The pace of global economic activity remains weak, and financial markets expect rates to stay lower for longer than anticipated in early 2019. Financial conditions have eased even more, helping contain downside risks and support the global economy in the near term. But loose financial conditions come at a cost: they encourage investors to take more chances in a quest for higher returns, so risks to financial stability and growth remain high in the medium term.

The latest edition of our Global Financial Stability Report highlights elevated vulnerabilities in the corporate and non-bank financial sectors in several large economies. These and other weak spots could amplify the impact of a shock, such as an intensification of trade t ensions or a no-deal Brexit, posing a threat to economic growth.

This situation poses a dilemma for policymakers. On the one hand, they may want to keep financial conditions easy to counter a deterioration in the economic outlook. On the other hand, they must guard against a further buildup of vulnerabilities. The GFSR points to some policy recommendations, including deploying and developing, as needed, new macroprudential tools for non-bank financial firms.

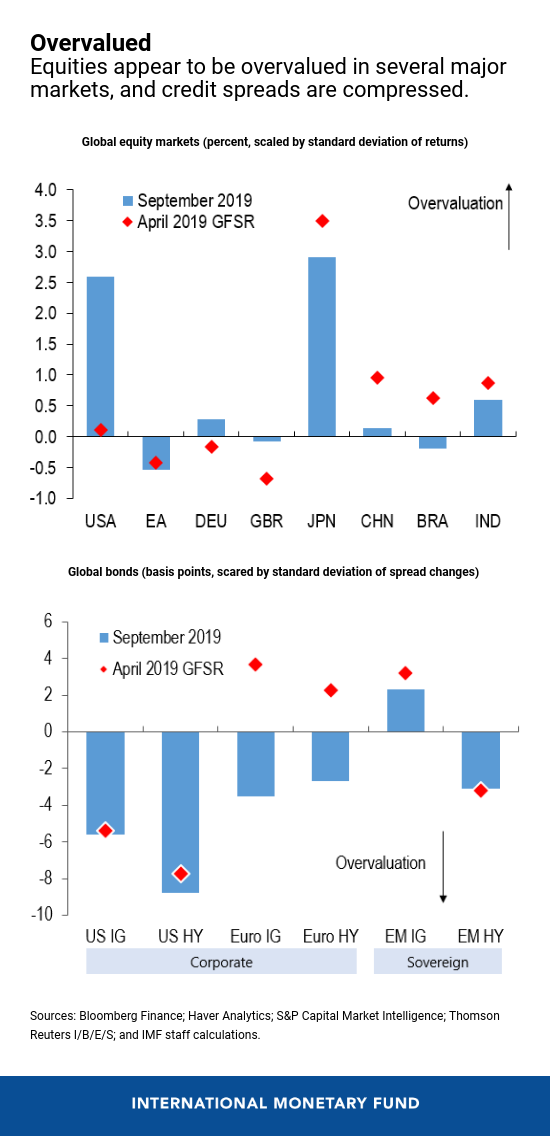

Stretched asset valuations in some markets are contributing to financial stability risks.

Twists and turns

Since the last edition of the GFSR in April, global financial markets have been buffeted by the twists and turns of trade tensions and significant policy uncertainty. A deterioration in business sentiment, weakening economic activity, and intensifying downside risks to the outlook have prompted central banks across the globe, including the European Central Bank and the Federal Reserve, to ease policy.

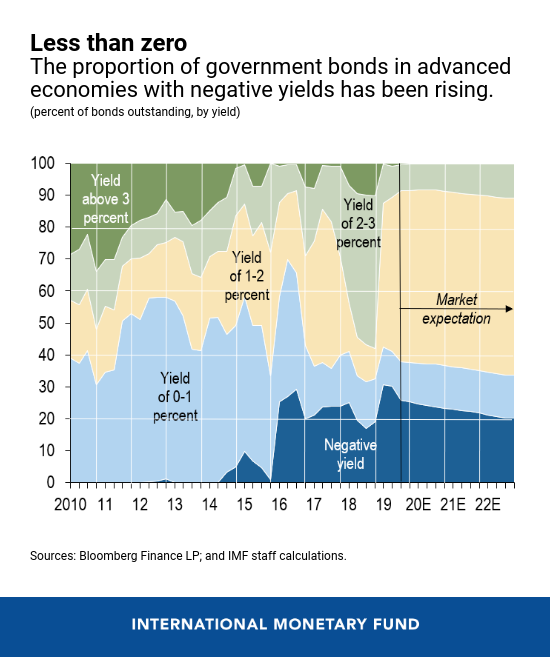

Investors have interpreted central bank actions and communications as a turning point in the monetary policy cycle. About 70 percent of economies, weighted by GDP, have adopted a more accommodative monetary stance. The shift has been accompanied by a sharp decline in longer-term yields; in some major economies, interest rates are deeply negative. Remarkably, the amount of government and corporate bonds with negative yields has increased to about $15 trillion.

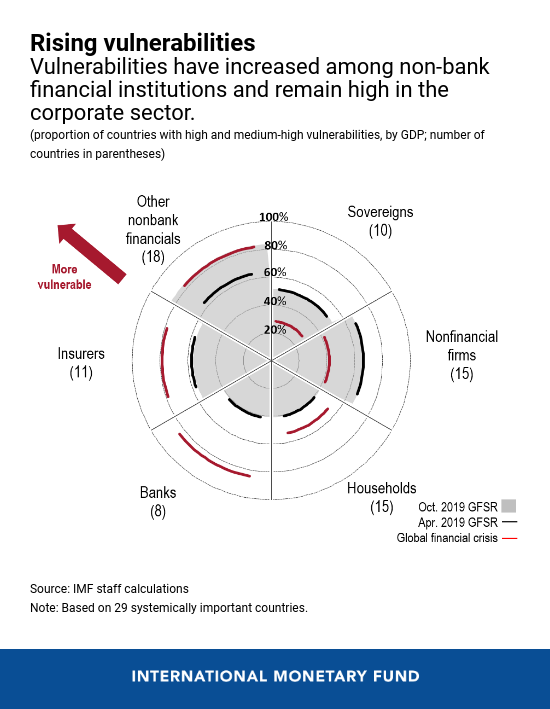

The result is even easier financial conditions but also a continued buildup of financial vulnerabilities, particularly in the corporate sector and among non-bank financial institutions.

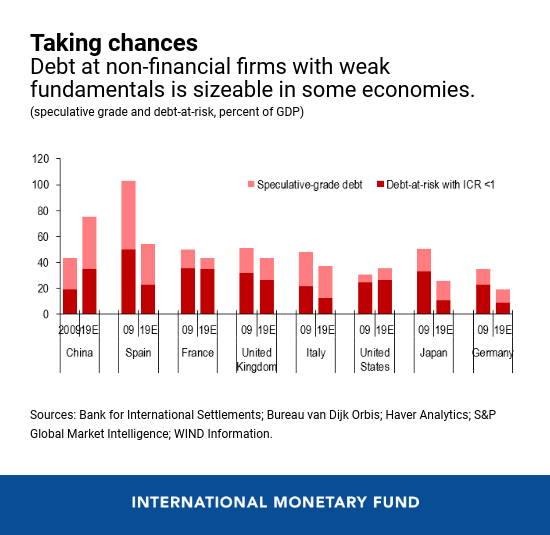

Corporations in eight major economies are taking on more debt, and their ability to service it is weakening. We look at the potential impact of a material economic slowdown—one that is as half as severe as the global financial crisis of 2007-08. Our conclusion is sobering: debt owed by firms unable to cover interest expenses with earnings, which we call corporate debt-at-risk, could rise to $19 trillion. That is almost 40 percent of total corporate debt in the economies we studied, which include the United States, China, and some European economies.

Among nonbank financial institutions, vulnerabilities have risen since April and are now elevated in 80 percent of economies, by GDP, with systemically important financial sectors—a level similar to the height of the global financial crisis.

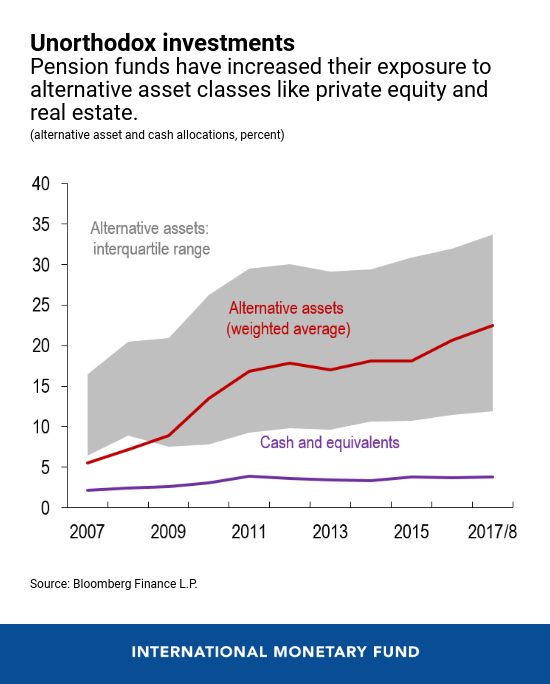

Very low rates have prompted institutional investors like insurance companies, pension funds, and asset managers to reach for yield and take on riskier and less liquid securities to generate targeted returns. For example, pension funds have increased their exposure to alternative asset classes like private equity and real estate.

What are the possible consequences? Similarities in portfolios of investment funds could amplify a market sell-off, and illiquid investments by pension funds could constrain their traditional stabilizing role in markets. In addition, cross-border investments by life insurers could provoke spillovers across markets.

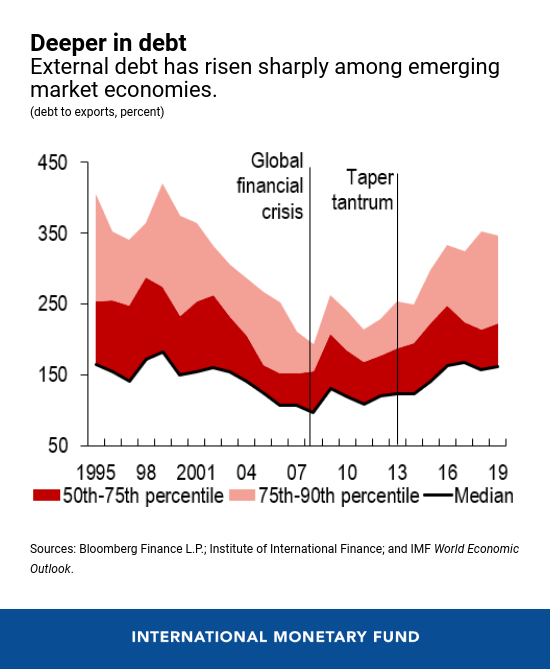

External debt is rising among emerging and frontier economies as they attract capital flows from advanced economies, where interest rates are lower. Median external debt has risen to 160 percent of exports from 100 percent in 2008 among emerging market economies. A sharp tightening in financial conditions and higher borrowing costs would make it harder for them to service their debts.

Unbalanced

Stretched asset valuations in some markets are also contributing to financial stability risks. Equity markets appear to be overvalued in the United States and Japan. In major bond markets, credit spreads—the compensation investors demand to bear credit risk—also seem to be too compressed relative to fundamentals.

A sharp, sudden tightening in financial conditions could unmask these vulnerabilities and put pressures on asset price valuations. So, what should policymakers do to tackle these risks? What tools can be deployed or developed to address the specific vulnerabilities identified in this report?

- Corporate debt-at-risk: stricter supervisory and macroprudential oversight, including targeted stress testing of banks and prudential tools for highly levered firms.

- Institutional investors: strengthened oversight and enhanced disclosures, including stepped-up efforts to mitigate leverage and other balance-sheet mismatches.

- Emerging and frontier markets: prudent sovereign-debt management practices and frameworks.

With financial conditions still easy so late in the cycle, and with vulnerabilities building, policymakers should act quickly to avoid putting growth at risk in the medium term. Uncertainty may reign today — but sound policy decisions, adopted soon, could help avoid the most dangerous outcomes.