Unburnable Wealth of Nations

Finance & Development, March 2017, Vol. 54, No. 1

James Cust, David Manley, and Giorgia Cecchinato

Successful action to address climate change would diminish the value of fossil fuel resources in many of the world’s poorest countries

To achieve climate change goals, the world must cut consumption of fossil fuels dramatically. But climate change success may put developing countries rich in fossil fuels in an almost no-win situation.

If there is no progress in combating climate change, poor countries are likely to be disproportionately harmed by the floods, droughts, and other weather-related problems spawned by a warming planet. But if there are successful global actions to address climate change, poorer countries that are rich in fossil fuels will likely face a precipitous fall in the value of their coal, gas, and oil deposits. If the world makes a permanent move away from using fossil fuels, the likely result will be a huge reduction in the value of their national and natural wealth.

These nations face three special challenges. First, they have a higher proportion of their national wealth at risk than do wealthier countries and on average more years of reserves than major oil and gas companies. Second, they have limited ability to diversify their economies and sources of government revenues—and it would take them longer to do so than countries less dependent on fossil fuel deposits.

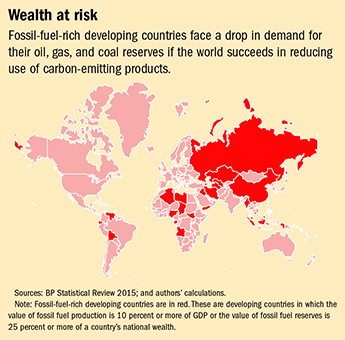

Last, economic and political forces in many of these countries create pressure to invest in industries, national companies, and projects based on fossil fuels—in essence doubling down on the risk and exacerbating the ultimate consequences of a decline in demand for their natural resources (see map).

Carbon risk

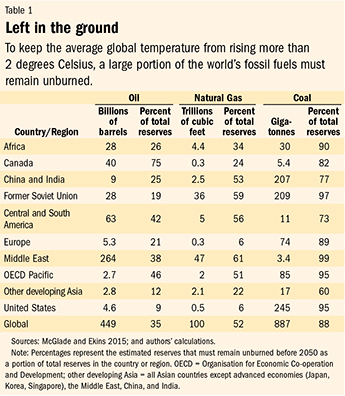

What seems clear to virtually all scientists who study the issue is that the world cannot consume all of its oil, gas, and coal reserves without catastrophic climate consequences. To limit the increase in global temperature to 2 degrees Celsius—the more conservative of the goals agreed to by governments at the 2015 climate change talks in Paris—more than two-thirds of current known reserves, let alone those yet to be discovered (see Table 1), must remain in the ground (IEA 2012). They are the indirect target of climate policies that seek to limit carbon emissions—probably through taxes and quotas on carbon and the fostering of new low-carbon technologies. At some point, therefore, it is likely that the market for fossil fuels, especially highly polluting coal, will dramatically shrink, and with it their value to exporting countries. Reserves—that is, so-called proven reserves, which are estimated to be extracted profitably at current prices—may also remain undeveloped if governments impose policies to limit the market supply of fossil fuel resources. For example, Collier and Venables propose a sequenced closing of the global coal industry (2014). Furthermore, unless there are major—and unlikely—breakthroughs in technology to capture the carbon emitted by fossil fuels, the sharply reduced demand for oil, gas, and coal will be permanent.

Such a “carbon market risk” is potentially catastrophic for the economies of low- and middle-income countries rich in fossil fuels. While many of them have enjoyed the benefits of fossil fuel extraction, including the significant excess profits sometimes associated with oil and gas exports, they have typically failed to diversify their economies. Those that discovered their fossil fuels more recently may find themselves arriving “too late to the party.”

For these countries, carbon market risk highlights three vulnerabilities:

- Fossil-fuel-rich developing countries are generally highly exposed to a shrinking market for oil, natural gas, and coal. A fall in fossil fuel prices for producers significantly reduces the excess profits available from fossil fuel extraction on existing investments and makes further development of reserves less profitable. If those reserves stay in the ground, future government revenues from fossil fuel extraction will be reduced as will other benefits to the domestic economy, such as job creation. Because fuel reserves are such a significant portion of their national wealth, these countries are more at risk if there is a permanent decline in prices than their richer counterparts and those less endowed with fossil fuel wealth. These countries have a median ratio of fossil fuel reserves to GDP of 3.6—which means the national wealth held in these reserves is valued at more than three-and-a-half times their total economic output. Lower demand for oil and gas would drain critical revenues that governments could spend on investments in health, education, and infrastructure. Further, fossil fuel exports are often a key source of government cash—accounting for over 50 percent of government budgets in the top 15 oil- and gas-producing countries between 2006 and 2010 (Venables 2016).

- Fossil-fuel-rich developing countries may be less able to diversify their assets away from this exposure than developed economies or fossil fuel companies. Whether they can diversify or reduce their wealth exposure to carbon market risk depends on how long it takes and how much it costs to convert fossil-fuel-related assets into other nonrelated assets and whether the economy can develop other strong productive sectors.

- Domestic political pressure to develop fossil fuel reserves pushes these countries into choices that might increase their exposure to carbon market risk. First, national oil companies, common in oil-rich countries, often involve state investment in fossil fuel assets for reasons other than maximizing revenue. If the expected life of these assets is so long that declining oil, gas, or coal prices will affect returns, or a government cannot liquidate them at a reasonable value, then governments that invest now in a national oil company—especially one intended to operate abroad—may be exposing national wealth and public assets to carbon market risk. For example, Table 2 shows the significant amount of state ownership in some of the largest national oil companies of fossil-fuel-rich developing countries. Second, policies to promote domestic participation in supply chains that process and/or transport fossil fuels may expose a country to carbon market risk by increasing the total share of a country’s assets vulnerable to a decline in fossil fuel demand. Finally, fossil-fuel-rich countries have tended to develop economies that use a lot of carbon-based products. Research shows that petroleum and coal producers emit a significantly larger amount of carbon per dollar of GDP than countries that produce neither petroleum nor coal. A major reason is that the fossil-fuel-rich countries tend to subsidize consumption of fuels, such as gasoline (Friedrichs and Inderwildi 2013).

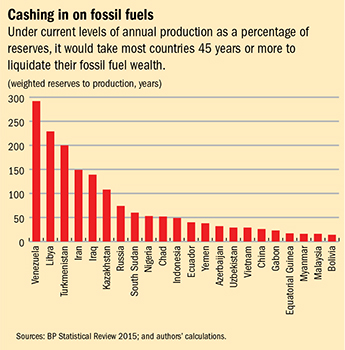

Analysts have warned that carbon market risk could strand the assets of fossil fuel companies (Leaton 2013), but countries are more vulnerable than private companies. Not only is it more difficult for countries to shift capital and capabilities into renewable energy technologies or other activities than it is for companies, countries are tied, geographically and constitutionally, to ownership of reserves, which cannot be sold outright but only licensed to companies for development. Unlike many fossil-fuel-rich developing countries, companies hold the development rights to relatively few reserves—and those have relatively high production rates. For example, in 2013, the reserve-to-production ratios for all oil and gas companies were 12.8 years and 13.9 years, respectively (EY 2013). Companies could, if they wanted, run down their existing reserves in less than 15 years.

Fossil-fuel-rich developing countries hold oil, gas, and coal assets that are harder to turn into cash—typically they can be converted into other assets only after the countries develop, produce, and sell fuel. Using past reserve-to-production ratios as a guide, we found that, unless they can find ways to significantly increase their rates of production, most countries must wait 45 years on average to liquidate their fossil fuel wealth (see chart).

Because it is difficult to develop new sources of national wealth, few resource-rich governments have successfully diversified their revenue streams. Moreover, their ability to use fossil fuel revenue to invest in foreign nonfuel assets—for example, through sovereign wealth funds—has been limited by the rate at which they can extract their reserves and the pressure to spend rather than save revenues. Consequently, the assets of sovereign wealth funds owned by governments of fossil-fuel-rich developing countries represent on average only 3 percent of the value of their fossil fuel reserves.

Policy prospects

There are four policy implications arising from this carbon market risk that governments of fossil-fuel-rich developing countries should consider.

The first is that diversification of the economy is more important than ever. This means countries should expand nonfuel sectors of the economy, especially alternative export sectors, such as manufacturing and agricultural processing, and certain services, such as information and communication technology. But it also means the tax base must be widened to wean the government off dependence on fossil fuel revenues.

Moreover, because it is not only reserves that become endangered by falling prices and demand, governments need to reconsider all their energy-related investments. State-owned companies and energy-related infrastructure and investments to enable the country to participate in supply chains may also fail to provide a sufficient return to the country if the world reduces its use of fossil fuels. Governments may wish to limit investment in these areas.

Some value of local businesses may decline, and a workforce specialized in fossil fuel extraction may become obsolescent. If local suppliers and labor can relatively easily adapt to changed circumstances and participate in supply chains outside the fossil fuel sector without protection or subsidies, a country may be able to benefit from educating workers in the fossil fuel sector. However, if training workers or building company capability to supply the fossil fuel sector takes decades—and if these skills and products are not transferable to other industries—not only will state capital invested in this effort be wasted, but so may the human capital that the workers and firms represent.

Second,governments should continue to promote the competitiveness of their fossil fuel sectors so long as they moderate public investment in these sectors. This may seem counterintuitive, but by reducing the costs investors face, it may be possible to mitigate the stranding of reserves by remaining an attractive destination for production. Studies suggest that oil and gas development is determined not only by geography but also by the quality of a country’s political institutions, such as openness to foreign investors, the fairness of its judicial system (which reduces the threat of expropriation), and the ease of doing business (Cust and Harding 2015; Arezki, Toscani, and van der Ploeg 2016).

Although the world may have more reserves than can be safely burned, it does not follow that exploration should stop entirely in the lowest-income countries. Development and extraction are costly, but costs vary significantly across different geology, so it may be worthwhile for certain countries to allow exploration for reserves that may be less expensive to extract, even after a carbon tax is factored in.

Third, governments should avoid subsidizing fossil fuel use and the fossil fuel sector. Subsidies on the production side—either explicit, such as tax breaks, or implicit, such as poorly negotiated deals that reduce the tax burden of companies—may encourage too much exploration or extraction and keep the country dependent on fossil fuels for too long.

Consumption subsidies, such as on gasoline, might make other sectors of the economy (transportation, for example) more dependent on fossil fuels, reduce consumer incentives to drive less and use more-efficient forms of transportation—such as railroads or mass transit—or encourage investment related to fossil fuel consumption, such as highways.

Fourth, governments and citizens should carefully consider whether to extract faster, slower, or not at all. The right answer may be different for different countries, but the danger of being “last to the party” may encourage some countries to promote exploration in the hope of realizing extraction revenues before climate policies or new technologies fully kick in.

However, Stevens, Lahn, and Kooroshy (2015) argue that for low-income countries, a slower pace of licensing may give the government time to upgrade institutions and potentially earn more future income by reducing investor risk and improving negotiating capacity. Further, even if faster development is an optimum strategy for one country, if all producers do the same thing, supply may rise and prices fall, a result known as the “green paradox” (van der Ploeg and Withagen 2015).

While still highly uncertain, there is a growing likelihood that fossil fuel consumption overall will decline. This is indicated not only by the outcome of the Paris climate change talks, but by emerging evidence that global economic activity is using less carbon per dollar of GDP and by the promise of technological breakthroughs in alternative energy sources such as solar and wind power. This creates the risk of “stranded nations” whose vast fossil fuel reserves are no longer worth extracting. It is unclear when, or by how much, this stranding will occur. But for policymakers in fossil-fuel-rich developing economies, stuck between the effects of a warming planet and global action to prevent such warming, how to deal with declining demand for their resources will be an ever more critical question and will call for new policy approaches. These countries should seek to harness the moment to develop other sectors of the economy rather than wait for the next commodity price boom. ■

James Cust is an Economist in the Office of the Chief Economist for Africa at the World Bank, and David Manley is a Senior Economic Analyst and Giorgia Cecchinato a former Research Associate, both at the Natural Resource Governance Institute.

This article is based on the authors’ paper “Stranded Nations? The Climate Policy Implications for Fossil Fuel-Rich Developing Countries” from the Oxford Centre for the Analysis of Resource Rich Countries at the University of Oxford.

References

Arezki, Rabah, Frederik G.Toscani, and Frederick van der Ploeg. 2016. “Shifting Frontiers in Global Resource Wealth.” CEPR Discussion Paper DP11553, Centre for Economic Policy Research, London.

Collier, Paul, and Anthony J. Venables. 2014. “Closing Coal: Economic and Moral Incentives.” Oxford Review of Economic Policy 30 (3): 492–512.

Cust, James, and Torfinn Harding. 2015. “Institutions and the Location of Oil Exploration.” OxCarre Research Paper Series 127, Oxford University Centre for the Analysis of Resource Rich Countries, Oxford, United Kingdom.

EY. 2013. “ Global Oil and Gas Reserves Study.” London.

Friedrichs, Jörg, and Oliver Inderwildi. 2013. “The Carbon Curse: Are Fuel Rich Countries Doomed to High CO2 Intensities?” Energy Policy 62: 1356–65.

International Energy Agency (IEA). 2012. World Energy Outlook. Paris.

Leaton, James. 2013. “Unburnable Carbon 2013—Wasted Capital and Stranded Assets.” Carbon Tracker Initiative, London.

McGlade, Christopher, and Paul Ekins. 2015. “The Geographical Distribution of Fossil Fuels Unused When Limiting Global Warming to 2 °C.” Nature 517 (7533): 187–90.

Stevens, Paul, Glada Lahn, and Jaakko Kooroshy. 2015. “The Resource Curse Revisited.” Chatham House Research Paper, London.

van der Ploeg, Frederick, and Cees Withagen. 2015. “Global Warming and the Green Paradox: A Review of Adverse Effects of Climate Policies.” Review of Environmental Economics and Policy 9 (2): 285–303.

Venables, Anthony J. 2016. “Using Natural Resources for Development: Why Has It Proven So Difficult?” Journal of Economic Perspectives 30 (1): 161–84.