December 6, 2017

Version in عربي (Arabic), 中文(Chinese), Español (Spanish), Français (French), 日本語 (Japanese), Русский (Russian)

[caption id="attachment_22044" align="alignnone" width="1024"] A man walks past a bank branch in Beijing: China’s leaders have made financial stability one of their top priorities (photo: Stephen Shaver/UPI/Newscom).[/caption]

A man walks past a bank branch in Beijing: China’s leaders have made financial stability one of their top priorities (photo: Stephen Shaver/UPI/Newscom).[/caption]

China’s leaders have made financial stability one of their top priorities. Given the size and importance of the Chinese market, with the world’s largest banks and second-largest stock market, that is welcome news for China and the world. The financial system permeates virtually all aspects of economic activity, having played a key role in facilitating rapid economic growth and in sharply reducing poverty rates.

China is moving from the world’s factory floor toward a more modern, consumer-driven economy. During this transition, however, some tensions have emerged in the financial sector.

Three concerns

The IMF recently concluded its latest evaluation for China under the IMF's Financial Sector Assessment Program (FSAP). The assessment identifies three important and interconnected concerns about the Chinese financial system:

- Lending boom. A focus on maintaining growth and employment has resulted in sustained rapid credit growth despite the slowing economy. This debt is largely owed by companies—some of which may not have good prospects—and local governments, but an increasing share is owed by households. Credit growth is an important indicator of future financial distress, because lending standards often fall in the rush to make more loans.

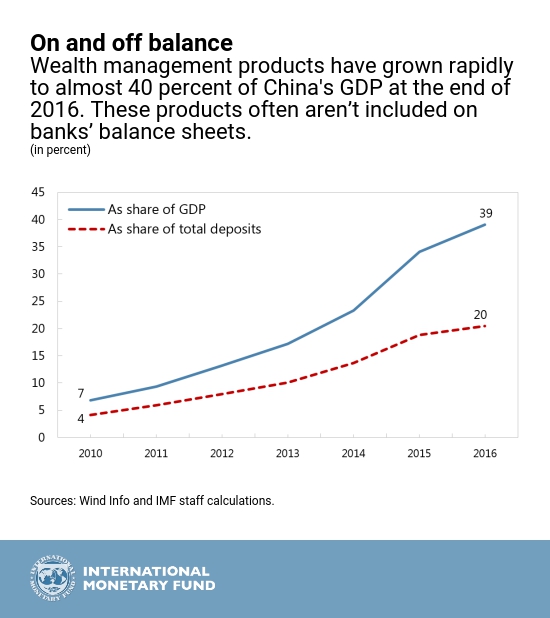

- Complexity. Rules on bank lending to traditional sectors, such as construction and real estate, have pushed risky borrowers away from banks and toward more lightly regulated financial products. At the same time, banks are offering increasingly complex wealth management products to savers looking for higher-yielding assets.

- Guarantees. Banks often compensate investors for losses on financial products to preserve their reputations; the government has repeatedly intervened to stabilize financial markets; and investors have come to believe that state-owned enterprises will be bailed out if they get into trouble. But protecting investors and companies from losses encourages them to underestimate risk and can lead to a misallocation of investment to less productive economic activities.

Taken together, these factors have created a highly dynamic and fast-moving financial system that is very difficult to monitor. Removing implicit guarantees—allowing markets to fall, firms to fail, and investors to lose money—is particularly challenging. Better social safety nets, financial education, and improved bankruptcy procedures will help. But credit growth will not slow sustainably unless tolerance for job losses and slower economic growth rises, particularly at local level, and new sources of revenue are found for local governments. Key goal

Key goal

China’s authorities recognize these risks and are seeking to contain them. President Xi in April cited financial stability as a key goal for China. And since the last assessment in 2011, the Chinese authorities have continuously improved supervision of banks, insurance companies, and securities firms.

The IMF’s main recommendations for further improvement are in five key areas: systemic risk monitoring, interagency coordination, bank capital, liquidity buffers, and crisis management. Let’s take a closer look at the recommendations in each area:

- China’s authorities should create a body, focused solely on financial stability, to improve oversight of systemic risk. Such a body, by regularly discussing and assessing issues on a cross-agency basis, can help identify systemic risks and make recommendations to the implementing supervisors. Improving the quality of data will be important in this regard.

- Financial supervisors need to have greater independence to pursue their mandates without concern about being overruled. They also need more resources to adequately supervise a large and complex system. Finally, better coordination – at all levels, not just at the top – is essential to identifying and managing risks.

- The large size of the credit boom calls for gradually increasing capital at banks to cushion them against a sudden cyclical economic downturn. An increasingly complex and interlinked financial system also calls for higher buffers at several large banks to prevent shocks from spreading to other parts of the financial system. Finally, China’s unique risks – such as the dangers inherent in lifting widespread implicit guarantees and the presence of large off-balance sheet exposures that banks have historically guaranteed – call for higher levels of capital across the system during the transition.

- Banks and other financial institutions are increasingly using very short-term borrowing to finance their investments. To contain risks if those flows reverse, banks should hold more liquid assets, and rules on lending among financial institutions should be amended to encourage safer, and longer-term, lending.

- Several elements of an effective framework for crisis management are already in place. Further reforms are needed to reduce the reliance on public funds in managing weak financial institutions, while ensuring they can fail safely, for example by expanding administrative resolution powers in line with international standards.

Supervising one of the world’s largest and most complicated systems is a challenging task. The Chinese authorities have worked hard to keep pace with growth and innovation but, as in all countries, many gaps remain. They recently created a Financial Stability and Development Committee to monitor systemic risks and prevent financial disruptions and announced new rules to contain riskiness of asset management products. Addressing such concerns should help China continue to grow both rapidly and safely.