Capacity Development

for Tax Policy and Administration Reform

Boosting domestic revenue mobilization is a key area in which IMF expertise—and the support of its partners—is being tapped to help its member countries achieve the UN Sustainable Development Goals.

Peru

Miraflores District in Lima, Peru

Since October 2011, the IMF—with support from the Swiss State Secretariat for Economic Affairs (SECO)—has been providing technical assistance to Peru’s revenue administration to strengthen revenue mobilization.

The core work of the project has focused on deepening taxpayer compliance. The project was developed in the customs and tax administration agency (SUNAT) and involved implementing a risk-based audit system for each taxpayer segment and an integrated taxpayer current account, centralizing systems for auditing tax

FIGURE 1

Five-year tax burden

Tax collection as a percent of GDP

2006-10

2.9 Mining and Hydrocarbon

12.8 Other Activities

2011-15

1.9 Mining and Hydrocarbon

14.1 Other Activities

and customs operations, and strengthening coordination between different levels of the agency.

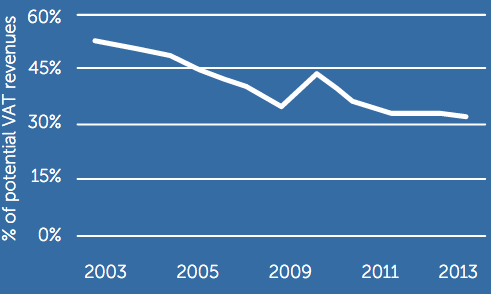

During 2015, the SECO-financed program funded two IMF missions and three short-term expert assignments. A review found that the objectives had been achieved, with significant increases in tax collections (Figure 1.1) and substantial reductions in the value-added tax compliance gap (Figure 1.2).

Video: Peru Plans for a Bigger Public Purse

FIGURE 2

VAT compliance gap, 2003-2013

Mauritania

Nouakchott, market, Mauritania

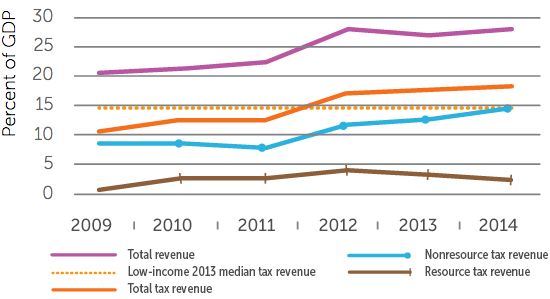

Mauritania has seen tax revenue collection increase significantly in recent years, well above the median for low-income countries. Between 2009 and 2014, total revenue increased from 20.4 percent to 27.6 percent of GDP, and total tax revenue increased from 11.5 percent to 18.5 percent of GDP (Figure 1.3). While booming mining activities drove economic growth, the country’s non-resource sector contributed most to the remarkable improvement.

The increase can be partly explained by a series of actions to simplify and improve the tax system following a multi-year IMF technical assistance program. The program was supported by two IMF topical trust funds, Tax Policy and Administration Topical Trust Fund and Managing Natural Resource Wealth.

Mauritania: Government Resources and Non-Resource Revenues

Kosovo

Prizren, Kosovo

As a post-conflict country, Kosovo faced serious obstacles to ensuring adequate public revenues to fund services when it joined the Fund in 2009. Tax compliance had to be improved. Government institutions were new, and the economic situation was difficult.

Video: Partnerships for Change: Kosovo

The IMF has managed a tax administration modernization project for Kosovo since 2010 with funding from the Swiss development agency SECO. Through this project, the Tax Administration of Kosovo (TAK) has substantially improved its management and organizational arrangements.

TAK’s approach to tax compliance now can be considered regional best practice. Since 2012, TAK has allocated its operational resources by tailoring administrative activities to specific tax risks. The idea is to achieve the greatest impact on taxpayer behavior and administrative efficiency. A strong monitoring system has been established.

Improving fairness has also been a priority. TAK has taken steps to build trust and cooperation with taxpayers. As a result, tax collections have strengthened significantly, with revenues up 8.5 percent in 2015 compared with 2014 and a tax-to-GDP ratio that has steadily increased from 20.3 percent in 2009 to 22.2 percent in 2015.

also inside

-

Overview

Spotlights

Regional Highlights

-

What We Do

Economic Surveillance

Lending

Capacity Development

-

FINANCES, ORGANIZATION & Accountability

Medium-term Budget

Human Resources

Accountability

Outreach and Engagement with External Stakeholders

Quota and Governance

Transparency

-

Looking Ahead

Fifteenth General Review of Quotas

Financial Sector Assessment Program Agenda in FY2017

Fiscal Work in Progress

Income and Gender Inequality

Corruption: Costs and Mitigating Strategies

Global Challenges