Economic Surveillance

"Surveillance" is the catch-all term encompassing the process by which the IMF oversees the international monetary system and global economic developments and monitors the economic and financial policies of its 189 member countries. As part of this typically annual financial health check, the IMF highlights possible risks to stability and advises on the necessary policy adjustments. In this way, it helps the international monetary system serve its essential purpose of facilitating the exchange of goods, services, and capital among countries, thereby sustaining sound economic growth.

There are two main aspects to the IMF’s surveillance: bilateral surveillance, or the appraisal of and advice on the policies of each member country, and multilateral surveillance, or oversight of the world economy. By integrating bilateral and multilateral surveillance, the IMF can ensure more comprehensive, consistent analysis of “spillovers”—how one country’s policies may affect other countries.

The centerpiece of bilateral surveillance is the Article IV consultation, named after the article of the IMF’s Articles of Agreement that requires a review of economic developments and policies in each of the IMF’s 189 member countries. Article IV consultations cover a range of issues considered to be of macrocritical importance—fiscal, financial, foreign exchange, monetary, and structural—focusing on risks and vulnerabilities and policy responses. Hundreds of IMF economists and other IMF staff members are involved in the Article IV process.

The consultations take the form of a two-way policy dialogue with the country authorities, rather than one-sided IMF assessments. The IMF team typically meets with government and central bank officials, as well as other stakeholders such as parliamentarians, business representatives, civil society, and labor unions, to help evaluate the country’s economic policies and direction. The staff presents a report to the IMF’s Executive Board, normally for discussion, after which the consultation is concluded and a summary of the meeting is transmitted to the country’s authorities. In most cases and subject to the member country’s agreement, the Board’s assessment is published as a press release, along with the associated staff reports. In FY2016, the IMF conducted 117 Article IV consultations (see Web Table 2.1).

Following the global financial crisis, the IMF has also conducted financial sector assessments as part of surveillance for countries with systemically important financial sectors.

Multilateral surveillance involves monitoring global and regional economic trends and analyzing spillovers from members’ policies onto the global economy. As part of its World Economic and Financial Surveys, the IMF publishes flagship reports on multilateral surveillance twice a year: World Economic Outlook (WEO), Global Financial Stability Report (GFSR), and Fiscal Monitor (FM). The WEO provides detailed analysis of the state of the world economy, addressing issues of pressing interest such as the protracted global financial turmoil and ongoing economic recovery from the global financial crisis. The GFSR provides an up-to-date assessment of global financial markets and prospects and highlights imbalances and vulnerabilities that could pose risks to financial market stability. The FM updates medium-term fiscal projections and assesses developments in public finances. The IMF also publishes Regional Economic Outlook (REO) reports as part of its World Economic and Financial Surveys.

Bilateral Surveillance

The centerpiece of bilateral surveillance is the so-called Article IV consultation, named after the article of the IMF’s Articles of Agreement that requires a review of economic developments and policies in each of the IMF’s 188 member countries. The consultations cover a range of issues considered to be of macrocritical importance—fiscal, financial, foreign exchange, monetary, and structural—focusing on risks and vulnerabilities and policy responses. Hundreds of IMF economists are involved in the Article IV process.

The consultations are a two-way policy dialogue with the country authorities, rather than the IMF assessing a country. The IMF team typically meets with government and central bank officials, as well as other stakeholders such as parliamentarians, business representatives, civil society, and labor unions, to help evaluate the country’s economic policies and direction. The staff presents a report to the IMF’s Executive Board, normally for discussion, after which the consultation is concluded and a summary of the meeting is transmitted to the country’s authorities. In the vast majority of cases, the Board’s assessment is published as a press release, along with the Staff Reports, with agreement of the member country in question. In FY2015, the IMF conducted 131 Article IV consultations (see Web Table 2.1).

The IMF has also conducted financial sector surveillance since the Asian crisis, with special emphasis on the need to strengthen following the 2008 global financial crisis.

Multilateral Surveillance

Multilateral surveillance involves monitoring global and regional economic trends and analyzing spillovers from members’ policies onto the global economy. The flagship reports on multilateral surveillance are published twice a year: the World Economic Outlook (WEO), Global Financial Stability Report (GFSR), and Fiscal Monitor (FM). The WEO provides detailed analysis of the state of the world economy, addressing issues of pressing interest, such as the current global financial turmoil and economic downturn. The GFSR provides an up-to-date assessment of global financial markets and prospects, and highlights imbalances and vulnerabilities that could pose risks to financial market stability. The FM updates medium-term fiscal projections and assesses developments in public finances. The IMF also publishes Regional Economic Outlook (REO) reports, as part of its World Economic and Financial Surveys.

Bilateral surveillance

The Article IV Consultation Process: The Annual Economic Policy Assessment

The Article IV consultation process for a particular member country unfolds over a period of several months, beginning with an internal review of key policy issues and surveillance priorities across IMF departments and with management, set out in a briefing document known as the Policy Note.

The Policy Note elaborates on key economic policy directions and recommendations to be discussed with the member country’s government. Review of the Policy Note with all IMF departments to build consensus about a country ahead of the consultation culminates in a Policy Consultation Meeting, and then the Policy Note goes to IMF management for approval. After Policy Note approval, the Article IV team travels to the country for its meetings with government officials and stakeholders. Upon the team’s return to IMF Headquarters, a staff report is prepared that again proceeds through departmental and management review before being considered by the IMF Executive Board.

Annual Report on Delayed Article IV Consultations

In line with a framework introduced in 2012 for addressing excessive delays in the completion of Article IV consultations, the Fund releases annually a list of member countries for which such consultations have been delayed longer than 18 months. The Fund staff groups the reasons for the delays into the following categories: program-related issues, further discussions, political/security situation, government change, staffing constraints, authorities’ request, no agreement on mission dates/modalities, and miscellaneous.

The most recent list, issued in April 2016, included the following countries:

- Venezuela (no agreement on mission dates/modalities)

- Argentina (miscellaneous—the Argentine authorities have confirmed their intention to restart Article IV consultations in 2016)

- Eritrea (no agreement on mission dates/modalities)

- Syrian Arab Republic (political/security situation)

- Central African Republic (political/security situation)

- Guinea (miscellaneous)

- Libya (political/security situation)

TRIENNIAL SURVEILLANCE REVIEW

The 2014 Triennial Surveillance Review (TSR), part of the IMF’s regular review of the effectiveness of how it monitors economic developments and provides policy advice across its member countries and the global economy, discussed in the 2015 Annual Report, highlighted a number of issues related to bilateral and multilateral surveillance conducted by the IMF. As a follow-up to TSR recommendations, the Executive Board and the Fund staff initiated a set of policy reviews intended to strengthen surveillance work. Three papers prepared during FY2016 followed through on this work: “Mainstreaming Macro- Financial Surveillance,” “Balance Sheet Analysis in Fund Surveillance,” and “Evenhandedness of Fund Surveillance.”

Mainstreaming Macro-Financial Surveillance

The global financial crisis demonstrated that national and regional financial linkages could adversely affect macroeconomic performance and transmit spillovers across the global economy. Many of the financial problems that emerged—including flight from credit instruments, extreme illiquidity in key markets, and institutional stress and failure— had not been foreseen and were not easily incorporated into the models that the Fund and others were using.

The IMF has been working to understand these macrofinancial issues and how better to incorporate related developments and linkages into its work. This was a key element of the 2014 Triennial Surveillance Review, which recommended the mainstreaming of macro-financial surveillance. In so doing, the Fund is moving beyond treating the financial sector as an isolated element in its analytical framework, giving more consideration to how financial issues affect other sectors, and, in turn, how those sectors influence financial developments.

THE ROLES OF IMF AREA AND FUNCTIONAL DEPARTMENTS

Surveillance work at the staff level is led by the Fund’s area departments, which cover sub-Saharan Africa, Asia and the Pacific, Europe, the Middle East and Central Asia, and the Western Hemisphere and conduct analysis and formulate policy advice. During FY2016, several specific issues were incorporated into country analyses, including how the recent oil price shock will affect bank health and lending, how very low inflation feeds through balance sheets to the financial system, the capacity of local banks to finance very large publicprivate partnership programs, and policies to overcome the impediments small and medium-sized enterprises face in accessing finance. Enhanced training, knowledge sharing, and greater use of good-practice examples are complementing Article IV work in this area.

The Fund’s functional departments, which include the Research Department, Monetary and Capital Markets Department, the Institute for Capacity Development, Statistics Department, and Legal Department, also contribute expertise, increasing the number of country teams supported in their macro-financial analysis to around 60 Article IV consultations. Functional departments are also developing new analytical tools:

- Sound credit growth forecasts are important in assessing how the financial sector affects baseline outlooks. The Research Department has developed a desktop toolkit to check consistency between real sector and financial sector forecasts.

- The Monetary and Capital Markets Department has revamped its financial analytics, including tools to assess changes in the macro-financial environment and measure financial sector resilience.

- To support balance sheet analysis, the Statistics Department has developed a template to generate the balance sheet approach matrix following the format of the 2014 Triennial Surveillance Review, populated using in-house data.

- Staff training is also a priority to build up the Fund’s capacity and familiarity with the issues involved. The Institute for Capacity Development has launched a five-module course for Fund staff on key macro-financial topics.

Balance Sheet Analysis in Surveillance

The global financial crisis dramatically illustrated the importance of incorporating balance sheets into assessments of the economic outlook and risks. The 2014 Triennial Surveillance Review reinforced the importance to Fund surveillance of stability risks and the need to devote greater attention to national balance sheets in assessing vulnerabilities. The TSR called on the Fund to develop and adapt its balance sheet analysis using more-detailed data.

A staff report discussed by the Executive Board in an informal session on June 19, 2015, reviewed the use of balance sheet analysis in the Fund’s bilateral surveillance and introduced practical examples of how it can be deepened. The work was placed in the context of the Fund’s more intensive coverage of macro-financial issues.

The report was a first step to highlight useful examples of such analysis conducted by the IMF staff over the past decade. It documents the data and tools that have been used and outlines some limitations. In addition, it discusses recent improvements in the coverage and quality of balance sheet data through initiatives launched in the wake of the crisis, as well as key remaining gaps that need to be addressed through international collaboration.

The paper suggests focusing additional work in two broad areas:

- Addressing key data gaps hampering surveillance— especially related to nonbank financial institutions, nonfinancial corporations, governments, and households—and information related to currency and maturity breakdown, counterparties, and off-balance-sheet exposures. Efforts are also needed to increase coverage of balance sheet data for lowincome countries and to better capture increasingly complex financial instruments in more advanced economies.

- Designing more tools to help the IMF staff analyze balance sheets and deepen the assessment of macro-financial linkages and spillovers. Some new approaches along those lines are introduced in the paper.

- Box 2.1: U.S. Financial Sector Assessment

-

The U.S. financial sector—the largest in the world—plays a crucial role in ensuring global financial stability. In 2010, in the wake of the global financial crisis, the IMF Executive Board decided to mandate an assessment under the Financial Sector Assessment Program (FSAP) of the world’s top 25 financial systems every five years. The list was expanded to 29 countries in 2013.

The FSAP is a comprehensive, in-depth analysis of the country’s financial sector. In its 2015 assessment of the U.S. financial system, conducted as part of the mandatory financial stability assessment, the IMF determined that the country’s banks appeared healthier and stronger than at the time of the previous assessment in 2010. The report highlighted, however, pockets of vulnerabilities in the fast-growing nonbank sector.

The IMF based its findings in part on stress tests conducted to assess the stability of the U.S. financial system. The tests found that the banking system is resilient to severe shocks, similar in magnitude to the crisis. The Fund analysis also indicated that insurance companies, hedge funds, and other managed funds contribute to overall financial risks to an extent larger than suggested by their size, and therefore deserve greater attention.

Evenhandedness of Fund Surveillance

Following recommendations in the 2014 Triennial Surveillance Review, the IMF Executive Board agreed to move forward with a framework to help ensure the evenhandedness of Fund surveillance.

The framework that the Executive Board adopted has two key elements, as outlined in the staff paper “Evenhandedness of Fund Surveillance—Principles and Mechanisms for Addressing Concerns,” which the Board discussed on February 22, 2016.

First, the framework articulates principles of what it means to be evenhanded. Second, it establishes a mechanism for reporting and assessing specific concerns about any lack of evenhandedness in surveillance.

The evenhandedness of IMF analysis and advice is critical to the institution’s credibility and the effectiveness of its engagement with member countries. The TSR examined the issue in detail, including through an external study.

While it did not find a systematic lack of evenhandedness, it identified instances in which differences in surveillance across countries were not justified by country circumstances. The TSR also highlighted long-standing perceptions that the Fund is not evenhanded.

The new framework aims to address both perceptions and instances of lack of evenhandedness transparently, while safeguarding the independence and candor of staff advice. By forging a common understanding of evenhandedness, the principles can support a deeper dialogue through which evenhandedness issues can be identified earlier and discussed more candidly in the surveillance process.

Executive Directors supported the establishment of a mechanism for authorities to report concerns about lack of evenhandedness. The mechanism is intended to serve as a backstop to assess remaining concerns and identify lessons to promote better practices. In this respect, the evenhandedness framework also supports the TSR’s broader goals to strengthen and promote more member-focused surveillance.

Directors emphasized that the agreed framework for guiding evenhanded surveillance was a new and untested approach that would need to adapt and evolve as the Fund gains experience. They agreed that the 2019 Review of Surveillance would provide the appropriate opportunity for a thorough evaluation of the newly established principles and mechanism.

Surveillance of Countries with Common Policies

The IMF’s surveillance work at the country level is augmented by policy discussions at a regional level in several cases in which a country belongs to a currency union. The Fund staff holds regular consultations with regional institutions responsible for common policies of currency union member countries to strengthen the bilateral discussions held under the Article IV process.

A staff report is prepared on each of the regional groupings, and those reports are submitted to the Executive Board for discussion. The views expressed by Executive Directors are made public in a press release, which is published along with the staff report. These reports are part of the Article IV consultations with the individual member countries of each regional group.

Such regional policy discussions are held with the following groupings: the Central African Economic and Monetary Community (CEMAC), the Eastern Caribbean Currency Union (ECCU), the euro area, and the West African Economic and Monetary Union (WAEMU).

In January 2016, Managing Director Christine Lagarde addressed policy challenges facing CEMAC member countries during a visit to Cameroon.

- Box 2.2: Completion of 2015 Islamic Republic of Iran Article IV Consultation

-

The IMF Executive Board concluded the IMF’s Article IV consultation with the Islamic Republic of Iran in December 2015. The Board assessment indicated that the “sharp decline in global oil prices, tight corporate and bank balance sheets, and postponed consumption and investment decisions ahead of the expected lifting of economic sanctions have significantly slowed down economic activity since the fourth quarter of 2014/15.”

The Board assessment continued: “Real GDP growth is projected to decline from 3 percent in 2014/15 to somewhere between 0.5 and –0.5 percent in 2015/16. Twelve-month (point-to-point) inflation has declined to about 10 percent in recent months, largely reflecting lower food and beverage inflation, and the inflation rate is expected to remain close to 14 percent by year end.

“Prospects for 2016/17 are brighter, owing to the prospective lifting of economic sanctions. Higher oil production, lower costs for trade and financial transactions, and restored access to foreign assets are expected to lift real GDP to about 4–5.5 percent next year.”

Multilateral surveillance

2015 External Sector Report

The IMF’s “Fourth External Sector Report,” issued in July 2015, assesses the largest economies’ external sector positions and policies in 2014 and early 2015. The Executive Board discussed the report in an informal session, along with its companion paper on “Individual Economy Assessments.”

Together with the 2015 Spillover Report and Article IV consultations, the report is part of an effort to ensure that the IMF is able to address the possible effects that spillovers from members’ policies could have on global stability and to monitor the stability of members’ external sectors in a comprehensive fashion. The reports provide an assessment of exchange rates, current accounts, reserves, capital flows, and external balance sheets..

- KEY FINDINGS

-

- After narrowing modestly in 2013, the global scale of current account imbalances and excess imbalances held steady in 2014. While the country composition of imbalances has rotated, little overall progress has been made in reducing excess imbalances.

- Several significant developments were seen as affecting external positions in 2015: sharply lower oil prices, cyclical divergence and different monetary policies among the major economies, and related currency movements.

- The pattern of projected near-term changes in current accounts is dominated by the effects of the oil price decline, though these will be partly offset by related currency movements and by eventual expenditure responses. Changes in real effective exchange rates—nearly 10 percent in some cases—also will affect current accounts.

- The currency shifts associated with economic and monetary policy divergence among the major economies are reflections of an incomplete recovery and the need for broader policy action to support demand and growth. Implementation of the full policy agenda—including demand-supporting policies beyond monetary policies—would likely affect exchange rates but, more importantly, would improve prospects for sustained global growth and financial stability. Efforts by both surplus and deficit economies would be mutually reinforcing and support growth.

- The global financial environment will be complicated by the diverse risks associated with especially accommodative monetary policies and by the process of exit from those policies, with the potential to disrupt markets. Policymakers should be prepared to respond flexibly to changing financial conditions using a range of tools.

2015 Spillover Report

The 2015 Spillover Report, prepared in conjunction with the External Sector Report, analyzes the potential cross-border impact of macroeconomic and macro-financial developments in systemically important member countries. The report was discussed in an informal Executive Board session on June 22, 2015.

The report focuses on the implications and spillover effects of monetary policy actions in advanced economies and the decline in world oil prices, which created what the report terms a “spillover-rich” environment.

The report describes the challenges that many systemically important advanced economies face in closing output gaps and raising potential output growth. Addressing these challenges, the report says, requires a package of macroeconomic, financial, and structural policies that will boost both aggregate demand and aggregate supply, while closing the shortfall between demand and supply. It concludes that each element of the policy package is important and that one cannot substitute for the other. It states that easy monetary policy will not raise potential output just as structural reforms will not close output gaps.

- Box 2.3: The Early Warning Exercise

-

In 2008, the Group of Twenty industrialized economies asked the IMF and Financial Stability Board (FSB) to collaborate on regular Early Warning Exercises (EWEs). The EWEs assess low-probability, but potentially high-impact, risks to the global economy and identify policies to mitigate them.

The EWEs integrate macroeconomic and financial perspectives on systemic risks, drawing on a range of quantitative tools and broad-based consultations. The EWEs are conducted semiannually, drawing on a broad range of inputs, including the World Economic Outlook, Global Financial Stability Report, and Fiscal Monitor, the IMF’s flagship publications on global surveillance. The IMF’s bilateral and multilateral surveillance activities are used to follow up on EWE findings and policy recommendations.

After discussions at the IMF Executive Board and with the FSB, the EWE’s findings are presented to senior IMF officials during the IMF–World Bank Spring and Annual Meetings.

Virtual Currencies

New technologies—supported by advances in encryption and network computing—have the potential to drive change in the global economy, including in how goods, services, and assets are exchanged. An important development in this process has been the emergence of virtual currencies and the underlying distributed ledger technologies.

A Staff Discussion Note, “Virtual Currencies and Beyond: Initial Considerations,” was released in January 2016 to address the challenges of achieving a balanced regulatory framework that guards against potential risks such as money laundering, terrorism financing, and tax evasion, without stifling innovation.

The note provides an overview of virtual currencies, how they work, and how they fit into monetary systems, both domestically and internationally. It discusses the potential implications and benefits of the technological advances underlying virtual currencies, such as the distributed ledger system, before examining the regulatory and policy challenges in the areas of consumer protection, financial integrity, taxation, financial stability, exchange and capital controls, and monetary policy. The paper also sets out principles for the design of regulatory frameworks for virtual currencies at both the domestic and international levels.

A key conclusion of the note is that the distributed ledger concept has the potential to change finance by reducing costs and allowing for deeper financial inclusion. This could prove especially important for remittances, which can involve high transaction costs. The potential for transformational change means that policymakers need to continue to closely monitor developments in virtual currencies and distributed ledger technologies.

Figure 2.1

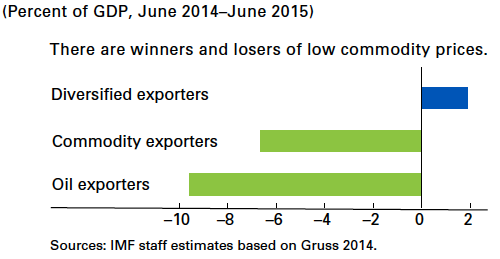

LIDCs—Net commodity price index by country groups

Figure 2.2

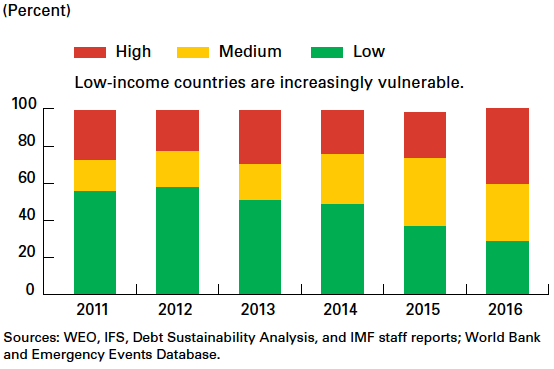

LIDCs—Rising vulnerabilities

Figure 2.3

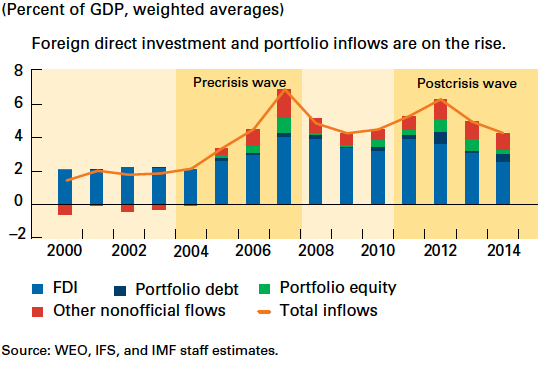

LIDCs—Capital inflows

Macroeconomic Developments and Prospects in Low-Income Developing Countries

“Macroeconomic Developments and Prospects in Low-Income Developing Countries: 2015,” the second annual staff paper on this topic, discussed by the Executive Board on December 9, 2015, examines the implications of the sharp decline in commodity prices and the expected low-price environment into the medium term. The report also analyzes the experience of low-income developing countries (LIDCs) with capital inflows over the past decade.

During their discussion, Executive Directors saw merit in having an annual formal Board discussion of macroeconomic developments in LIDCs, while stressing the importance of consistent messages. Directors also welcomed the effort to differentiate between LIDC subgroups, which should provide useful guidance for tailored policy advice, financial support, and technical assistance, while noting country-specific circumstances, even within subgroups.

Directors broadly agreed with the assessment of recent economic developments in LIDCs against the backdrop of a more challenging external environment. They noted that the impact of the sharp fall in commodity prices has varied. Many commodity-dependent exporters, especially oil producers, have been hit hard, whereas countries less dependent on commodity exports have gained from falling import prices, notably through lower oil import bills (see Figure 2.1).

While growth has slowed in many commodity-dependent exporters, economic performance has typically remained robust in countries with more diversified trade structures. Moreover, several LIDCs have been badly hit by domestic supply shocks, including from natural disasters and epidemics (such as Ebola) and worsening security conditions.

Directors noted that, while several diversified exporters have maintained strong fundamentals, short-term economic vulnerabilities have increased across a significant number of LIDCs (Figure 2.2). In part this reflects the economic shocks experienced by commodity exporters, but it also reflects the erosion of policy buffers in some countries less dependent on commodity exports. Directors underscored the importance of using good times to build the fiscal and external buffers needed to allow countries to handle future adverse shocks effectively.

Directors noted that, in recent years, portfolio inflows to LIDCs have risen markedly alongside foreign direct investment (Figure 2.3). They recognized that, while global financial conditions have provided a supportive environment, improved domestic fundamentals have played an essential role in attracting inflows.

Evolving Monetary Policy Frameworks in Low-Income Countries

Many low- and lower-middle-income countries have improved control over fiscal policy, liberalized and deepened financial markets, and stabilized inflation at moderate levels over the past two decades. Monetary policy frameworks that have helped achieve these ends are facing challenges from financial development and increased exposure to global capital markets.

A staff report, “Evolving Monetary Policy Frameworks in Low-Income and Other Developing Countries,” was discussed in an informal Executive Board session on November 9, 2015. An accompanying paper examines country experiences with monetary policy issues.

The report describes the improvements countries are considering and implementing in their monetary policy frameworks. Among the report’s findings:

- Countries should develop coherent and transparent monetary policy frameworks. Central banks should have a clear mandate that assigns primacy to price stability while fostering macroeconomic and financial stability.

- An explicit inflation objective should serve as the cornerstone for monetary policy actions and communications. Such an objective anchors inflation and provides a clear benchmark for measuring central bank performance.

- Trade-offs between price stability and other policy goals are difficult to manage, though credibly establishing the primacy of the price stability objective can give central banks more room to take other objectives into account in policy decisions.

- Central bank procedures for implementing monetary policy should be framed in terms of a specific short-term interest rate. Such operating procedures can reduce interest rate volatility, promote financial market development, and enhance the transmission of monetary policy to the broader economy.

The Fund will continue to support low- and lower-middleincome countries in strengthening and modernizing their frameworks through policy advice, in both surveillance and program contexts, as well as technical assistance and training.

Public Debt Vulnerabilities in Low-Income Countries

The IMF and World Bank in 2015 prepared their first joint report on public debt vulnerabilities in low-income countries (LICs). The report, which was presented to an informal session of the Executive Board in November 2015, examines debtrelated developments and their underlying causes since the onset of the global financial crisis. The report’s findings will inform an upcoming review of LIC debt sustainability.

The report, which examines 74 countries, determines that more diverse financing sources that have become available to LICs in recent years can offer new opportunities but also pose risks. It shows that public debt trends have changed significantly over the past decade. Debt relief programs, strong growth, and high demand for commodities reduced the average debt-to-GDP ratio from 66 percent in 2006 to about 48 percent at the end of 2014.

Good macroeconomic performance in many low-income countries—especially frontier market economies—helped expand financing sources in external markets. The report documents that the share of nonconcessional to total external debt broadly doubled between 2007 and 2014 for frontier market economies and commodity exporters.

- Box 2.4: Small Middle-Income Countries in Africa

-

The IMF African Department in January 2016 issued a book titled Unlocking the Potential of Small Middle- Income States, and held a conference on the topic in Gabarone, Botswana.

In recent years, small middle-income countries (SMICs) in sub-Saharan Africa have enjoyed stronger growth and economic development than most other countries in the region. Their governments have also effectively addressed development challenges such as narrowing the infrastructure gap and improving access to education and health.

However, a number of recent external developments have created headwinds and slowed economic activity. As a result, SMICs need to adjust their policies to preserve stability and restore growth. At the same time, they must decide on the structural reforms that could lay the foundation for long-term growth. The policies discussed in the book set out a possible road map for implementing reforms to eventually propel SMICs to advanced economy status.

For the period under examination, debt vulnerabilities Regulatory Challenges.” remain generally lower than before the crisis. Between 2007 and 2015, the proportion of countries at high risk of external debt distress (or in distress) fell from 43 to 26 percent. At the same time, liquidity buffers narrowed and debt-to-GDP ratios edged higher, reflecting countercyclical policies as well as some utilization of borrowing headroom to finance priority spending.

The paper highlights the importance of greater vigilance as LICs navigate shifting market conditions and a weaker global outlook. Their closer integration into the global economy, greater exposure to market risks, and reduced fiscal buffers place a premium on prudent fiscal policies and enhanced debt management. These policies are likely to be tested by lower global commodity prices, less favorable global lending conditions as monetary policies normalize, and currency pressures.

Options for Low-Income Countries’ Effective Use of Tax Incentives

IMF staff members joined staff members from the World Bank, Organisation for Economic Co-operation and Development, and United Nations to prepare a background paper for the G20, “Options for Low-Income Countries’ Effective and Efficient Use of Tax Incentives for Investment.”

The paper—which was presented to the Development Working Group of the G20 in September 2015 and to the IMF Executive Board the following month—describes tools that low-income countries can use to assess tax incentives:

- An application of cost-benefit analysis provides an overarching framework for assessing tax incentives.

- Three tools—tax expenditure assessment, corporate micro-simulation models, and effective tax rate models— address aspects of cost-benefit analysis.

- Two others assess the transparency and governance of tax incentives.

Financial Integration in Latin America

Many Latin American economies have experienced significant reductions in growth in the past few years as a result of the sharp decline in commodity prices, the rebalancing of China’s growth, and the protracted sluggish growth in advanced economies. In addition, since the global financial crisis, many multinational banks have withdrawn from the region, potentially worsening access to credit or reducing competition in the financial sector.

- Box 2.5: Economic Linkages between Latin America and Asia

-

Trade and financial integration between Asia and Latin America were the focus of a conference held at IMF headquarters on March 3, 2016. Economic integration involving the two regions has deepened over the past decade, particularly as Asia—led by China—has become a major export market for Latin American commodities. Investment flows also have been growing, mainly from Asia to Latin America.

As the Chinese economy undergoes an important rebalancing and its demand for commodities slows, trade and investment linkages are expected to evolve. The conference explored the main opportunities and challenges for these evolving trade and financial ties, including an assessment of the implications of the Trans-Pacific Partnership.

An IMF staff report, “Financial Integration in Latin America,” released in March 2016, makes the case that the timing may be appropriate for Latin American economies to work toward greater regional financial integration. The Executive Board discussed the report in an informal session in March 2016.

The report states that regional financial integration would not be a substitute for wider integration in the world economy. However, given the retrenchment by multinational banks and limited agreement on global initiatives, regional integration could be a step toward achieving global integration.

For example, regional financial integration could facilitate the adoption of best practices by Latin American economies in such areas as supervision and accounting. It could also facilitate inward investment, enable markets to achieve minimum viable size, and add a dimension of diversification so that the economies would not rely solely on domestic or global developments. Instead, they could reap benefits from the economic stability of other countries in the region.

The report suggests preconditions that would enable integration to proceed safely, along with barriers that could be progressively reduced and eliminated to facilitate integration.

Policy advice

Financial Inclusion

Financial inclusion is rapidly moving up the economic reform agenda as an important means to improve people’s livelihoods, reduce poverty, and advance economic development. More than 60 governments have established financial inclusion as a policy goal, and the United Nations’ Sustainable Development Goals give financial inclusion a prominent role. The Fund’s own work on inclusive growth also takes financial inclusion into account in ongoing analytical and statistical work and policy advice to member countries. The issue gained crucial attention during FY2016 with the issuance of a Staff Discussion Note, “Financial Inclusion: Can It Meet Multiple Macroeconomic Goals?,” followed by a flagship seminar on the topics at the Annual Meetings, and a major conference, “The Future of Asia’s Finance,” held in Jakarta, Indonesia, in September 2015. A conference on financial inclusion in Central Africa was held in March 2015. In April 2016, the IMF also co-organized a major conference in Washington on “Financial Inclusion: Macroeconomic and For the period under examination, debt vulnerabilities Regulatory Challenges.”

“Financial inclusion is not just a matter of products or regulations,” observed Managing Director Christine Lagarde in a keynote address to the Jakarta conference. “It is the provision of services and the creation of opportunities where there is inequality—inequality of income and gender, education, and health.”

The Staff Discussion Note findings show that financial inclusion—as part of the process of financial deepening in emerging market and developing economies—brings substantial economic benefits such as higher GDP growth. At the same time, the benefits are shown to decline with advances in financial deepening. The note draws upon comprehensive global data from the Fund’s Financial Access Survey (compiled on an annual basis with support from the Netherlands and the Bill and Melinda Gates Foundation) and other data sets.

The world has seen improvements in financial inclusion, but considerable gaps remain. The percentage of adults with bank accounts increased from 50 percent to about 60 percent worldwide between 2011 and 2014. However, some 2 billion adults remain “unbanked.” In addition, nearly 40 percent of the banked population do not effectively use their accounts to make deposits or withdraw money.

The note also shows that bank stability risks increase when access to credit expands, especially without adequate regulation and supervision. So greater emphasis has to be placed on enhanced supervision and regulation.

However, increased access to other financial services such as automated teller machines (ATMs), branches, and payment of salaries and pensions through bank accounts does not have a strong impact on banking stability.

Financial Inclusion and Gender Inequality

IMF staff research shows that financial exclusion is closely associated with gender inequality. Worldwide, men are 7 percent more likely than women to have bank accounts and 9 percent more likely in developing countries.

Globally, 58 percent of women hold accounts, compared with 65 percent of men. While there is no gender gap in the advanced economies of the Organisation for Economic Cooperation and Development, where 94 percent of all adults have an account, the gap is particularly large in South Asia, where only 37 percent of women have accounts, compared with 55 percent of men.

The gender gap is even higher when one moves beyond account ownership to overall usage of financial services. For instance, women entrepreneurs are more likely than men to face barriers in financial access: an estimated 70 percent of women-owned small and medium-sized enterprises in developing countries are unserved or underserved by financial institutions.

On the credit supply side, women often face more restrictive collateral requirements, shorter loan maturities, and higher interest rates. On the demand side, illiteracy and lack of control over household financial resources are barriers to obtaining loans.

There is also a gender gap within the financial services industry. Across various regions, less than 20 percent of bank directors are women. Moreover, only 15 of some 800 banks across 72 countries had women chief executive officers in 2013. Similarly, the share of women on boards of directors of bank supervisory and regulatory agencies is low.

Financial Inclusion in Bangladesh

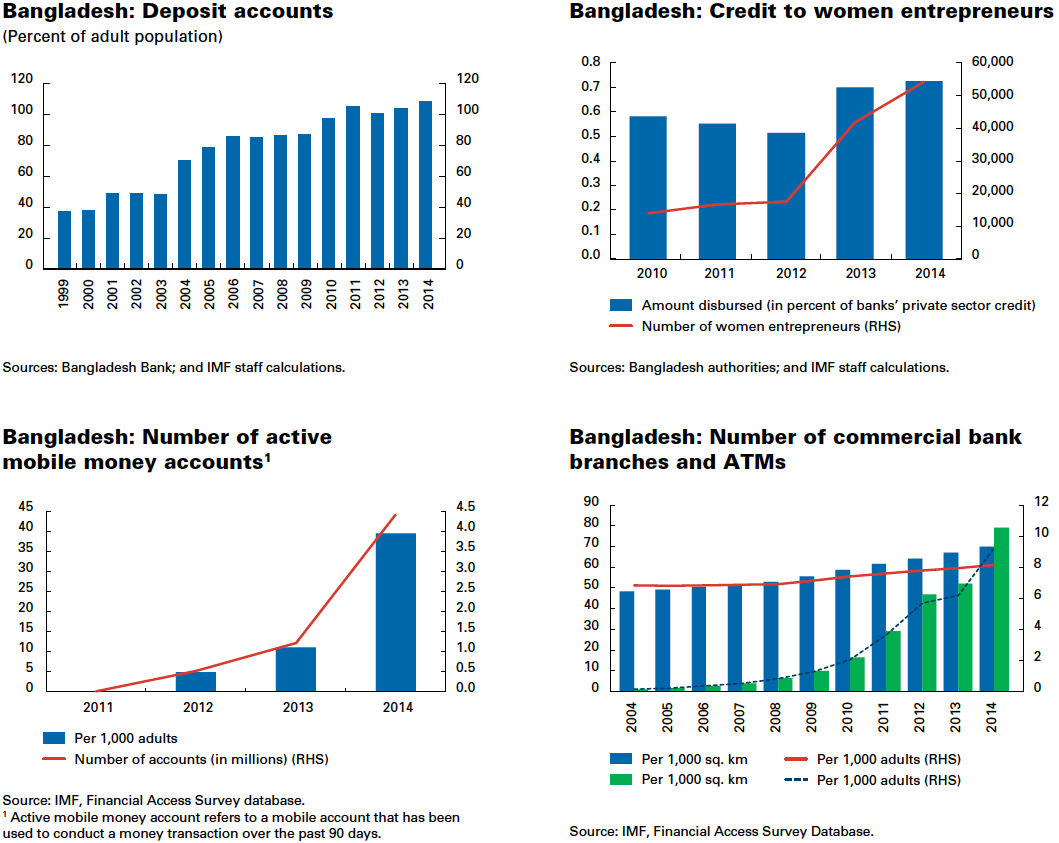

Bangladesh has experienced a rapid increase in financial inclusion over the past decade as its authorities have taken several measures to enhance access to financial services.

The policies—which build on advances in the provision of microcredit since the 1970s—specifically target those excluded from or having little access to the mainstream financial sector.

Policies include introducing financial services via mobile banking, requiring that banks open at least 50 percent of their branches in rural areas, agent-based banking to provide services in the remotest areas, floors on credit to the agricultural and rural sectors backed by credit lines on concessional terms, support for small and medium-sized enterprises and women entrepreneurs, programs aimed at shifting slum dwellers to rural areas, and no-frills bank accounts.

As a result, the percentage of bank deposit accounts in the adult population, the amount of credit provided to small and medium-sized enterprises run by women, the actual number of women entrepreneurs, and the number of active mobile money accounts have all increased sharply, while geographic and demographic access to ATMs and bank branches has widened (see Figure 2.4).

Figure 2.4

Financial Inclusion and Growing the Palestinian Economy

For many countries around the world, financial inclusion— the access to and use of financial services by households and firms—is a vital ingredient for economic development and poverty reduction. This is especially true in the West Bank and Gaza, where restrictions on the circulation of people, goods, and money pose an added challenge for policymakers.

The Palestine Monetary Authority (PMA), with technical support from the IMF and other donors, has championed financial inclusion and stability as the centerpiece of its efforts to increase growth and create jobs in a private sector–led economy. Over the past decade, the PMA has made important strides in improving access to financial services and the health of the banking system. In addition to increasing the number of bank branches, the PMA has promoted the use of e-banking services and tried to close gender gaps in account usage. In Gaza, improved access to ATMs and the use of mobile banking enabled banks to continue serving clients during the 2014 conflict.

Financial inclusion is, of course, only one element of the growth equation, and the IMF’s technical advice has covered a range of economic policy issues. However, more targeted IMF technical assistance helped the PMA establish a credit registry and strengthen risk-based supervision. Credit registries, which monitor loans above a certain threshold and are usually managed by central banks or bank supervision agencies, are used by policymakers, regulators, and other officials in macroprudential regulation and oversight. As a result, credit to the private sector has grown by double digits since 2009.

Despite these successes, policymakers in the West Bank and Gaza recognize there is a long way to go to ensure that financial inclusion supports broad-based economic progress, for example by expanding banking services to the large informal sector. With this goal in mind, the PMA launched its first Financial Inclusion Strategy in 2015—and the Fund will continue to help.

Fiscal Policy and Long-Term Growth

A major IMF policy paper on “Fiscal Policy and Long-Term Growth,” discussed by the Executive Board in June 2015, highlighted the role that fiscal policies can play in lifting potential growth. The study, released at a time of disappointing global growth, finds that fiscal reforms, especially when complemented by supportive changes in other economic policies, can help achieve strong and equitable growth. IMF Fiscal Affairs Department Director Vitor Gaspar presented the paper at the Peterson Institute for International Economics on June 30.

The paper draws on the existing literature and the Fund’s extensive technical assistance on fiscal reforms, as well as several analytical studies. They include case studies of successful fiscal reform across advanced, emerging market economies, and low-income countries; a statistical analysis of growth accelerations following fiscal reforms; and simulations of an endogenous growth model. The paper includes a supplement on case studies.

The paper determines that fiscal policy promotes growth through macro and structural tax and expenditure policies. At the macro level, it plays an important role in ensuring macroeconomic stability, which is a prerequisite for achieving and maintaining economic growth. At the micro level, through well-designed tax and spending policies, it can boost employment, investment, and productivity. Findings include:

- Lowering the tax wedge and improving the design of labor taxes and social benefits can strengthen work incentives and induce a positive labor supply response.

- More equitable access to education and health care contributes to human capital accumulation, a key factor for growth.

- Reforming capital income taxes reduces distortions and encourages private investment; well-targeted tax incentives can stimulate private investment and enhance productivity through research and development.

- Efficient public investment, especially in infrastructure, can raise an economy’s productive capacity.

- If growth-friendly reforms require fiscal space, revenue measures should focus on broadening the tax base and minimizing distortions, and expenditure measures should aim at rationalizing spending and improving efficiency.

Managing Capital Outflows—Further Operational Considerations

In 2013 IMF management issued a “Guidance Note for the Liberalization and Management of Capital Flows,” which provides operational guidance to staff on appropriate policies with respect to the liberalization of capital flows and the management of disruptive capital inflows and outflows.

In December 2015, management issued a note elaborating on the original guidance and laying out possible configurations of capital flow policies. The note, titled “Managing Capital Outflows—Further Operational Considerations,” elaborates on the guidance to staff regarding the appropriate macroeconomic and financial policy response to capital outflows in noncrisistype circumstances, based on the IMF’s institutional view on the liberalization and management of capital flows approved by the Board in 2012 and the 2013 Guidance Note. The 2015 note was considered particularly topical because capital outflows have become a more relevant policy challenge for member countries. It was issued to the Executive Board on a for-information basis.

External Balance Assessment Methodology

The IMF took important steps to enhance its external sector assessments in 2012 with the launch of the External Balance Assessment (EBA) methodology and the External Sector Report. The EBA methodology assesses current accounts and exchange rates of the external positions and policies of 49 economies plus the euro area. The External Sector Report discusses the staff assessments of the external positions of 29 systemically important economies, in tandem with bilateral surveillance, in a multilaterally consistent manner. The 2014 Triennial Surveillance Review (TSR) called for the application of the EBA’s innovations to a broader set of countries.

The Managing Director’s Action Plan in response to the TSR proposed the development of “EBA-lite” to meet that goal. In fall 2014, the launch of the EBA-lite methodology for current account assessments provided the first extension of the EBA to non-EBA countries. In summer 2015, the real exchange rate index model and the external sustainability approach were added to the framework.

A note issued in February 2016 to the Executive Board for information serves as a reference for the EBA-lite methodology. The note provides:

- Motivations for developing EBA-lite and guidance for its use

- Technical explanations of three EBA-lite approaches

- Suggestions on how to articulate staff assessments of the external sector informed by model results.

Structural Reforms and Macroeconomic Performance

The 2014 Triennial Surveillance Review (TSR) called for further work to enhance the Fund’s ability to selectively provide more expert analysis and advice on structural issues, particularly where there is broad interest among member countries.

In response, a staff report on “Structural Reforms and Macroeconomic Performance: Initial Considerations for the Fund” was published in November 2015 after presentation to the Executive Board during an informal session in October. The paper was intended to engage the Board on staff ’s post- TSR work toward strengthening the Fund’s capacity to analyze and, where relevant, offer policy advice on topical structural issues. The paper was accompanied by a policy paper on country cases relevant to the analysis of structural policies.

Structural policies have become a prominent feature of the current macroeconomic policy discussion. For many countries, lackluster economic growth and high unemployment have clouded the economic outlook. With fewer traditional policy options, policymakers are increasingly focused on the complementary role of structural policies in promoting more durable, job-rich growth. In particular, the G20 has emphasized the essential role of structural reforms in ensuring strong, sustainable, and balanced growth.

An extensive range of work on structural policies is underway across the IMF. For example, the Spring 2016 World Economic Outlook contained a chapter on the “Macroeconomic Effects of Labor and Product Market Reforms in Advanced Economies.” The paper presented considerations to help frame a more strategic approach on structural issues that would better support the range of macro-structural needs of member countries. While the paper does not signal a dramatic shift in the Fund’s agenda or coverage of structural issues, it highlights the need to account for overall business cycle conditions and available macroeconomic policy space when determining structural reform priorities—two issues that were also highlighted in the staff note for the G20 on “A Guiding Framework for Structural Reforms,” which built largely on the chapter’s key findings. Indeed, the main finding from the chapter is that while reforms pay off over the medium term, their short-term impact varies across different types of reforms and, in some cases (labor market reforms), depends on the cyclical position of the economy and the stance of macroeconomic policies.

Another paper covering the broad membership finds that structural reforms matter for growth and that their benefits tend to increase when they are bundled together. It also determines that the potential productivity payoff from different types of reforms varies across income groups—structural reforms that are typically more effective for a low-income country might not have the same impact in a country that is further along the development curve.

Building on these recent efforts, the IMF plans to continue to develop a richer analytical foundation and range of diagnostic tools that country teams can leverage in their analysis and dialogue with member countries. This in turn will help to leverage and share policy experiences across different countries. As the work develops, the expectation is that the Fund will:

- Be equipped to recognize all structural issues that are critical to the macroeconomic health of IMF member countries and highlight the macroeconomic implications and interplay with other policies in country consultations

- Limit its policy advice to areas where staff has the necessary expertise, but explore the possibility of building expertise in select areas of high impact and high demand, such as infrastructure and labor market issues

- Strengthen collaboration with other agencies on structural reforms that are outside the IMF’s core areas of expertise

Engagement with Postconflict and Fragile States

A core element of the Fund’s work with low-income developing countries is the interaction with countries in postconflict and fragile situations. Work with these countries was also an important element of IMF commitments to the international community at the July 2016 Financing for Development conference in Addis Ababa.

In May 2015 the Executive Board discussed, at an informal session, a paper titled “IMF Engagement with Countries in Post-Conflict and Fragile Situations—Stocktaking.” It examines the experience implementing lessons drawn in a 2011 Board paper and an ensuing 2012 Guidance Note, and discusses how the IMF can strengthen its engagement with fragile states. The recommendations focus on three areas:

- Capacity building: Fragile state governments expressed a preference for capacity building adapted to their absorptive capacity, with a stronger focus on training and support through resident advisors. The paper proposes a new pilot approach that would provide support through a framework of goals for institution building, identify immediate and planned technical assistance and training from the Fund and other development partners, and allow for fine-tuning of support.

- Fund facilities and program design: Use of the Rapid Credit Facility (RCF) by fragile states has increased, substituting in some cases for the use of staff-monitored programs. Fragile states’ authorities highlighted inadequate levels of IMF financing as the key shortcoming of the Fund’s existing facilities, with access under the RCF particularly low. The paper noted ongoing work on options to increase IMF financial resources to fragile states and tilt the Fund’s concessional resources towards the poorest and most vulnerable members—including through commitments at the Financing for Development conference—subject to maintaining the self-sustaining nature of the Poverty Reduction and Growth Trust. The paper noted that more substantive changes in facilities will be considered in the next facilities review. It also proposed steps to protect priority social spending in Fund-supported programs through targeted spending floors and adoption of contingency plans to protect such spending against fiscal shocks. The Fund increased resources available to the poorest and most vulnerable members in July 2015.

- Policy support: Fragile state governments view the Fund’s policy support as high quality, but would like to see Fund teams bring greater peer experience to assist in developing alternative policy solutions. The paper calls for staff training on political economy issues to be continued and knowledge sharing on fragile states fostered.

Income Inequality and Labor Market Share

As part of the IMF’s interaction with the G20 countries, staff regularly prepare research papers on issues of concern to the G20 authorities, often in collaboration with other international institutions.

In August 2015 IMF staff, working with the International Labour Organization, the Organisation for Economic Co-operation and Development, and the World Bank, prepared a paper on “Income Inequality and Labor Income Share in G-20 Countries—Trends, Impacts and Causes.” The paper was presented to the IMF Executive Board on a for-information basis.

Turkey, which held the G20 presidency during 2015, had made inclusiveness one of three policy priorities during its presidency. The G20 “Sherpas”—representatives of heads of state or government at an international summit—and the G20 Employment Working Group asked the organizations to prepare the paper, which addressed the consequences of rising inequality and falling labor income shares.

Making Public Investment More Efficient

Public investment supports the delivery of public services and provides economic opportunities through the construction of schools, hospitals, ports, power generation facilities, and other projects. By providing social and economic infrastructure, public investment can serve as a catalyst for growth.

IMF staff in June 2015 presented to an informal meeting of the Executive Board a paper on “Making Public Investment More Efficient.” The paper highlights the importance of efficiency in public spending. A comparison of the value of public capital and measures of infrastructure coverage and quality across countries revealed average inefficiencies in public investment processes of about 30 percent. The economic dividends from closing this efficiency gap are substantial: the most efficient public investors get twice the output “bang” for their public investment “buck” than the least efficient.

To help countries evaluate the strength of their public investment management practices and identify areas for reform, the IMF developed the Public Investment Management Assessment (PIMA), a tool that was introduced in July 2015 in the context of the UN Financing for Development Conference in Addis Ababa. The PIMA evaluates institutions that shape public investment decision-making at three key stages:

- Planning sustainable investment across the public sector

- Allocating investment to the right sectors and projects

- Implementing projects on time and on budget

The PIMA covers the full public investment cycle, including national sectoral planning, investment budgeting, project appraisal and selection, and managing and monitoring of project implementation. It is relevant to countries at all levels of development by reflecting advanced practices in the areas of fiscal rules, oversight of public-private partnerships (PPPs), and monitoring of public assets. Finally, PIMA offers an accessible summary of strengths and weaknesses through charts showing how a country’s assessments compare with those of its peers.

As part of the IMF’s role in helping countries to become more efficient public investors, it plans to develop the PIMA into a comprehensive assessment of public investment management practices. Through the PIMA process, reform priorities will be identified and capacity-building strategies developed in collaboration with other institutions, particularly the World Bank.

As a way to complement its fiscal assessment tools, in April 2016, the Fund, in collaboration with the World Bank, launched a new analytical tool, the PPP Fiscal Risk Assessment Model, to assess the potential fiscal costs and risks arising from PPP projects. Without rigorous affordability checks, governments may end up procuring projects that either cannot be funded within their budgetary envelope or that expose public finances to excessive fiscal risks. To address these concerns, the model was developed to quantify the macro-fiscal implications of PPP projects, for use not only in the context of IMF and World Bank technical assistance, but also by PPP units in ministries of finance.

Monetary Policy and Financial Stability

The issue of using monetary policy for financial stability purposes is contentious. The global financial crisis served as a reminder that price stability is not sufficient for financial stability, that financial crises are costly, and that monetary policy should aim to reduce the likelihood of crises and not rely only on dealing with their repercussions once they occur.

The IMF Executive Board, meeting in an informal session, discussed a staff paper on “Monetary Policy and Financial Stability” in September 2015. The paper sought to bring clarity to some of the issues that have arisen surrounding the topic.

Many of the same issues are addressed over time in the flagship Global Financial Stability Report, which is issued twice a year in April and October, with updates to the Executive Board in January and July. Monetary policy and financial stability are also central to other Fund surveillance. In addition, a high-level seminar on monetary policy frameworks and financial stability was held during the 2015 Annual Meetings in Lima, Peru.

While the staff paper does not seek to provide final answers, it is designed to help policymakers assess the value and implications of using monetary policy to support financial stability. It provides a framework to conceptualize and clarify the channels of transmission and policy tradeoffs, gives initial policy guidance based on the most recent empirical findings, and emphasizes the gaps that need to be filled before more definitive policy advice can be formulated.

Among its conclusions, the paper states that monetary policy in principle should deviate from its traditional response only if costs are smaller than benefits. Costs arise in the short term from lower output and inflation, the paper explains. Benefits materialize mainly in the medium term, as financial risks are mitigated, though effects are more uncertain. Based on current knowledge, the case for “leaning against the wind” is limited, as in most circumstances costs outweigh benefits.

However, the current understanding of the channels through which monetary policy affects financial stability domestically, across borders, and over the business cycle is rapidly evolving.

Data

Ninth Review of the Data Standards Initiatives

In May 2015, the Executive Board discussed the Ninth Review of the IMF’s Data Standards Initiatives. The review found that the Special Data Dissemination Standard (SDDS) is at a mature stage, with no changes needed; its focus is on increasing the number of its subscribers. The SDDS Plus was launched with adherence of the first nine countries in February 2014.

The review also found that the General Data Dissemination System (GDDS) has remained largely unchanged since its establishment in 1997 and that a lack of incentives to disseminate data inhibits statistical development. The review proposed addressing this issue by enhancing the GDDS (e-GDDS) to refocus the framework on the publication of data essential for surveillance by the IMF and markets, while leveraging the Article IV consultation dialogue to direct the authorities’ attention on progress toward subscription to the SDDS.

Executive Directors broadly shared the staff assessment and approved the proposal to replace the GDDS with the e-GDDS in order to support transparency, encourage statistical development, and help create strong synergies between data dissemination and surveillance.

ENHANCED GENERAL DATA DISSEMINATION SYSTEM

During the year, Botswana, Lesotho, and Nigeria became the first IMF member countries to implement the recommendations of the e-GDDS, which replaced the GDDS in May 2015. The three countries hosted an e-GDDS mission and subsequently published a National Summary Data Page (NSDP). The NSDP, which is supported by the Open Data Platform, serves as a one-stop publication vehicle for key macroeconomic data.

SPECIAL DATA DISSEMINATION SYSTEM

China and Sri Lanka subscribed to the SDDS in 2015, bringing the total number of countries graduating from the GDDS (now the e-GDDS) to 15. Subscription to the SDDS enhances the availability of timely statistics, thereby contributing to sound macroeconomic policies and the more efficient functioning of financial markets.

DATA GAPS INITIATIVE

Given the significant progress made to address data gaps revealed by the global financial crisis, the G20 Finance Ministers and the Central Bank Governors in September 2015 endorsed the second phase of the Data Gap Initiative (DGI-2), which focuses on data that support financial sector risk analysis and the interlinkages across the economic and financial system. In September 2016, the first progress report on the second phase, including the finalized five-year action plans for DGI-2 implementation, will be presented to the G20 Finance Ministers and the Central Bank Governors.

STATISTICS FOR GLOBAL ECONOMIC AND FINANCIAL STABILITY

The Statistics Department disseminates to the general public internationally comparable data on its member countries’ financial sectors, helping to monitor financial stability at a national and global level. Monetary statistics constitute the main tool for analyzing monetary developments and formulating monetary policy. The challenge now is to substantially expand the coverage of nonbank financial institutions, beyond the 43 countries currently reporting these data. Financial soundness indicators, which reflect the health of a country’s financial sector and its clients, for 108 countries are posted on the IMF’s external website, with plans to steadily increase their number.