Governments confront difficult trade-offs amid sharp increases in food and energy prices. Policymakers must protect low-income families from large real income losses and ensure their access to food and energy. But they must also reduce vulnerabilities from large public debts and, in response to high inflation, maintain a tight fiscal stance so that fiscal policy does not work at cross-purposes with monetary policy.

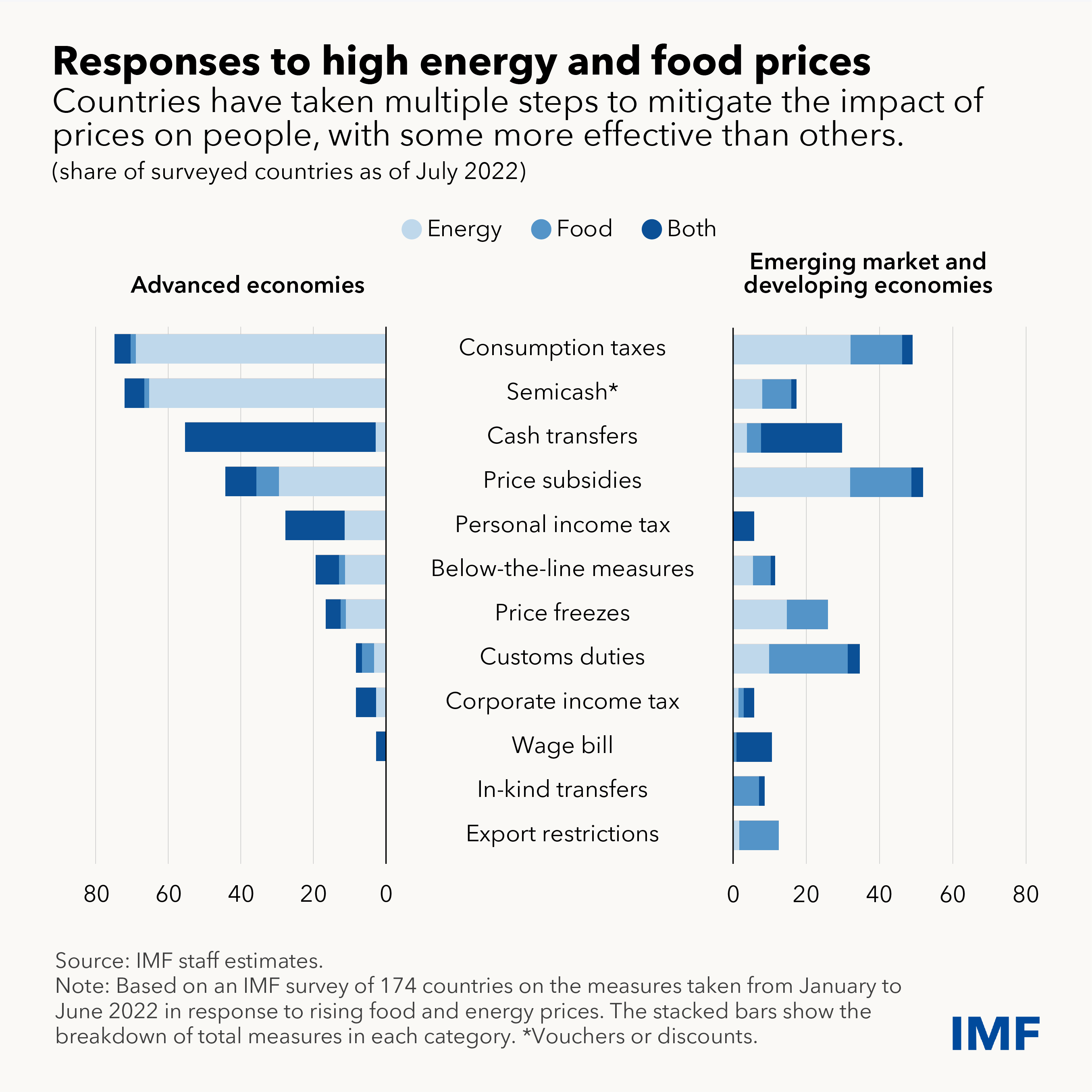

Food prices have been up by half since 2019 and supply disruptions have persisted in both food and energy markets. Higher prices threaten people’s standard of living everywhere, prompting governments to introduce a variety of fiscal measures, including price subsidies, tax cuts, and cash transfers. We estimate the median fiscal cost of such measures at 0.6 percent of national gross domestic product, on top of pre-existing subsidies, among countries for which estimates were available.

Most governments face further pressure on public finances already strained by the pandemic. Rising inflation, weakening currencies, and climbing interest rates have led to surging credit spreads in many countries and higher interest expense going forward. Global public debt is projected to remain elevated at 91 percent of GDP in 2022—after receding from a historic high in 2020—and remains about 7.5 percentage points higher than prepandemic levels. Low-income countries are particularly vulnerable: nearly 60 percent of the poorest economies are in debt distress or at high risk of it.

In our latest Fiscal Monitor, we discuss how policymakers can approach these trade-offs, helping people bounce back from the current crisis and better cope with future challenges.

Food and energy response

Facing high debt levels and rising borrowing costs, policymakers should prioritize targeted support through social safety nets to the most vulnerable people. In some countries, this might entail providing discounts on utility bills (for basic usage) to vulnerable low- and middle-income families. Allowing energy prices to adjust is crucial to preserving broader incentives to curb energy use and increase supply. Faced with long-lasting supply shocks and broad-based inflation, governments should not attempt to limit price increases through price controls, subsidies, or tax cuts. Such a move would be costly to budgets and ultimately ineffective. With limited resources, many low-income countries will need greater global efforts in humanitarian assistance and emergency financing.

In a time of high inflation, policies to address high food and energy prices should not add to aggregate demand. Demand pressures force central banks to raise interest rates even higher, making it more expensive to service government debt. A tightening fiscal stance sends a powerful signal that policymakers are aligned in their fight against inflation.

Fostering economic resilience

Our report highlights that governments need to build resilience over time to a range of adverse shocks. The pandemic and the global financial crisis, beyond country-specific natural disasters and other adverse events, have shown that governments must prepare for rainy days. Building fiscal buffers gradually would eventually allow policymakers to respond swiftly and flexibly to crises.

Several fiscal tools that have proved useful during the pandemic can be made part of a more permanent toolkit, depending on countries’ capacity and available fiscal space. Job-retention schemes, for example, proved effective during the pandemic by stabilizing more than 40 percent of individual income loss in the European Union. Exceptional financial support to companies can prevent widespread bankruptcies. But such support should be reserved for severe crises as it exposes governments to sizable fiscal risks.

More generally, social safety nets help people bounce back from unemployment, sickness, or poverty, making them more resilient to a broad set of challenges. Such systems can be made readily scalable and better targeted with the help of digital technology.

We have seen how major global crises during the past decade-and-a-half have led to innovative and forceful fiscal responses, against the backdrop of rising debt and constrained monetary policy. Countries should rethink the role of fiscal policy in a shock-prone era—how it can better buffer against losses during crises and build resilience—and learn from experiences across the world.

—This blog is based on the October 2022 Fiscal Monitor, “Helping People Bounce Back.”