Lending

- Nonconcessional Financing Activity

- Concessional Financing Activity

- Program Design

- Policy Support Instruments

IMF loans are meant to help member countries tackle balance-of-payments problems, stabilize their economies, and restore sustainable economic growth. This crisis resolution role is at the core of IMF lending. At the same time, the recent global financial crisis has highlighted the need for effective global financial safety nets to help countries cope with adverse shocks. A key objective of recent lending reforms has therefore been to complement the traditional crisis resolution role of the IMF with additional tools for crisis prevention. Unlike development banks, the IMF does not lend for specific projects.

In broad terms, the IMF has two types of lending — money provided at nonconcessional interest rates and loans provided to poorer countries on concessional terms, where interest rates are low or in some cases zero.

Nonconsessional Financial Activity

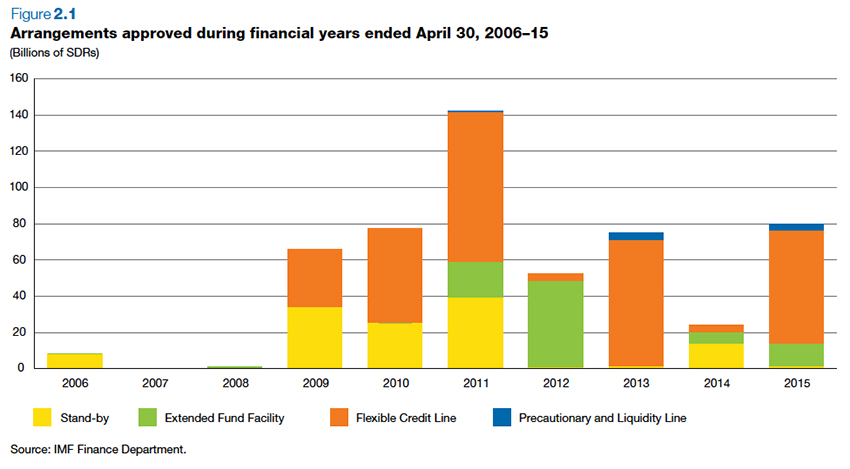

In FY2015, the Executive Board approved nine arrangements under the IMF’s nonconcessional financing facilities, for a gross total of SDR 80 billion ($112 billion not netted for canceled arrangements, and converted to United States dollars at the SDR/$ exchange rate on April 30, 2015 of 0.71103 (see Table 2.1). Six precautionary arrangements under the Flexible Credit Line (FCL) and Precautionary and Liquidity Line (PLL) accounted for more than 84 percent of these commitments, including an FCL with access amounting to SDR 47 billion ($67 billion) for Mexico. The two FCL arrangements approved for Mexico and Poland and the PLL arrangement approved for Morocco were successors to previous arrangements that were expiring. The remaining three precautionary arrangements were Stand-By Arrangements with Honduras, Kenya, and the Republic of Serbia totaling SDR 1.4 billion ($1.9 billion), which were treated as precautionary by the authorities upon approval of the programs. In addition, the Board approved an extended arrangement under the EFF for Ukraine with exceptional access amounting to SDR 12.348 billion or $17.5 billion to support the authorities’ adjustment program.

Fighting Fires: Why the IMF Lends:

Also in:عربي

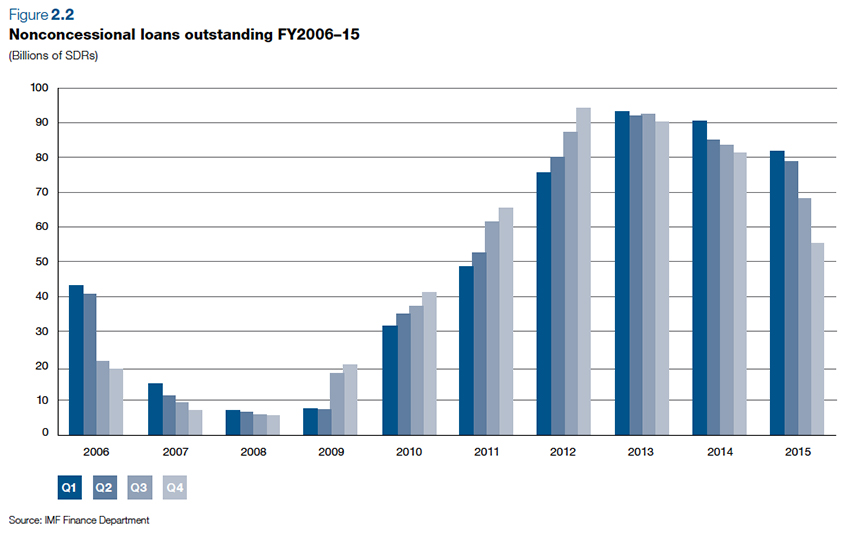

日本語

By end-April 2015, disbursements under financing arrangements from the General Resources Account (GRA), referred to as “purchases,” totaled SDR 12.0 billion ($16.9 billion), with purchases by Ukraine amounting to SDR 6.5 billion ($9.2 billion) or 54 percent. Total repayments, termed “repurchases,” for the financial year amounted to SDR 38.0 billion ($53.4 billion). Of these, advance repurchases from Ireland and Portugal during the period amounted to SDR 20.8 billion ($29 billion). Sizable repurchases and stalled purchases associated with off-track programs resulted in the stock of GRA credit falling from SDR 81.2 billion ($114.2 billion) to SDR 55.2 billion ($78 billion) in FY2015. Table 2.1 details the arrangements approved during the year, and Figure 2.1 the arrangements approved over the past 10 years. Tables 2.2 and 2.3 provide general information about the IMF’s financing instruments and facilities, with Figure 2.2 offering information on nonconcessional financing amounts outstanding over the past 10 years.

Consessional Financial Activity

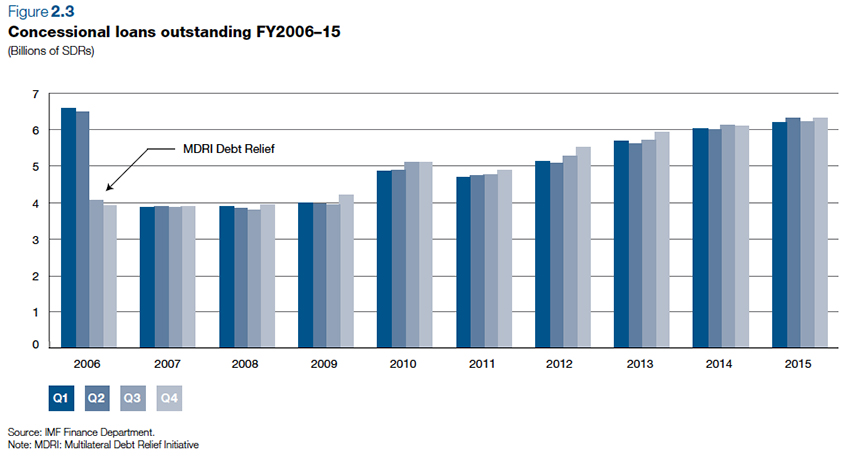

In FY2015, the IMF committed loans amounting to SDR 1.8 billion to its low-income developing member countries under programs supported by the Poverty Reduction and Growth Trust (PRGT). Total concessional loans outstanding of 58 members amounted to SDR 6.3 billion at end-April 2015. Table 2.4 provides detailed information on new arrangements and augmentations of access under the IMF’s concessional financing facilities, and Table 2.5 on IMF support to Ebola-afflicted countries. Figure 2.3 illustrates amounts outstanding on concessional loans over the past decade.

The IMF provided grants to be used as debt relief to eligible countries through the newly created Catastrophe Containment and Relief Trust (CCRT), transforming the Post-Catastrophe Debt Relief (PCDR) Trust. The CCRT, established in February 2015, expanded the circumstances under which the IMF can provide exceptional assistance to its low-income members to include public health disasters that could spread rapidly across borders. The CCRT provides exceptional support to countries confronting major natural disasters, including lifethreatening, fast-spreading epidemics with the potential to spread to other countries, but also other types of catastrophic disasters such as massive earthquakes. As of end-April 2015, the IMF had provided grants under this Trust to cover debt relief of SDR 68 million to the three countries worst hit by the Ebola epidemic (Guinea, SDR 21.42 million; Liberia, SDR 25.84 million; and Sierra Leone, SDR 20.74 million).

Apart from CCRT relief, the IMF had also provided a total of SDR 5.2 billion of debt relief to eligible countries as of end-April 2015. This includes assistance under the Heavily Indebted Poor Countries (HIPC) Initiative of SDR 2.6 billion to 36 countries, debt relief under the Multilateral Debt Relief Initiative (MDRI) of SDR 2.3 billion to 30 countries, “beyond HIPC” debt relief to Liberia, and debt relief under the PCDR Trust to Haiti. All countries that reached the completion point under the enhanced HIPC Initiative, and those with per capita incomes below $380 and outstanding debt to the IMF at end-2004, also received debt relief under the MDRI. Afghanistan, Comoros, Haiti, and Togo did not have MDRI-eligible debt with the IMF, while Chad, Côte d’Ivoire, and Guinea had fully repaid MDRI-eligible debt to the IMF by the completion point date. These countries, therefore, did not receive debt relief under the MDRI from the IMF.

- Box 2.3 Supporting Tunisia’s revival

-

After Tunisia’s January 2011 revolution and a period in which growth declined sharply, the country’s economy embarked on a moderate recovery despite a difficult political transition and an uncertain international economic environment.

Throughout the political transition to new elections, the country made progress on reforms needed to achieve short-term macroeconomic stabilization and address the challenges of widespread social and economic disparities and a fragile banking sector. The successful end of the political transition and the installation of a post-transition government with broad support in parliament provide an opportunity to push further ahead with reforms needed to address these challenges. Key elements of the government’s program are to:

Build up fiscal and external buffers with appropriate fiscal, monetary, and exchange rate policies.

Support growth by addressing critical vulnerabilities in the banking sector and improving the investment climate through reforms of the tax and investment regimes.

Strengthen social safety nets to protect the vulnerable. The authorities also reduced regressive energy subsidies, creating room to increase social and investment spending. This included increased social transfers to vulnerable households and the introduction of a social electricity tariff that protects poorer households.

In support of the reform agenda, in June 2013 the Executive Board approved a 24-month Stand-By Arrangement (SBA) amounting to about $1.75 billion. In December 2014, the Board completed the fifth review under the SBA, bringing total disbursements to $1.15 billion, and in May 2015, approved a seven-month extension of the SBA to December 31, 2015.

The IMF also supports Tunisia by providing technical assistance for tax policy and revenue administration, improving public financial management, strengthening the central bank’s supervision capacity and collateral framework, and improving the production of monetary statistics.

Program Design

More Flexible Public Debt Limits

The Board began discussing reform of the IMF’s policy on the use of conditionality on public external debt in Fund-supported programs—also known as the “debt limits policy”—in March 2013. The discussion took place against a backdrop of lower-income countries seeking to boost growth through higher public investment levels, targeted in particular at large infrastructure gaps, while facing both a wider range of financing opportunities and limits on the supply of traditional concessional financing.

The reform of the IMF’s policy on debt conditionality in 2009 was a first step to accommodate these new realities. But experience with the 2009 reforms pointed to the need for more fundamental reforms to provide countries with greater flexibility to finance productive investments while containing risks to medium-term debt sustainability.

In December 2014, the Executive Board endorsed the new Policy on Public Debt Limits in Fund-Supported Programs. In a press release, the Executive Board agreed that the new debt limits policy should take effect at end-June 2015.

The paper discussed at the Board sought to accommodate a number of concerns emphasized by Executive Directors and other stakeholders, including: (1) ensuring evenhandedness across the membership in the application of the policy, consistent with the principle of uniformity of treatment; (2) ensuring that the coverage of debt limits is unified and comprehensive, covering both concessional and nonconcessional borrowing; and (3) ensuring that there are incentives for creditors to provide, and borrowers to seek, financing on concessional terms.

Executive Directors welcomed the opportunity to revisit debt conditionality in Fund-supported programs. They emphasized that reforms to the policy should balance debt sustainability and borrowing requirements for investment and growth. They agreed that the coverage of debt limits should be unified and comprehensive, covering both concessional and nonconcessional debt, and supported the principle that debt conditionality should cover all public debt. They also agreed that there should be incentives for creditors to provide, and for borrowers to seek, financing on concessional terms.

Directors agreed that the use of debt conditionality in Fund-supported programs is warranted when a member faces significant debt vulnerabilities, and that debt sustainability analysis should continue to play the key role in identifying debt vulnerabilities. Directors emphasized that the broad principles that will guide the new debt limits policy should be applied in a transparent and evenhanded manner, and that the particular form of debt conditionality adopted should reflect country-specific circumstances and program goals.

- Box 2.4 Zero-interest-rate policy for low-income countries

-

In December 2014 the Executive Board approved the third extension of the exceptional waiver on interest payments for IMF concessional loans through the end of 2016.

The Executive Board initially endorsed temporary relief of interest payments on all outstanding concessional loans to Poverty Reduction and Growth Trust (PRGT)-eligible members in 2009, waiving all interest payments on PRGT loans through December 2011. Three subsequent extensions of the exceptional interest rate waiver were approved by the Board, first to end-December 2012, then to end-2014, and the latest to end-2016.

The PRGT has three facilities: the Extended Credit Facility to provide flexible medium-term support, the Stand-By Credit Facility to address short-term and precautionary needs, and the Rapid Credit Facility to provide emergency support.

Policy Support Instruments

Policy Support Instruments (PSIs) offer low-income countries that do not want—or need—IMF financial assistance a flexible tool that enables them to secure Fund advice and support without a borrowing arrangement. This nonfinancial instrument is a valuable complement to the IMF’s lending facilities under the PRGT. PSIs help countries design effective economic programs that deliver clear signals to donors, creditors, and the general public on the strength of a member’s policies.

In July 2014, the Executive Board approved a new threeyear PSI for Tanzania. The IMF had previously concluded the final review of the country’s economic performance under a Stand-By Credit Facility arrangement and under a previous PSI, together with the Article IV consultation with the country in April. The PSI for Tanzania aims to support the authorities’ medium-term objectives, which include maintaining macroeconomic stability, preserving debt sustainability, and promoting more equitable growth and job creation.

As of April 2015, the Executive Board had approved 17 PSIs for seven members: Cabo Verde, Mozambique, Nigeria, Rwanda, Senegal, Tanzania, and Uganda.