Getting It Right

Finance & Development, March 2017, Vol. 54, No. 1

Well-designed fiscal incentives can help spur innovation and ultimately growth

There is considerable debate over how countries can increase their potential economic growth in the coming years. Many will rely on productivity growth, driven by innovation.

Just as inventions such as electricity and the internal combustion engine in the late 19th century laid the foundation for high growth in the mid-20th century, so too could three-dimensional printing, driverless cars, and artificial intelligence pave the way for growth during the coming decades. Some observers, such as Erik Brynjolfsson and Andrew McAfee of the Massachusetts Institute of Technology, believe a major growth surge is in the offing. Others, such as Northwestern University’s Robert Gordon, are less optimistic.

Whatever your view of the future, one thing is clear: policy matters. Governments generally pursue a wide variety of policies to make a welcoming environment for innovation—through the protection of intellectual property rights, competition policies, labor market regulation, and effective bankruptcy laws. Tax and spending policies do much to stimulate innovation and growth—provided they are well designed.

Inspiration, perspiration, incentives

Research and development help drive innovation. Governments play an important role in funding higher education and basic research at universities and public laboratories, which helps advance innovation at private companies. But fiscal policies can also play a direct role in fostering innovation by businesses.

Private firms typically do not invest enough in research and development, in part because they lack adequate incentives. These investments tend to benefit the broader economy in addition to what the firm itself can appropriate. Others may imitate the technology in new products, which often inspires follow-up innovations. As a result, research by one firm usually ends up being beneficial to others. Private companies are not interested in giving anything away, so they will not spend enough on research and development.

This underinvestment can be addressed by fiscal incentives such as tax credits and direct subsidies, which lower the cost of innovation and encourage firms to invest more. Empirical studies suggest that fiscal incentives must reduce a firm’s research and development costs by approximately 50 percent to factor in the spillover benefits that others gain.

During the past decade, fiscal support for private research and development has increased in most countries. Yet differences remain large, and support is generally well below the 50 percent desirable level. If advanced economies were to increase their support in the form of tax credits or other incentives to meet this target level, estimates suggest that research and development would increase by approximately 40 percent. Such expansion could lift GDP in these economies by as much as 5 to 8 percent over the long term.

But it is not just the size of fiscal incentives that matters: good design and implementation are also critical. Countries vary widely in this regard. In Australia and Korea, for instance, relatively generous tax credits effectively reduce the cost of extra research and development investment by nearly 50 percent—that is, they approach the theoretical ideal. Germany offers targeted subsidies to encourage collaboration between universities and private firms. Other countries grant tax relief for the wages of researchers. Most of these fiscal incentives have worked well, studies suggest, when they were implemented effectively.

However, not all fiscal incentive policies are equally effective at nurturing innovation.

Take, for example, the so-called patent box regimes many European countries have introduced recently. These programs significantly reduce the corporate tax burden on income from innovation (such as from patents), but they have not worked. Although they reward success, they do not reduce the cost of experimentation, which often leads to failure. And knowledge spillovers thrive on trial and error. In some countries, patent box regimes appear to have had no measurable impact on research and development. Elsewhere, such as in the Netherlands, they have. For every euro spent by the Dutch government on the patent box, research and development expanded by 56 cents, one study reports. However, another study found that the Dutch tax credit plan yielded an impact of €1.77 for every euro spent. In other words, innovation could be spurred considerably by shifting funds from the ill-designed patent box toward the well-designed tax credit.

Sincerest form of flattery

Imitation of technology from abroad is another critical component of innovation, especially in emerging market and developing economies. These technology transfers increasingly originate in multinational corporations that disseminate their advances across the world through foreign direct investment. Foreign investment inflows can bring important productivity gains to an economy if local firms learn about the new technology or copy new management and organizational practices. To boost productivity, many governments therefore try to attract foreign investment, including through tax and spending policies.

Some of these policies, however, are highly ineffective and inefficient. For example, many countries offer generous tax incentives to multinational investors, such as tax holidays or tax exemptions in special economic zones. But investors report when surveyed that such incentives have relatively little effect on their choice of investment location—a view supported by empirical evidence.

What really matters are good institutions and a predictable legal system. Moreover, domestic firms benefit from foreign investment only if there is a solid human capital base in the country—in other words, people able to absorb the imported knowledge. There is a significant positive association between productivity gains from foreign investment and human capital indices, which measure countries’ ability to nurture, develop, and deploy talent for economic growth.

In light of this, governments would do better to redirect revenue currently spent on ill-designed tax incentives to education. China understood this well when it phased out several tax incentives for foreign direct investment in 2008 as part of broader corporate income tax reform and instead plowed money into education and research to create a strong human capital base capable of absorbing foreign knowledge.

Banishing “success” taxes

Many radical innovations arise from new entrepreneurial ventures, which have no vested interest in existing technologies. The pace of innovation therefore depends critically on an efficient process of entrepreneurial entry, growth, and exit—a process that in many countries is hampered by red tape, financial constraints, and tax barriers.

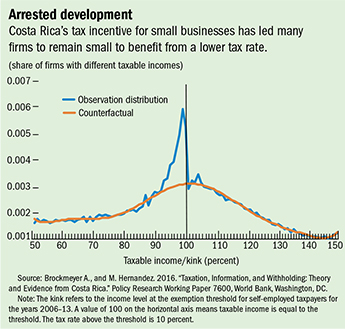

Evidence indeed suggests that high corporate income taxes are a drag on entrepreneurship and thus deter productivity growth. Governments in some countries try to offset this tax distortion by offering special tax incentives for small companies—for example, by granting them a reduced corporate income tax rate. Despite good intentions, however, such incentives are not cost-effective. In fact, they tend to hamper productivity growth by discouraging firms from expanding and losing the small business tax incentive. This small business trap is evident in data for Costa Rica that show bunching of small firms as they try to stay just below the income threshold for preferential treatment (see chart).

To foster entrepreneurship, governments should target fiscal support to new firms instead of small ones. Countries such as Chile and France, for instance, have developed effective policy initiatives to support innovative start-ups. Such incentives are by definition temporary. Support is granted when the start-up does not yet generate much income. Many new firms incur losses early on and do not benefit from simple relief of income taxation. Generous loss-offset rules are also critical for entrepreneurs whose endeavors have a significant risk of failure.

While no one really knows what will happen to productivity growth over the long term, one thing is certain: appropriate fiscal incentives for research and development and entrepreneurship matter for the pace of innovation. Ultimately, such well-designed and well-implemented incentives at the micro level are critical to sustained growth at the macro level. ■

Ruud De Mooij is Chief of the Tax Policy Division of the IMF’s Fiscal Affairs Department.

This article is based on the April 2016 issue of the IMF’s Fiscal Monitor.