Sino Shift

Finance & Development, June 2014, Vol. 51, No. 2

China’s rebalancing opens new opportunities for developing Asia

OF all the World Bank projects carried out in China during my years as Country Director, one small project stands out.

The World Bank gave a very modest grant to a nongovernmental organization that was trying to help “left-behind children” in rural Sichuan. Both parents of these children had left for better economic opportunities—the mothers often to work in labor-intensive factories in the areas surrounding Hong Kong SAR, the fathers more typically to work construction in cities throughout the country. Children were left behind in rural villages with their grandparents.

The project brought in college kids on weekend visits from the provincial capital to help the children with computer and Internet skills they could not learn from their grandparents. Under new policies unveiled at the recent National People’s Congress, and driven very much by the country’s demographics, the nature of rural-urban migration in China is set to change. The kind of manufacturing and construction employment that migrant workers sought in the past has already peaked, so future migrants are likely to work in the service sector. And it will be increasingly easy for migrants to bring their families and become permanent urban residents, benefiting from a full range of urban services.

These shifts reflect the rebalancing of China’s economy away from a growth model that relied heavily on investment and exports toward a new model that relies more on innovation as a source of growth and on consumption as a source of demand. The extent to which China succeeds in this rebalancing will have a large effect on the global economy, and on developing economies in particular.

The old growth model

China has been growing extremely rapidly for a long time, but an important shift in this growth pattern occurred at the time of the global financial crisis.

Before the crisis, during the six years ending in 2007, China’s GDP grew at an average rate of 11 percent, with investment of 41.5 percent of GDP. That investment expanded the housing stock, manufacturing capacity, and infrastructure such as roads and rail. The country’s current account surplus (exports minus imports) was rising in this period, reaching more than 10 percent of GDP. In the six years since the global crisis, the external surplus fell sharply to 2 to 3 percent of GDP; the shortfall in demand was made up almost completely by an increase in investment, reaching more than 50 percent of GDP in recent years. China’s growth has been impressive compared with the rest of the world, but lost in the admiration is the fact that the growth rate has slowed to less than 8 percent, more than 3 percentage points slower than in the precrisis period. Thus, China has recently been using a lot more investment to grow significantly more slowly than in the past.

This pattern of growth manifests three problems. First, technological advance as measured by total factor productivity (TFP) growth has slowed. TFP measures how much an economy is getting from its capital and labor. Second and closely related, the marginal product of capital is dropping—it takes more and more investment to produce less and less growth. The real-world indicators of this falling capital productivity are empty apartment buildings, unused airports, and idled factories in important manufacturing sectors such as steel—excessive investment that generates little additional GDP. And third, consumption is now very low, especially household consumption, at only 34 percent of GDP.

The earlier experiences of Japan, Korea, and Taiwan Province of China provide some useful historical guidance about China’s current stage of development. When those economies were at this level of per capita GDP in the 1970s and 1980s, their investment, averaging 35 percent of GDP, was high by global standards but 15 percentage points below China’s recent level. They were still experiencing rapid TFP growth so they grew about as quickly as China is now, but using less capital. Those economies tended to have current account deficits until this stage of development, after which they went through a gradual decline in investment as the return to capital diminished, and they shifted from trade deficits to trade surpluses. Their average household consumption rate at this stage was 52 percent, 18 percentage points higher than China’s now.

China’s leaders are aware that the country faces a unique challenge of rebalancing: it needs to bring down the ultrahigh investment rate while stimulating greater consumption. The recently completed Third Plenum outlined a series of reforms to stimulate innovation and productivity growth, rein in wasteful investment, and raise household income and consumption.

China’s reform agenda

The resolution that came out of the Third Plenum sketched out dozens if not hundreds of reforms. Those that are likely to have the most effect on rebalancing fall into four areas: liberalization of the household registration system (hukou); intergovernmental fiscal reform; financial liberalization; and opening up China’s service sector to competition.

Under China’s hukou system 62 percent of the population is registered as rural residents, and until now it was extremely difficult for a person to formally change this designation. The result of this system naturally has been to slow rural-urban migration. China has one of the highest urban-rural income divides in the world: the average urban dweller makes more than three times as much as a rural resident. Many peasant families, if permitted, would move to cities. Despite the restrictions, many young rural residents come to cities as migrant workers. Even including these migrants, though, China’s urbanization rate—52 percent of the population lives in cities—is low given its level of development.

One key feature of the system is that while migrants can come as workers, they cannot bring families and truly become citizens of the cities (hence the “left-behind children” in Sichuan and other interior provinces). The migrant worker system provides low-cost labor for construction and exports while suppressing domestic demand by leaving families behind in poor rural areas with few public services. Reforming the hukou system would affect rebalancing in several ways. An important source of productivity growth is the movement of labor from small-scale farming to higher-paying jobs in manufacturing and services. Relaxing restrictions on mobility should lead to higher productivity growth, higher incomes for people who are now registered as rural residents, and greater government expenditure on social services.

This vision could become a reality: in his report to the National People’s Congress on March 5, 2014, Premier Li Keqiang set a target of “granting urban residency to around 100 million rural people who have moved to cities.”

One reason local governments have resisted hukou reform is fear that they will not have sufficient fiscal resources to fund the increased social services required by migrant families who come to their regions. China overall has ample fiscal resources, but is characterized by a mismatch between the central government, which collects most of the revenue, and local governments, which bear most of the responsibility for expenditures.

In response to this reluctance by local governments, the Ministry of Finance announced the following general plans for fiscal reform to support rebalancing:

• Introduce measures to bolster local government revenue. A nationwide property tax, for example, could become a stable source of finance for local governments and discourage the hoarding of apartments, one form of excessive investment in China.

• Increase the share of state enterprise profits that must be paid into the public budget. Because state enterprises in the aggregate are profitable, increasing the dividend rate at both the local and central levels would reduce some bias toward investment and help ensure resources for public spending on education, health, and environmental protection.

• Allow municipalities to issue bonds to fund their infrastructure projects, rather than relying on shorter-term off-budget bank loans to local government infrastructure companies.

• Change the incentives of local officials to align with rebalancing. Changing incentives may be the most difficult fiscal reform of all. Local officials are generally rewarded for their ability to provide investment and growth and are less successful at meeting other, more socially oriented, objectives such as clean air, food safety, and quality education and health services.

Liberalization of China’s repressed financial system is another reform prescribed by the Third Plenum, and it has a significant potential impact on rebalancing. China’s bank-dominated system has kept interest rates below or near the inflation rate, and these close-to-zero real interest rates act as a tax on household savers and a subsidy for investment by firms and local governments that are able to borrow from the banking system. Although real interest rates have been near zero almost everywhere in the world in recent years, China’s case is unusual because such rates there go back more than a decade. The government has taken some initial steps to raise deposit and lending rates and to allow a shadow banking system—whereby nonbank financial institutions engage in services traditionally provided by banks—to develop, with better returns for savers and higher-cost loans for riskier clients.

But most shadow banking wealth products are now marketed by commercial banks and are therefore erroneously perceived by households as low risk. Total shadow banking lending has grown explosively in recent years and, unsurprisingly, some of the funded investments are starting to go bad. Investments as diverse as coal mines in Shanxi, solar panels in the Shanghai area, and real estate in second-tier cities are going bust, and the companies involved are defaulting on their loans. The first corporate bond default in modern Chinese history occurred earlier this year. It is good for investors to see that risky shadow banking products can go bust, but at the same time the government does not want the public to lose confidence in the financial system overall.

The announcement of plans to formally introduce deposit insurance this year is an important step in separating a cautious commercial banking sector from a risky shadow banking sector. Central Bank Governor Zhou Xiaochuan recently announced that interest rate liberalization would be completed within one to two years. Recent moves to liberalize the bond and stock markets to give private firms better access to capital markets are also a step in the right direction, as was the recent widening of the band within which the exchange rate can move.

The IMF assesses that China’s exchange rate has gone from “substantial undervaluation” to “moderate undervaluation” in recent years, so it should not be too difficult for the authorities to further reduce their intervention to allow a more market-determined rate. Opening up the capital account should be the last step in this process of financial reform.

Finally, China’s service sector must be exposed to competition from private firms and the international market. State-owned enterprises continue to dominate modern services—in finance, telecommunications, media, and logistics, to name a few. The rebalancing from investment toward consumption means that manufacturing will grow less rapidly than in the past while the service sector expands. China will need more productivity growth in the service sector, which is hard to achieve in a protected economy, but its plan to sell shares in more services firms (partial privatization) should help if it is accompanied by more openness and competition in these markets.

Implications for developing economies

Successful rebalancing in China will be a mixed blessing for other developing economies. Compared with “business as usual,” rebalancing is likely to lead to a slowdown in growth in the immediate future as wasteful investment is reined in. But over time it is likely to lead to modestly faster growth because it will alleviate the diminishing returns of the old growth model. Most important, the composition of China’s growth will change under rebalancing—with less investment, more productivity growth, and more consumption.

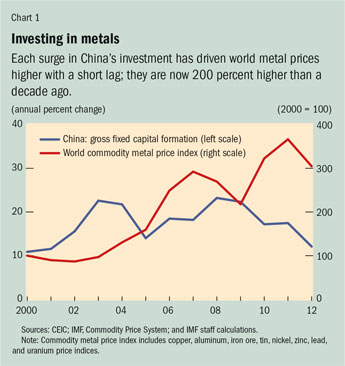

For other developing economies, China’s rebalancing means a diminished appetite for minerals and energy imports. As a driver of high metal prices for the past decade each surge in China’s investment pushed metal prices higher with a short lag; those prices are 200 percent higher now than a decade ago (see Chart 1). Reining in investment in China is already leading to softer commodity prices. When the IMF’s World Economic Outlook assumes moderate rebalancing in China, it projects correspondingly moderate declines in energy and materials prices of 3 to 4 percent a year.

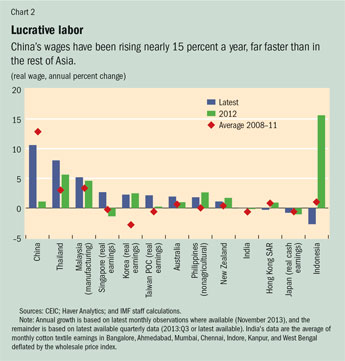

While it is notoriously difficult to predict commodity prices, they are likely to fall in response to more aggressive rebalancing in China. U.S. dollar interest rates are rising (owing to the recovery of the U.S. economy and normalization of the Federal Reserve’s monetary policy) as commodity prices moderate in response to China’s slowdown, which will mean problems for commodity-exporting developing economies, especially those that have borrowed imprudently. While China’s appetite for commodities is likely to moderate, rebalancing can be expected to increase its demand for manufactures and services from other developing economies. In recent years China’s real wages have been rising nearly 15 percent a year, far faster than elsewhere in Asia, where low single digits have been the norm (see Chart 2). Add in the real effective appreciation of China’s exchange rate, and the result is a China that is a high-wage producer among Asian developing economies.

This means China is losing its comparative advantage in labor-intensive activities such as manufacturing of garments and footwear and electronics assembly. Lower-wage developing economies can now step in and seize some market share from China, either exporting directly to final markets in the United States and Europe or exporting to China as part of a supply chain (see “Adding Value” in the December 2013 F&D). Since China still has a large surplus and is moving up the value chain, this loss of market share in labor-intensive activities is a healthy development that mirrors the earlier transitions of economies such as Korea and Taiwan Province of China. This transformation is already occurring and should be a powerful incentive for nearby developing economies to improve their investment climate and maintain sound macroeconomic policies so that they get the maximum benefit.

On the services side, developing Asian economies are dramatically increasing tourism services to China. Last year 100 million Chinese tourists traveled abroad, the vast majority within Asia.

In a successful rebalancing, China’s external surplus is not likely to grow as a share of its GDP, but is projected to remain about 3 percent of a rapidly growing GDP—an absolute increase. At the moment the counterpart to China’s current account surplus is primarily reserve accumulation. But it’s not hard to imagine a scenario several years from now in which China has a large net outflow of foreign direct investment and no longer intervenes in the currency market in a significant way. China is rapidly emerging as a major source of foreign direct investment. Initially much of this was in the energy and mineral sectors, where it is now a large importer. But recently Chinese foreign investment has tended to expand toward different sectors and geographic areas. Some of the connection to Chinese supply chains will certainly come through outward investment by Chinese manufacturers.

China’s rebalancing presents disadvantages for other developing economies, but opportunities as well. A world without Chinese rebalancing, on the other hand, is likely to be more volatile. In the short run, commodity prices would likely stay high as China’s investment continues apace. But most observers deem investment of 50 percent of GDP unsustainable: the already evident excess capacity in housing, manufacturing, and infrastructure would become increasingly acute. At some point China’s commercial investment will have to drop in response to poor returns; this already seems to be happening in the first half of 2014. And government-backed investment faces the problem that the overall ratio of government debt to GDP, while not yet alarming, has been rising rapidly.

The hitch would be a simultaneous sharp drop in investment in China and abrupt slowdown in growth. Commodity prices would then fall more steeply than in a rebalancing situation. This is also a setting in which a market-driven Chinese exchange rate might depreciate: if investment drops sharply without a commensurate rise in consumption the exchange rate would likely depreciate and the trade surplus widen. China would then be hanging on to labor-intensive manufacturing exports rather than opening up space for other countries.

China’s successful rebalancing presents a much more attractive scenario for the world’s developing economies. ■