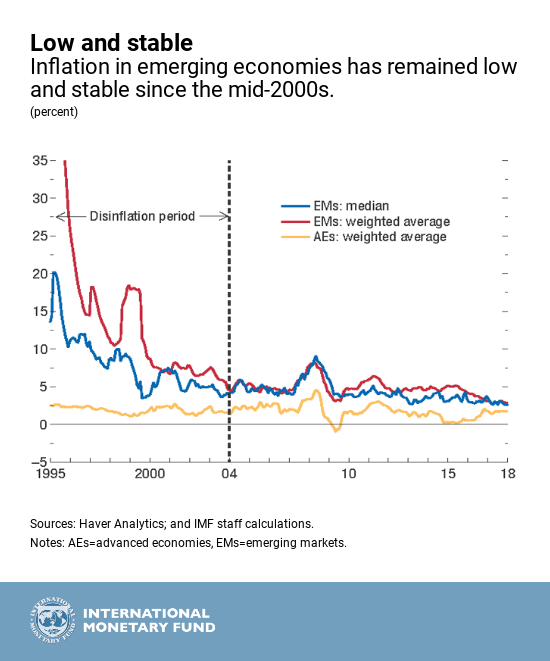

Since the mid-2000s, inflation in emerging market economies has been remarkably low and stable, in sharp contrast to the 1990s. But rising interest rates in advanced economies like the United States have triggered currency depreciations in emerging market economies over the past few months—quite sharp in some cases—and are testing their ability to fend off inflationary pressures.

In Chapter 3 of the October 2018 World Economic Outlook, we analyze the recent improvements in inflation performance in emerging economies and show that these gains can be maintained if central banks’ commitment to low inflation is credible and expectations of future inflation remain under control.

Expectations of future inflation are key

Our study looks at 19 emerging market economies from 2004 to 2018 and finds that inflation remained low and stable despite sharp swings in commodity prices, periods of sustained U.S. dollar appreciation, and the global financial crisis. However, this recent inflation performance is not uniform, as some countries continue to struggle to keep inflation under control.

The main driver of inflation in emerging market economies during the past decade and a half is changes in longer-term inflation expectations. We find that longer-term inflation expectations were particularly important in exerting inflationary pressure in countries where inflation has remained above the target. Other commonly explored drivers of inflation—such as excess capacity in economic activity and external price pressures—also matter but played less of a role.

Inflation in emerging market economies has been remarkably low and stable since the mid-2000s.

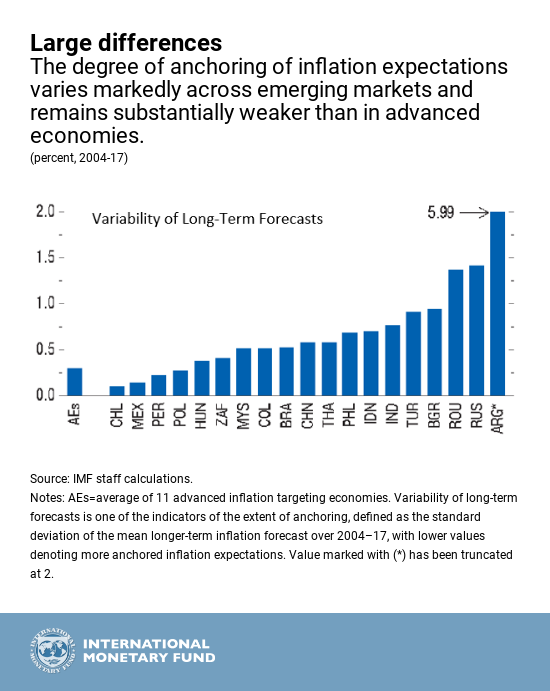

Motivated by these findings, our analysis explores how the extent of anchoring of inflation expectations in emerging markets—a proxy for the credibility of their monetary policy—has evolved over time and differs across countries. The concept of anchoring of expectations is measured using several indicators, such as the impact of inflation surprises on expectations and the extent of agreement among experts about future inflation. The data shows that longer-term inflation expectations have become increasingly anchored in emerging economies over the past two decades. At the same time, there are sizable differences across emerging economies and relative to advanced economies. The extent of anchoring in, for example, Chile and Poland is comparable to the average of advanced economies, but expectations are much less anchored in Russia and Argentina.

Building greater resilience to external shocks

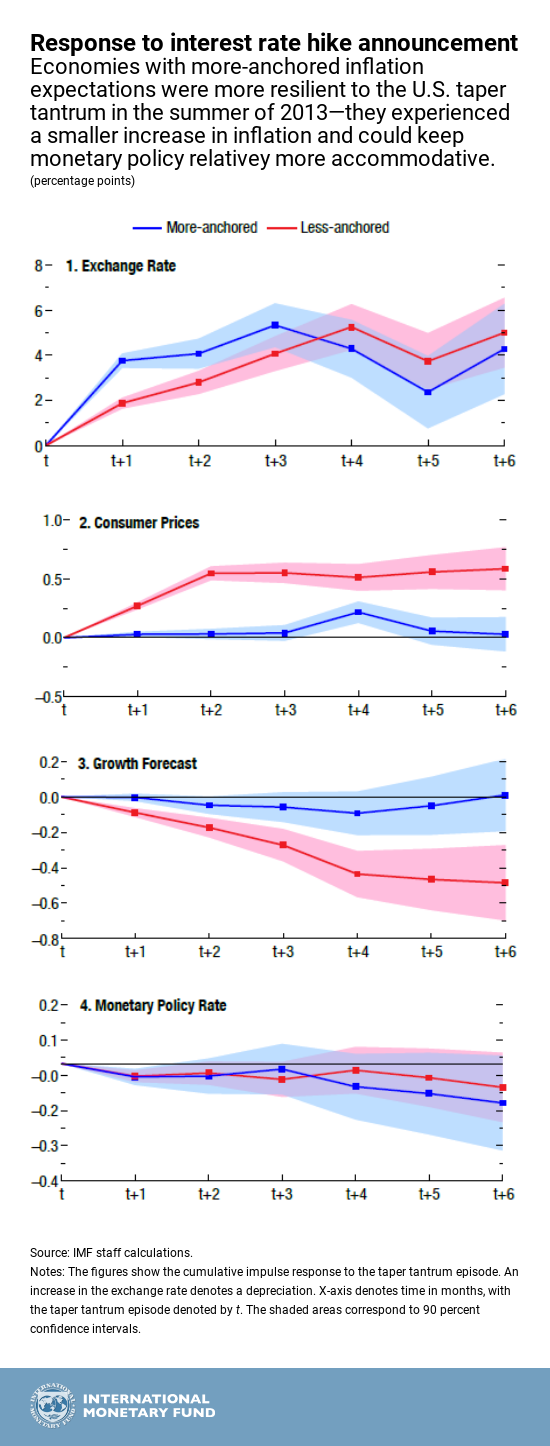

External shocks that depress economic activity while also triggering temporary increases in inflation pose a dilemma for policymakers in emerging economies. But we find that this dilemma is less pronounced when inflation expectations are well anchored.

A good example of that kind of shock is what happened during the taper tantrum in 2013—when the United States suddenly announced it was thinking of beginning to increase interest rates.

During the taper tantrum, countries with more-anchored inflation expectations saw larger short-term exchange rate depreciations than those with less-anchored expectations. Interestingly, however, sharper depreciations in the former group did not translate into higher (imported) domestic inflation. As the impact of the exchange rate on inflation was substantially larger in less-anchored countries, which also faced worse output prospects, central banks in less-anchored countries could not afford to pursue looser monetary policies.

These findings have implications for the period of monetary normalization in advanced economies. A temporary increase in inflation rates in emerging economies is to be expected if global financial conditions tighten and emerging market currencies depreciate. But, if expectations are well anchored, price stability would not be jeopardized.

Improving fiscal and monetary policy frameworks

How can central banks improve the extent of anchoring of inflation expectations? Our analysis as well as the evidence in the literature indicate that the soundness of both monetary and fiscal policy frameworks is key for well-anchored inflation expectations. Policymakers should therefore keep improving the long-term sustainability of public finances, including by adopting rules that limit the scope for policies that threaten debt sustainability and building fiscal buffers in good times that can then be relied on during bad times. Equally important is their commitment to improving the credibility of central banks, by consolidating and enhancing their independence, as well as through improvements in timeliness, clarity, transparency, and openness in their communications.

Anchoring inflation expectations takes time, so continuous effort is needed even in countries that have already made significant progress. In countries where the credibility of monetary frameworks is relatively low, the emphasis should be on ensuring that fiscal sustainability is not a threat for their monetary objectives and on communicating clearly the reasons for their monetary policy actions, including those taken in response to global developments.