(Version in Türk)

Turkey is going through a time of economic transition, with slowing growth that risks the country being caught in a “middle-income trap,” unable to join the ranks of high income economies.

The country grew at 6 percent per year on average in the period 2010-13, with policies supportive of domestic consumption. This has generated a large current account deficit, mostly financed by short-term capital flows. The reliance on consumption at the expense of investment, slow export growth, and sizable investment needs have hurt potential growth, with the economy already growing more modestly. Moreover, Turkey’s low domestic savings and competitiveness challenges have limited investment as well as exports, which have also suffered from the slow growth in Europe.

With current policies, Turkey's economy is expected to grow only 3.5 percent annually over the next five years. Going forward, the economy must be rebalanced to make it more competitive and to restore output and employment growth.

Four areas for rebalancing the economy

The Turkish government’s economic policy agenda incorporates the right diagnosis of the economic needs, with macroeconomic policies and structural reforms that will need to be carefully sequenced:

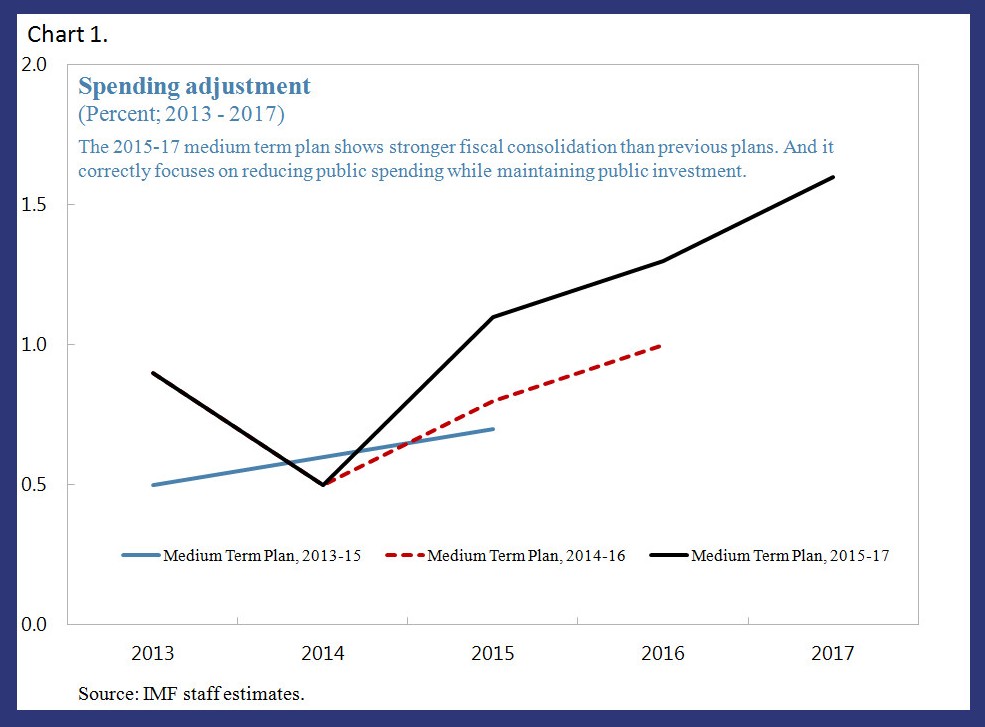

- More public savings. The tighter fiscal policy in the government’s medium term program is correctly focused on reducing current spending while preserving public investment. This will increase national savings in the medium term by about 1.3 percent of GDP. Analysis by IMF staff (see Chart 1 and chapter on the “External Imbalance: Boosting National Savings Will Limit the Burden of Adjustment”) shows that policies that directly increase national savings reduce the external imbalance without weakening private investment. Thus, such adjustment has the least negative impact on growth, and therefore on employment. If instead the adjustment were to be left to monetary policy only or to the markets, the negative effect on growth and private investment would be much larger.

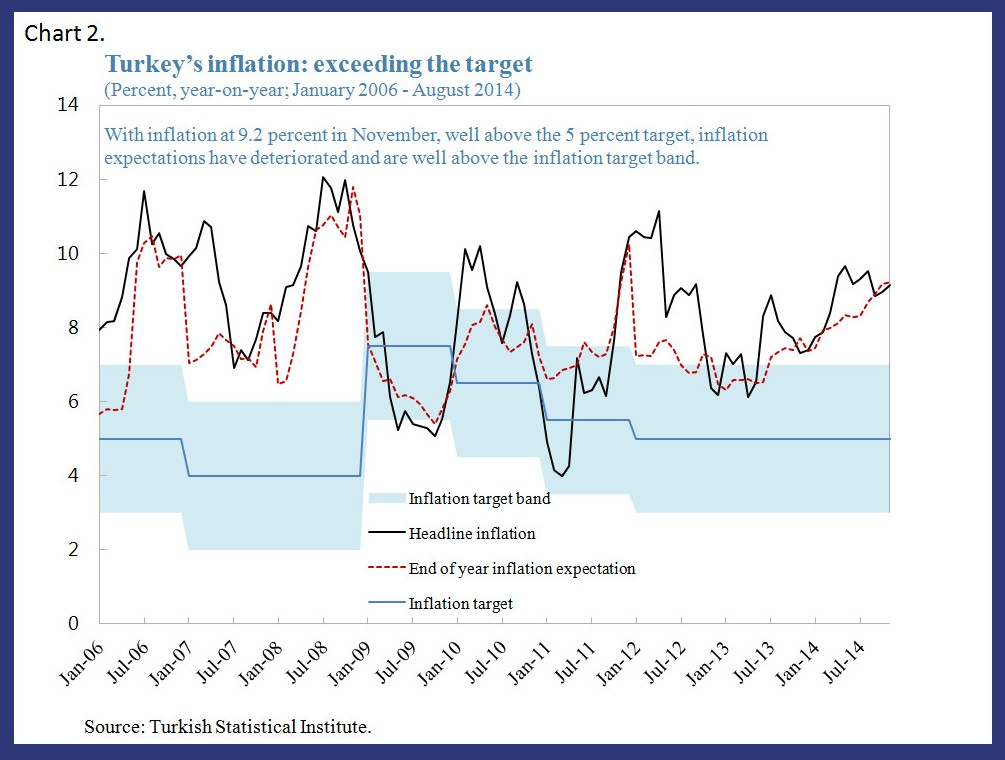

- Renewed focus on the inflation target. The Central Bank of the Republic of Turkey (CBRT) has missed its inflation target in the past (see Chart 2 and chapter on “Credibility of the Inflation Targeting Regime”). At present, the markets do not believe the 5 percent inflation target can be met in the short term. With the envisaged tighter fiscal stance, the burden on monetary policy to meet the inflation target will be lower, facilitating the authorities’ disinflation objective.

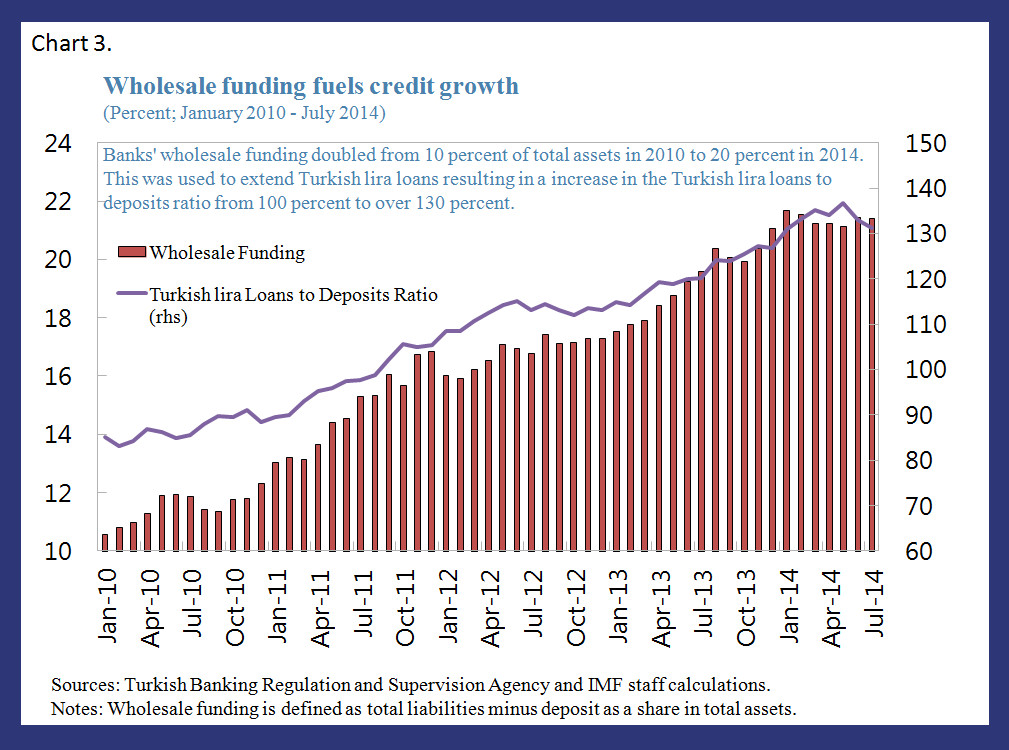

- An expanded macroprudential toolkit to preserve financial stability. Ample capital inflows intermediated by local banks have led to rapid leveraging in foreign currency (FX) in the financial sector and increasing wholesale funding (see Chart 3 and chapter on “Containing Wholesale FX Funding and Risk in the Banking Sector”). This has complicated the task of the CBRT to meet the inflation target while safeguarding financial stability. While capital inflows have allowed financial deepening and supported growth, they have also put upward pressure on the exchange rate, promoted leveraging in FX, and fuelled excessive credit growth, potentially exposing the banking sector to direct rollover and indirect FX risk. The authorities have successfully introduced tools to reduce excessive consumer lending in the first half of 2014. More recently, they introduced additional measures to contain foreign exchange risk and promote the banking sector’s reliance on core funding.

- More private savings. While the right macroeconomic policy mix is important, in the longer run, rebalancing the economy will depend on structural reforms. Thus, the authorities need to accelerate the ambitious structural reform program included in the 10th Development Plan. Priority should be given to policies that encourage higher private sector savings, which has the highest impact on the external imbalance with the least negative impact on growth.

For more details, see the IMF’s latest assessment of Turkey’s economy.