The Financial Sector Stability Fund (FSSF) is central to the IMF’s delivery of capacity development on financial sector stability issues. Strong financial sector frameworks increase macroeconomic resilience and help mitigate costs of financial crises. Financial sector stability is also a prerequisite for achieving sustainable growth and increasing financial inclusion. Since its launch in late 2017, the FSSF has been supporting the IMF’s CD delivery on strengthening financial sector frameworks in low and lower-middle income countries (LLMICs) and fragile and conflict-affected states (FCSs) through the development and implementation of adequate micro- and macro-prudential frameworks, safety nets, and improvements in financial sector statistics.

Framework

The strength of the program lays in its programmatic approach, whereby a rigorous diagnostic of the country’s capacity, namely Financial Sector Stability Review (FSSR), to identify, monitor, manage, and mitigate financial stability risks anchors the follow-up TA projects, which are implemented in full partnership with recipient countries and in close collaboration with other providers of CD. Two FSSR diagnostics were completed in FY2024: Burundi and Eswatini. With these, the total number of completed FSSR diagnostics reached 23, most of them in Africa. Work on FSSR diagnostics in Papua New Guinea and Somalia also started in FY2024 and Kenya, Vanuatu, Madagascar have started in early FY2025. Looking specifically at TA missions, nearly 60 LLMICs have benefitted from the FSSF Statistics Module by end-FY2024.

The FSSF-financed CD projects are country-tailored and are accompanied by a rigorous monitoring and evaluation framework. The objectives and outcomes of the FSSF-financed CD projects are combined in a strategic logical framework (logframe) that measures and monitors results and is fully consistent with the IMF’s enhanced results-based management (RBM) framework.

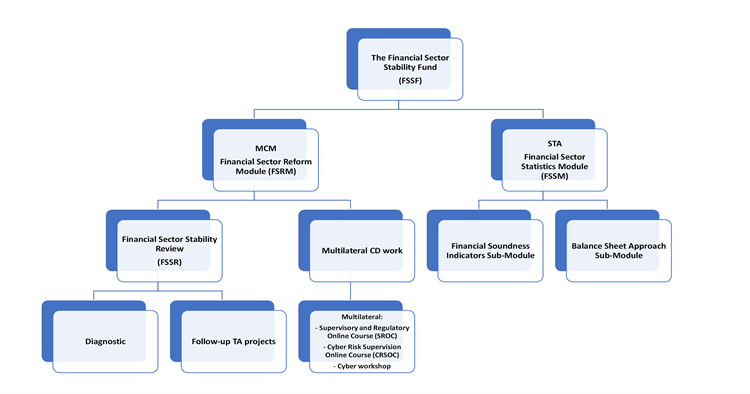

The FSSF-financed activities are delivered through two complementary pillars: the Financial Reform Module and the Statistics Module. The objective of the Financial Reform Module is to strengthen the capacity of country authorities to identify, measure, analyze, and mitigate risks to financial stability. The online training tools provide complementary capacity building in areas of high demand, to support the learning needs of government officials in an accessible and efficient manner. The Statistics Module provides policymakers with key, reliable and comprehensive financial sector statistics for assessing financial sector stability, risks, and vulnerabilities, as well as the interconnectedness of sectors within an economy and with the rest of the world.

Even though the two modules are managed independently, their activities are closely integrated. While the Financial Reform Module is overseen by the IMF’s Monetary and Capital Markets Department (MCM) and the Statistics Module is managed by the IMF’s Statistics Department (STA),coordination and integration between both modules depends on country-specific circumstances.For some of its missions, MCM consults closely and coordinates with STA, who leads on the statistical aspects of the TA.

CD Modalities

FSSF delivery focuses on the following modalities:

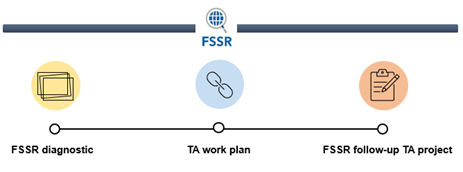

- FSSR diagnostics. The FSSR diagnostic mission provides a comprehensive assessment designed to help authorities identify potential gaps and weaknesses in the financial sector oversight and stability frameworks, as well as in producing relevant financial sector statistics. The FSSR diagnostic missions are led by IMF staff and comprise several experts or HQ staff.

- TA work plan. Based on a country’s diagnostic review, the medium-term TA work plan will link the identified strategic reforms to a well-prioritized and sequenced set of TA activities. The TA work plans will be formulated by the FSSR diagnostic mission to serve as a basis for FSSR follow-up TA projects. The work plan will be focused on the workstreams where the gaps in the country’s financial sector framework are seen as largest.

- FSSR follow-up TA projects. They will be developed based on the TA work plan, and a list of beneficiary countries will be approved by the FSSF Steering Committee. The projects will reflect demand from the authorities, assessment of the country’s TA absorption capacity, discussions with the country teams in the IMF’s area departments, consultation with staff in MCM functional divisions, and consideration of the ongoing and planned TA activities by other partners, particularly World Bank. The projects will be governed by a rigorous monitoring and evaluation, based on the overall IMF RBM framework.

- Multi-country training. Multi-country activities—online, in-person, or hybrid—will remain an integral component of the FSSF. These activities, including online trainings tools and annual workshops, such as the flagship Cyber Security Workshop, will provide complementary CD in areas of high demand to support the learning needs of country officials.

- Statistical CD activities. The FSSM supports eligible countries in ensuring the availability of reliable and comprehensive financial sector statistics and its counterparts with the two sub-modules: (i) Financial Soundness Indicators (FSI) and (ii) Balance Sheet Approach (BSA). A variety of delivery options is used for TA, including bilateral missions, regional workshops, and ad-hoc limited engagements in line with the recipient countries’ needs.

Transition

Phase I (FY2018-24) of the FSSF was highly successful, establishing a strong track record in supporting LLMICs and FCSs to strengthen their financial stability frameworks through comprehensive programmatic approaches. By the end of FY2024, 23 FSSR diagnostics were completed and almost all countries with a completed diagnostic benefitted from follow-up TA projects. In terms of the Statistics Module, since the launch of Phase I, almost the entire universe of over 90 eligible countries has been covered through either TA missions, trainings, or limited engagements to develop relevant financial sector and balance sheet statistics Looking specifically at TA missions, nearly 60 LLMICs have benefitted from the Statistics Module by end-FY2024. Demand for FSSF-supported capacity building remains strong, with positive feedback from authorities, particularly valuing the tailored technical assistance provided by resident advisors.

Phase II (FY2025-29) of the FSSF will continue to support eligible countries in strengthening financial sector stability frameworks. The FSSF will remain the main thematic fund financing IMF CD activities to identify, assess, monitor, and mitigate systemic risks to financial stability in LLMICs and FCS. The objectives of individual projects will depend on country circumstances. Multilateral CD activities will complement bilateral country work.

Governance

The Steering Committee (SC), comprised of representatives from donors, the IMF and the World Bank, provides the FSSF with its strategic direction. SC members and observers meet once a year to guide the FSSF’s strategic path, review progress against its work plan, and discuss and endorse a work plan for the following 12–18 months. A mid-year check-in enables the SC to review progress with the work program over the first half of the fiscal year and to endorse any planned changes for the rest of the fiscal year.

Beneficiaries

Updated FSSR table of country diagnostics and follow-up TA

|

Country |

Diagnostic Completed/On-going |

IMF Fiscal Year for Diagnostics (May 1-April 30) |

Follow-up Project Completed/On-going |

|

|

1 |

Bangladesh |

x |

FY20 |

NA |

|

2 |

Burundi |

x |

FY24 |

Forthcoming FY25 |

|

3 |

Cabo Verde |

x |

FY22 |

x |

|

4 |

Cambodia |

x |

FY19 |

x |

|

5 |

Djibouti |

x |

FY20 |

x |

|

6 |

DRC |

x |

FY22 |

x |

|

7 |

Eswatini |

x |

FY24 |

Forthcoming FY25 |

|

8 |

Gambia |

x |

FY20 |

x |

|

9 |

Guinea |

x |

FY20 |

x |

|

10 |

Kenya |

x |

Forthcoming FY25 |

|

|

11 |

Kosovo |

x |

FY19 |

x |

|

12 |

Lesotho* |

x |

FY21 |

x |

|

13 |

Madagascar |

x |

Forthcoming FY25 |

|

|

14 |

Moldova* |

x |

FY22 |

|

|

15 |

Nepal |

x |

FY23 |

Forthcoming FY25 |

|

16 |

Nicaragua |

x |

FY19 |

NA |

|

17 |

PNG |

x |

FY25 |

Forthcoming FY25 |

|

18 |

Rwanda |

x |

FY20 |

x |

|

19 |

Sierra Leone |

x |

FY21 |

x |

|

20 |

Somalia |

x |

FY25 |

Forthcoming FY25 |

|

21 |

Sri Lanka |

x |

FY19 |

x |

|

22 |

Tajikistan* |

x |

FY22 |

x |

|

23 |

Uganda |

x |

FY18 |

x |

|

25 |

Uzbekistan |

x |

FY21 |

x |

|

26 |

Vanuatu |

x |

Forthcoming FY25 |

|

|

27 |

Vietnam |

x |

FY23 |

Forthcoming FY25 |

|

28 |

West Bank And Gaza |

x |

FY19 |

x |

|

29 |

Zimbabwe |

x |

FY19 |

x |

| FSSM Bilateral Missions (2018-Aug 2024) | |||

|

Country |

FSI |

BSA |

|

|

1 |

Angola |

X |

X |

|

2 |

Bangladesh |

X |

X |

|

3 |

Bhutan |

X |

X |

|

4 |

Bolivia |

X |

|

|

5 |

Burkina Faso |

X |

|

|

6 |

Burundi |

X |

|

|

7 |

Cabo Verde |

X |

X |

|

8 |

Cambodia |

X |

X |

|

9 |

CEMAC |

X |

|

|

10 |

Comoros |

X |

|

|

11 |

Congo, Democratic Rep. |

X |

|

|

12 |

Congo, Rep. |

X |

|

|

13 |

Djibouti |

X |

X |

|

14 |

El Salvador |

X |

|

|

15 |

Eritrea |

X |

X |

|

16 |

Eswatini |

X |

X |

|

17 |

Ethiopia |

X |

X |

|

18 |

Gambia |

X |

|

|

19 |

Ghana |

X |

|

|

20 |

Guatemala |

X |

|

|

21 |

Guinea |

X |

|

|

22 |

Haiti |

X |

|

|

23 |

Honduras |

X |

|

|

24 |

Indonesia |

X |

|

|

25 |

Jordan |

X |

X |

|

26 |

Kenya |

X |

|

|

27 |

Kiribati |

X |

|

|

28 |

Kosovo |

X |

|

|

29 |

Lesotho |

X |

X |

|

30 |

Liberia |

X |

X |

|

31 |

Libya |

X |

|

|

32 |

Madagascar |

X |

X |

|

33 |

Malawi |

X |

|

|

34 |

Maldives |

X |

|

|

35 |

Mauritania |

X |

X |

|

36 |

Mauritania |

X |

|

|

37 |

Micronesia |

X |

|

|

38 |

Moldova |

X |

|

|

39 |

Morocco |

X |

X |

|

40 |

Morocco |

||

|

41 |

Mozambique |

X |

X |

|

42 |

Nepal |

X |

X |

|

43 |

Nigeria |

X |

X |

|

44 |

Papua New Guinea |

X |

|

|

45 |

Philippines |

X |

X |

|

46 |

Rwanda |

X |

|

|

47 |

Samoa |

X |

X |

|

48 |

Sierra Leone |

X |

|

|

49 |

Solomon Islands |

X |

|

|

50 |

Somalia |

X |

|

|

51 |

South Sudan |

X |

X |

|

52 |

Sri Lanka |

X |

|

|

53 |

Sudan |

X |

X |

|

54 |

Tajikistan |

X |

X |

|

55 |

Tanzania |

X |

|

|

56 |

Timor-Leste |

X |

|

|

57 |

Tunisia |

X |

X |

|

58 |

Uganda |

X |

|

|

59 |

Uzbekistan |

X |

|

|

60 |

Vietnam |

X |

|

|

61 |

Yemen |

X |

|

|

62 |

Zambia |

X |

|

|

63 |

Zimbabwe |

X |

X |

Publications

FSSR TA Reports

Kingdom of Eswatini: Financial Sector Stability Review (imf.org)

Kingdom of Eswatini: Technical Assistance Report-Financial Sector Stability Review (imf.org)

Nepal: Technical Assistance Report—Financial Sector Stability Review (imf.org)

Republic of Kosovo: Technical Assistance Report-Financial Sector Stability Review (imf.org)

Democratic Republic of the Congo: Technical Assistance Report-Financial Sector Stability Review

Republic of Moldova: Technical Assistance Report-Financial Sector Stability Review

Zimbabwe: Technical Assistance Report—Financial Sector Stability Review Consolidated Supervision

Republic of Kosovo: Technical Assistance Report-Financial Sector Stability Review

Zimbabwe: Technical Assistance Report-Basel III Implementation

Guinea: Financial Sector Stability Review

Nepal: Technical Assistance Report—Financial Sector Stability Review

FSSM TA Reports

Zimbabwe: Technical Assistance Report—Financial Soundness Indicators Statistics Mission

Indonesia: Technical Assistance Report-Financial Soundness Indicators Statistics Mission

Philippines: Financial Soundness Indicators

Cabo Verde: Technical Assistance Report-Monetary and Financial Statistics Mission

Philippines: Technical Assistance Report-Monetary and Financial Statistics Mission

Djibouti: Technical Assistance Report-Financial Soundness Indicators Mission

Jordan: Technical Assistance Report-Monetary and Financial Statistics Mission

Maldives: Technical Assistance Report-Financial Soundness Indicators Mission

FSSM Workshops

The Pacific Financial Technical Assistance Centre FSI Workshop