Russia's invasion of Ukraine raises financial stability risks for the world and poses questions about the longer-term impact on economies and markets. The war, amid an already slowing recovery from the pandemic, is set to test the resilience of financial markets and poses a threat to financial stability as discussed in our latest Global Financial Stability Report.

Ukraine and Russia face the most pressing risks. Yet it is already clear that the severity of disruptions in commodity markets and to supply chains are creating downside risks by weighing adversely on macrofinancial stability, inflation, and the global economy.

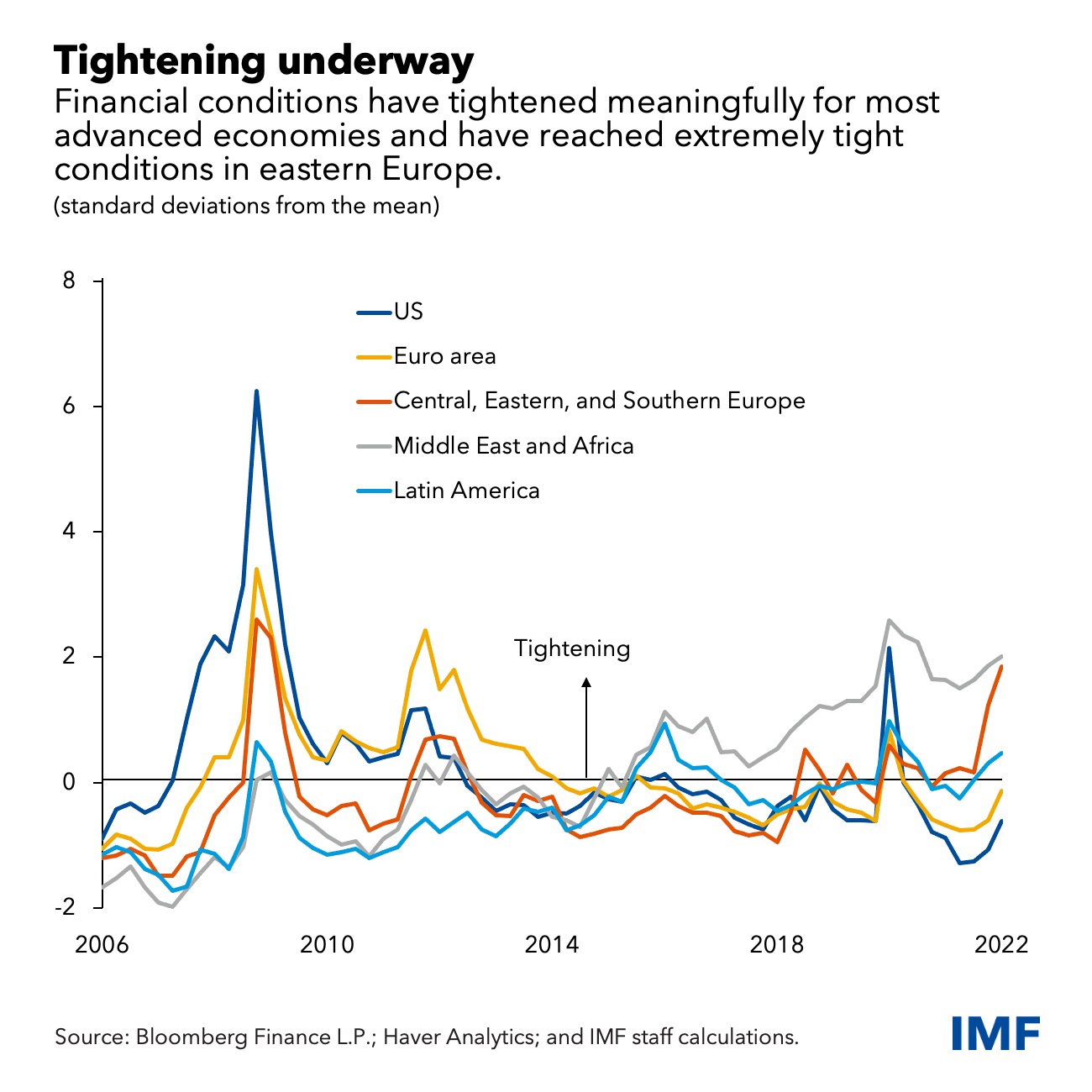

Since the beginning of the year, financial conditions have tightened significantly across most of the world, particularly in Eastern Europe. Amid rising inflation, expected interest-rate hikes have led to a notable tightening in advanced economies in the weeks following the Russian invasion of Ukraine. Even with that tightening, financial conditions are close to historical averages, and real rates remain accommodative in most countries.

Tighter financial conditions help to slow demand, as well as to prevent an unmooring of inflation expectations (that is, where anticipation of continued price increases in the future becomes the norm) and to bring inflation back to target.

Many central banks may have to move further and faster than what is currently priced in markets to contain inflation. This could bring policy rates above neutral levels (a “neutral” level is one at which monetary policy is neither accommodative nor restrictive and is consistent with the economy maintaining full employment and stable inflation). This is likely to lead to even tighter global financial conditions.

The new geopolitical reality complicates the work of central banks, which already faced a delicate balancing act with stubbornly high inflation. They must bring inflation back to target, mindful that excessive tightening of global financial conditions hurts economic growth. Against this backdrop, and in light of heightened financial stability risks, any sudden reassessment and repricing of risk resulting from an intensification of the war in Ukraine, or from an escalation of sanctions on Russia, may expose some of the vulnerabilities built up during the pandemic (surge in house prices and stretched valuations), leading to a sharp decline in asset prices.

Shock transmission

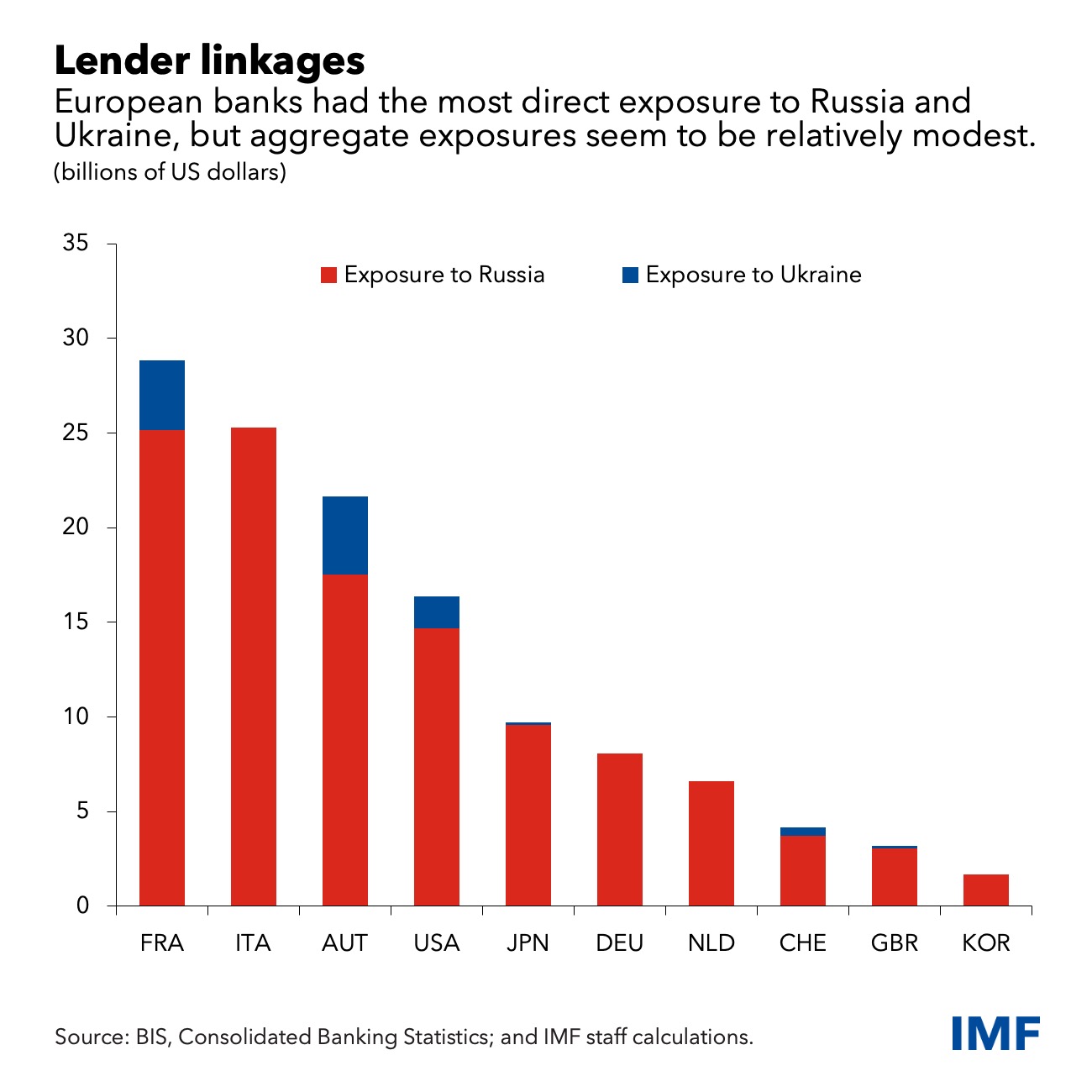

Repercussions of the war and ensuing sanctions continue to reverberate. The resilience of the global financial system will be tested through various potential amplification channels. These include the exposures of financial institutions to Russian and Ukrainian assets; market liquidity and funding strains; and the acceleration of cryptoization—residents opting to use crypto assets instead of the local currency—in emerging markets.

Europe bears a higher risk than other regions due to its geographic proximity to the war, reliance on Russian energy, and the non-negligible exposure of some banks and other financial institutions to Russian financial assets and markets. Moreover, ongoing volatility in commodity prices may severely pressure commodity financing and derivatives markets and could even cause more disruptions like the wild swings that halted some nickel trading last month. Such episodes, amid heightened geopolitical uncertainty, may weigh on liquidity and funding conditions.

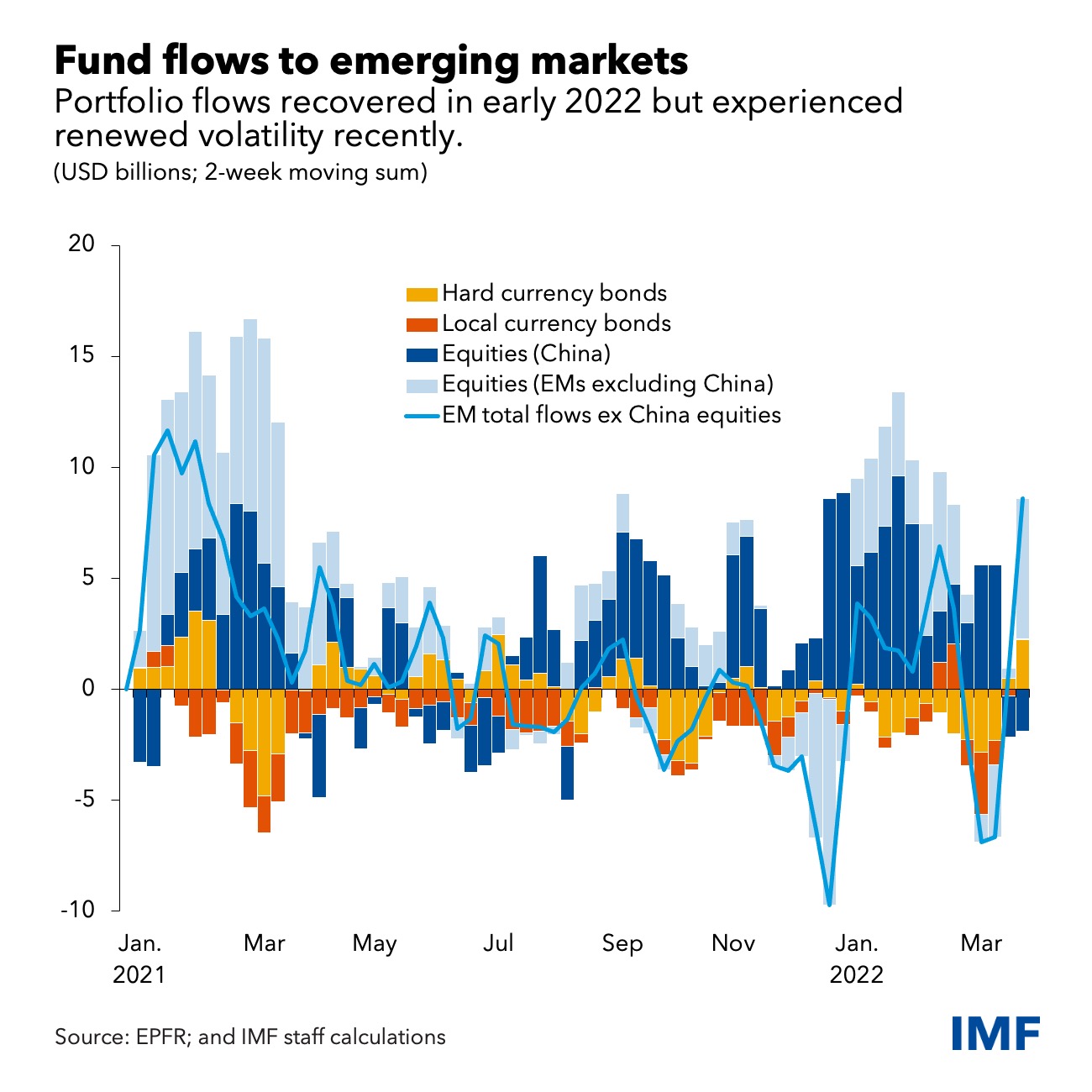

Emerging and frontier markets now face higher risks of capital outflows, with differentiation across countries between commodities importers and exporters. Amid geopolitical uncertainty, the interplay of tighter external financial conditions and the US Federal Reserve normalization (first rate increase delivered in March and unwinding of the balance sheet expected to be faster), is likely to increase the risk of capital flight.

Following the Russian invasion of Ukraine, the number of emerging and frontier market sovereign issuers trading at distressed levels (that is, spreads above 1,000 basis points) has surged higher to more than 20 percent of issuers, surpassing pandemic-peak levels. While worrisome, this has a limited impact on systemic concerns given these issuers account for a relatively lower proportion of total outstanding debt, to date.

In China, the recent equity sell-off, particularly in the technology segment, combined with ongoing stress in the real estate sector and renewed lockdowns, have raised concerns about a growth slowdown, with possible spillovers to emerging markets. Financial stability risks have risen amid ongoing stress in the battered real estate sector. Extraordinary financial support measures may be needed to ease balance sheet pressures, but these would add to debt vulnerabilities down the road.

Policy actions

In the near term, central banks should take decisive action to prevent inflation from becoming entrenched and keep expectations of future price increases in check. Interest rates might have to rise beyond what is currently priced in markets to get inflation back to target in a timely manner. This may entail pushing interest rates well above their neutral level. For advanced-economy central banks, clear communication is crucial to avoid unnecessary volatility in financial markets, by providing clear guidance about the tightening process while remaining data dependent.

In emerging markets, many central banks have already significantly tightened policy. They should continue to do so—depending on individual circumstances—to preserve their inflation-fighting credibility and anchor inflation expectations.

Policymakers should tighten selected macroprudential tools to tackle pockets of elevated vulnerabilities (for example, to lean against the surge in house prices), while avoiding a broad tightening of financial conditions. Striking the right balance here is important given uncertainties about the economic outlook, the ongoing monetary policy normalization process, and limits on post-pandemic fiscal space.

Policymakers will also face structural issues such as fragmentation in capital markets, which would have implications for the role of the US dollar. Payment systems face similar risks as central banks seek to establish their own digital currencies that are independent of existing international networks. Regulators will also be under pressure to narrow regulatory gaps to ensure integrity and protect consumers in the fast-evolving world of crypto assets.

At the same time, tradeoffs between energy security (adequate, affordable supplies) and climate (regulatory mechanisms intended to increase oil and gas prices) are being laid bare as supply and price effects of international sanctions on Russia ripple across Europe and beyond. There may be some setbacks in the climate transition in the immediate future, but the impetus to reduce energy dependency on Russia could be a catalyst for change. Policymakers should, therefore, strive to honor commitments on climate and intensify their efforts to achieve net-zero targets, while taking additional appropriate steps to address energy security concerns.