If house prices are rising in Tokyo, are they also going up in London?

Increasingly, the answer is yes.

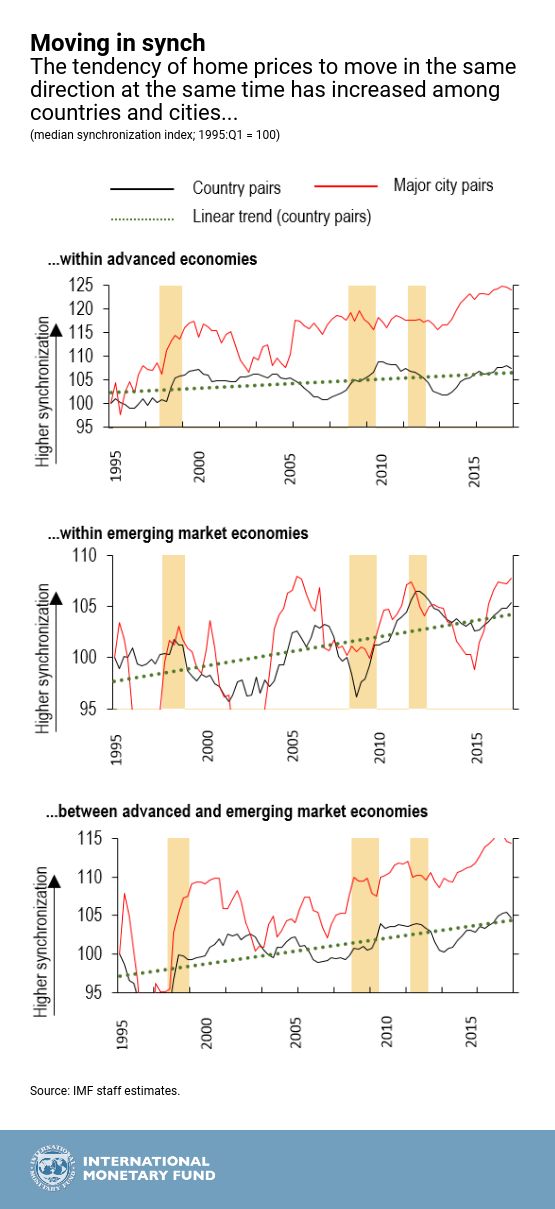

In recent decades, house prices around the world have shown a growing tendency to move in the same direction at the same time. What accounts for this phenomenon, and what are the implications for the world economy? These are questions that IMF economists explore in Chapter 3 of the latest Global Financial Stability Report.

Our study of 44 cities and 40 advanced and emerging-market economies shows that the growing integration of financial markets plays an important role. As a result, housing markets in one country are more sensitive to swings in another. Policy makers should pay attention, because the heightened tendency for house prices to move in tandem may signal greater odds of an economic slowdown. An economic shock in one part of the world is more likely to affect housing markets elsewhere.

Let’s look at why home prices are more synchronized in a financially integrated world.

- Interest rates: The world’s major central banks have kept interest rates unusually low for a long time in a bid to stimulate growth. That has produced a ripple effect of low borrowing costs, including cheap mortgages, across the globe, which has helped push up prices.

- Institutional investors, private equity firms, and Real Estate Investment Trusts have been increasingly active in major cities such as Amsterdam, Sydney, and Vancouver as they seek out higher returns.

- Wealthy individuals have also snapped up properties in major financial centers in search of safe places to invest their money (and perhaps to live). One result: because the wealthy prefer high-end properties, their investments push up prices in expensive neighborhoods in places like New York and London at the same time.

- Economic growth: In addition to financial factors, coordinated movements in the real economy contribute to the phenomenon. In 2017, growth picked up in 120 economies, accounting for three-quarters of world GDP. It was the broadest synchronized growth surge since 2010. Economic growth is a major driver of demand for homes, and hence prices.

All of this suggests that house prices are starting to behave more like the prices of financial assets, such as stocks and bonds, which are influenced by investors elsewhere in the world. In countries that are more open to global capital flows, prices of both homes and equities tend to be more synchronized with global markets.

Policy responses

But there’s a significant difference. Homes represent the biggest asset for most families (as well as the biggest liability, in the form of a mortgage.) And banks invest heavily in real estate loans, making them vulnerable to swings in home prices. So, policy makers should keep a close eye on synchronous moves in home prices, especially when housing market activity or valuations are considered excessive. Fortunately, our research also shows that policy actions to cool down hot housing markets remain effective and can have the additional benefit of taming house price synchronicity. Such actions include raising property taxes and stamp duties and limiting the size of a home loan in relation to a home’s value.

More broadly, policies that enhance resilience to global financial shocks may help. These include flexible exchange rates, which give policy makers more control over domestic borrowing costs, as well as policies to protect consumers against excessive indebtedness during housing busts.