Key Questions on Somalia

Updated: December 13, 2023

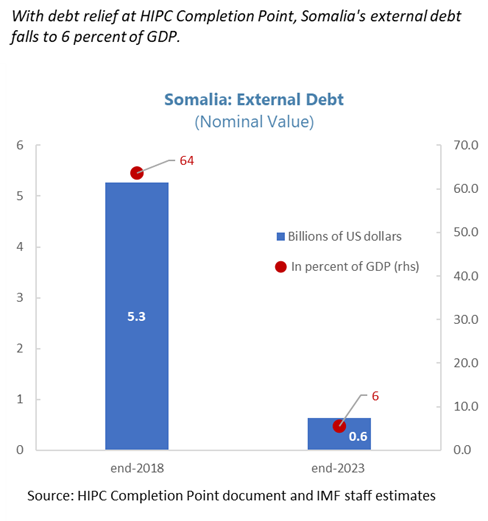

On December 13, 2023, the Executive Boards of the International Monetary Fund (IMF) and the World Bank's International Development Association (IDA) approved Somalia’s Completion Point under the enhanced Heavily Indebted Poor Countries (HIPC) Initiative. Debt relief will help Somalia make lasting change for its people by irrevocably reducing its external public debt from US$5.3 billion at end-2018 to US$0.6 billion at end-2023.

What does the HIPC Completion Point mean and why is it important for Somalia?

At the HIPC Completion Point, Somalia’s debt has been reduced from US$5.3 billion (64 percent of GDP) at end- 2018 to US$0.6 billion (less than 6 percent of GDP) at end-2023.

Not only does the HIPC Completion Point reduce Somalia’s external debt repayments to sustainable levels, it also opens the way for Somalia to access new external financing to help accelerate growth, improve social conditions, and raise millions of its population out of poverty.

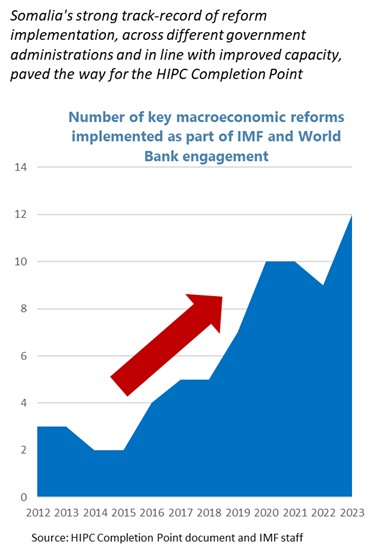

Achievement of the Completion Point is a testament to the Somali authorities’ sustained track record of reform implementation over the past years, despite numerous challenges. This achievement was by no means assured when the HIPC Decision Point was reached in March 2020, and considering the extraordinary events that have impacted Somalia in recent years, including the Covid-19 pandemic, a desert locust infestation, two years of severe drought, and the impact of the external shocks on food supply and prices.

This achievement also highlights the collective effort and strong backing from international partners. Strong support from Somalia’s multilateral and bilateral creditors cleared the way for irrevocable debt relief. This was a truly global effort with more than 100 countries, including many low-income countries, contributing financial resources that were used to clear Somalia’s debt to the IMF. We are very grateful to our membership for their strong support for this effort.

Which international creditors were involved in the HIPC debt relief for Somalia?

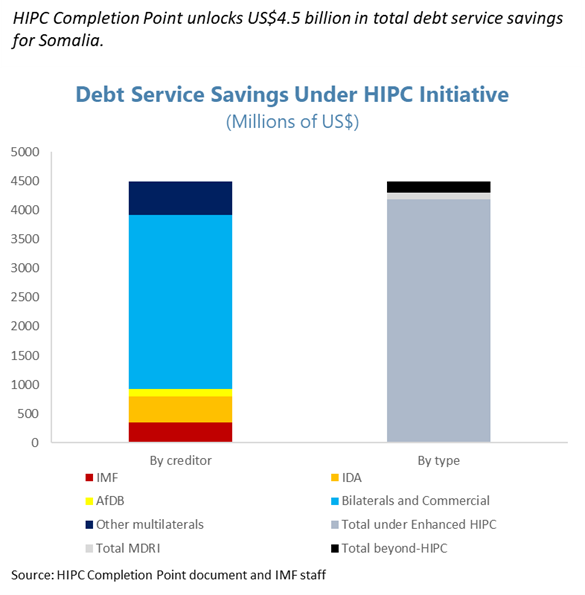

The HIPC Completion Point unlocks total debt service savings of US$4.5 billion for Somalia. This includes debt service relief from the IMF (US$343.2 million), IDA (US$448.5 million), African Development Fund (ADF) (US$131.0 million) and other multilateral creditors (US$573.1 million). Debt service savings for Somalia from bilateral and commercial creditors amount to US$3 billion. Bilateral creditors include members of the Paris Club and creditors from the Arab Coordination Group.

What are the expected benefits of the debt relief for Somalia’s economy?

Debt relief provided at HIPC Completion Point is critical for Somalia, as it paves the way for fully normalizing its relationships with key international partners and securing enhanced access to vital financial resources. This support is essential for fostering economic growth and poverty reduction. A lower debt burden reduces Somalia’s debt servicing costs. This enables the allocation of resources to investment in education, healthcare, infrastructure, and other key areas to improve the overall quality of life of the Somali people.

What is the purpose of Somalia’s new arrangement with the IMF?

Despite the progress achieved, Somalia still faces significant challenges, including those stemming from economic, social, security, and climate risks. Poverty is widespread with 54 percent of the population living on less than US$ 2 per day. Growth is currently insufficient to reduce poverty, address substantial social needs, and generate adequate employment opportunities for young people. Somalia is also highly vulnerable to climate shocks that hurt growth and hinder poverty reduction efforts.

What kind of economic reforms did Somalia implement as part of the debt relief agreement?

Somalia’s journey towards the HIPC Completion Point demonstrated the country’s commitment to wide-ranging reforms to strengthen key economic and financial institutions, as well as improve governance. In the lead up to the HIPC Completion Point, Somalia completed a 45-month IMF-supported program under the Extended Credit Facility (ECF), preceded by four consecutive staff monitored programs since 2016. The IMF provided sustained capacity development support throughout, sponsored by the Somalia Country Fund. Key policy efforts included:

- - Maintaining macroeconomic stability, as evidenced by satisfactory performance under the ECF, and establishing a solid track record of reform implementation;

- - Significantly increasing pro-poor expenditures and implementing the Nineth National Development Plan, to help mitigate somewhat the impact of multiple negative shocks on poverty;

- - Increasing government revenues to finance critical needs;

- - Strengthening public financial management to improve expenditure management, transparency, and accountability;

- - Improving financial sector regulation and supervision and enhancing the capacity of Central Bank of Somalia to promote financial stability and financial inclusion;

- - Advancing structural reforms including improvements on governance, social sectors, and statistics.

On December 13, 2024, the IMF Executive Board discussed a new three-year arrangement under the Extended Credit Facility (ECF) for Somalia. The new arrangement and the related capacity development support will help Somalia further strengthen key economic institutions, in order to promote economic and social development, protect macroeconomic stability, and build resilience to climate and other shocks.

Building on progress so far, key pillars of the program are to (1) maintain fiscal sustainability to ensure Somalia’s continued access to external financing; (2) increase domestic revenues and strengthen public financial management to expand the government’s capacity to finance its expenses, expand its social services, and undertake high quality development projects, (3) promote financial deepening to attract and channel domestic savings to economic development; (4) improve the business environment and governance to promote private investment; and (5) enhance statistics to better inform economic policies.

What steps are being taken to ensure that Somalia remains on a stable financial path post-HIPC Completion Point?

The authorities are committed to a prudent fiscal framework that balances the need for higher development expenditure with protecting fiscal sustainability, while taking into account capacity constraints. Increasing domestic revenues is a key pillar of the authorities’ reform strategy. In addition, external financing is expected to be based solely on grants and concessional loans to preserve debt sustainability.

Importantly, continued support from international partners—both capacity development support and concessional financing—is essential for the successful implementation of the authorities’ reform strategy post-HIPC. The IMF will continue to support the Somali authorities with policy advice, capacity development support, and financing under the new ECF arrangement.