Many also have high debt and constrained budgets because of the pandemic and face higher government borrowing costs amid rising interest rates around the world, making it especially difficult for public finance to meet pressing climate financing needs.

These factors mean mobilizing private capital on a large scale will be key to achieving their climate objectives. Financial markets alone can’t do the job, but combining public and private capital offers unique advantages by reducing investment risk and attracting greater funding. Multilateral development banks and international financial institutions can provide support through creating blended financing structures to alter the risk-return profile for the climate transition in emerging economies.

It’s important to start by establishing an attractive investment climate and policies to incentivize private participation. Climate policies and finance are complementary because better policies attract private investment, in turn helping meet policy objectives. Carbon pricing is the most effective tool to make high emitters pay for the climate costs they impose and thereby channel private investment toward projects that emit less.

More generally, climate policies and commitments like the Paris Agreement’s Nationally Determined Contributions can signal to investors to direct investment to a low-carbon economy. Establishing a strong climate information architecture for data, taxonomies, and disclosures also will help.

Opportunity for impact

Unfortunately, private climate finance faces multiple constraints, from future policy uncertainty and technological costs that raise the cost of capital to other barriers such as data limitations and unattractive risk-return profiles. Despite these challenges, private climate finance can help emerging economies meet Paris Agreement goals.

Innovative financing instruments can attract investors with different risk profiles and investment horizons, as we noted in our October Global Financial Stability Report. In larger emerging markets with functioning bond markets, investment vehicles such as green bond funds can help broaden the investor base by drawing in institutional participants like insurance companies and pension funds.

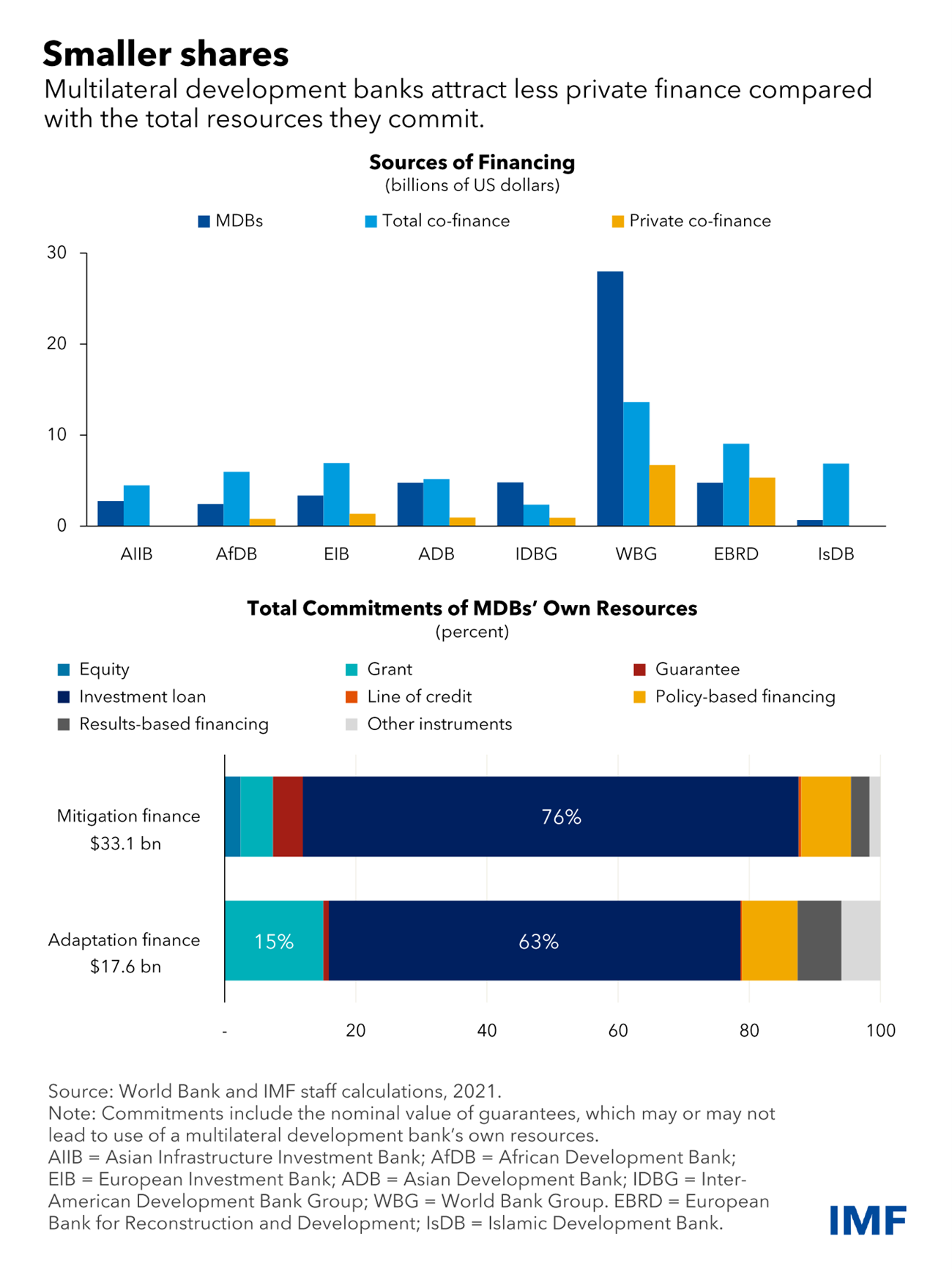

Multilateral development banks and international financial institutions have a crucial role to play to attract much larger sums of private capital. They can provide technical assistance, helping develop projects, improve governments’ institutional capacity, and build the local currency bond markets to broaden the set of domestic investors.

By agreeing to be first to endure losses in green funding vehicles and securitizations, development banks can increase the expected risk-adjusted return for private investors. With appropriate governance, public backing can help avoid moral hazard associated with guarantees, which involve risk that gains are privatized while losses socialized. Advanced economies could back public equity as a way of delivering on their annual $100 billion commitment to emerging and developing economies.

In addition, equity investment can effectively leverage public money.

Commitments by development banks are matched by less than a third of the

amount from private sources, for emerging and developing economies, on average. That contrasts with smaller deals

by the World Bank Group’s International Finance Corporation and Amundi SA,

Europe's largest asset manager. The IFC-Amundi structured fund attracted 16

times as much private investment.

For less-developed economies, green infrastructure projects will remain a key instrument, and development banks will naturally play a central and enduring role. More climate financing could be channeled through development banks to support such projects by increasing their capital base and through partnerships with the private sector.

Public money, including from development banks and international financial institutions, can help launch green or climate structured funds where risk is distributed among lower tranches of such funds, which could attract much more private capital to take the senior tranches.

Blended support

In addition, if green or climate funds invest in the equity of climate projects, development banks and commercial lenders may be more willing to lend. As such, public money provides incentives at the fund and project level, and both can be blended with public and private money.

The IMF can play an important role through its surveillance, capacity development, risk assessments, and climate diagnostic tools. Our first ever long-term financing tool, the Resilience and Sustainability Trust, now has more than $40 billion in funding pledges, and staff-level agreements with Barbados, Costa Rica, and Rwanda. Under the RST, lending by the Resilience and Sustainability Facility can help boost private financing.

Fund staff will work with governments, development banks and investors to identify financing constraints and further explore how to scale up private financing. We’ll also continue to promote carbon pricing, along with alternatives that can achieve equivalent outcomes, such as feebates and regulations. And, finally, the IMF will continue to strengthen the climate information architecture and help emerging economies promote private climate finance.