Stuck in a Rut

Finance & Development, March 2017, Vol. 54, No. 1

Gustavo Adler and Romain Duval

To revive global productivity, start by addressing the legacies of the financial crisis

Technological change seems to be happening faster than ever. The prospect of such inventions as driverless cars, robot lawyers, and 3D-printed human organs becoming commonplace suggests a new wave of technological progress. These advances should raise our standard of living by allowing us to produce more goods and services with less capital and fewer hours of work—that is, to be more productive. But, to paraphrase Nobel laureate Robert Solow, we can see it everywhere but in the productivity statistics.

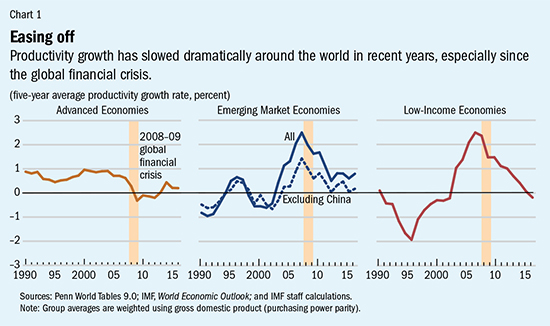

The vexing truth is that output per worker and total factor productivity—which measures the overall productivity of both labor and capital and reflects such elements as technology—have slowed sharply over the past decade, and especially since the 2008–09 global financial crisis. This phenomenon is evident in advanced economies and seems to extend to many developing economies as well (see Chart 1).

Of course, productivity is inherently difficult to measure, but there is no good reason to suspect that measurement error has increased over the past decade—and even if it has, it would hardly account for the bulk of the slowdown, as recent studies show (Svyerson 2016).

If sustained, sluggish productivity growth will seriously threaten progress in raising global living standards, the sustainability of private and public debt, the viability of social protection systems, and economic policy’s ability to respond to future shocks. It would be unwise to sit around and wait for artificial intelligence and other cutting-edge technologies to spawn a hypothetical productivity revival. But, to cure the affliction, we must first diagnose its root causes.

Lasting scars

Productivity growth comes from technological innovation and diffusion, and there is no shortage of explanations for why either or both may have slowed. Some blame a fading information and communication technology boom (Fernald 2015; Gordon 2016); lethargic businesses and insufficient labor and product market reforms (Andrews, Criscuolo, and Gal 2015; Cette, Fernald, and Mojon 2016); the rise of specific-knowledge-based capital and winner-take-all market dynamics; mismatched and deficient skills; demographic factors such as aging populations; or slowing global trade integration (IMF 2016).

Many of these factors have played a significant role and may well remain a drag on productivity. But the abruptness, magnitude, and persistence of the productivity slowdown in the aftermath of the global financial crisis suggest that these slow-moving forces are not the only, or even the main, culprits. The crisis itself is a first-order factor.

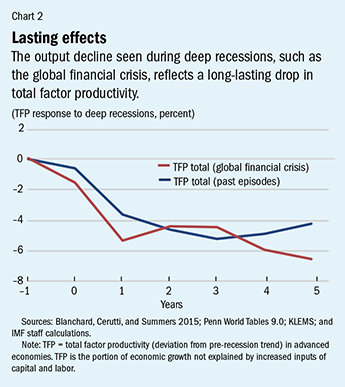

Unlike typical economic slowdowns, deep recessions—often associated with financial crises—involve large and persistent declines in output. Such output losses reflect not only continuing declines in employment and investment but also a permanent drop in productivity (see Chart 2). The dynamics following the global financial crisis were no different.

How could a major—but seemingly temporary—financial shock have such large and persistent effects on productivity?

Much can be attributed to the interplay of weak corporate balance sheets, along with tight credit conditions, weak aggregate demand, and the economic and policy uncertainty that characterize the postcrisis environment. These factors appear to have fed a vicious circle between weak investment, total factor productivity, and potential growth. We focused primarily on advanced economies, and although some of our findings apply to developing economies, factors behind their productivity slowdown are less clear and warrant more research.

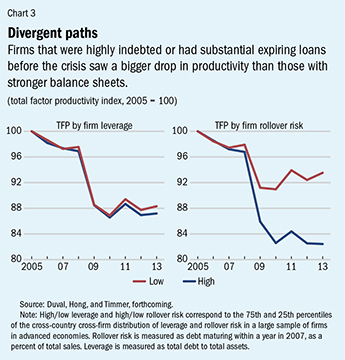

In advanced economies, firms with weaker balance sheets—that is, those with high debt or substantial expiring loans—before the crisis experienced a more abrupt productivity drop than their counterparts with stronger balance sheets (see Chart 3). This was not good news. If these firms had been doing badly before the crisis, their downsizing or outright market exit would have led to higher aggregate productivity—allowing the so-called cleansing effect of recessions to play out. But this was not the case. Firms with more vulnerable balance sheets enjoyed productivity dynamics similar to those with lower vulnerability until 2008, which suggests that the persistent sluggish performance of more vulnerable firms after 2008 resulted from the crisis shock, not from intrinsically poor performance.

Balance sheet vulnerabilities were compounded by hardening financial conditions. In fact, the sharp drying up of credit that followed the Lehman Brothers failure, and later the euro area crisis, sets the global financial crisis apart from past recessions. The combination of two factors visibly affected productivity—particularly in countries where financial conditions tightened the most. In those economies, the postcrisis divergence in productivity between firms that entered the crisis with sizable maturing loans and those with low refinancing needs was most striking. A simple calculation suggests that the interplay between preexisting firm-level vulnerability and tighter credit may account, on average, for up to a third of the total slowdown in productivity after the crisis in advanced economy firms.

Why did the credit crunch wreak such enduring harm on productivity of existing firms? Our evidence suggests that the sudden liquidity squeeze and the associated difficulty in financing working capital may have forced distressed firms into asset fire sales, layoffs, intangible investment cuts, or bankruptcy, with lingering adverse effects on productivity. Immediately following the Lehman failure, firms with preexisting balance sheet weakness invested substantially less in intangible assets than their less vulnerable counterparts (Duval, Hong, and Timmer, forthcoming). More broadly, tight access to credit induces firms to shift their investment spending toward shorter-term, lower-risk, lower-return projects (Aghion and others 2012).

Tight credit conditions seem to have undermined not only productivity growth within firms but also the economy’s ability to shift capital to areas where it is most productive. Indeed, capital misallocation (measured by the dispersion in the return of capital across firms and sectors) increased following the crisis.

Although the causes are not yet fully understood, tighter credit conditions during the crisis may have played a role by impeding the growth of financially constrained firms vis-à-vis their less constrained counterparts. Insofar as some firms in the former group offered strong return prospects while some in the latter group offered weak prospects, any failure to reallocate capital between them would show up at the aggregate level as an increase in resource misallocation and weaker productivity.

It is also possible that some banks routinely renewed loans—without requiring that the principal be paid off—to weak (so-called zombie) firms to delay recognizing losses from bad loans and the need to raise capital. To the extent that such routine renewals benefited highly profitable firms as well as those that were not profitable, it may have weakened the usual process of resource reallocation away from the latter toward the former, as is typical in a well-functioning market economy.

Persistent weak demand and investment are also distinctive features of the postcrisis era, especially in advanced economies. Arguably, this phenomenon also helped erode productivity gains by slowing the adoption of new technologies, which are often embodied in capital. In the late 1990s and early 2000s, for example, technological change such as Internet use was embodied in new and increasingly powerful computers. Estimates suggest that falling investment may have lowered total factor productivity growth in advanced economies by nearly 0.2 percentage point a year following the crisis.

Elevated policy uncertainty since the crisis also appears to have played a significant role in driving down investment and productivity in important economies. Higher uncertainty leads firms, especially those dependent on external financing, not only to cut investment but also to concentrate what it does invest on shorter-term, lower-risk, lower-return projects. According to new IMF findings, greater uncertainty weakened productivity disproportionately in industries (for example, construction) that relied more on external financing. Weaker investment in information and communication technology were a contributing factor. Higher uncertainty overall may have aggravated the postcrisis productivity slowdown by as much as 0.2 percent a year, on average, in Europe, 0.1 percent in Japan, and 0.07 percent in the United States.

Structural forces

The effects of the crisis have held back productivity growth since the late 2000s, but other adverse longer-term forces were already at play.

Not long after the information and communication technology revolution of the late 1990s, productivity growth in sectors most reliant on this technology slowed significantly, especially in the most technologically advanced countries. This also affected lagging economies, where adoption of leading technologies had been an important driver of productivity.

Population aging in advanced economies also appears to have gradually become a drag on productivity. Worker skills tend to increase until a certain age and then start to decline—with attendant effects on innovation and productivity. Analysis of the relationship between the age structure of the workforce and aggregate productivity suggests that rapid aging during the 2000s may have lowered total factor productivity growth in advanced economies more than 0.2 percentage point a year on average relative to the 1990s.

The global trade slowdown is another long-term drag on productivity. Rapidly increasing international trade flows in the late 1990s and early 2000s supported productivity growth by strengthening domestic firms’ incentives and ability to produce efficiently, innovate, and use more or better inputs. Learning from exposure to foreign markets, as well as economies’ reallocation of resources toward activities with international comparative advantage, also helped raise productivity. We estimate, for example, that increased trade solely from China’s global trade integration may account for as much as 10 percent of the average overall productivity increase in advanced economies between 1995 and 2007.

Since 2012, however, trade has barely kept pace with global GDP. This reflects primarily weak economic activity, but also to a lesser extent waning trade liberalization efforts and maturing global supply chains, which contributed to slower productivity (IMF 2015). As global trade integration matures it could also mean lower productivity gains in the future—and, of course, new outright trade restrictions would mean a reversal of earlier productivity gains.

Another global headwind is a decline in the level of educational attainment that made an important contribution to aggregate labor productivity growth in past decades. This slowdown may have contributed about 0.3 percentage point to weaker annual labor productivity growth since the turn of the century.

Healing productivity

To address these long-term issues, policymakers should strive to advance structural reforms, strengthen innovation and education, and continue to reap the gains from open trade and migration, ensuring that these benefits are shared widely within countries as well. But because much of the slowdown reflects scars of the global financial crisis, reviving productivity growth—and its key role in boosting living standards—requires action targeted to crisis legacies, primarily in continental Europe.

- Boost demand where it remains weak, particularly investment—through carefully selected public investment projects and removal of obstacles to private investment—to support capital accumulation and the adoption of new technologies and help reverse the downward spiral of weak investment and productivity.

- Help firms restructure debt and strengthen bank balance sheets to ease their access to credit and stimulate investment in physical and intangible capital. Aggregate productivity will benefit as well—especially in Europe, where balance sheet repair has been slower than in the United States and is likely a persistent drag on productivity growth. Facilitating corporate restructuring and stepping up banking supervision will also improve capital allocation across firms.

- Give clear signals about future economic policy, in particular regarding fiscal, regulatory, and trade policies. This will support investment and its shift toward higher risk and higher returns.

Policies aimed at addressing crisis legacies and longer-term issues can be mutually supportive. Lifting future potential growth—for instance, through research and development tax incentives, infrastructure spending, or migration and trade policies—would raise expectations of future demand and investment returns. Such measures would help support current investment and technological innovation.

Policies geared toward boosting domestic demand and investment in the short term—including through balance sheet repair—would pave the way for structural reforms with high long-term productivity payoffs. All in all, a comprehensive approach is the best way to break the vicious circle of low output and productivity growth.

The debate on the future of productivity has yet to be settled. A new leap in innovation, driven by major breakthroughs in artificial intelligence or other general purpose technologies, may be around the corner—or not. But without some major innovation, the prospects for a return to a healthy pace of productivity growth look dim, unless we tackle the crisis legacies up front and the longer-term challenges, such as aging populations, at least gradually. Otherwise, growth may be stuck in a rut for years to come. ■

Gustavo Adler is Deputy Division Chief and Romain Duval an Advisor in the IMF’s Research Department.

This article is based on the IMF Staff Discussion Note “Gone with the Headwinds: Global Productivity.”

Reference

Aghion, Philippe, and others. 2012. “Credit Constraints and the Cyclicality of R&D Investment: Evidence from France.” Journal of the European Economic Association 10 (5): 1001–24.

Andrews, Dan, Chiara Criscuolo, and Peter N. Gal. 2015. “Frontier Firms, Technology Diffusion and Public Policy: Micro Evidence from OECD Countries.” OECD Productivity Working Paper 2, Organisation for Economic Co-operation and Development, Paris.

Blanchard, Olivier, Eugenio Cerutti, and Lawrence Summers. 2015. “Inflation and Activity—Two Explorations and their Monetary Policy Implications.” NBER Working Paper 21726, National Bureau of Economic Research, Cambridge, MA.

Cette, Gilbert, John Fernald, and Benoît Mojon. 2016. “The Pre-Great Recession Slowdown in Productivity.” European Economic Review (88): 3–20.

Duval, Romain, Gee Hee Hong, and Yannick Timmer. Forthcoming. “Financial Frictions and The Great Productivity Slowdown.” IMF Working Paper, International Monetary Fund, Washington, DC.

Fernald, John G. 2015. “Productivity and Potential Output before, during, and after the Great Recession.” In NBER Macroeconomics Annual 2014, Volume 29, edited by Jonathan A. Parker and Michael Woodford. Cambridge, MA: National Bureau of Economic Research, 1–51.

Gordon, Robert. 2016. The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War. Princeton, NJ: Princeton University Press.

International Monetary Fund (IMF). 2015. “Private Investment: What’s the Holdup?” World Economic Outlook, Chapter 4, Washington, DC, April.

———. 2016. “Global Trade: What’s behind the Slowdown?” World Economic Outlook, Chapter 2, Washington, DC, October.

Svyerson, Chad. 2016. “Challenges to Mismeasurement Explanations for the U.S. Productivity Slowdown.” Unpublished