Capacity Development

The IMF shares its expertise with officials in member countries and provides training to them—what it calls “capacity development”—to help countries build strong institutions and boost skills to formulate and implement sound macroeconomic and financial policies. Capacity development is closely linked to the IMF’s surveillance and lending activities and highly appreciated by member countries.

Technical assistance and training activities have expanded rapidly to meet member countries’ extensive demands.

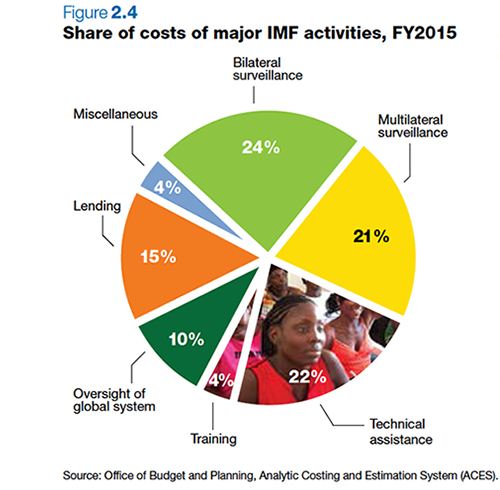

Capacity development represented about a quarter of the IMF’s administrative expenditures in FY2015.

Partners for Progress

Most of this spending was on technical assistance, which represents 22 percent, while training accounts for 4 percent (see Figure 2.4).

Following an informal meeting of the IMF’s Executive Board in April 2014, a new statement on IMF Policies and Practices on Capacity Development was approved by the Board in September 2014. The statement superseded the 2001 Policy Statement on IMF Technical Assistance, while incorporating the principles outlined in the 2013 capacity development strategy paper also approved by the Executive Board.

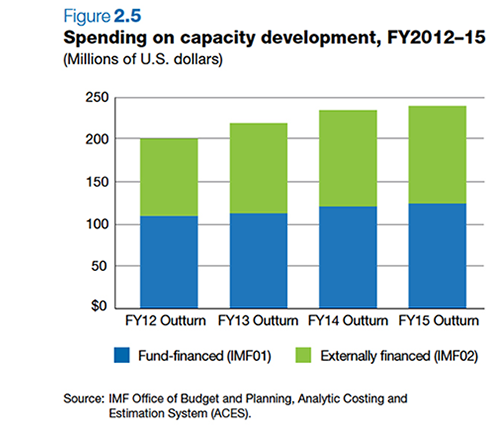

The strong growth in IMF capacity development activities supported by donor funding since 2009 tapered off in FY2015, mainly reflecting institutional and resource constraints. Total direct spending on capacity development activities (externally and IMF-financed) was $242 million in FY2015, compared with $237 million in FY2014, a growth of 2 percent (Figure 2.5). Growth of externally funded capacity development slowed to 1.7 percent in FY2015 from 7.2 percent in FY2014 and 17.4 percent in FY2013.

Technical Assistance

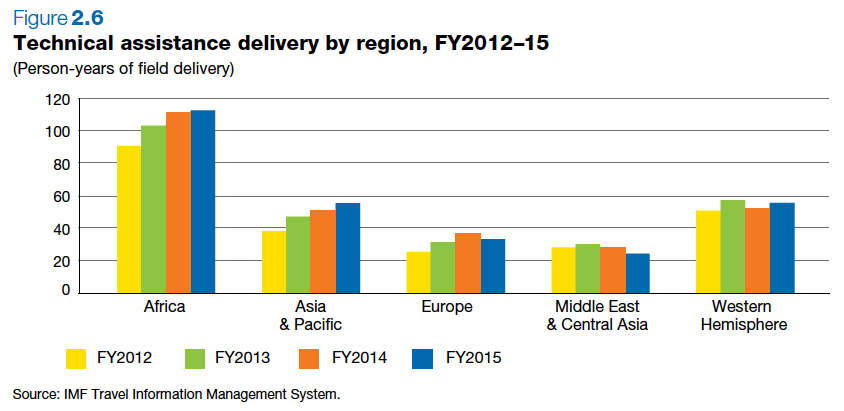

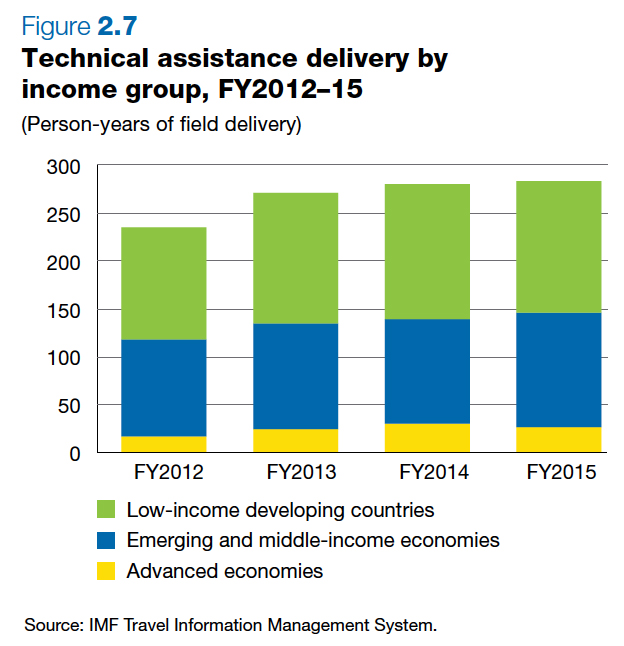

Technical assistance delivery increased in FY2015, mainly in the sub-Saharan African, Asia-Pacific, and Western Hemisphere regions (Figure 2.6). About half of all IMF technical assistance continued to go to low-income developing countries (Figure 2.7).

In FY2015, sub-Saharan Africa accounted for the largest share of technical assistance, reflecting the high number of low-income developing countries in this region.

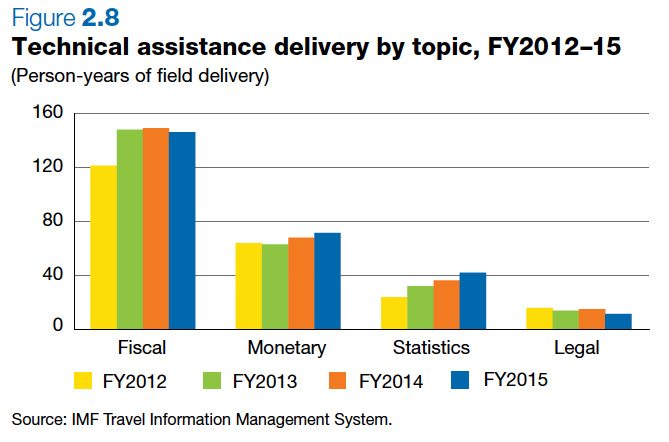

Delivery of technical assistance on monetary and financial topics and on statistical topics has been increasing recently, in response to demand from the membership (Figure 2.8). Fiscal topics continued to be the main area of technical assistance provided by the IMF. The IMF has also been developing a suite of fiscal assessment tools to strengthen the analytical basis for fiscal surveillance, guide structural fiscal reforms, and set priorities for technical assistance. Seven main fiscal assessment tools are currently operational or undergoing testing (see Box 2.5).

Highlights of fiscal capacity building

Peru Plans for a Bigger Public Purse

The IMF continued to respond swiftly to meet both longer-term capacity development and more urgent technical assistance needs in a broad set of countries. In Ukraine, the IMF has in place a broad-based technical assistance program that has supported, among other projects, reforms aimed at strengthening the authorities’ long-term capacity to formulate and implement sound macroeconomic and financial sector policies, as well as reforms of the pension system and energy subsidies, developing a framework for managing state-owned enterprises, reviewing public financial management systems, and evaluating tax policy issues, including taxation of highwealth individuals, establishing an institutional framework to prevent corruption, social security contributions, agricultural and international taxation, and subnational taxation powers. In Egypt and Tunisia, the IMF provided support for public financial management, and tax and revenue administration reforms.

The IMF has been providing advice in resource-rich countries aimed at reducing revenue volatility and broadening the revenue base.

Ghana: Managing Financial Risks

In Angola, the IMF delivered technical assistance on fuel subsidy reform and modernizing revenue administration. In Tanzania, the IMF supported the preparation of a fiscal and budget policy framework for the management of revenues from natural gas production. In Kenya, the IMF assisted in the design and implementation of the new petroleum fiscal regime. Mongolia was one of the first countries to benefit from a new natural resource revenue template that the IMF has developed to enhance transparency of these revenue flows and help mobilize domestic revenue. The template has been endorsed by the Extractive Industries Transparency Initiative, a global standard to promote open and accountable management of natural resources. In Lebanon, the IMF has held various interactive workshops with the authorities on tax policy issues for the country’s nascent gas sector. The IMF also helped introduce a new consumer price index that reflects significantly improved compilation methods, including expanded coverage.

In response to the Ebola outbreak in West Africa, the IMF delivered urgently required technical assistance remotely from headquarters and the African Regional Technical Assistance Centers AFRITAC West 2 Regional Technical Assistance Center (RTAC). This assistance included advice to Liberia on the final phase of implementing a semi-autonomous revenue authority and planning for the introduction of a value-added tax. Remote technical assistance delivery was also provided to Sierra Leone to improve the tax administration’s capacity to assess and collect revenues from the extractive industry, as well as to Guinea to maintain capacity in public financial management and further improve national accounts statistics.

Highlights of monetary and financial sector capacity building

Partnerships for Development: Switzerland and the IMF

In the monetary and financial sector areas, the IMF deepened its engagement as well and launched new technical assistance programs to promote financial stability in low- and middleincome countries. Comprehensive technical assistance programs were implemented bilaterally and regionally to identify and manage financial sector vulnerabilities, strengthen regulatory and supervisory frameworks, support IMF lending programs, and build institutional capacities.

For example, banking supervision technical assistance in Cambodia, Myanmar, Nepal, and the Philippines helped establish the fundamental supervisory and regulatory infrastructure to safeguard financial stability.

Myanmar also received support in monetary operations, foreign exchange market operations, and central bank financial management. Countries in the Caribbean received technical assistance in the area of banking supervision and bank resolution; Barbados, Belize, Jamaica, and Suriname received assistance to improve the functioning of their domestic debt markets, and in central banking. Monetary and financial sector support to fragile and postconflict countries was provided in Democratic Republic of Congo, Somalia, and South Sudan.

In South Sudan, technical assistance aimed at supporting financial and macroeconomic stability through strengthening the Bank of South Sudan’s institutional capacity and frameworks continued to progress despite a break due to security issues in the country. In Somalia, with the support of a new donor trust fund (see section on donor support below), assistance focused on establishing core activities of the central bank and building capacity for financial sector oversight and surveillance. In the Democratic Republic of the Congo, a multiyear program continued to make progress in strengthening financial sector supervision and regulation and implementing the central bank’s modernization program.

Highlights of statistics capacity building

The IMF’s technical assistance in macroeconomic statistics has increased significantly during the past few years (FY2012–15), posting a 76 percent increase. This growth was made possible through strengthened partnerships with donors, enabling the IMF to respond to the rising demand for capacity development compounded by the impact of the global financial crisis.

For example, in the Asia-Pacific region, 15 countries started to compile and disseminate balance-ofpayments and international investment position (IIP) statistics in line with the Balance of Payments and International Investment Position Manual (BPM6), while 11 countries have for the first time submitted balance-of-payments or IIP statistics to the IMF for publication. Furthermore, 11 Asian countries started to report annual government finance statistics to the IMF with nine reporting high frequency data. Six countries began participating in the IMF–World Bank quarterly public sector debt database.

In the area of real sector statistics, notable outcomes include the implementation of the System of National Accounts 2008, the latest version of the international statistical standard for the national accounts, adopted by the United Nations, in Belarus, Bosnia, Macedonia, Moldova, Montenegro, and Serbia; the development of quarterly national accounts in Bosnia, Moldova, and Montenegro; and advances in the quality of price and merchandise trade statistics in some beneficiary countries. Demand for legal technical assistance in both program and nonprogram countries continued in FY2015 in the areas of anti-money laundering and combating the financing of terrorism, financial and fiscal law, insolvency, and judicial reform. On tax law, new fields such as legal underpinnings for tax administration and natural resource taxation expanded in FY2015.

RTACs are instrumental in providing handson and longer-term reform implementation support and guidance to country authorities in a range of fiscal, macroeconomic statistics, and financial sector areas, including public financial management, tax administration, macro-fiscal analysis, national accounts and price statistics, external sector statistics, government finance statistics, banking supervision and regulation, monetary and foreign exchange operations, and debt management.

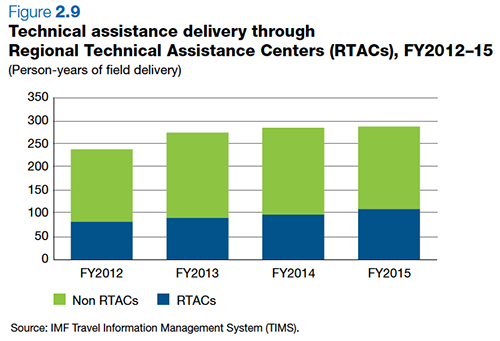

Technical assistance provided by the IMF through RTACs reached a peak of 38.3 percent of the total delivered in FY2015 (Figure 2.9). Currently, nine centers serve countries in Africa, the Caribbean, Central America, the Middle East, and the Pacific.

- Box 2.5 Fiscal assessment tools

-

The IMF’s standardized fiscal assessment tools review the fiscal institutional frameworks that countries have in place and help identify priorities for fiscal reform and technical assistance.

Revenue Administration Fiscal Information Tool (RA-FIT) gathers and analyzes tax and customs information, and establishes baseline indicators relating to administration performance. A first report based on the submissions of 85 countries in the first round of data gathering was prepared in 2014. A second round of data gathering was conducted in 2014 and 2015 via an online data-capture portal. Collaboration with other international organizations is proceeding with the goal of making RA-FIT the standard platform for capture, analysis, and dissemination of revenue administration information.

Revenue Administration Gap Analysis Program (RA-GAP) estimates the gap between current and potential revenue collections. Detailed gap estimates for value-added tax were broadened to eight countries from four countries during FY2015.

Tax Administration Diagnostic Assessment Tool (TADAT) provides a framework for standardized assessments of tax administration performance to help improve prioritization and sequencing of reforms; it is designed and governed in close cooperation with international partners. TADAT is still in the piloting phase, and four additional country pilots were successfully concluded in FY2015. The framework will be tested in about seven more countries before being rolled out for public use in November 2015. An online course is being launched in mid-May 2015 to train prospective TADAT assessors.

Fiscal Transparency Evaluations (FTEs) replace the fiscal module of the Reports on the Observance of Standards and Codes. They offer a four-pillar structure for assessing the quality of published information with a strong focus on identifying and managing fiscal risks. Five new FTEs were published in FY2015, and further FTEs are scheduled for FY2016. The framework is to be finalized in FY2016 with the completion of pillar 4 on resource revenue management and a Fiscal Transparency Manual.

Fiscal Analysis of Resource Industries (FARI) is a modeling framework to perform fiscal analysis of extractive industries (EIs). FARI provides a powerful tool for evaluating, comparing, and designing fiscal regimes for EIs by analyzing how annual project cash flows over the life of an EI project are shared between investors and the government, through detailed modeling of a particular fiscal regime.

Public-Private Partnership Fiscal Risk Assessment Model (P-FRAM) is an analytical tool to assess potential fiscal costs and risks arising from public-private partnerships. It is designed to provide a structured and guided process for gathering relevant data, quantifying the impact on deficit and debt, and performing sensitivity analysis to changes in key macroeconomic and project-specific parameters.

Public Investment Management Assessment (PIMA) is a framework designed to evaluate the strength of public investment management practices in a comprehensive manner. It evaluates institutions shaping decisionmaking at three key stages: planning, allocating, and implementing investment. PIMAs assess institutional strengths and weaknesses, and provide practical recommendations to improve public investment management institutions. The PIMA framework will be piloted in FY2016.

Training

The IMF’s training program is an integral part of the IMF’s capacity development mandate and strives to respond to evolving global macroeconomic developments and policy challenges, membership demands, and technological innovations. Last year, the IMF’s Institute for Capacity Development added new topics of strategic importance for the IMF’s membership, such as debt sustainability and energy subsidy reforms. The courses provide theoretical lectures, analytical tools, and handson workshops. The IMF’s online learning courses, which are free and open to anyone with an Internet connection, continued to grow, with the addition of one course on Energy Subsidy Reform and the translation into French of the Financial Programming and Policies, Part 1 course. Online training grew sharply by 38 percent to 13 percent of total IMF training in FY2015.

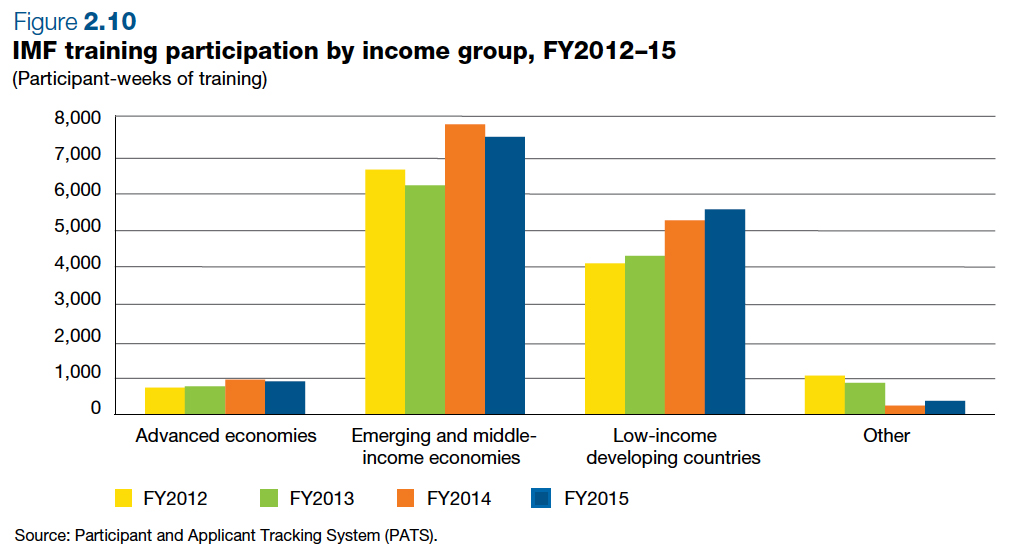

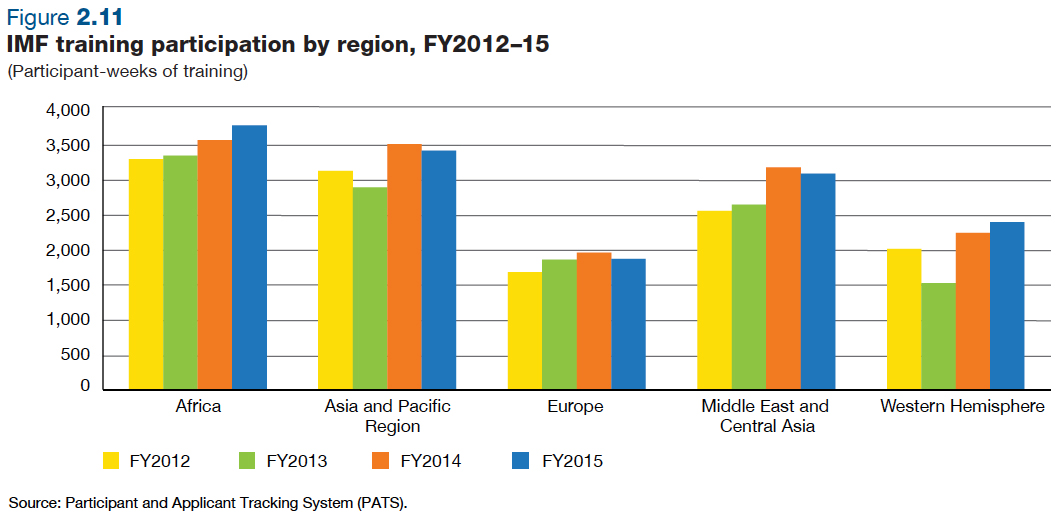

During FY2015, 345 training events were delivered by the IMF to its members, with some 11,315 officials attending them. Emerging market economies received the largest volume of IMF training, at about 53 percent of the total for the year (Figure 2.10). In terms of regional distribution, sub-Saharan Africa, Asia and the Pacific, and the Middle East and Central Asia received the largest volume of IMF training during the year (Figure 2.11).

Donor Support for Capacity Development

Donor support continues to bolster the IMF’s ability to deliver technical assistance and training to member countries. New contributions totaling $145 million were received during FY2015, and activities financed by donors totaled $152 million. The IMF leverages external support for capacity development through several vehicles, including RTACs, Regional Training Centers, Topical Trust Funds, and bilateral partnerships.

Multidonor vehicles have been effective in delivering technical assistance and training to low- and lower-middle-income countries. The network of nine RTACs in the Pacific, the Middle East, Africa, the Caribbean, and Central America provided hands-on technical assistance and training. With the support of these centers, member countries achieved tangible results in reforming their economic and financial institutions. Topical Trust Funds offer specialized advice based on the latest research and draw on the IMF’s global experiences. There are now two country-focused and seven thematic Topical Trust Funds.

In FY2015, the Somalia Trust Fund for Capacity Development was successfully launched with $6.6 million in donor commitments. With the receipt of a $3.1 million contribution from Norway during the year, the South Sudan Trust Fund’s $10.2 million program is now fully funded. A second five-year phase of the trust fund for Anti- Money Laundering and Combating the Financing of Terrorism began in May 2014. The new Tax Administration Diagnostic Assessment Tool Trust Fund contributes to improving tax administration functions in member countries.

Independent mid-term evaluations of five RTACs, the Tax Policy and Administration Topical Trust Fund, and the Managing Natural Resources Wealth Topical Trust Fund found that these vehicles are delivering relevant, effective, and high-quality capacity development services.

The IMF expanded partnerships with longstanding donors on bilaterally funded projects. The top five donors to IMF capacity building are Japan, the European Union, Canada, the United Kingdom, and Switzerland. Japan, the largest donor, made new contributions totaling $29.6 million to finance technical assistance and training, including two scholarship programs. The IMF and the United Kingdom’s Department for International Development (DFID) agreed on a new project to improve macroeconomic statistics in 44 countries in Africa and the Middle East under which DFID will provide about $9.3 million to support capacity development over the next five years.

The previous Enhanced Data Dissemination Initiative project was the first phase of a DFID-funded statistics project for Africa that was implemented by the IMF during 2010–15. It achieved many concrete results, helping numerous countries to produce for the first time quarterly national accounts, IIP statistics, and financial soundness indicators; rebase their national accounts; expand coverage in monetary statistics; increase the frequency and accuracy of government finance statistics; expand data dissemination by publishing national summary data pages and advance release calendars; and add more countries to the IMF’s General Data Dissemination System and Special Data Dissemination Standard.