What We Do: The "Big Three"

The IMF has three main roles

Economic Surveillance

117 Country Health Checks

The IMF oversees the international monetary system and monitors the economic and financial policies of its 189 member countries. As part of this surveillance process, which takes place both at the global level and in individual countries, the IMF highlights possible risks to stability and advises on needed policy adjustments.

Lending

$9.2 billion to 16 countries, including $1.2 billion in low- or zero-interest loans to 13 low-income developing member countries

The IMF provides loans to member countries experiencing actual or potential balance-of-payments problems to help them rebuild their international reserves, stabilize their currencies, continue paying for imports, and restore conditions for strong economic growth, while correcting underlying problems.

Capacity Development

$256 million for expert advice and training

The IMF helps its member countries design economic policies and manage their financial affairs more effectively by strengthening their human and institutional capacity through expert advice known as "technical assistance" and training, which together it calls "capacity development."

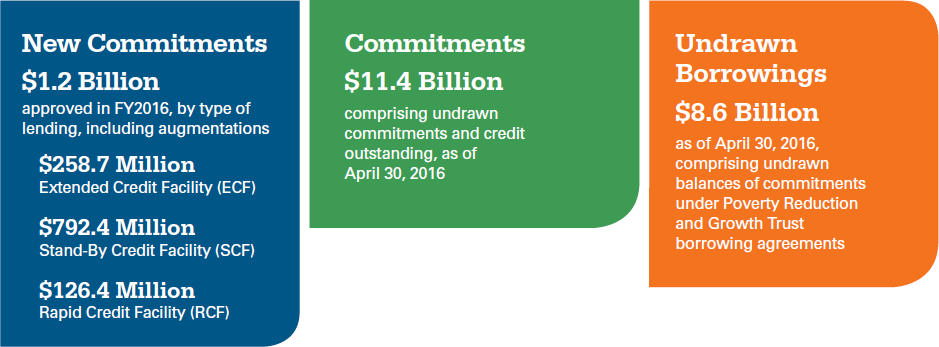

IMF Lending at a Glance

In broad terms, the IMF has two types of lending—loans provided at market-related (nonconcessional) interest rates and loans provided to low-income countries on concessional terms, for which interest rates are low or in some cases zero.

Nonconcessional Lending

Under the General Resources Account

Concessional Lending

Low- or zero-interest-rate loans for low-income developing countries under the Poverty Reduction and Growth Trust