Governments in most emerging economies, including in Latin America, have reduced their exposure to U.S. interest rates over the past decade, by issuing a greater share of public debt in domestic currencies.

Even so, sudden changes in U.S. interest rates still have the power to roil financial markets in emerging economies. Witness last year’s “taper tantrum”—when the Fed hinted at the possibility of tapering its bond purchases sooner than previously expected, causing bond yields to rise sharply.

Market turbulence has since subsided and emerging market investors have generally become less worried about spillovers from U.S. monetary policy. But what do longer data series tell us about these spillovers? In our latest Regional Economic Outlook for the Western Hemisphere, we pursue this question from two different perspectives—government bond yields and capital flows.

Impact on domestic bond yields

Changes in U.S. interest rates can reverberate throughout the global financial system. In particular, rising U.S. dollar interest rates lower the attractiveness of investments in other currencies, putting pressure on emerging market exchange rates and bond prices.

Our study focuses on changes in U.S. interest rates that reflect perceived news on the monetary policy outlook. We define contractionary monetary shocks as news that drive up the 10-year U.S. bond yield while depressing U.S. equity prices. Such news could include greater-than-expected inflation pressure, an unexpectedly hawkish policy stance, or rising uncertainty over future monetary policy. In contrast, we assume that positive growth surprises or stronger risk appetite would raise bond yields and equity prices, distinguishing them from monetary shocks.

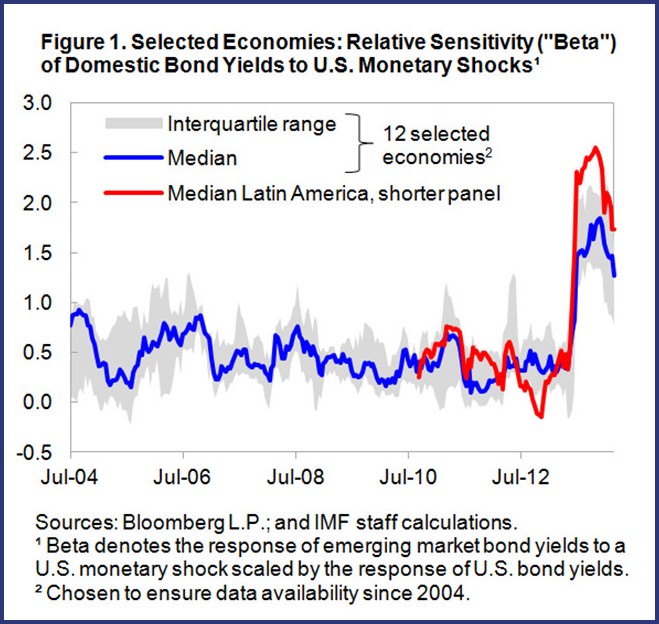

How do emerging market bond yields respond to U.S. monetary shocks? Our results suggest that, within a two-day window after a contractionary shock, domestic government bond yields in emerging markets tend to increase, but typically less than the corresponding U.S. bond yield. As Figure 1 shows, the relative sensitivity in emerging markets has averaged about one-half over the past ten years.

First tantrum, then tedium?

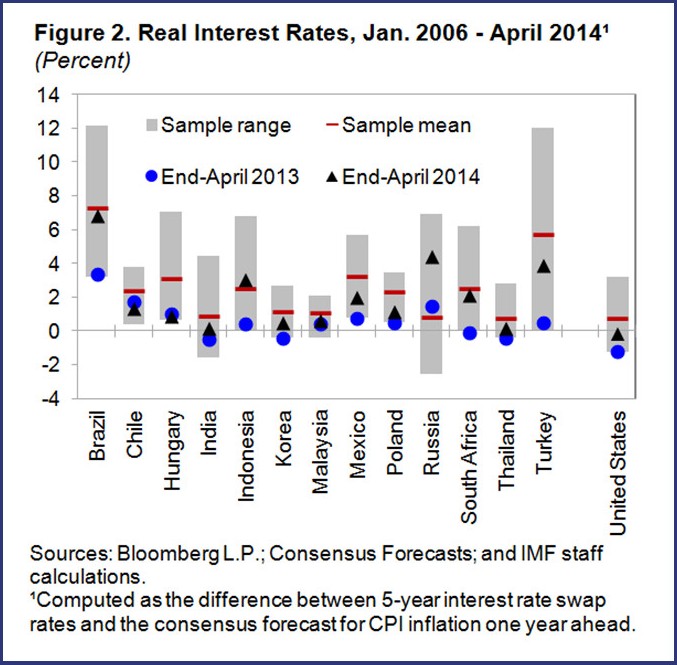

However, these sensitivities surged markedly with the mid-2013 taper shock, when bond yields in most emerging markets—and especially in Latin America—responded far more strongly than U.S. bond yields themselves. One factor that may explain this unusual response is the extreme market situation right before the taper shock (Figure 2). In almost all emerging economies, longer-term interest rates had hit record lows,

In almost all emerging economies, longer-term interest rates had hit record lows,

fueled by an intense “search for yield.” Like an overstretched rubber band, yields snapped back up when the taper shock hit. To the extent that interest rates have normalized since then, new shocks may have more moderate effects, consistent with the dominant pattern over the past decade. Still, fresh bouts of volatility remain a risk.

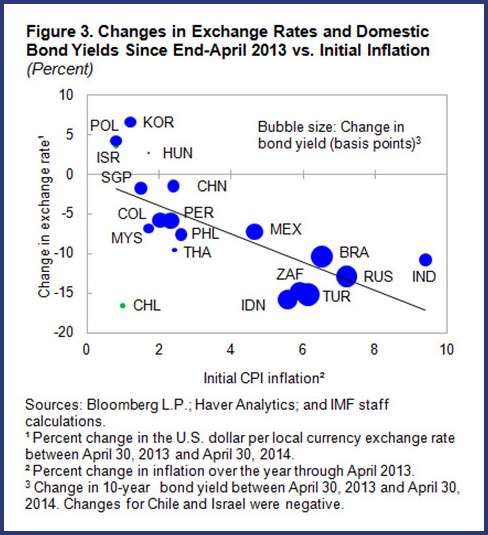

The near-universal rise in bond yields since May 2013 suggests that emerging economies cannot protect themselves fully against external financial shocks. However, markets appear to have differentiated among countries based on fundamentals, penalizing economies with higher external current account deficits and domestic inflation problems (Figure 3), such as Turkey, South Africa, and Brazil. This points to the importance of preserving strong balance sheets and credible policy frameworks to bolster economic resilience.

(Figure 3), such as Turkey, South Africa, and Brazil. This points to the importance of preserving strong balance sheets and credible policy frameworks to bolster economic resilience.

A capital flow perspective

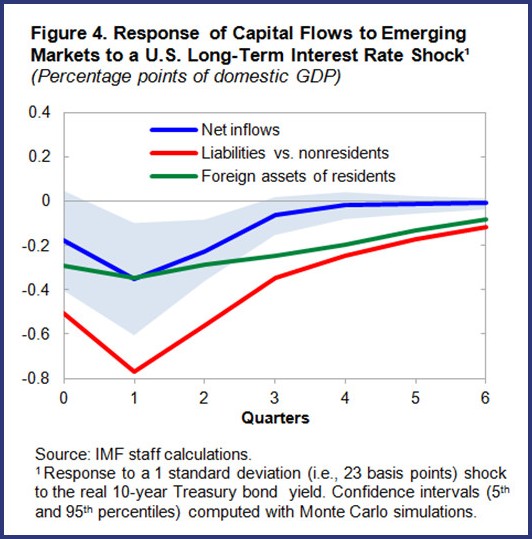

Capital flows provide another lens through which to analyze the impact of U.S. interest rate changes. Our results—based on a large panel of emerging economies since 1990—suggest that shocks to the real U.S. bond rate have a significant impact on capital flows to emerging markets (Figure 4). Inflows of nonresident capital decline markedly, falling by almost 2 percent of GDP over six quarters in response to a 100-basis-point increase in the real 10-year Treasury rate. The impact on net capital inflows, while also negative, is more muted, reflecting the stabilizing role of residents, who react by repatriating external assets. Developments during 2013 match this historical pattern quite well in most emerging markets, including in Latin America.

Inflows of nonresident capital decline markedly, falling by almost 2 percent of GDP over six quarters in response to a 100-basis-point increase in the real 10-year Treasury rate. The impact on net capital inflows, while also negative, is more muted, reflecting the stabilizing role of residents, who react by repatriating external assets. Developments during 2013 match this historical pattern quite well in most emerging markets, including in Latin America.

Instead of a U.S. interest rate shock, let’s consider the case of a positive U.S. output shock. Here, we find that net capital flows to emerging markets increase, despite the associated rise in U.S. interest rates. This finding suggests that emerging economies should have relatively little to fear from an orderly normalization of U.S. monetary policy that mirrors better U.S. growth. By contrast, an independent interest rate increase would likely cause capital outflow pressures.

Shoring up the economy

Although many emerging economies have reduced their reliance on dollar-denominated debt, there is no complete insulation from U.S. monetary shocks. In a scenario of gradually normalizing U.S. monetary policy, adverse spillovers from rising U.S. interest rates should be contained. For close trading partners, in fact, the positive impulse from stronger U.S. growth is very likely to dominate.

Nonetheless, policymakers should stay prepared for renewed volatility. The key to shoring up the domestic economy lies in:

- Robust balance sheets that withstand investor scrutiny even at times of acute risk aversion; and

- Strong policy frameworks, which will typically include prudent fiscal policy, a credible inflation target, and exchange rate flexibility as the first line of defense against external shocks.