Iceland: Spectacular Turnaround from Financial Meltdown

May 2019

Iceland was among the first countries hit by the financial tsunami of the global financial crisis. With assets 10 times the size of GDP and relying on aggressive foreign borrowing, Iceland’s banking system was extraordinarily large relative to the economy. When the Icelandic foreign exchange market and banks collapsed, the króna threatened to spiral out of control, dealing a blow to firms and households heavily indebted with foreign currency and inflation-indexed loans.

The IMF was called in, and within 10 days there was an agreement on a set of policy measures. The IMF-supported program of $2.1 billion remains among the largest relative to the size of the economy—18 percent of Iceland’s GDP, or 1,190 percent of Iceland’s quota in the IMF. The support and solidarity of other countries in the region made Iceland an example of the ability of the IMF’s seal of approval to catalyze broad international support.

Iceland took unorthodox measures to overcome the severe crisis. The program featured policies to rebuild confidence in the economy and garner the broadest political support:

- Capital controls with no predefined time frame were a critical part of the toolkit to restore monetary stability. They helped stabilize the króna and prevented an increase in domestic interest rates that would have taken a higher toll on growth and balance sheets.

- Rebuilding the collapsed banking system required splitting up the banks, which were too big to save, and putting public money only where it was essential. A split between the failed banks’ domestic operations and their much larger foreign operations allowed taxpayer support to focus on shielding the domestic economy, while maximizing asset recovery.

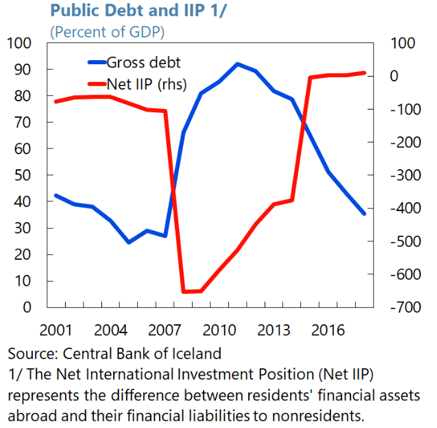

- Phased fiscal consolidation accommodated fiscal pressure during the first year of the program and prevented a deeper collapse in demand as government debt surged because of public support for the financial sector. Nonetheless, there was a strong political commitment to restoring the downward path of public debt in due course.

- Safeguarding Iceland’s social welfare system played a key role in protecting vulnerable groups and even reducing inequality during the program.

A decade after the crisis outbreak, Iceland has already experienced eight years of robust growth averaging close to 4 percent. The capital controls have largely been lifted, closing an important chapter in the country’s financial crisis saga. Iceland’s current account and budget have remained in surplus for several years. Its gross public debt has declined from 92 percent of GDP at its peak to 35 percent in 2018. Iceland now has more assets abroad than liabilities, a high level of foreign exchange reserves, and banks that are sound and well capitalized.