عربي, 中文, Español, Français, 日本語, Português, Русский

The COVID-19 pandemic is intensifying the vicious circle of inequality. To break this pattern and give everyone a fair shot at prosperity, governments need to improve access to basic public services—such as health care (including vaccination) and education—and strengthen redistributive policies.

For most countries, this would require raising additional revenue and improving the efficiency of spending. These reforms must be complemented by greater transparency and accountability, which can help increase overall trust in government and contribute to more cohesive societies.

COVID-19 and inequality

Inequality was a pre-existing condition that worsened COVID-19’s impact. Disparities in access to basic services have contributed to uneven health outcomes. According to our research, countries with worse access to health care, proxied by the number of hospital beds, have had higher COVID-19 mortality rates than predicted by the number of cases and age structure. Similarly, our analysis shows that countries with higher relative poverty had higher rates of both cases and deaths.

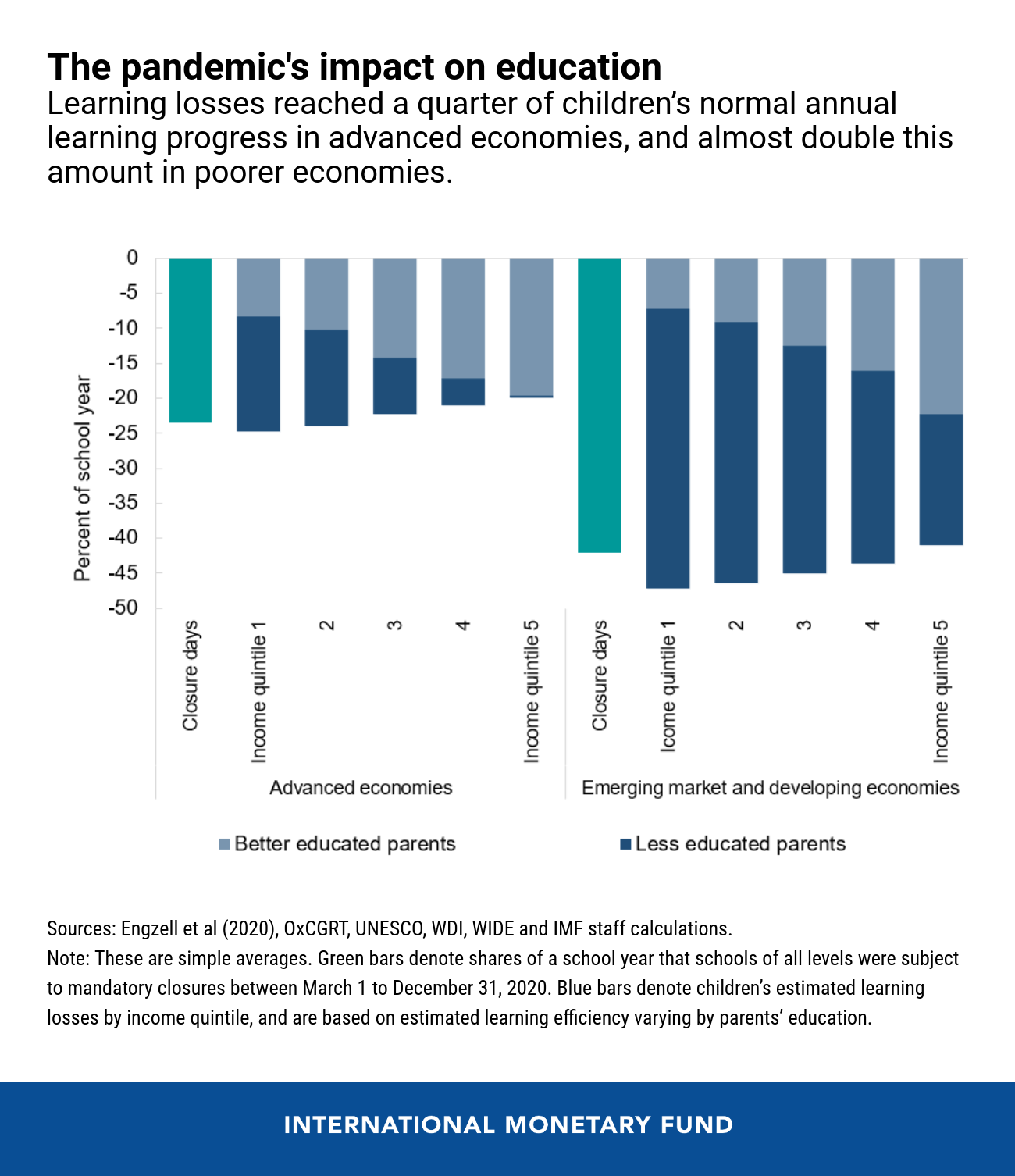

And COVID-19 is also widening inequality. One example is children’s education. Our analysis shows that, with widespread school closures, education losses in 2020 are estimated at a quarter of the school year in advanced economies and twice as much in emerging market and developing economies. Children from poorer families have been disproportionately affected. We estimate that up to 6 million children in emerging market and developing economies could drop out of school in 2021, with lifelong adverse consequences.

In addition, the pandemic has hit the most vulnerable groups the hardest. Lower-skilled and younger workers have experienced more job losses than those in higher-skilled occupations. Likewise, disadvantaged ethnic groups and informal sector workers have been harder hit. And women, who tend to be overrepresented in sectors most affected by COVID-19 such as hospitality and retail, have been particularly affected by the pandemic, especially in poorer countries.

A holistic approach

Breaking the cycle of inequality requires both predistributive and redistributive policies. With the former, governments ensure that people have access to basic public services and good jobs. This makes it possible to reduce income inequality before government redistributes with taxes and transfers.

Investing in education, healthcare, and early childhood development can have a powerful effect on improving access to these services and hence to lifetime opportunities. If governments increased spending on education by 1 percent of GDP, for example, they could reduce the gap in enrollment rates between the richest and the poorest families by almost one-third. In addition to increasing spending, all governments should focus on reducing spending inefficiencies, which are sizable, especially in poorer countries.

The COVID-19 crisis has demonstrated the vital importance of a good social safety net that can be quickly activated to provide lifelines to struggling families. High social spending is effective in reducing poverty only when it provides adequate assistance and covers the poorest segments of society. Developing and maintaining comprehensive social registries with a reliable citizen identification system is a good investment. These elements would ideally be complemented by effective distribution mechanisms such as e-payments and, where access to bank accounts is limited, mobile money transfers.

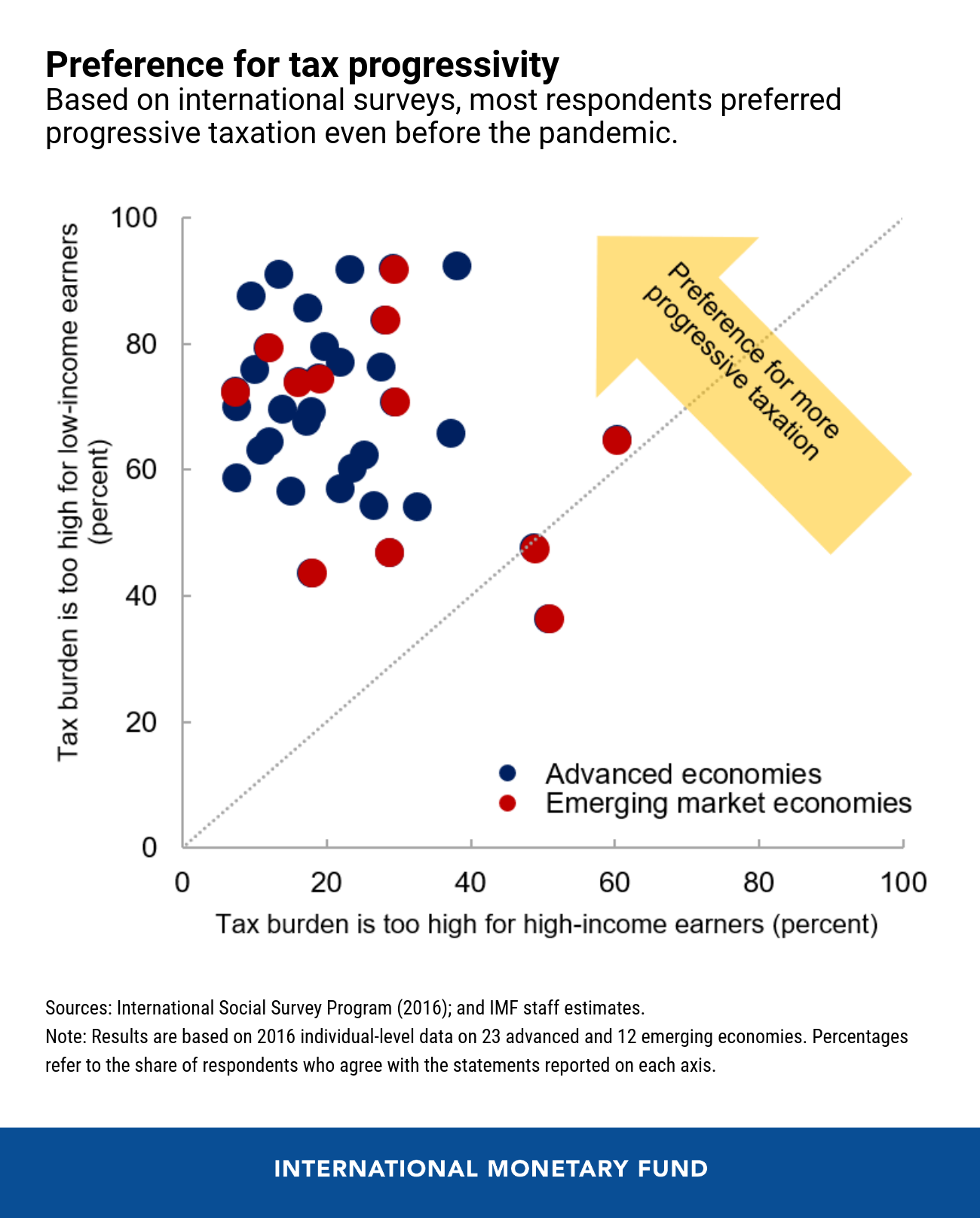

Enhancing access to basic public services will require additional resources, which can be mobilized, depending on country circumstances, by strengthening overall tax capacity. Many countries could rely more on property and inheritance taxes. Countries could also raise tax progressivity as some governments have room to increase top marginal personal income tax rates, whereas others could focus on eliminating loopholes in capital income taxation. Moreover, governments could consider levying temporary COVID-19 recovery contributions as supplements to personal income taxes for high-income households and modernizing corporate income taxation. In emerging market economies and low-income countries in particular, additional revenues could also be raised through consumption taxes to finance social spending. Further, low-income countries will need support from the international community to help with financing and implementing home-grown taxation and spending reforms.

Strong public support needed

Governments may want to consider developing comprehensive policy packages that promise expanded access to public services and better protection from income shocks while supporting a job-rich, inclusive recovery. In some countries, public support for better access to basic services, financed through higher taxes, has been strong and is likely increasing with the pandemic. A recent survey in the United States shows that those who had personally experienced the impact of COVID-19, either through illness or unemployment, have developed a stronger preference for more progressive taxation.

Such policies should be embedded in medium-term fiscal frameworks and complemented by actions that strengthen transparency and accountability. Meaningful gains in spending efficiency are also necessary. Experience with past pandemics shows that the stakes are high because trust in government can quickly deteriorate and contribute to greater polarization. Resolute actions by governments to deliver needed services and foster inclusive growth can counteract this trend and help build social cohesion.