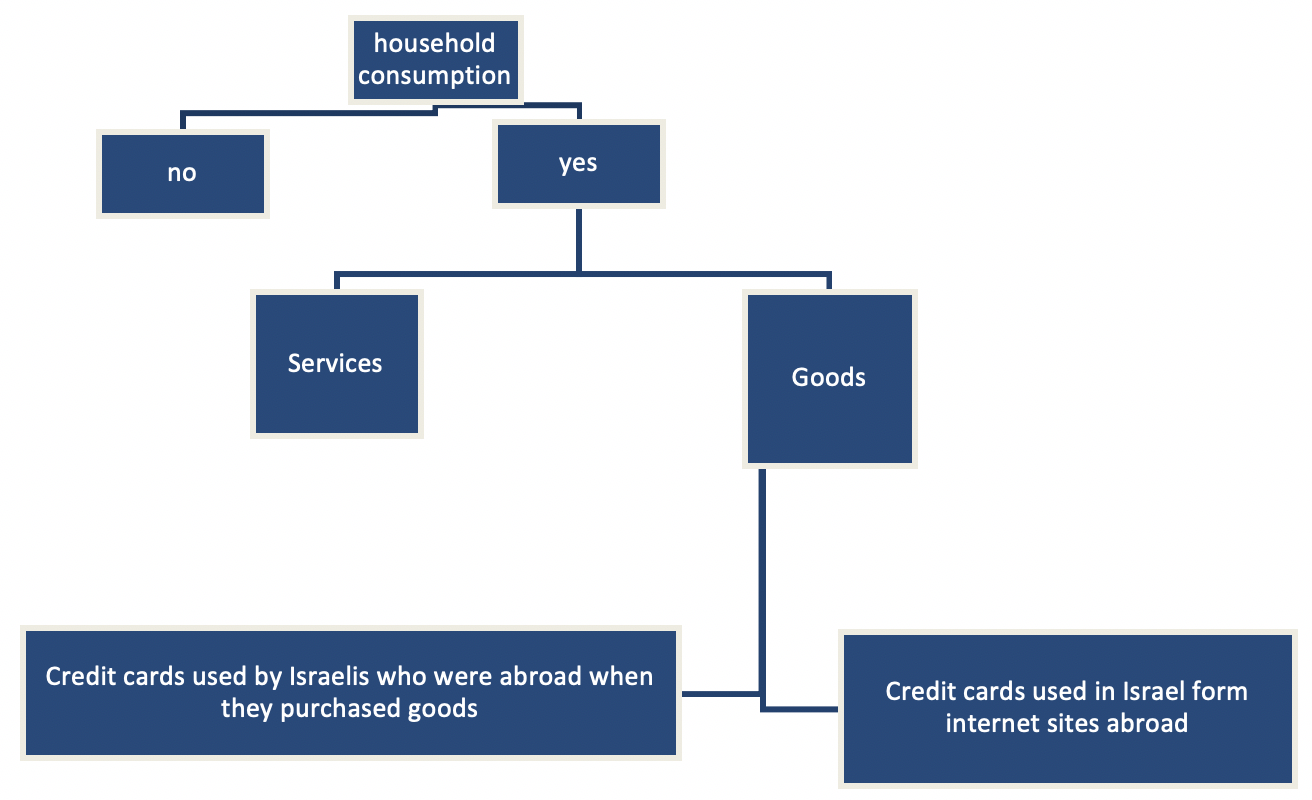

The estimation of on-line purchases is included in balance of payments under the goods account.

Current Challenges and Conclusions

At this point, we are referring only to data on goods purchased by Israelis from internet site abroad. This addition is included in the private consumption expenditure on industrial goods in the National Accounts and is also used for the adjustments to import in the balance sheets.

In addition, an index was prepared for conversion of MCC industries to the industrial classification of data household consumption expenditure at the CBS, based on the ISIC (International Standard Classification of All Economic Activities), Rev. 4.

The goods by industry classification have not yet been published, and we are still in the process of determining how to classify them (due to the fact that the MCC is divided into industries according to businesses, rather than according to the type of good or service).