Globalization Resets

Finance & Development, December 2016, Vol. 53, No. 4

Globalization's winners and losers ![]()

The retrenchment in cross-border capital flows and trade may be less dire than it seems

The two decades following the Cold War were celebrated and decried as the era of globalization. Cross-border movement of capital, goods, and people expanded inexorably. Between the fall of the Berlin Wall in 1989 and the early onset of the global financial crisis in 2007, international capital flows grew from 5 percent of global GDP to 21 percent; trade leaped from 39 percent to 59 percent; and the number of people living outside their country of birth jumped by more than a quarter.

But today the picture is more complex. International flows of capital have collapsed. Trade has stagnated. Only the cross-border movement of people marches on.

Do these developments portend the start of a new era—perhaps one of deglobalization? Such a reversal is possible: the rapid globalization of the late 19th century gave way to the deglobalization of the early 20th. And yet, in the absence of a shock comparable to World War I or the Great Depression of the 1930s, history seems unlikely to repeat itself. A look beyond the headlines suggests that globalization is changing rather than stagnating or reversing.

Capital flows

Consider first the trends in global capital movement—the most compelling area of the deglobalization story. The McKinsey Global Institute (Lund and others, 2013) reports that, in 2008, cross-border flows of capital crashed to 4 percent of global output, a fifth of their peak the previous year (see Chart 1). That collapse, and the even lower level of cross-border financing in 2009, reflected the extraordinary freeze-up of financial markets following the September 2008 bankruptcy of the U.S. investment firm Lehman Brothers. But what is more remarkable is that financial globalization has yet to recover. McKinsey, in an update of the data used in its 2013 study, reports cross-border flows fell to 2.6 percent of global GDP in 2015 and over the period 2011–15 averaged just 5.4 percent of global GDP—a quarter of the 2007 level.

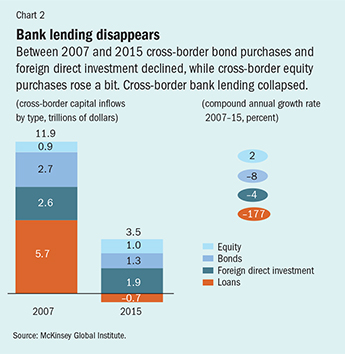

What might explain this? The first clue can be found by separating cross-border finance into four categories (see Chart 2). One of these—portfolio equity investment, that is, investors’ purchases of shares in foreign stock markets—is up slightly in dollar terms since 2007. Two types of flows—bond purchases and foreign direct investment—have fallen, but not dramatically. It is the fourth—bank lending—that has collapsed. In 2015, net cross-border lending was actually negative, as banks called in more international loans than they extended. Taking these figures together, McKinsey calculates that the evaporation of cross-border bank lending explains three-quarters of the overall fall in cross-border finance since 2007.

To some extent—indeed, probably to quite a large extent—the retreat from cross-border lending represents a healthy correction. In the years before 2007, two parallel manias boosted international lending unsustainably: European banks were loading up on U.S. subprime mortgages, and banks in northern Europe were lending prodigiously to the Mediterranean periphery. It is therefore not surprising that the collapse of cross-border lending has been concentrated among banks in Europe. According to the Bank for International Settlements, euro area banks reduced their overseas claims by almost $1 trillion annually in the eight years following the Lehman Brothers bankruptcy, a far more dramatic contraction than occurred in other regions.

Getting it right

Seen in this light, the years leading up to the financial crisis are not a useful guide to how much financial globalization is normal or desirable. Cross-border capital flows peaking at 21 percent of global output reflected a toxic mix of ambition and credulity, notably among European banks. But if 2005–07 was an aberration, what is the appropriate benchmark for global integration?

One way to answer this question is to consider the period from 2002 to 2004, a relatively calm interlude between the early 2000s crash of internet-based companies (the so-called dot-com collapse) and the U.S. subprime borrowing and euro area bank lending mania later in the decade. In those three years, cross-border capital flows averaged 9.9 percent of global GDP. Judging by that benchmark, the new normal of 2011–15 is just over half the old normal of the previous decade. By this measure, financial deglobalization may have overshot.

There is, however, a second way of answering the question, for what was normal even in the calm years of the early to mid-2000s may not necessarily have been desirable. Since that time, there has been a reappraisal of the case for cross-border finance. For one thing, some of its theoretical advantages appear to be just that: theoretical. In principle, financial globalization allows savers in rich countries to reap high returns in fast-growing emerging market economies, thus easing the rich-country challenge of paying for retirement. Meanwhile, it supplies foreign capital to emerging market economies, allowing them to invest more and thereby catch up faster with the rich world. But in reality, many large emerging markets have grown by mobilizing domestic savings, exporting capital rather than importing it. The textbook case for financial globalization exists mostly in textbooks.

If the upside of financial globalization has been elusive in practice, the downsides have grown more obvious. First, global capital tends to rush into small open economies during good times, aggravating the risk of overinvestment and bubbles; it flees in bad times, exacerbating recession. That has led middle-income nations to experiment with capital controls. Second, cross-border banking involves large, complex, and hard-to-regulate lenders, which poses risks to society that became evident during the 2008 bust. Because of those risks, regulators in the rich world have discouraged banks from foreign adventures, which has added materially to deglobalization. Forbes, Reinhardt, and Wieladek (2016) show that, in the case of Britain, regulatory discouragement of foreign lending can be remarkably powerful, accounting for about 30 percent of the attrition in cross-border lending by U.K. banks during 2012–13.

Although there is no denying that finance is less international than it used to be, it is debatable whether this retrenchment is best described as “deglobalization,” with its connotations of retreat, or as something more positive—“sounder global management.” After all, the new regulatory restrictions are at least partly a response to the risks of cross-border financing, which suggests a desirable level of flows considerably lower than the 9.9 percent of global output during 2002–04. If the optimal ratio were, say, around 5 percent, today’s degree of financial globalization might be just about right.

Trade retreat

Now consider the second form of globalization: trade. Here, there is less doubt about the benefit of cross-border activity. The great development success stories of east Asia were built on exports. From Africa to Latin America to south Asia, autarky, in which states prefer self-sufficiency to trade, has fared badly as a formula for poverty reduction. According to economists Gary Hufbauer and Euijin Jung (2016), progressive trade expansion since World War II has added more than $1 trillion a year to U.S. national income, and the global gains are commensurately larger. Although it is true that trade, like technological advances, can skew the distribution of income, the benefits of globalization to the overall economy far outweigh the losses to workers hurt by imports. So the right response to inequality is not protectionism. It is taxing and spending policies that redistribute some of the overall gains to those who are hurt by trade. That this redistribution has so far been inadequate is a failure of politics rather than of globalization.

Because trade is so beneficial, the current backlash against it is damaging. The Doha Round of global trade talks has failed; the Trans-Pacific Partnership faces an uncertain path to ratification; efforts to conclude the Transatlantic Trade and Investment Partnership have stalled. By opting to leave the European Union, British voters demonstrated indifference to the benefits of Europe’s single market—or at least their unwillingness to accept migration as the price of membership. In the United States, the recent presidential campaign showed how support for trade has withered. Republican presidential candidate Donald Trump promised to impose punitive tariffs on trading partners. Democratic candidate Hillary Clinton abandoned her support for the Trans-Pacific deal.

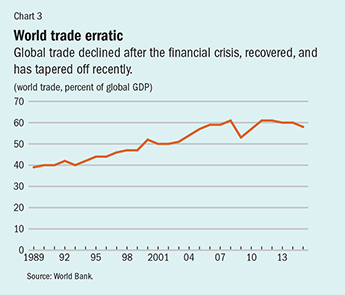

This backlash mirrors a sharp deceleration in the growth of trade relative to GDP. Between 1990 and 2007, global trade grew at about twice the rate of global output; since 2008, it has lagged global growth. As with financial globalization, this setback has outlasted the immediate aftermath of the Lehman crisis. Measured as a share of global GDP, trade crashed in 2009, then recovered sharply in 2010–11. But starting in 2012, it drifted sideways and then down (see Chart 3).

And yet, as with finance, this seeming shock to the project of constructive globalization is not as bad as it looks. A small part of the slowdown reflects the erection of myriad subtle trade barriers—what Hufbauer and Jung term “microprotectionism.” The IMF recently examined the effects of this uptick in protectionism and called them “limited.” So a larger part of the trade slowdown reflects statistical factors that should not be interpreted as setbacks to globalization. Some part may even reflect shifts that prove how effectively globalization is working.

Take, for example, the decline in trade from 60 percent of global GDP in 2014 to 58 percent in 2015—a fall equivalent to $4.5 trillion. A good chunk of this decline is a statistical illusion: the dollar was stronger and commodity prices were lower, so the dollar value of trade went down. Most obviously, the oil price was 48 percent lower in 2015 than in 2014, causing an $891 billion drop in the value of oil traded, even though the number of barrels traded actually increased (BP, 2016). This effect alone explains a fifth of the shortfall in trade relative to GDP in 2015. Meanwhile, the price of iron ore was down 43 percent, and wheat was down 24 percent. These price adjustments make trade look anemic, but they tell us nothing about the health of globalization.

Trade can also be affected when production moves closer to consumers, even when this is not prompted by protectionist impediments to cross-border commerce. For example, a breakthrough in drilling technology, called fracking, has reduced the U.S. need to import oil and gas. The maturation of manufacturing supply chains in Asia may be having a similar effect. China used to assemble products such as the iPhone, importing such complex components as semiconductors. Today, China’s increasing sophistication allows it to make components domestically, reducing imports. In this way, ironically, China’s trade-based development model, which is a prime example of the success of globalization, has allowed it to reduce some aspects of its trade dependence.

Two final considerations encourage the conclusion that trade’s apparent stagnation is not a grave setback—at least, not yet. First, as the world economy becomes richer, it shifts naturally from manufacturing to services, and services are traded less, partly because of higher protectionist barriers in service industries. Second, to the extent that current account imbalances shrink, trade may decelerate, even though smaller imbalances are a sign of healthier globalization. In 2007, according to the World Bank, China ran a current account surplus equivalent to 10 percent of its economy—meaning that a shortfall in domestic spending required it to generate net exports worth a tenth of output. But by 2015, China’s current account surplus had shrunk to just 3 percent. China is now spending more of its income, so it is no longer compelled to ship so much of what it makes abroad. Of course, China could theoretically trade more even while avoiding a trade surplus. But reductions in savings imbalances may be a factor behind sluggish trade data. Savings deficits have shrunk in the United States and Mediterranean Europe even as China’s savings surplus has fallen.

In sum, trade is a clearly beneficial aspect of globalization. A world with minimal trade barriers allows producers in each country to concentrate on its comparative advantages, learn through global competition, and reap economies of scale. The policy backlash against trade is therefore troubling, especially since a less open and competitive world will mean slower gains in productivity, adding to the squeeze on middle-class incomes that trade’s critics lament. But the trade data, sometimes cited to support the view that we are deglobalizing already, do not justify despondency—at least, not yet.

Migration grows

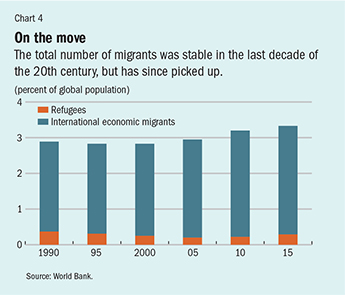

The third aspect of globalization, the movement of people, has been growing of late. During the 1990s, there was almost no increase in economic migration relative to global population: at the start of the decade, economic migrants accounted for 2.5 percent of the world’s people; in 2000 the share was 2.6 percent (see Chart 4). Since the turn of the century, however, migration has gained momentum, rising to 3 percent of global population by 2015. Some 222 million people now live outside their native countries, suggesting that expatriate opportunities outweigh the psychological benefits of rootedness—proximity to family and a sense of cultural affinity.

Tragically, trends in flows of refugees fleeing wars and other instability have followed a similar pattern, according to the World Bank. From 1990 to 2005, refugees declined as a share of global population, from 0.37 percent to 0.20 percent. But that trend has since reversed, with the refugee share rising to 0.29 percent in 2015—still lower than the proportion in the first half of the 1990s, when millions fled the fighting in the former Yugoslavia, but bigger in absolute numbers. In 2015 there were 21 million refugees, more than the peak of 20 million in 1992. Moreover, the number of internally displaced people is higher now. The global problem of war and disaster-driven displacement is now at a record.

More positive than negative

If globalization is the process of sharing ideas and resources across borders, the evidence reviewed here is more positive than otherwise. Financial globalization has reversed, but the new level may be healthier. What’s more, foreign direct investment—the most stable, knowledge-intensive, and productive form of cross-border capital flow because it gives those in recipient countries a direct role in running a business—now accounts for a far larger share of total cross-border flows. With respect to trade, the political climate is damagingly hostile, but recent trade data are less worrisome than they appear. Meanwhile, the movement of people, perhaps the most important of the three traditional forms of globalization, continues to outpace global population growth. If globalization is ultimately about freeing individuals to seek inspiration and opportunity beyond their borders, or even just to escape harsh circumstances at home, there is little sign of a slowdown.

But the most compelling ground for optimism lies elsewhere. During the past 15 years or so a fourth channel for globalization has emerged, one that was barely recognized when the Berlin Wall came down. Ideas, data, news, and entertainment are now shared globally on the internet, in volume that dwarfs the traditional channels of interaction across borders. The McKinsey Global Institute (Manyika and others, 2016) reckons that this digital globalization now exerts a larger impact on growth than merchandise goods trade. Millions of small businesses that lack the scale to venture abroad physically have turned themselves into exporters by participating in online marketplaces. Some 900 million people use social media to connect with friends or colleagues across borders. Millions of students study in virtual classrooms, taught by people on the other side of the world.

The progress of globalization depends on two forces: technology, which eases travel and communication, and politics that underpin an open world. The remarkable thing about the 1990s was that both forces operated together: cheaper travel and telephony were reinforced by the opening up of China and by a series of breakthroughs in trade liberalization—the North American Free Trade Agreement, the European single market, and the Uruguay Round of global trade negotiations.

There is no denying that the world finds itself in a new era: technology still drives integration forward, but political resistance is growing. And yet, for the moment, the drag from politics seems weaker than the thrust from technology. Absent some truly cataclysmic shock—something akin to a world war or a depression—the best bet is that globalization will march on. ■

Sebastian Mallaby is the Paul A. Volcker Senior Fellow for International Economics at the Council on Foreign Relations and author, most recently, of The Man Who Knew: The Life & Times of Alan Greenspan.

References

British Petroleum (BP), 2016, Statistical Review of World Energy (London).

Forbes, Kristin, Dennis Reinhardt, and Tomasz Wieladek, 2016, “The Spillovers, Interactions, and (Un)Intended Consequences of Monetary and Regulatory Policies,” NBER Working Paper 22307 (Cambridge, Massachusetts: National Bureau of Economic Research).

Hufbauer, Gary, and Euijin Jung, 2016, “Why Has Trade Stopped Growing? Not Much Liberalization and Lots of Microprotection,” Peterson Institute for International Economics report (Washington).

International Monetary Fund (IMF), 2016, World Economic Outlook (Washington, October).

Lund, Susan, Toos Daruvala, Richard Dobbs, Philipp Härle, Ju-Hon Kwek, and Ricardo Falcón, 2013, Financial Globalization: Retreat or Reset? (Washington: McKinsey Global Institute).

Manyika, James, Susan Lund, Jacques Bughin, Jonathan Woetzel, Kalin Stamenov, and Dhruv Dhingra, 2016, Digital Globalization: The New Era of Global Flows (Washington: McKinsey Global Institute).

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.