September 27, 2017

Versions in عربي (Arabic), 中文 (Chinese), Español (Spanish), Français (French), 日本語 (Japanese), Русский (Russian)

[caption id="attachment_21415" align="alignnone" width="1024"] Domestic fiscal policies, such as public spending, can generate meaningful spillovers to neighboring countries (Photo: Ymgerman/iStock by GettyImages) [/caption]

Domestic fiscal policies, such as public spending, can generate meaningful spillovers to neighboring countries (Photo: Ymgerman/iStock by GettyImages) [/caption]

In the wake of the global financial crisis, fiscal stimulus was advocated widely to help mitigate the recession. The thinking at the time was that fiscal stimulus would be particularly effective because its impact on activity tends to be larger when demand falls short of supply and central banks keep interest rates low. This, in turn, would lead to larger positive cross-border effects—or spillovers—on other countries.

Nearly a decade later, economic circumstances have improved. Do spillovers from fiscal actions still matter today in the context of less global economic slack (excess capacity) and less accommodative monetary policy? The answer is yes. But as our analysis in Chapter 4 of the October 2017 World Economic Outlook shows, their magnitude will depend on the nature of the fiscal action—spending vs. taxes—as well as circumstances in both countries that generate fiscal shocks and those that receive them.

Economic conditions are key

Building on research pioneered by Auerbach and Gorodnichenko (2013), we consider a wide range of fiscal actions—associated with both government spending and taxes, both for fiscal expansions and consolidations—and analyze how fiscal spillovers on a broad sample of advanced and emerging economies depend on economic conditions.

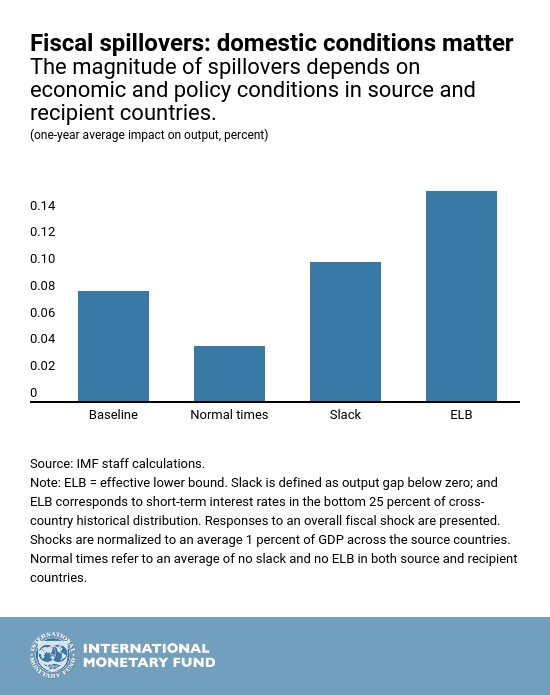

Our empirical analysis finds strong evidence that economic conditions matter in determining the size of spillovers from fiscal policy.

Interestingly, this holds not only for the country that takes fiscal action but also for those receiving spillovers from it. The same forces that tend to amplify the domestic effects of fiscal policy also shape spillovers in the recipients.

Specifically, spillovers can be considerably larger when there is economic slack, or when monetary policy is compelled to keep interest rates low despite higher demand, as compared to ‘normal times.’ For example, for a one-percent of GDP increase in the fiscal deficit in a large systemic country (like the U.S.), output in the recipient country would increase by about 0.1 percent if there is economic slack, and by about half that amount otherwise. By the same token, if the interest rate is exceptionally low, the increase in output could be four times stronger than in normal times.

There are sound reasons why this is the case:

-

Expansionary fiscal actions would more likely come at the expense of private employment when labor markets are tight—i.e. there is less economic slack. The net impact on the domestic economy is muted and so are the spillovers to trading partners through higher demand for imports. Similarly, in the absence of slack in recipient countries, the higher external demand may crowd out activity elsewhere in the economy, dampening the overall impact.

-

When monetary policy is unable or unwilling to counter the demand and price effects of a fiscal action, the domestic effect is larger, and so is the change in demand for imports. From the perspective of recipients, the same logic applies—when faced with a change in external demand due to a fiscal action elsewhere, the impact will be larger when monetary policy does not counteract the external impetus.

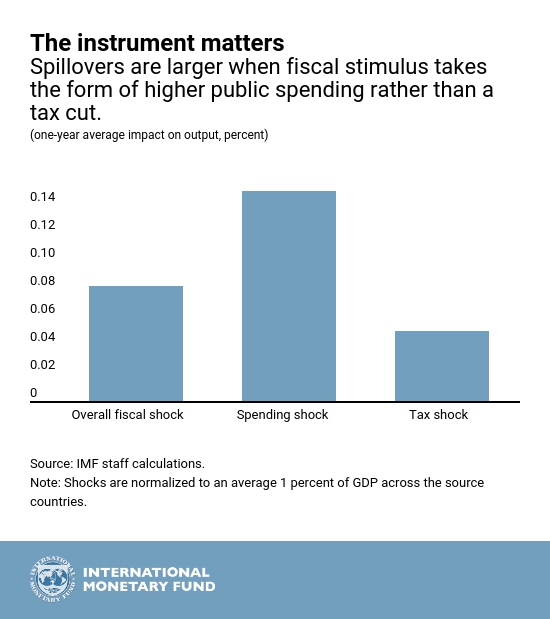

The fiscal instrument matters: spending vs. taxes

Not all forms of fiscal stimulus will have the same domestic or spillover effects. In general, it is expected that an increase in government spending—say, on infrastructure development—will pay the biggest dividends, since it boosts output directly and can increase the economy’s productive capacity. Both channels would prompt a stronger increase in demand for imports, and thus a larger boost to other countries. By contrast, reducing taxes has only an indirect impact on output, as it depends on saving and spending decisions by firms and individuals.

These predictions are borne out by our empirical analysis, which suggests that a 1 percent of GDP government spending increase will have a larger effect on other countries’ output—of about 0.15 percent—compared to an equally sized decrease in taxes, which would have an impact of only about 0.05 percent (results in this figure do not differentiate spillovers depending on economic conditions).

Implications for fiscal policy today

Our analysis provides information on potential cross-country effects from domestic fiscal policies. For example, fiscal stimulus in Germany through higher public investment would generate meaningful spillovers to neighboring countries in Europe where output remains below potential and interest rates are exceptionally low. Spending on public investment is also likely to produce greater cross-border dividends than tax cuts. Conversely, given cyclical conditions in the United States, a U.S. fiscal stimulus would likely have modest spillovers, especially if implemented through tax policy measures.