The Presource Curse

Finance & Development, December 2017, Vol. 54, No. 4

Oil discoveries can lead first to jubilation then to economic jeopardy

Every year there are major discoveries of oil and gas deposits around the world. Government officials and citizens alike are jubilant, anticipating the prosperity these discoveries herald. But that exuberance can often be misplaced. Some countries have experienced growth disappointments after major oil finds, and economic problems have set in shortly thereafter.

The world has long recognized that countries with abundant revenues from oil and other natural resources often tend to have less economic growth and more social problems than do less-endowed countries—a phenomenon dubbed the resource curse.

But it turns out that in many cases, especially in countries with weak political institutions, economic growth begins to underperform long before the first drop of oil is produced, an event we call the presource curse.

Back to Earth

In 2009 Ghana was soaring. Barack Obama had chosen it to be the first African country he would visit as president of the United States. The country, which had navigated a peaceful transfer of power in 2007, was bucking the global economic slowdown at the time, with robust economic growth that averaged 7 percent between 2003 and 2013.

To cap it all, Ghana had twice struck gold—or to be more precise, black gold. It had a major offshore oil discovery in 2007 and another in 2010. Hopes were high that these finds would help propel Ghana toward middle-income prosperity. Ghana’s then- president, John Kufuor, proclaimed in 2007, “Even without oil we are doing well. . . . With oil as a shot in the arm, we are going to fly.”

Fast-forward to today; Ghana is not flying. Growth dropped below 4 percent between 2014 and 2016, despite IMF forecasts for above 7 percent. The oil discovery and the financial windfall it promised appeared to usher in an era of economic imprudence: heavy borrowing, profligate spending, and exposure of the economy to the oil price crash of 2014. Ghana also succeeded in defying the spirit of its own saving rules. While it saved a prescribed $484 million in oil revenues for a rainy day, it also borrowed $4.5 billion on international markets. Since 2015 the country has been in an IMF program of support and surveillance. A new government took over in 2017, but the crisis continues.

Ghana is not alone. Other countries have experienced the jubilation of discoveries, only to see growth stumble or fall. In Mozambique, the largest offshore gas deposits in sub-Saharan Africa were discovered in 2009. Growth averaged 6 percent. Following these discoveries forecasts put growth on a path above 7 percent. However, by 2016, growth had slumped to an average of 3 percent as the disastrous consequences of enormous off-budget borrowing unraveled. Meanwhile, IMF support has been suspended pending the results of an audit of the off-budget borrowing.

Our research suggests that Ghana and Mozambique are not aberrations. On average around the world, after major discoveries, growth has underperformed the postdiscovery forecasts. For certain countries, such discoveries have led to significant growth disappointments, even compared with prediscovery trends.

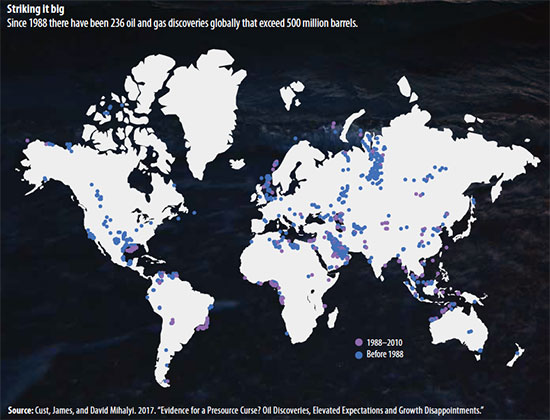

Since 1988 there have been 236 giant discoveries (larger than 500 million barrels) covering 46 countries (see map). These discoveries are significant—the potential value of each averaging 1.4 percent of a country’s GDP.

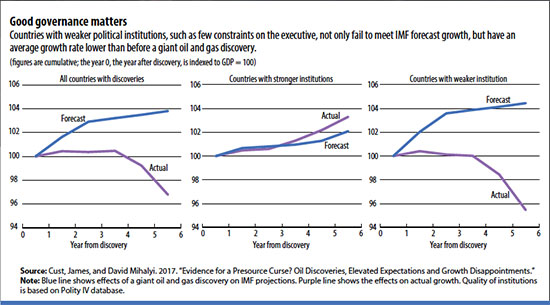

The textbook says that a discovery should increase output, and hence growth, as the economy adjusts to its new wealth and the higher level of consumption that can be sustained. IMF forecasts agree—suggesting that discoveries are worth 0.52 percentage point a year in higher growth over the first five years. To determine whether a country captures the positive potential of a major oil or gas discovery we use two comparisons:

Whether growth is higher on average after a discovery than before;

Whether growth keeps pace with postdiscovery IMF projections (published in the IMF’s World Economic Outlook)—in other words, are countries reaching the growth rate predicted by the textbook?

On both counts the picture is not good. Growth, on average, systematically lags IMF projections and, for some countries, falls.

But the picture also appears bifurcated (see chart). We see the biggest effects in countries with weaker political institutions, such as ineffective constraints on the executive. These countries not only fail to meet IMF forecast growth, but their average growth rate is lower than before a discovery. On the other hand, countries that had strong political institutions at the time of a discovery fare well—growth continues at the same rate and keeps pace with IMF projections.

Countries that fall behind their potential growth rates are subject to what we call the presource curse.

As in the case of its cousin, the resource curse, we find that natural resource abundance can be bad for some countries, in some circumstances—and problems may set in much earlier than conventionally thought. In the case of the presource curse, it is the promise, rather than the reality, of resource abundance that causes bad effects.

The resource curse hypothesis focuses on the long-term negative consequences for the economy from resource production and taxation. For example, so-called Dutch disease describes a boom in the resource sector that crowds out the manufacturing sector and lowers productivity growth. The volatility of export and tax revenues from natural resources may worsen public finances. The problems could also be political. Resource revenues can corrupt or trigger and sustain violent conflict. Some have argued that oil wealth can erode democratic institutions.

The presource curse in contrast focuses on what happens in the short period between discovery and the start of production. During that window, economic problems can occur if economic behavior is based on an overly optimistic assessment of the boon from future resource wealth. Moreover, sometimes countries are tripped up by the steps needed to turn discoveries into dollars, and they fail to produce.

The reality of the forecast

Forecasting growth is challenging. The IMF’s World Economic Outlook publishes country growth forecasts every six months, and other forecasters put out similar estimates, though often with fewer countries covered. Research has found that IMF forecasts are accurate, although not always without biases. For example, in a 2013 paper, former IMF chief economist Olivier Blanchard and colleague Daniel Leigh showed that forecasts for EU countries were unduly pessimistic about growth multipliers after the global financial crisis. In contrast, we find expert forecasts might be overly optimistic in their growth predictions for certain types of countries following resource discoveries.

Whether forecasts are too optimistic or pessimistic matters. First, governments and the private sector rely on forecasts to plan and make decisions. Second, the media and voting public can also be influenced. Their elevated expectations can put pressure on governments to behave imprudently—overspending and overborrowing. Third, forecasts might affect assessments by lenders and rating agencies and therefore the cost of borrowing. If borrowing costs are artificially low, they could fuel overborrowing. Our estimates suggest that country borrowing scores by institutional investors are affected by growth forecasts—scores improve when forecasts rise, even after we account for a country’s historical growth.

Getting from resource discovery to sustained prosperity depends on a series of steps. Countries must secure investment to move a project to production, and government policy must respond by preparing the wider economy for an influx of investment and foreign currency. Other preproduction challenges—such as government revenues from up-front payments such as signing bonuses—may arise.

Some countries, such as Tanzania and Mozambique, never got to production. In others, such as Kazakhstan—whose Kashagan oil field took 13 years to begin production—the process took much longer than expected. Such delays or failures are common. The consulting firm Ernst & Young reported in 2016 that 73 percent of oil and gas projects around the world report schedule delays. The time it takes to get from discovery to production, at least in the mining sector, is slower in countries with weaker institutions and higher corruption, according to Tehmina Khan and her coauthors, in a 2016 World Bank working paper.

If the presource curse indeed exists, it has a range of policy ramifications. Newly resource-rich countries may need to approach discoveries more cautiously. They should pay greater attention to preproduction steps than to counting their chickens. This means a new approach to borrowing and spending commitments by government before revenues arrive. The center of attention in economic policy after discoveries has been the design of savings instruments such as sovereign wealth funds.

Our findings suggest countries should pay more attention to behavior before revenues arrive—such as obtaining public consensus to constrain government budgets—rather than focusing on what percentage of future receipts will be saved. Further, countries may need to pay closer attention to their tax and spending position under different scenarios. What if the projects are delayed? What if prices crash? And what if the government fails to capture all the tax benefits anticipated?

Asymmetric risks

Resource discoveries present asymmetric risks. If prices fall enough, countries may see projects cancelled and miss out on anticipated investment, taxes, and jobs. But if prices go higher, countries get only a share of the increased profits through taxes.

If key financial institutions have overly rosy expectations, they may lend too much money or monitor borrowers less diligently than they should.

The presource curse may also have implications for other parties, such as the IMF. Projections may need to take systematic consideration of country conditions and governance. The timing and scale of resource wealth and its benefits might depend on these factors.

Managing citizen expectations is key. As Paul Collier put it in a 2017 article in the Journal of Development Studies that focused on Ghana, psychological factors drive the curse. A 500-million-barrel oil discovery may be misinterpreted as implying vast wealth for all citizens. But, once it is broken down per capita and spread over the typical 20-year production period, there might be only $30 in government revenues for each Ghanaian.

The presource curse, like the resource curse, is not preordained. Many countries, such as Tanzania, have avoided both. Tanzania, like its neighbor Mozambique, had large offshore gas discoveries. For Tanzania, they came a year later, in 2010. But its growth rate actually picked up following discoveries, from 6 to 7 percent, as the country maintained low levels of debt and showed commitment to fiscal sustainability through legislating a fiscal rule. On the other hand, Tanzania has yet to see the expected significant investment in the sector, and with prices for liquefied natural gas remaining low, production may not materialize for many years.

What seems to matter is not only the resources, but how governments respond to the news of the discovery of those resources. Technology is also transforming the timeline from discovery to production, changing the nature of the potential challenge. Ghana will not be the last country to find significant new oil fields. But perhaps it can be the last to fall prey to an overly optimistic response to this good news.

JAMES CUST is an economist in the Office of the Chief Economist for Africa at the World Bank and an external research associate at the University of Oxford, and DAVID MIHALYI is an economist at the Natural Resource Governance Institute and a visiting research fellow at the Central European University.