A Time for Action

Finance & Development, December 2017, Vol. 54, No. 4

Countries of the Middle East and North Africa have an opportunity to pursue the reforms needed to ensure prosperity for decades to come

The uprisings of 2011 ushered in a period of unprecedented change in the Middle East and North Africa. While demands for political transformation commanded the world’s attention, those calls were largely motivated by unresolved socioeconomic issues. Demonstrators in the streets of Cairo and Tunis demanding “bread, dignity, and social justice” expressed widely held aspirations for basic economic rights, along with greater prosperity and equity.

Almost seven years later, notable progress has been achieved in terms of public finance reforms. However, these reforms still have a long way to go to reduce disparities in the distribution of wealth within most countries of the region or narrow the development gaps between them. Protracted regional conflicts, low oil prices, weak productivity, and poor governance have inflicted a heavy toll. Growth has not been strong enough to reduce unemployment significantly; a staggering 25 percent of young people are jobless.

As a result, countries in the Middle East and North Africa now face a stark choice between short-term retrenchment and resolute pursuit of the long-term reforms needed to secure their future economic prosperity. Forsaking important economic adjustments needed to strengthen inclusive growth and modernize the state and private sectors would set the region back, possibly for decades. A healthy global economy provides a welcome opportunity to accelerate the pace of reform.

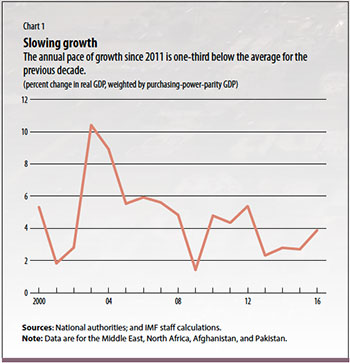

While countries in the region have maintained macroeconomic stability, growth has been far too slow to keep pace with an expanding population, with the result that unemployment is rising. Economic growth has averaged just 3.6 percent a year since 2011, a pace one-third below that of the previous decade (see Chart 1). The overall unemployment rate of 10 percent does not appear alarming, but it ranges from less than 1 percent in Qatar to more than 18 percent in Jordan, and women and youth are disproportionately affected. Maintaining the status quo will only make things worse. The IMF estimates that if growth continues at its post-2011 pace, average unemployment could rise above 14 percent by 2030.

Furthermore, conflicts in Afghanistan, Iraq, Libya, Syria, and Yemen have taken a tragic toll: half a million people are estimated to have died in these conflicts since 2011. In Syria alone, 12 million people have been displaced. The economic impact has been devastating: homes, hospitals, roads, and schools have been damaged or destroyed, with an estimated cost four times the countries’ preconflict GDP. The exodus of refugees from conflict areas is adding considerable pressure to budgets, infrastructure, and labor and housing markets in host countries, such as Lebanon and Jordan. The conflicts have also disrupted trade, tourism, and investment.

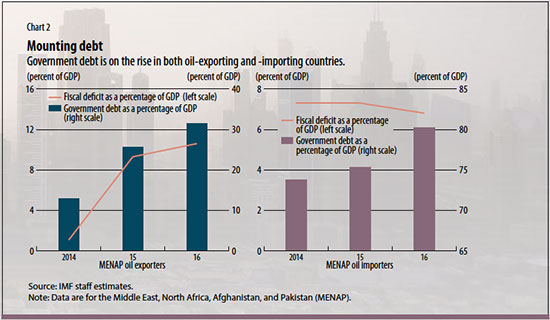

Oil-exporting countries, meanwhile, are grappling with a steep decline in energy prices that has led to large fiscal deficits and a decline in growth. On average, deficits increased to more than 10 percent of GDP in 2016, and public debt has doubled to more than 30 percent of GDP since 2014. Still, these figures mask significant deficit-reduction efforts. The non-oil primary balance—which excludes the impact of oil prices and can be seen as the fiscal effort undertaken by governments—has improved by more than 12 percentage points of GDP since 2014.

Budget deficits also remain elevated in oil-importing countries, even though these countries are benefiting from lower oil prices (see Chart 2). Deficits exceed 6 percent of GDP on average, and debt levels surpass 90 percent of GDP in Egypt, Jordan, and Lebanon. Although these countries have managed to reduce deficits enough to maintain economic stability, they need to make additional resources available to address social and development issues. Growth is projected to increase to more than 4 percent this year as a result of stronger private consumption and exports.

Development plans

Policymakers in the region recognize the need to generate more employment and stronger growth and have added these goals, along with better inclusion, to their national development plans. If well executed, these plans could go a long way toward meeting those goals. Recognition of the need to grant equal rights to women and better integrate them into the labor force will be particularly important. Recent moves—including Saudi Arabia’s decision to allow women to drive—are steps in the right direction, but more is needed. Education and labor market policies will also be key, given that about 60 percent of the population is under the age of 30. With proper opportunities and education, the region’s young people could fuel unprecedented economic growth and generate a demographic dividend like the one that propelled the Asian Tigers a few decades ago.

Governments are making efforts to stimulate trade and investment. Many countries—from Jordan to Saudi Arabia—have reduced trade barriers. Morocco and Tunisia have joined the G20 Compact with Africa aimed at promoting private investment, which should help improve infrastructure. Jordan, Morocco, and Tunisia have made efforts to diversify their manufacturing bases, supporting exports and jobs. Morocco, for instance, has attracted automakers, including PSA Peugeot Citroën and the Renault Group, by providing good infrastructure, power supply, and skilled labor. As a result, its automotive sector aims to create 90,000 jobs by 2020. How much more growth could more trade bring? The IMF estimates that if the region matched its best one-year improvement in openness so far, the average annual pace of economic growth would rise 1 percentage point over the next five years, compared with a baseline forecast of 3.3 percent.

Job creation

Governments are also putting job creation at the forefront of their policy agendas. These plans aim to develop the private sector by providing better job opportunities for youth and women and increasing access to finance. They also seek to provide better public services, improve transparency and accountability, and contribute higher and more efficient social and investment spending. Many of these themes were already at the forefront of the debate in 2014 when regional leaders gathered in Amman to define policies to boost jobs, growth, and fairness in the Arab world. They remain at the center of debate today as people demand faster and deeper change.

Fortunately, stronger global growth and innovations in technology help create a favorable environment for reforms. It will take time to generate results, so policymakers should act sooner, rather than later, and seize the opportunity to strengthen economic stability and promote growth for the benefit of society as a whole.

Governments need to develop and execute agendas for inclusive growth: medium-term action plans that offer practical solutions to pressing priorities and help restore the confidence of investors and citizens. Five levers will be critical: sound fiscal policy, financial inclusion, reform of the labor market and the educational system, improved governance, and a stronger business environment. This approach will also enable governments to rethink their growth models and implement more equitable social contracts over time, while preserving macroeconomic stability. The first step is a vision that inspires citizens; specific goals and a strategy for achieving them should follow.

Fiscal reforms remain the main policy lever to promote inclusive growth. Countries with larger fiscal buffers and lower debt can gradually reduce deficits to avoid unnecessarily curbing growth; those with large deficits and high debt, such as Jordan, Lebanon, and Mauritania, need to step up their deficit-reduction efforts.

Fiscal reforms

One way to reduce deficits is to raise more revenue by broadening the tax base. The region’s average tax-to-GDP ratio of less than 10 percent is low relative to the average of 18 percent in emerging markets. Reducing exemptions, combating tax evasion, and a more progressive personal income tax will also help, as will slimming down excessive public sector wage bills. These make up almost 10 percent of GDP in the six countries of the Gulf Cooperation Council, compared with an average of 6 percent in emerging and developing economies as a whole. Reducing the discrepancy between public and private sector wages will help absorb the 27 million young people projected to enter the workforce in the next five years. Currently, many qualified young people choose to remain idle for long periods as they wait for highly paid public sector jobs to become available.

Some countries have already shown that savings from such measures can be used to increase investment and spending on much-needed social services. Eleven countries have replaced fuel subsidies that apply to the whole population with cash transfers targeted at the poor. Among such countries is Egypt, which has raised targeted cash transfers tenfold, to 1.7 million households, over two years. But progress is uneven, and more social spending is needed to improve growth and living standards significantly over the medium term. Accelerating the sale of state-owned companies will help—as will selecting and managing projects with a view to robust economic returns to improve the quality of public investment.

Increasing access to finance will go a long way toward fostering private sector activity. About two-thirds of the population lacks a bank account, and bank loans to small and medium-sized firms, at 2 percent of GDP, are among the lowest in the world. Better bookkeeping by companies would help improve access to finance because banks could more easily assess credit risk. Capital markets also need to be developed further to make it easier for companies to obtain equity and debt financing.

Leveraging technology

With 60 percent of the region’s population using mobile phones, financial technology presents an opportunity to give more consumers access to financial services. Yet most countries in the region have not enacted reforms to allow nonbanks to enter this space. Regulators should develop frameworks that promote innovation while protecting consumers and data privacy and preventing money laundering and terrorism financing.

More broadly, technology can boost productivity and growth; green technology in particular, including solar energy, offers considerable promise. But while technology can make workers more efficient and create jobs in new sectors, it may also render some jobs obsolete. Income and employment gaps could continue to grow if these workers are not effectively reintegrated into the economy.

That’s why improved education and training are critical. Except in a few countries, such as Bahrain, Egypt, and Saudi Arabia, the pool of working-age adults with postsecondary education is far smaller than the global average of 17 percent. Education should focus more on skills demanded by employers in industries such as electronics, automobiles, aeronautics, and financial technology.

Education will also be the key to promoting gender equality. Women participate in the labor force at just one-third the rate of men. Policies that encourage women to work, such as flexible hours and child care services, help bring more women into the formal job market and boost productivity and growth. But those are just a start. It’s hard to imagine a bright economic future for the region without profound changes in rigid conceptions of social and gender roles. Equal access to finance, training, and technology should be the foundation for empowering women and enabling them to compete on an equal basis with men.

Building trust

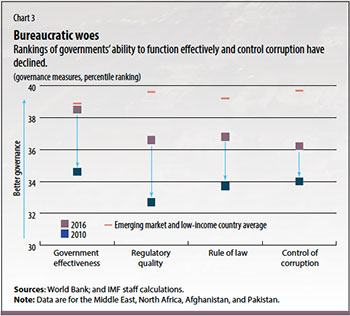

Along with lack of jobs, corruption and inefficiency were among the sources of popular discontent that fueled the uprising. Improving governance would not only help address social grievances, it would also boost business confidence and investment. Most countries in the region still rank in the bottom half of global indexes that measure governments’ ability to function effectively and control corruption, and the rankings have deteriorated in recent years (see Chart 3). Governments should provide the resources and legal authority to improve transparency and financial management while also fighting corruption.

The devastation of war poses the gravest test of all. Refugees need food, housing, education, and help finding jobs; host countries can’t afford to bear these burdens alone. When conflicts end, the next task will be to mobilize the resources needed to rebuild infrastructure and institutions and bring displaced people back into the labor force. Postconflict countries tend to experience volatile patterns of financing. Strong coordination at the international level will be needed to ensure adequate support. Official financing should come in the form of grants, or on highly concessional terms, and needs to be complemented by significant private sector flows, including donations and remittances.

There is little doubt that the region is at a crossroads in its modern history, with potentially significant consequences for global prosperity. There has never been a more critical time for policymakers to focus on empowering a sizable pool of untapped talent. Progress will be limited if women, who represent half the population, do not have opportunities to succeed. Transition will therefore not be sustainable without accelerating the pace of reforms, with economic inclusion as a primary goal. The global recovery provides a unique opportunity, and when peace returns to the region, the impact of reforms undertaken today will be magnified many times over. Action therefore is needed now to raise growth and living standards in a sustainable fashion and meet the aspirations of the people in the region. Inaction would be disastrous and would mean continued economic stagnation, rising unemployment, social tensions, and protracted conflict. Now is the moment to move from goals to action.