Cyprus: Restoring the Banking Sector and Public Finances

May 2019

In the aftermath of the global financial crisis, Cyprus began to suffer a confidence crisis, linked to weakness in its very large banking sector and sizable external and internal imbalances.

Cyprus approached the IMF for a three-year lending arrangement of about €1 billion with two goals: putting the banking sector on a sound footing and returning public finances to a sustainable path. The authorities took bold steps to address the crisis, including restructuring banks and implementing ambitious fiscal consolidation measures. The IMF arrangement was part of a combined financing package with the European Stability Mechanism.The immediate priority was to stabilize the banking sector. The authorities completed a challenging bank recapitalization process and restored liquidity. In parallel, decisive steps were taken to restructure weak banks. New foreclosure and insolvency rules sought to encourage banks and borrowers to find workable solutions for unpaid loans. Supervision and regulation of banks was strengthened. While legacy challenges remained at the conclusion of the arrangement, much progress was made in restoring stability.

The Cypriot authorities also undertook a strong fiscal adjustment under difficult economic circumstances. Although overall public spending was reduced, there were efforts to protect the most vulnerable through a well-targeted income support program. Cyprus also introduced legislation to modernize the budget process, strengthen accountability for public spending, and establish medium-term fiscal planning. Tax collection was made more efficient and equitable.

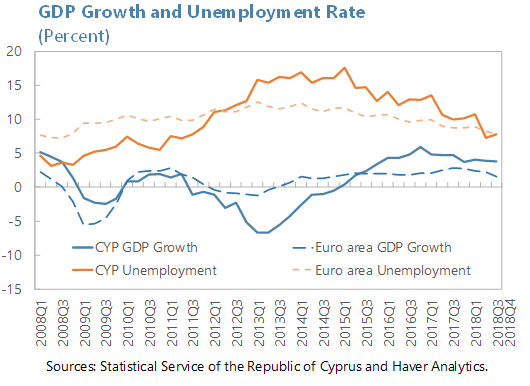

Cyprus regained access to international financial markets barely 16 months after the crisis and has successfully issued debt on favorable terms multiple times since then. The economy got back on a growth track and the banking system on more solid footing. Growth returned earlier than expected, and unemployment began to fall. Although the crisis took a toll on the public purse, fiscal balances have swung to large surpluses, which has helped the public debt decline rapidly and permitted repayment earlier than scheduled. Thanks to this strong performance, Cyprus ended its IMF bailout program before term.

Going forward, only steady and resolute implementation of reforms can ensure a sustained return to jobs and prosperity. Securing the notable achievements of recent years and overcoming remaining challenges will require steadfastly continuing along the path of policy discipline and economic reform.