When countries asked people to stay at home to control COVID-19, consumers cut spending on services and bought more manufactured goods instead. The reopening of economies boosted manufacturing output, but renewed lockdowns and shortages of intermediate inputs from chemicals to microchips caused the factory recovery to stall. Prices of core consumer goods rose rapidly as delivery times reached record highs—sparking a debate about inflation and the course of monetary policy.

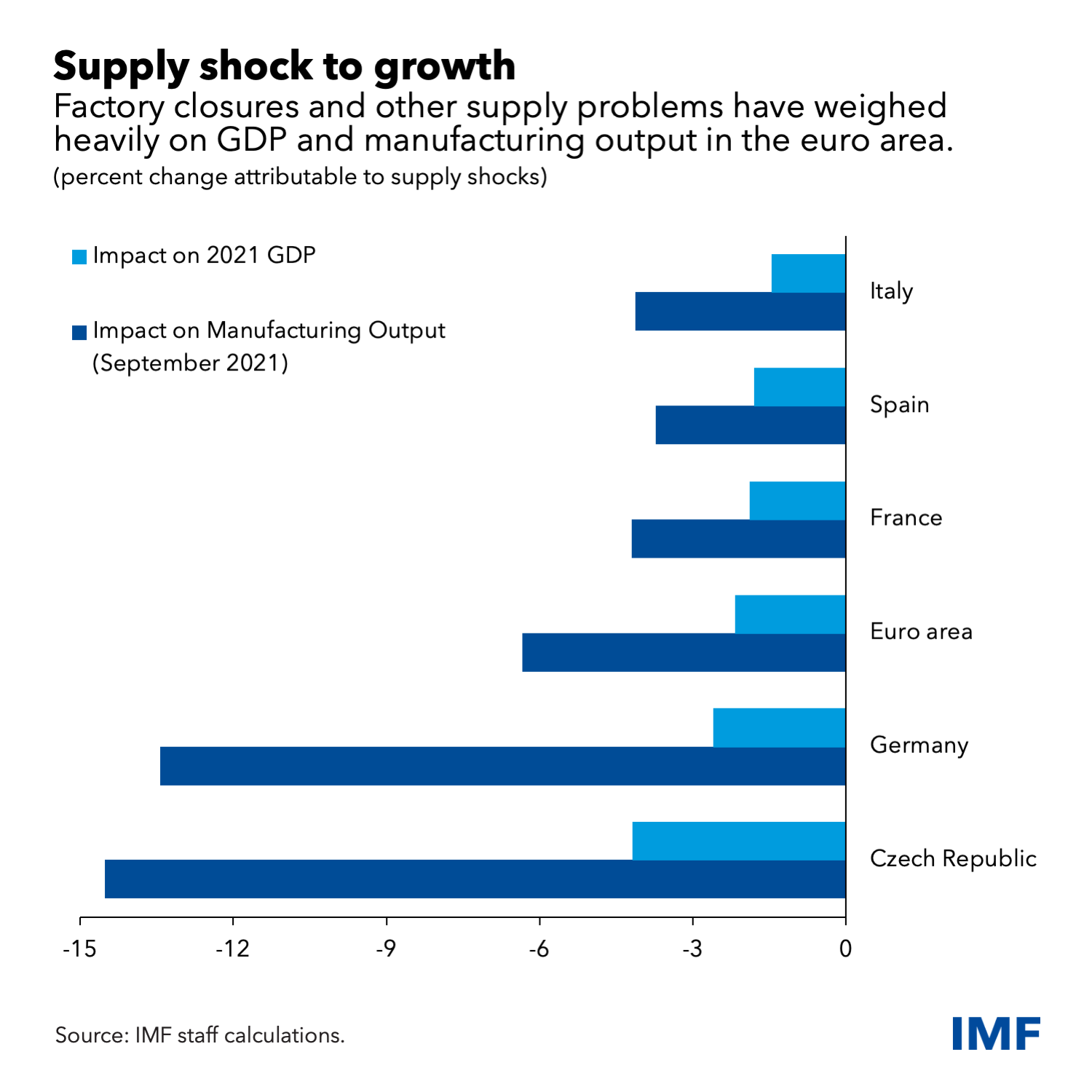

In a new paper, we estimate that euro-area manufacturing output in the fall of 2021 would have been about 6 percent higher without the constraints on supply. Based on the historical correlation between manufacturing and overall output, we assess that gross domestic product would have been about 2 percent higher—equivalent to about one year’s worth of growth in normal pre-pandemic times for many European economies.

The drag on output was largest in countries where manufacturing firms operate at the downstream end of global value chains and are reliant on highly differentiated intermediate inputs. Key examples include countries with large automotive sectors, such as Germany and the Czech Republic, where manufacturing output would have been as much as 14 percent higher.

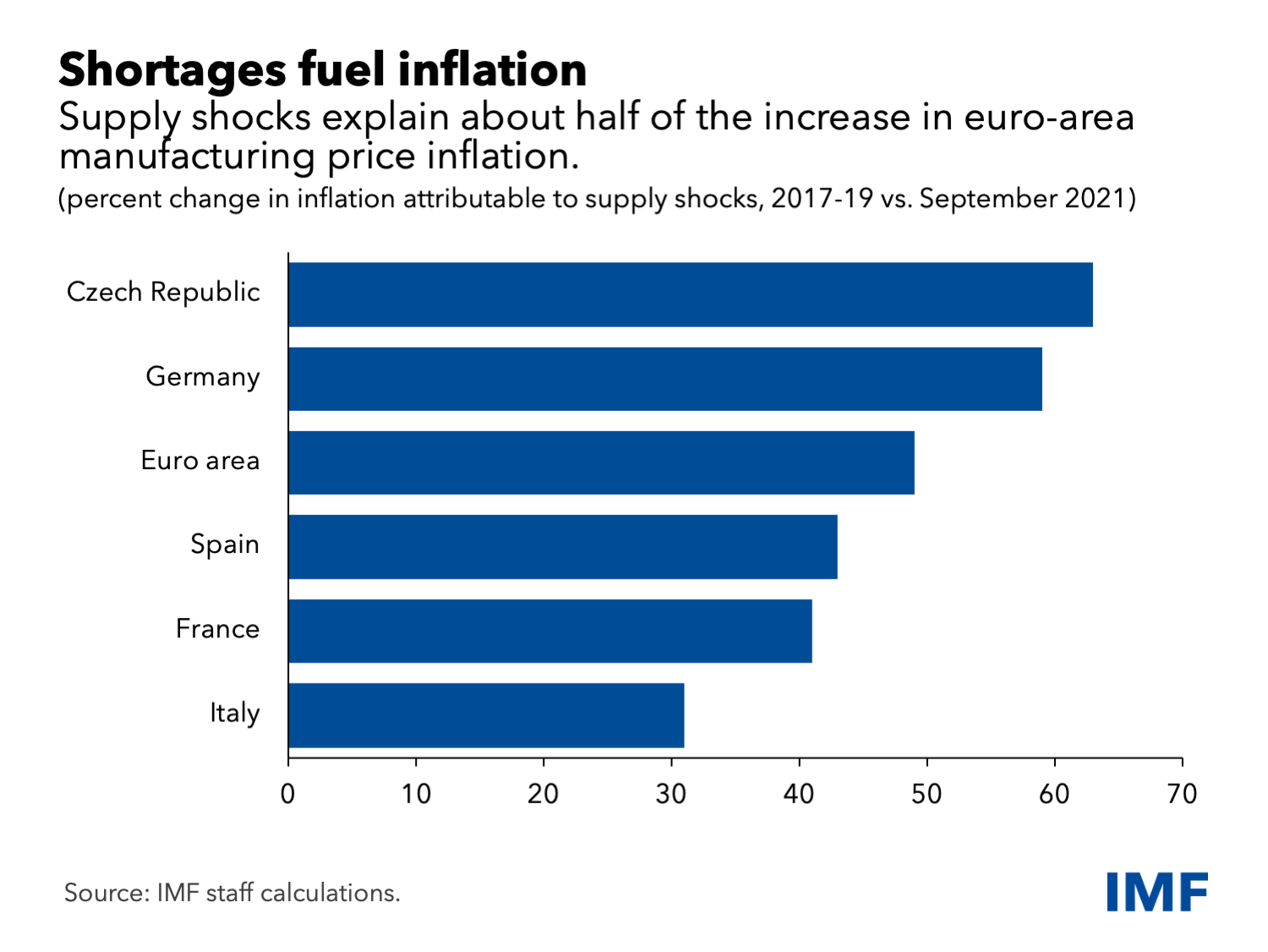

Supply constraints also played a significant part in fueling producer price inflation in the euro area—but so did strong demand. The manufacturing component of producer price inflation was about 10 percentage points higher relative to pre-pandemic times in the first three quarters of 2021. We estimate that supply shocks can explain about half of the increase in the inflation of manufactured goods prices. The rest is mostly explained by increased demand.

Supply disruptions had less of an impact on core consumer prices (inflation excluding energy and food prices). This measure of inflation was only about 0.5 percentage points higher over the same period because of supply constraints for manufactured goods than it would otherwise have been. This smaller effect is not surprising because goods make up less than half of the consumption basket. The prices of services, which account for more than half, are less sensitive than those of goods to manufacturing supply shocks.

Problems could persist

Globally, we find that up to 40 percent of the supply constraints in manufacturing can be traced to shutdowns, which should have only transient effects on inflation. The same is true of the severe weather and industrial accidents that hindered microchip and auto output in 2021. Other drivers of supply constraints, such as labor shortages (which explain up to 10 percent of manufacturing supply constraints globally) and aging logistics infrastructure, could however have more persistent effects on supply and inflation than shutdowns.

Late last year industry experts expected supply shortages for autos to largely dissipate by mid-2022, and broader bottlenecks by the end of this year. Omicron has injected new uncertainty. Europe and China have imposed new restrictions and more disruptions could follow. All in all, supply disruptions could last for longer, possibly into 2023.

Policy priorities

The first line of defense is to tackle supply bottlenecks directly with regulatory measures wherever possible, for instance by fast-tracking the licensing of transport and logistics workers, temporarily easing restrictions on port operating hours, streamlining customs inspections, easing immigration rules to alleviate labor shortages, and mandating practices that limit the spread of the virus and protect the health of workers.

Fiscal measures should also be deployed actively to ease the bottlenecks and avoid permanent damage to potential output. Broad-based aggregate demand support at this time could intensify the bottlenecks and raise inflation with limited impact on output and employment. Support should instead be well targeted.

For instance, it remains important to preserve the jobs that will be viable once the bottlenecks ease (such as the skills-intensive manufacturing jobs affected by intermediate input shortages). Equally vital is to ensure a recovery in labor supply by removing obstacles to work (by expanding reliable care for children and the elderly, for example) and by helping to train workers in newly needed skills.

The prospect of prolonged supply bottlenecks raises challenges for monetary policymakers—namely to sustain a still-incomplete recovery and ensure that output catches up with its pre-pandemic trend—without allowing wages and prices to spiral upwards. Keeping medium-term inflation expectations stable despite transient boosts to inflation, including from supply disruptions and surging energy prices, is key to managing this trade-off.

Despite rapidly tightening labor markets in the euro area, recent data and historical precedent suggest that wages will rise only moderately, and hence we expect inflation to fall slightly below the European Central Bank’s target once the pandemic fades. The ECB has appropriately decided to maintain an accommodative monetary stance until its medium-term inflation target is met while preserving its flexibility to adjust course if high underlying inflation proves more durable than expected.

In general, to anchor inflation expectations at target rates, it is critical that central bankers continue to communicate how they will react to inflation and other economic data, including movements in inflation expectations, and signal readiness to respond rapidly to any significant change in the medium-term inflation outlook.

The more successful regulatory and targeted fiscal measures are in alleviating the supply bottlenecks, the less likely it is that policymakers will be forced to dampen down aggregate demand and economic growth to contain inflation.